Kentucky Farmers: Maximize Your Crop Insurance Protection with Farmonaut’s Advanced Agricultural Risk Management Tools

“Kentucky farmers can choose from over 20 different crop insurance policy types to protect their agricultural investments.”

Welcome to our comprehensive guide on agricultural risk management for Kentucky farmers. In today’s unpredictable farming landscape, understanding and implementing effective crop insurance policies and risk mitigation strategies is crucial for the success and sustainability of your farm. As we navigate through the complexities of farm risk management, we’ll explore essential USDA crop programs, state-specific resources, and innovative agricultural data tools that can help you safeguard your livelihood.

At Farmonaut, we understand the unique challenges faced by Kentucky farmers. Our advanced satellite-based farm management solutions are designed to complement your risk management strategies, enhancing farm productivity and resilience. Whether you’re a beginning farmer or a seasoned producer, this blog will provide you with valuable insights into crop insurance deadlines, disaster relief options, and cutting-edge agricultural data tools.

The Importance of Crop Insurance for Kentucky Farmers

Crop insurance is a vital component of agricultural risk management, providing a safety net for farmers against unforeseen circumstances such as natural disasters, market fluctuations, and crop failures. In Kentucky, where agriculture plays a significant role in the state’s economy, having robust crop insurance policies is not just a precaution—it’s a necessity for sustainable farming.

- Protection against weather-related losses

- Stabilization of farm income

- Improved access to farm credit

- Support for long-term farm planning

With the variety of crops grown in Kentucky, from corn and soybeans to tobacco and livestock, it’s essential to have tailored insurance solutions that address the specific risks associated with each commodity.

Understanding USDA Crop Programs

The United States Department of Agriculture (USDA) offers a range of crop insurance programs designed to support farmers across the nation, including those in Kentucky. These programs are administered by the Risk Management Agency (RMA) and provide a crucial safety net for agricultural producers.

Enhance your risk management with Farmonaut’s Web App

Key USDA crop programs available to Kentucky farmers include:

- Multi-Peril Crop Insurance (MPCI): Covers loss of crop yields from various natural causes.

- Whole-Farm Revenue Protection: Insures all commodities on a farm under one policy.

- Price Loss Coverage (PLC): Provides payments when the effective price of a covered commodity falls below its reference price.

- Agriculture Risk Coverage (ARC): Offers protection against losses in crop revenue.

These programs are designed to provide comprehensive coverage and help farmers manage risk effectively. It’s important for Kentucky farmers to familiarize themselves with the specific guidelines and deadlines associated with each program to maximize their protection.

Crop Insurance Deadlines: What Kentucky Farmers Need to Know

Adhering to crop insurance deadlines is crucial for maintaining continuous coverage and ensuring eligibility for claims. In Kentucky, these deadlines vary depending on the crop and the type of insurance policy. Here are some key dates to keep in mind:

- March 15: Sales closing date for most spring-planted crops

- July 15: Acreage reporting deadline for spring-planted crops

- September 30: Sales closing date for fall-planted crops

- November 15: Acreage reporting deadline for fall-planted crops

It’s essential to work closely with your crop insurance agent to stay informed about specific deadlines that apply to your farm and the crops you grow. Missing these deadlines can result in loss of coverage or reduced protection.

Navigating Disaster Relief Options for Kentucky Farmers

In addition to crop insurance, Kentucky farmers have access to various disaster relief programs that can provide assistance in times of severe weather events or other agricultural disasters. These programs are designed to help farmers recover and maintain their operations in the face of significant losses.

“USDA crop programs cover more than 100 commodities, offering diverse risk management options for Kentucky farmers.”

Some key disaster relief options include:

- Emergency Conservation Program (ECP): Provides funding for farmers to restore farmland damaged by natural disasters.

- Livestock Indemnity Program (LIP): Offers compensation for livestock deaths due to adverse weather or attacks by animals reintroduced by the federal government.

- Noninsured Crop Disaster Assistance Program (NAP): Provides financial assistance to producers of non-insurable crops when low yields, loss of inventory, or prevented planting occur due to natural disasters.

- Tree Assistance Program (TAP): Helps orchardists and nursery tree growers replant or rehabilitate trees, bushes, and vines damaged by natural disasters.

To access these programs, farmers typically need to report losses within a specified timeframe and provide documentation of the damage. It’s crucial to stay informed about the requirements and application processes for each program.

Explore Farmonaut’s API for advanced agricultural data

Leveraging Agricultural Data Tools for Risk Management

In today’s digital age, agricultural data tools play a vital role in risk management for Kentucky farmers. These tools provide valuable insights that can help in making informed decisions about planting, crop management, and insurance coverage.

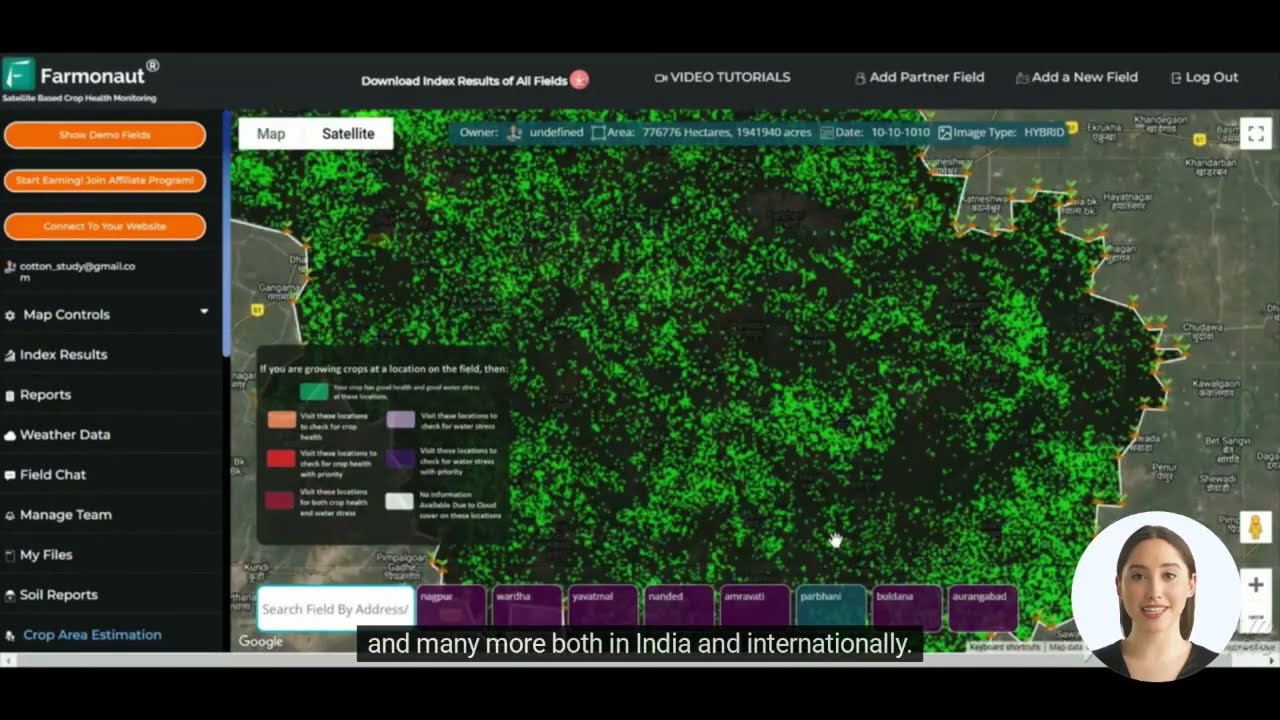

Farmonaut’s advanced satellite-based farm management solutions offer Kentucky farmers access to:

- Real-time crop health monitoring

- Soil moisture analysis

- Weather forecasting and historical data

- Yield prediction models

By integrating these tools into your farm management strategy, you can:

- Identify potential risks early

- Optimize resource allocation

- Make data-driven decisions about insurance coverage

- Improve overall farm productivity and resilience

Access Farmonaut’s API Developer Docs for integration

Types of Crop Insurance Policies Available in Kentucky

Kentucky farmers have access to a variety of crop insurance policies, each designed to address specific needs and risk profiles. Understanding these options is crucial for selecting the most appropriate coverage for your farm.

- Revenue Protection (RP): Protects against loss of revenue due to yield decreases, price declines, or a combination of both.

- Yield Protection (YP): Provides protection against production losses for a specific crop.

- Area Risk Protection Insurance (ARPI): Offers coverage based on the experience of an entire county rather than individual farms.

- Whole-Farm Revenue Protection (WFRP): Covers all commodities on a farm under a single policy.

- Margin Protection (MP): Provides coverage against an unexpected decrease in operating margin.

Additionally, there are specialized policies for specific crops such as tobacco, which is a significant crop in Kentucky. These policies are tailored to address the unique risks associated with tobacco cultivation.

Regional Considerations for Kentucky Farmers

Kentucky’s diverse geography and climate create unique challenges and opportunities for farmers across different regions of the state. When considering crop insurance and risk management strategies, it’s important to take these regional factors into account:

- Western Kentucky: Prone to flooding from the Ohio and Mississippi Rivers, requiring robust flood insurance considerations.

- Central Kentucky: Known for its fertile soil and diverse crop production, necessitating flexible insurance options.

- Eastern Kentucky: Mountainous terrain presents challenges for large-scale farming but offers opportunities for specialty crops.

Farmonaut’s satellite-based monitoring can provide valuable insights into these regional variations, helping farmers make informed decisions about crop selection and risk management strategies.

Download Farmonaut’s Android App for on-the-go farm management

Compliance Standards and Reporting Requirements

Adhering to compliance standards and reporting requirements is crucial for maintaining eligibility for crop insurance and USDA programs. Kentucky farmers should be aware of the following key compliance areas:

- Conservation Compliance: Farmers must comply with conservation requirements on highly erodible land and wetlands to maintain eligibility for USDA programs.

- Acreage Reporting: Accurate and timely reporting of planted acreage is essential for crop insurance coverage.

- Production Reporting: Farmers must report their actual production history to establish yield guarantees for insurance policies.

- Record Keeping: Maintaining detailed records of farming practices, inputs, and yields is crucial for both compliance and effective risk management.

Farmonaut’s digital tools can assist in maintaining accurate records and generating reports, streamlining the compliance process for Kentucky farmers.

Assessing Risk and Reporting Crop Losses

Effective risk assessment and timely reporting of crop losses are critical components of agricultural risk management. Kentucky farmers should follow these steps to ensure they’re adequately protected:

- Regular Crop Monitoring: Utilize Farmonaut’s satellite-based monitoring to keep a close eye on crop health and identify potential issues early.

- Document Everything: Keep detailed records of weather events, pest infestations, and any other factors that may impact crop yield.

- Prompt Reporting: In the event of crop damage, report losses to your insurance agent immediately. Most policies require reporting within 72 hours of discovery.

- Work with Adjusters: Cooperate fully with insurance adjusters during the loss assessment process.

By leveraging Farmonaut’s advanced agricultural data tools, farmers can enhance their ability to assess risks and provide accurate, timely information when reporting crop losses.

Irrigation Practices and Variety Selection for Risk Mitigation

Proper irrigation practices and careful variety selection are essential strategies for mitigating agricultural risks in Kentucky. Here’s how these factors contribute to effective risk management:

Irrigation Practices:

- Implement efficient irrigation systems to ensure optimal water usage

- Use soil moisture sensors to guide irrigation decisions

- Consider drought-resistant crop varieties for areas prone to water scarcity

Variety Selection:

- Choose crop varieties that are well-suited to Kentucky’s climate and soil conditions

- Consider disease-resistant varieties to reduce the risk of crop loss due to pathogens

- Diversify crop varieties to spread risk and improve overall farm resilience

Farmonaut’s satellite-based monitoring can provide valuable insights into soil moisture levels and crop health, helping farmers make informed decisions about irrigation and variety selection.

Get Farmonaut’s iOS App for comprehensive farm monitoring

Managing Prevented Planting Scenarios

Prevented planting is a situation where farmers are unable to plant their intended crop due to adverse weather conditions or other insured perils. In Kentucky, where weather patterns can be unpredictable, understanding how to manage prevented planting scenarios is crucial:

- Know Your Policy: Familiarize yourself with the prevented planting provisions in your crop insurance policy.

- Document Conditions: Keep detailed records of weather conditions and field status that prevent planting.

- Explore Alternatives: Consider planting a cover crop or an alternative crop if the primary crop cannot be planted.

- Timely Reporting: Report prevented planting acres to your insurance agent within the required timeframe.

Farmonaut’s weather forecasting and historical data can assist farmers in making informed decisions about planting timing and assessing the risk of prevented planting scenarios.

Resources for Beginning Farmers in Kentucky

For those new to farming in Kentucky, navigating the world of crop insurance and risk management can be overwhelming. Fortunately, there are numerous resources available to support beginning farmers:

- Kentucky Department of Agriculture: Offers programs and resources specifically for new and beginning farmers.

- USDA’s Beginning Farmer and Rancher Development Program: Provides grants and education to support new farmers.

- Kentucky Farm Bureau: Offers educational resources and networking opportunities for farmers at all stages.

- Cooperative Extension Services: Provides valuable educational resources and local expertise.

Farmonaut’s user-friendly platform and comprehensive agricultural data tools can be particularly beneficial for beginning farmers, providing accessible insights into farm management and risk mitigation strategies.

Comparing USDA Programs and Private Insurance Policies

When it comes to agricultural risk management in Kentucky, farmers have the option of choosing between USDA programs and private insurance policies. Understanding the differences and benefits of each can help you make an informed decision about the best protection for your farm.

| Insurance Features | USDA Programs | Private Insurance Policies |

|---|---|---|

| Coverage Types | Multi-Peril Crop Insurance, Whole-Farm Revenue Protection | Customized policies, Specialty crop coverage |

| Eligibility Criteria | Based on farm size, crop type, and conservation compliance | Varies by insurer, often more flexible |

| Application Deadlines | Strict federal deadlines | May offer more flexible enrollment periods |

| Risk Assessment Methods | Standardized across regions | May use more localized data and advanced analytics |

| Indemnity Calculation | Based on established USDA formulas | Can be tailored to specific farm needs |

| Compliance Requirements | Strict federal guidelines | May have more flexibility in reporting and documentation |

| Integration with Precision Agriculture Tools | Limited integration | Often more adaptable to new technologies like Farmonaut |

| Average Premium Costs | Typically 40-50% subsidized by the government | Varies, but may be higher without subsidies |

| Typical Coverage Levels | 50-85% of expected crop value | Can offer up to 90% or higher depending on the policy |

This comparison highlights the key differences between USDA programs and private insurance policies. While USDA programs offer standardized coverage with government subsidies, private policies can provide more tailored solutions and potentially higher coverage levels. Farmonaut’s precision agriculture tools can complement both types of insurance by providing accurate, real-time data for risk assessment and management.

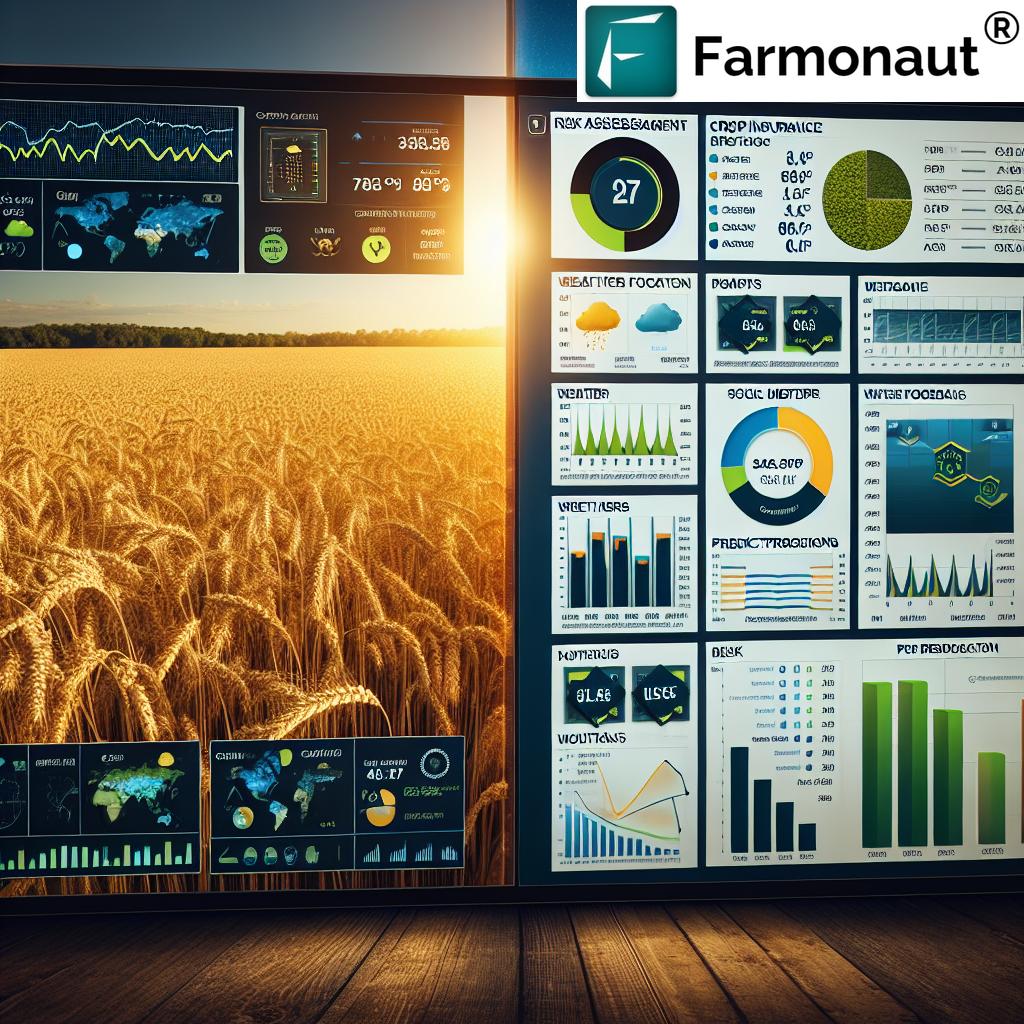

Farmonaut’s Role in Enhancing Agricultural Risk Management

As we’ve explored the various aspects of crop insurance and risk management for Kentucky farmers, it’s clear that having access to accurate, real-time data is crucial for making informed decisions. This is where Farmonaut’s advanced agricultural solutions come into play.

Farmonaut offers a comprehensive suite of tools that can significantly enhance your risk management strategies:

- Satellite-Based Crop Health Monitoring: Our multispectral satellite imagery provides insights into vegetation health (NDVI) and soil moisture levels, helping you identify potential issues before they become critical.

- AI-Powered Advisory System: Our Jeevn AI delivers personalized farm advice, weather forecasts, and expert crop management strategies, enabling you to make data-driven decisions.

- Blockchain-Based Traceability: For those involved in supply chains, our blockchain technology ensures transparency and security, potentially reducing risks associated with product authenticity and quality assurance.

- Resource Management Tools: Our platform helps optimize resource usage, reducing waste and improving overall farm efficiency.

By integrating Farmonaut’s solutions with your existing risk management practices, you can:

- Improve the accuracy of your crop reporting for insurance purposes

- Make more informed decisions about planting, irrigation, and harvesting

- Better assess and mitigate risks throughout the growing season

- Enhance your overall farm productivity and resilience

Conclusion: Empowering Kentucky Farmers with Advanced Risk Management Tools

As we’ve explored throughout this comprehensive guide, effective agricultural risk management is crucial for the success and sustainability of Kentucky farms. From understanding the nuances of crop insurance policies to leveraging advanced agricultural data tools, there are numerous strategies available to protect your farm against unforeseen challenges.

By combining traditional risk management practices with innovative solutions like those offered by Farmonaut, Kentucky farmers can create a robust defense against the uncertainties of modern agriculture. Our satellite-based monitoring, AI-powered advisory systems, and precision agriculture tools complement existing insurance policies and USDA programs, providing an additional layer of protection and insight.

Remember, the key to successful risk management lies in staying informed, adapting to new technologies, and making data-driven decisions. We encourage you to explore how Farmonaut’s solutions can enhance your farm’s risk management strategy and contribute to your long-term success.

For more information on how Farmonaut can support your agricultural risk management efforts, visit our website or contact our team of experts. Together, we can build a more resilient and productive future for Kentucky agriculture.

FAQ Section

Q: How can Farmonaut’s satellite monitoring help with my crop insurance claims?

A: Farmonaut’s satellite monitoring provides accurate, real-time data on crop health and field conditions. This information can be invaluable when filing insurance claims, as it offers objective evidence of crop damage or loss, potentially streamlining the claims process.

Q: Is Farmonaut’s platform compatible with USDA crop insurance programs?

A: While Farmonaut is not directly integrated with USDA systems, the data and insights provided by our platform can complement USDA programs. Farmers can use Farmonaut’s information to make more informed decisions about their USDA coverage and to provide additional documentation if needed.

Q: How often is Farmonaut’s satellite data updated?

A: The frequency of updates depends on the specific service tier, but typically ranges from daily to weekly updates. This ensures that farmers have access to current information for decision-making and risk management.

Q: Can Farmonaut’s tools help me with prevented planting decisions?

A: Yes, Farmonaut’s weather forecasting and historical data can provide valuable insights into field conditions and planting windows. This information can help farmers make more informed decisions about whether to plant or claim prevented planting.

Q: How does Farmonaut’s AI advisory system work with Kentucky-specific crops?

A: Our AI advisory system is designed to adapt to various crops and regions. For Kentucky-specific crops, it considers local climate data, soil conditions, and historical crop performance to provide tailored recommendations.