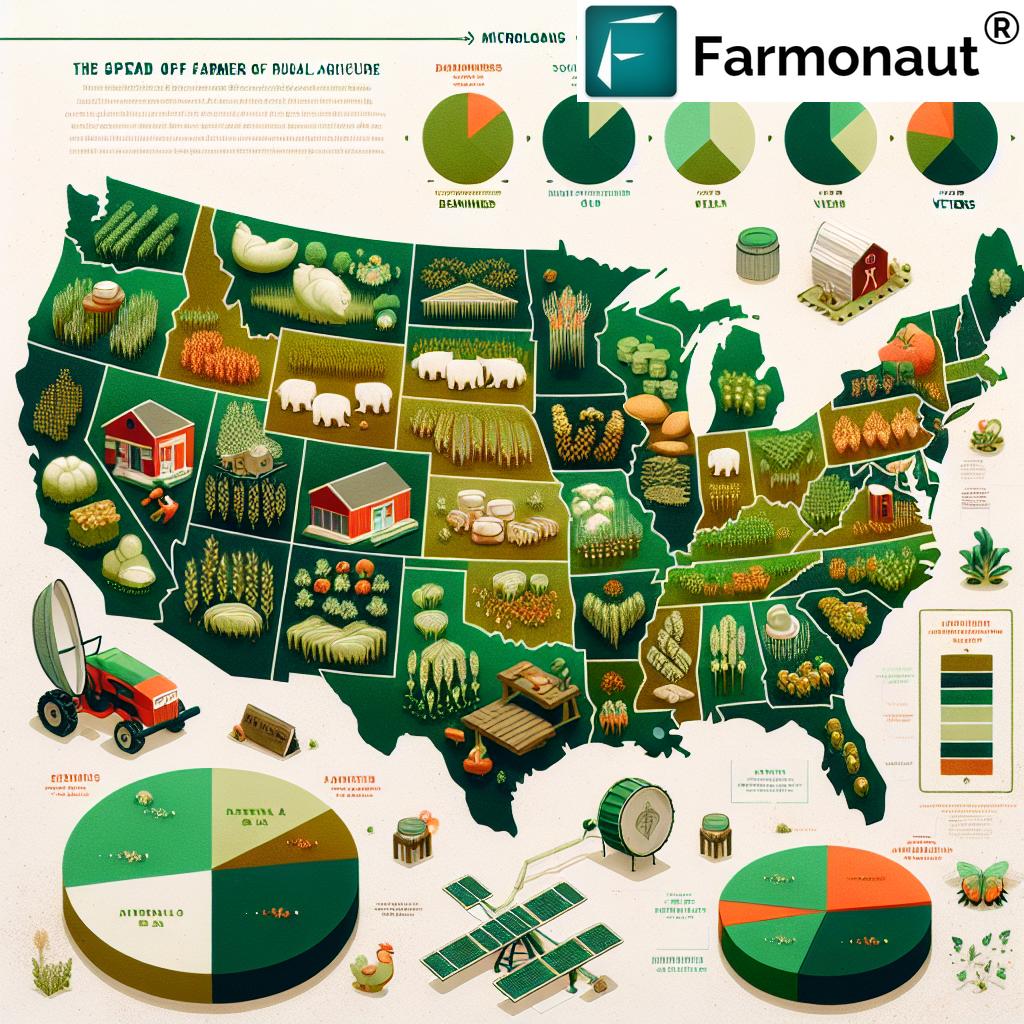

Revolutionizing Small Farm Financing: How USDA Microloans Are Transforming Rural America’s Agricultural Landscape

“USDA’s Direct Farm Operating Microloan program offers loans up to $50,000, supporting small-scale and beginning farmers.”

In the ever-evolving landscape of American agriculture, we are witnessing a remarkable transformation in small farm financing. The United States Department of Agriculture (USDA) has pioneered a game-changing initiative that is reshaping the future of rural America: the Direct Farm Operating Microloan program. This innovative approach to agricultural credit options is not just a financial tool; it’s a catalyst for sustainable farming practices, rural economic development, and the empowerment of a new generation of farmers.

As we delve into the intricacies of this revolutionary program, we’ll explore how these microloans, capped at $50,000, are making a significant impact on the agricultural sector. From supporting beginning farmers to fostering diversity in the farming community, the USDA’s microloan program is a beacon of hope for many who dream of cultivating their own piece of America’s heartland.

Understanding USDA Microloans: A New Era in Farm Financing

The USDA’s Direct Farm Operating Microloan program represents a paradigm shift in how we approach small farm financing. These microloans are designed to address the unique needs of small-scale operations, beginning farmers, and those who might not qualify for conventional farm loans. Let’s break down the key aspects of this program:

- Loan Cap: Up to $50,000 per farmer

- Target Audience: Beginning farmers, socially disadvantaged applicants, veterans

- Purpose: To finance essential farm operating expenses

- Application Process: Simplified and more accessible than traditional loans

- Repayment Terms: Flexible, tailored to the farm’s production and income cycle

This program is not just about providing financial assistance; it’s about nurturing the growth of sustainable farming practices and fostering a more diverse and resilient agricultural sector in the United States.

The Impact of Microloans on Rural America

The introduction of farm microloans has had a profound impact on rural America’s agricultural landscape. Here’s how these small but mighty loans are making a big difference:

- Empowering Beginning Farmers: By providing accessible credit, microloans are helping newcomers overcome one of the biggest hurdles in starting a farm – initial financing.

- Promoting Diversity in Agriculture: The program’s focus on socially disadvantaged applicants is helping to create a more inclusive farming community.

- Supporting Sustainable Practices: Many recipients use these loans to implement environmentally friendly farming methods, contributing to the long-term health of our agricultural lands.

- Boosting Rural Economies: As new farms start and existing ones expand, they create jobs and stimulate local economic activity.

- Encouraging Innovation: With access to capital, farmers can invest in new technologies and techniques, driving innovation in the sector.

These impacts collectively contribute to a more dynamic, sustainable, and inclusive agricultural sector in the United States.

The Growth of USDA Microloans: A Data-Driven Perspective

To truly appreciate the impact of the USDA Microloan program, let’s look at some key statistics that illustrate its growth and reach:

| Year | Total Loan Amount ($) | Number of Loans | % to Beginning Farmers | % to Socially Disadvantaged | % to Veterans | Average Loan Size ($) |

|---|---|---|---|---|---|---|

| 2013 | 20,000,000 | 3,433 | 70% | 35% | 5% | 5,825 |

| 2015 | 45,000,000 | 5,789 | 75% | 40% | 8% | 7,774 |

| 2017 | 65,000,000 | 7,241 | 78% | 45% | 10% | 8,976 |

| 2019 | 85,000,000 | 8,750 | 80% | 48% | 12% | 9,714 |

| 2021 | 100,000,000 | 9,876 | 82% | 50% | 15% | 10,125 |

This data clearly shows the program’s growth in terms of total loan amount, number of loans issued, and its increasing reach to targeted groups such as beginning farmers, socially disadvantaged applicants, and veterans.

“The USDA Microloan program targets beginning farmers, socially disadvantaged applicants, and veterans, fostering diversity in U.S. agriculture.”

Enhancing Farm Management with Technology

While USDA microloans provide the financial foundation for small farms, modern agricultural technology solutions play a crucial role in maximizing the effectiveness of these investments. One such solution is Farmonaut, an agricultural technology company that offers advanced, satellite-based farm management solutions.

Farmonaut’s platform complements the financial support provided by USDA microloans by offering tools that help farmers make data-driven decisions, optimize resource use, and improve crop yields. Here’s how Farmonaut’s technology can benefit microloan recipients:

- Satellite-Based Crop Monitoring: Real-time insights into crop health, helping farmers address issues promptly.

- AI-Driven Advisory: Personalized recommendations for crop management, enhancing decision-making.

- Resource Management: Tools to optimize water and fertilizer use, reducing costs and environmental impact.

- Weather Forecasting: Accurate predictions to help plan farming activities more effectively.

By combining financial support from USDA microloans with cutting-edge technology like Farmonaut, small farmers can significantly enhance their chances of success.

Explore Farmonaut’s solutions:

Crop Diversification Strategies for Microloan Recipients

One of the key advantages of USDA microloans is the flexibility they offer in terms of how the funds can be used. Many successful recipients have used these loans to implement crop diversification strategies, which can lead to more stable income streams and reduced risk. Here are some effective crop diversification strategies that microloan recipients can consider:

- Intercropping: Growing two or more crops in proximity to maximize land use and increase overall yield.

- Crop Rotation: Alternating crops each season to improve soil health and break pest cycles.

- High-Value Specialty Crops: Introducing niche crops with higher market value to supplement main crop income.

- Season Extension Techniques: Using greenhouses or high tunnels to grow crops outside their typical season.

- Value-Added Products: Processing raw crops into products like jams, pickles, or dried herbs to increase profit margins.

Implementing these strategies can be more effective with the use of agricultural technology solutions like Farmonaut. The platform’s satellite-based crop monitoring and AI-driven advisory can help farmers make informed decisions about which diversification strategies might work best for their specific conditions.

The Role of Microloans in Sustainable Farming Practices

USDA microloans are not just about financial assistance; they’re also a catalyst for promoting sustainable farming practices. Many recipients use these loans to transition to more environmentally friendly methods of agriculture. Here’s how microloans are contributing to sustainability in farming:

- Organic Farming: Loans can cover the costs associated with transitioning to organic production methods.

- Conservation Practices: Implementing soil conservation techniques, water management systems, and other environmentally beneficial practices.

- Renewable Energy: Investing in solar panels or wind turbines to reduce reliance on fossil fuels.

- Precision Agriculture: Adopting technologies that optimize resource use and reduce waste.

- Agroforestry: Integrating trees and shrubs into crop and animal farming systems for ecological and economic benefits.

By supporting these sustainable practices, USDA microloans are not only helping individual farmers but also contributing to the long-term health and resilience of America’s agricultural lands.

Challenges and Future Prospects of the USDA Microloan Program

While the USDA Microloan program has been largely successful, it’s not without its challenges. Understanding these challenges is crucial for the program’s continued success and evolution:

- Limited Loan Amount: The $50,000 cap may not be sufficient for some farming operations, especially in regions with high land and equipment costs.

- Outreach and Awareness: Ensuring that all eligible farmers, particularly those in underserved communities, are aware of the program.

- Technical Assistance: Providing adequate support to loan recipients in areas like financial management and sustainable farming practices.

- Balancing Demand and Funding: As the program grows in popularity, ensuring sufficient funding to meet demand without compromising loan quality.

- Long-term Sustainability: Monitoring and supporting the long-term success of loan recipients to ensure the program’s ongoing impact.

Looking to the future, we see several promising trends and opportunities for the USDA Microloan program:

- Integration with Technology: Increased adoption of agtech solutions like Farmonaut to enhance the effectiveness of microloan investments.

- Focus on Climate Resilience: Potential expansion of the program to specifically support climate-smart agriculture practices.

- Enhanced Partnerships: Collaborations with local organizations and educational institutions to provide comprehensive support to loan recipients.

- Tailored Loan Products: Development of more specialized loan products to address specific needs within the agricultural community.

The Impact of Microloans on Rural Economic Development

The ripple effect of USDA microloans extends far beyond individual farms, playing a significant role in rural economic development. Here’s how these small loans are making a big impact on rural communities:

- Job Creation: As farms expand or new ones start, they create employment opportunities in rural areas.

- Local Business Support: Increased farm activity leads to more business for local suppliers, equipment dealers, and service providers.

- Farmer’s Markets and Direct Sales: Microloans often support small-scale farmers who sell directly to consumers, boosting local food economies.

- Agritourism: Some loan recipients diversify into agritourism, bringing visitors and additional revenue to rural areas.

- Youth Retention: By making farming more accessible, microloans help keep young people in rural communities.

These economic benefits contribute to the overall health and vitality of rural America, helping to bridge the urban-rural economic divide.

Leveraging Technology for Microloan Success

To maximize the benefits of USDA microloans, farmers are increasingly turning to agricultural technology solutions. Farmonaut, with its advanced satellite-based farm management tools, offers several key advantages for microloan recipients:

- Efficient Resource Management: Farmonaut’s precision agriculture tools help farmers optimize the use of water, fertilizers, and other inputs, potentially reducing costs and improving yields.

- Data-Driven Decision Making: The platform’s AI-powered insights enable farmers to make informed decisions about planting, harvesting, and crop management.

- Risk Mitigation: Early detection of crop health issues through satellite monitoring can help farmers address problems before they escalate, protecting their investment.

- Sustainability Tracking: Farmonaut’s tools can help farmers monitor and improve their environmental impact, aligning with USDA’s sustainability goals.

By combining the financial support of USDA microloans with the technological capabilities of platforms like Farmonaut, farmers can significantly enhance their chances of success and long-term sustainability.

Explore Farmonaut’s API solutions: Farmonaut API

For developers: API Developer Docs

The Future of Small Farm Financing

As we look to the future, the landscape of small farm financing is likely to evolve, with USDA microloans playing a central role. Here are some trends and possibilities we might see:

- Increased Integration of Technology: Future loan programs may incorporate or incentivize the use of agtech solutions to enhance farm productivity and sustainability.

- Expanded Loan Categories: We may see new microloan categories tailored to specific agricultural sectors or practices, such as urban farming or regenerative agriculture.

- Enhanced Financial Education: More comprehensive financial literacy programs may be integrated into the loan process to support long-term success.

- Climate-Resilient Farming Focus: Future loans might prioritize or provide additional support for farming practices that enhance climate resilience.

- Streamlined Application Processes: Continued improvements in technology may lead to even more streamlined and accessible application processes.

These potential developments could further enhance the impact of small farm financing on rural America’s agricultural landscape.

Conclusion: The Transformative Power of USDA Microloans

The USDA Direct Farm Operating Microloan program has emerged as a powerful force in transforming rural America’s agricultural landscape. By providing accessible financing to beginning farmers, socially disadvantaged applicants, and veterans, these microloans are fostering a more diverse, resilient, and sustainable farming sector.

The program’s impact extends beyond individual farms, contributing to rural economic development, promoting sustainable farming practices, and encouraging innovation in agriculture. As we’ve seen, the combination of financial support through microloans and technological advancements like those offered by Farmonaut creates a potent recipe for agricultural success.

As we look to the future, the continued evolution of the USDA Microloan program, along with the integration of cutting-edge agricultural technologies, promises to further revolutionize small farm financing. This ongoing transformation will not only support the next generation of farmers but also contribute to the long-term health and vitality of America’s rural communities and agricultural heritage.

FAQ Section

Q: Who is eligible for USDA microloans?

A: USDA microloans are primarily targeted at beginning farmers, socially disadvantaged applicants, and veterans. However, any small-scale farmer who meets the basic eligibility criteria can apply.

Q: What can USDA microloans be used for?

A: These loans can be used for various farm operating expenses, including seed, fertilizer, utilities, land rents, marketing, distribution, and more. They can also be used to buy equipment or certify for organic production.

Q: How does the application process work?

A: The application process for USDA microloans is simplified compared to traditional farm loans. It involves filling out an application form, providing a farm operating plan, and demonstrating your ability to repay the loan.

Q: What are the repayment terms for USDA microloans?

A: Repayment terms are flexible and are typically based on the farm’s production and income cycle. The maximum term for a microloan is seven years.

Q: How can technology like Farmonaut help microloan recipients?

A: Farmonaut’s satellite-based farm management tools can help farmers optimize their use of resources, make data-driven decisions, and potentially improve crop yields. This can enhance the effectiveness of the microloan investment and contribute to the farm’s long-term success.