2023 Oklahoma Crop Insurance Update: Innovative Risk Management Solutions for Farmers

“USDA’s disaster assistance programs now cover wildfires in Oklahoma and Texas, affecting thousands of acres of farmland.”

Welcome to Farmonaut’s comprehensive guide on the latest crop insurance updates and agricultural risk management solutions for Oklahoma farmers in 2023. As pioneers in satellite-based farm management solutions, we understand the critical importance of staying informed about the evolving landscape of crop insurance options and disaster assistance programs. In this blog post, we’ll explore how recent changes in policies and innovative approaches are reshaping the way producers safeguard their livelihoods against natural disasters and market fluctuations.

The Changing Face of Agricultural Risk Management

In the heart of America’s agricultural belt, Oklahoma farmers face a unique set of challenges. From unpredictable weather patterns to market volatility, the need for robust risk management strategies has never been more pressing. The United States Department of Agriculture (USDA) and the Risk Management Agency (RMA) have responded with a suite of updated programs and policies designed to provide comprehensive protection for producers across various agricultural sectors.

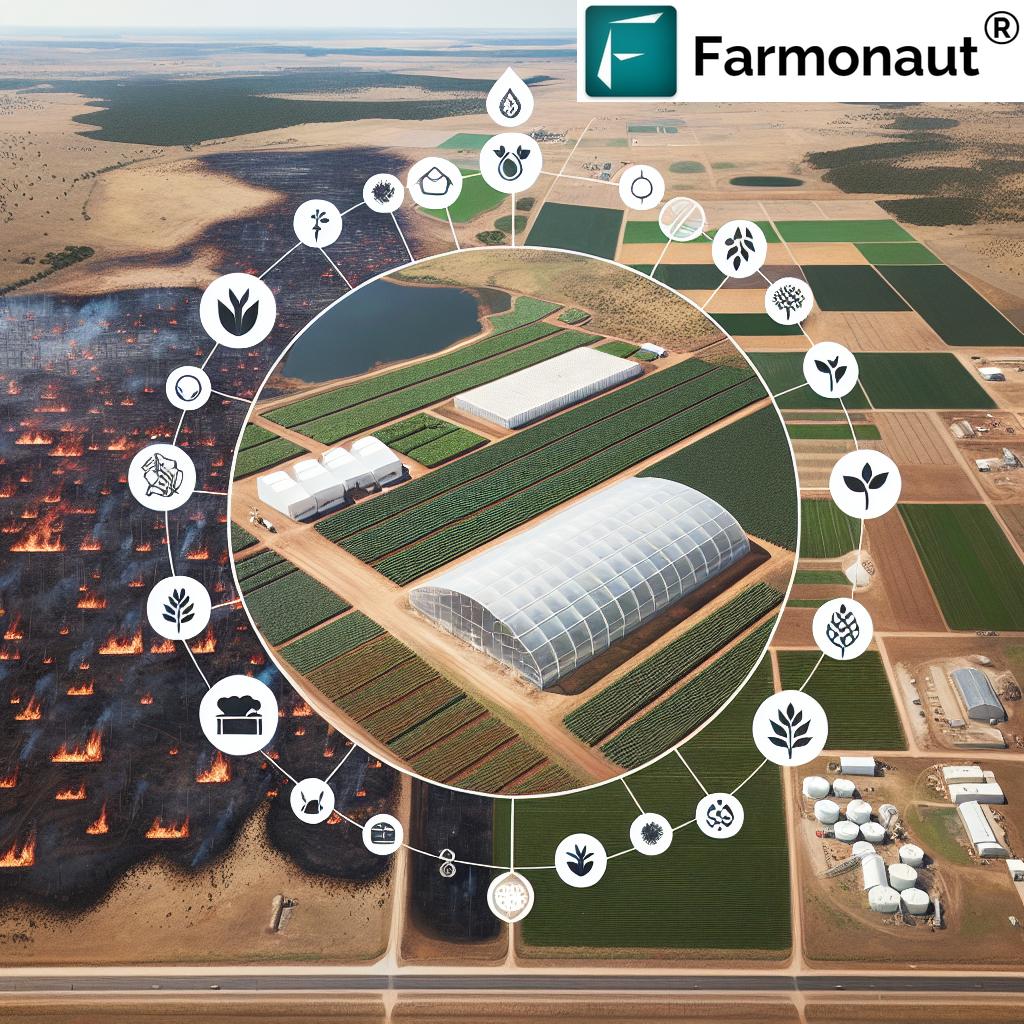

USDA Disaster Assistance Programs: A Lifeline for Oklahoma and Texas Farmers

Recent wildfires in Oklahoma and Texas have brought disaster assistance programs into sharp focus. The USDA has expanded its support for producers affected by these natural disasters, offering a range of options to help farmers recover and rebuild. These programs include:

- Emergency Conservation Program (ECP)

- Livestock Indemnity Program (LIP)

- Emergency Assistance for Livestock, Honeybees, and Farm-Raised Fish Program (ELAP)

- Tree Assistance Program (TAP)

These initiatives provide financial assistance for losses not covered by traditional crop insurance policies, ensuring that farmers have a safety net in place when disaster strikes.

Innovative Insurance Solutions for Specialty Crops

The agricultural landscape in Oklahoma is diverse, with many farmers venturing into specialty crop production. Recognizing this trend, the RMA has introduced new and expanded insurance options for specialty crop growers. These policies are designed to address the unique risks associated with crops such as fruits, vegetables, and nuts.

Key features of the specialty crop insurance updates include:

- Expanded coverage options for organic farming practices

- Tailored policies for greenhouse and controlled environment agriculture

- Increased flexibility in coverage levels and price elections

These innovations in specialty crop insurance reflect a growing recognition of the importance of diversified farming operations in maintaining a resilient agricultural economy.

Climate-Smart Agriculture: Insurance Solutions for Sustainable Farming

As climate change continues to impact agricultural practices, the RMA has introduced new coverage options that support climate-smart agriculture. One notable example is the expanded coverage for rice cultivated using sustainable irrigation methods. This initiative not only protects farmers’ investments but also encourages the adoption of environmentally friendly farming practices.

Climate-smart agriculture practices covered under new insurance options include:

- Conservation tillage

- Cover cropping

- Precision nutrient management

- Water-efficient irrigation systems

By aligning insurance policies with sustainable farming practices, the USDA is taking a proactive approach to addressing long-term agricultural challenges while providing immediate risk management benefits to producers.

Expanded Protection for Hurricane-Impacted Crops

While Oklahoma may not be directly in the path of hurricanes, the ripple effects of these powerful storms can impact agricultural markets across the country. In response to the increasing frequency and severity of hurricanes, the RMA has expanded protection for hurricane-impacted crops. This expansion includes:

- Increased coverage limits for wind and excess moisture damage

- Extended replanting provisions

- Flexibility in loss adjustment procedures for hurricane-affected areas

These changes ensure that farmers have adequate protection against the indirect consequences of major weather events, even if they’re not in the immediate impact zone.

Weaned Calf Risk Protection: A Game-Changer for Livestock Producers

Livestock producers in Oklahoma now have access to an innovative new insurance product: Weaned Calf Risk Protection. This policy is designed to protect against unexpected declines in market prices for weaned calves. Key features of this insurance include:

- Coverage for up to 4,000 head of cattle per endorsement period

- Flexible coverage levels based on expected market prices

- Protection against both local and national market fluctuations

This new offering demonstrates the RMA’s commitment to addressing the specific needs of livestock producers, who face unique challenges in managing price risk.

“New Weaned Calf Risk Protection insurance offers coverage for up to 4,000 head of cattle per endorsement period.”

Regional Updates: From the Midwest to the South

The 2023 crop insurance updates include specific provisions for different regions across the United States. For Oklahoma farmers, it’s essential to understand how these regional updates may impact their operations. Key regional considerations include:

- Midwest: Updates to corn and soybean insurance options

- Southern Region: Expanded coverage for cotton and peanut crops

- Western States: Drought-specific provisions for rangeland and pasture

These regional updates ensure that insurance policies are tailored to the specific agricultural challenges faced by farmers in different parts of the country.

Policy Changes and Reporting Deadlines

Staying informed about policy changes and reporting deadlines is crucial for farmers to maximize their insurance benefits. The 2023 updates include several important changes to be aware of:

- Revised acreage reporting deadlines for certain crops

- Updated prevented planting provisions

- Changes to quality loss option elections

- New requirements for production history reporting

Farmers are encouraged to work closely with their crop insurance agents to ensure compliance with these new requirements and deadlines.

Outreach Initiatives: Ensuring Farmers Stay Informed

The RMA has launched several outreach initiatives aimed at educating farmers about the latest crop insurance options and risk management strategies. These efforts include:

- Webinars and virtual workshops on new insurance products

- Partnerships with local agricultural organizations for information dissemination

- Enhanced online resources and decision support tools

- Targeted outreach to underserved and beginning farmers

By prioritizing farmer education, the RMA aims to ensure that all producers have access to the information they need to make informed decisions about their risk management strategies.

Leveraging Technology in Agricultural Risk Management

At Farmonaut, we understand the critical role that technology plays in modern agriculture. Our satellite-based farm management solutions complement the USDA’s risk management programs by providing farmers with real-time data and insights. By leveraging our API and mobile applications, farmers can make data-driven decisions that enhance their risk management strategies.

Key benefits of integrating technology with crop insurance include:

- Improved accuracy in acreage reporting

- Early detection of crop health issues

- Enhanced record-keeping for production history

- Data-driven decision-making for coverage selection

Our commitment to making precision agriculture accessible aligns with the USDA’s goals of supporting sustainable and resilient farming practices.

2023 Oklahoma Crop Insurance Program Updates

| Insurance Program | Crop Type | Coverage Changes | Eligibility Requirements |

|---|---|---|---|

| Disaster Assistance for Wildfire-Affected Areas | All Crops | Expanded coverage for fire damage, including smoke taint | Farms in declared disaster zones |

| Specialty Crop Insurance | Fruits, Vegetables, Nuts | New options for organic and sustainable practices | Certified specialty crop producers |

| Organic Farming Coverage | All Certified Organic Crops | Increased premium subsidies, expanded crop list | USDA Organic Certification required |

| Controlled Environment Agriculture Insurance | Greenhouse Crops | New policy for hydroponic and vertical farming | CEA facilities meeting USDA standards |

| Climate-Smart Agriculture Practices | Various | Coverage for sustainable irrigation, cover crops | Adoption of approved climate-smart practices |

| Weaned Calf Risk Protection | Livestock | Price protection for up to 4,000 head per period | Oklahoma cattle producers |

The Role of Farmonaut in Supporting Oklahoma Farmers

As a leading provider of satellite-based farm management solutions, Farmonaut is committed to supporting Oklahoma farmers in their risk management efforts. Our technology complements the USDA’s insurance programs by providing:

- Real-time crop health monitoring

- Precise acreage measurements

- Historical yield data analysis

- Weather forecasting and alerts

By integrating our solutions with crop insurance strategies, farmers can make more informed decisions and optimize their risk management approaches.

Explore our range of solutions:

Looking Ahead: The Future of Agricultural Risk Management

As we move forward, the landscape of agricultural risk management continues to evolve. Emerging trends that Oklahoma farmers should keep an eye on include:

- Integration of artificial intelligence in risk assessment

- Blockchain technology for improved traceability and transparency

- Expanded use of remote sensing for crop monitoring and claims assessment

- Development of parametric insurance products for specific weather events

These advancements promise to make risk management more precise, efficient, and tailored to individual farm needs.

Conclusion: Empowering Oklahoma Farmers Through Innovation

The 2023 crop insurance updates represent a significant step forward in protecting Oklahoma’s agricultural producers. By combining innovative insurance products with advanced technologies like those offered by Farmonaut, farmers are better equipped than ever to face the challenges of modern agriculture.

We encourage all Oklahoma farmers to:

- Review their current insurance policies in light of these updates

- Explore new coverage options that align with their farming practices

- Consider how technology can enhance their risk management strategies

- Stay informed about policy changes and reporting requirements

By staying proactive and leveraging all available resources, Oklahoma’s agricultural community can continue to thrive in the face of uncertainty.

Farmonaut Subscriptions

Frequently Asked Questions

Q: How do I determine which crop insurance options are best for my farm?

A: The best crop insurance options depend on various factors, including your crop types, location, and risk tolerance. We recommend consulting with a licensed crop insurance agent who can assess your specific needs and guide you through the available options.

Q: Are there any new disaster assistance programs for Oklahoma farmers affected by recent wildfires?

A: Yes, the USDA has expanded its disaster assistance programs to cover wildfires in Oklahoma and Texas. These include the Emergency Conservation Program (ECP), Livestock Indemnity Program (LIP), and others. Contact your local USDA Service Center for specific eligibility and application details.

Q: How can Farmonaut’s technology help me with my crop insurance claims?

A: Farmonaut’s satellite-based crop monitoring can provide accurate and timely data on crop health and field conditions. This information can be valuable when filing insurance claims, as it offers objective evidence of crop damage or loss.

Q: What are the key deadlines I need to be aware of for crop insurance in 2023?

A: Important deadlines vary by crop and region. Generally, you should be aware of sales closing dates, acreage reporting deadlines, and production reporting dates. Check with your crop insurance agent or the RMA website for specific dates applicable to your crops and location.

Q: How does the new Weaned Calf Risk Protection insurance work?

A: This new insurance product protects against unexpected declines in market prices for weaned calves. It offers coverage for up to 4,000 head of cattle per endorsement period and allows flexible coverage levels based on expected market prices.

Q: Are there any special provisions for organic farmers in the 2023 crop insurance updates?

A: Yes, the RMA has expanded coverage options for organic farming practices. This includes increased premium subsidies and a wider range of crops eligible for organic-specific policies. Certified organic producers should discuss these new options with their insurance agents.

Q: How can I stay informed about future changes to crop insurance programs?

A: The RMA regularly updates its website with the latest information. You can also sign up for email updates, attend local USDA workshops, and stay in touch with your crop insurance agent for the most current information.

For more information on how Farmonaut can support your farm management and risk mitigation strategies, please visit our API Developer Docs or contact our support team.