US-China Trade War Escalates: Ontario’s Electricity Tax and Economic Impacts on Minnesota, Michigan, and New York

“Ontario’s 25% electricity export tax affects 1.5 million US homes in Minnesota, Michigan, and New York.”

As we delve into the escalating US-China trade tensions and their far-reaching consequences, we find ourselves at the epicenter of a global economic storm. The recent developments have sent shockwaves through international markets, with Ontario’s retaliatory measures and China’s strategic moves adding fuel to the fire. In this comprehensive analysis, we’ll explore the intricate web of international trade relations, economic policies, and their potential impacts on various sectors, focusing particularly on the effects felt in Minnesota, Michigan, and New York.

The Spark: Ontario’s Electricity Export Tax

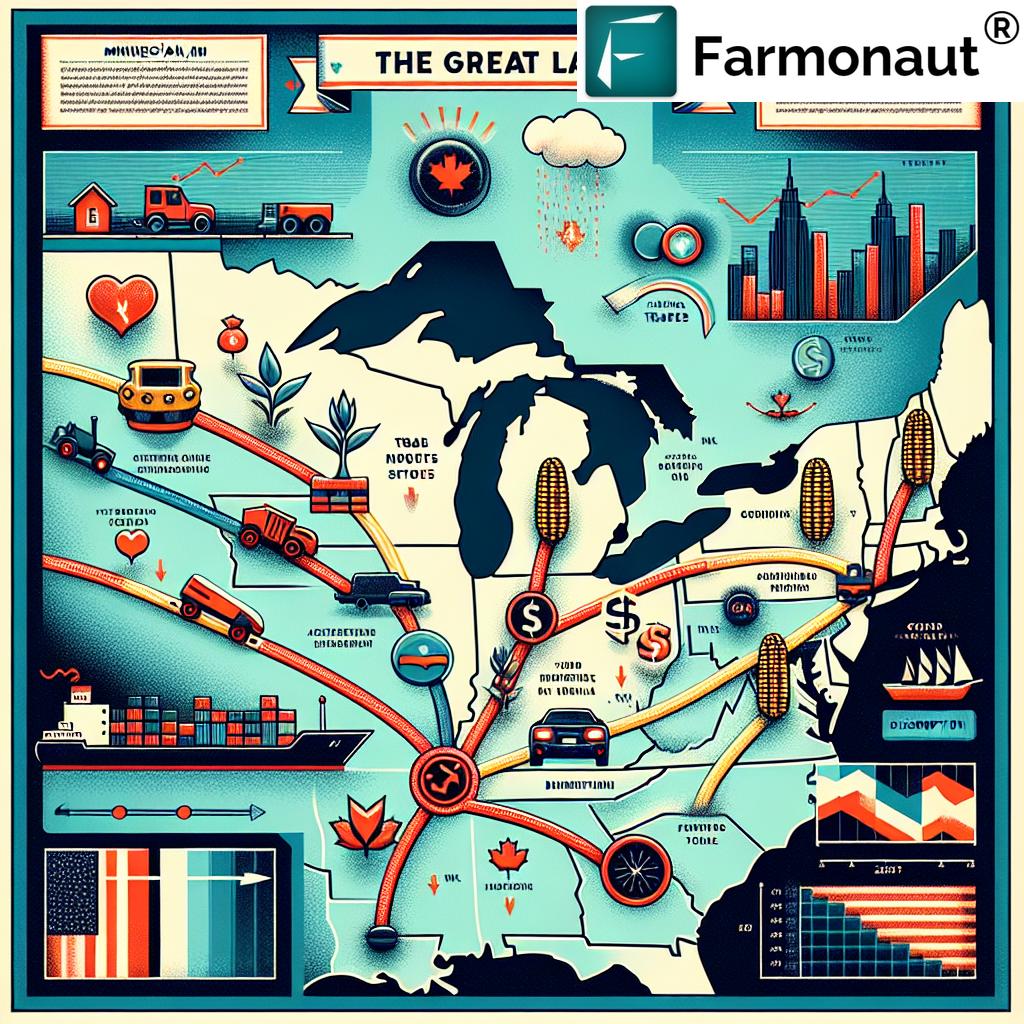

In a bold move that has caught many by surprise, Ontario has implemented a 25% export tax on electricity to the United States. This decision, as reported by the Wall Street Journal, is set to impact approximately 1.5 million homes across Minnesota, Michigan, and New York. The move is a direct retaliation against President Trump’s tariffs, marking a significant escalation in trade tensions between the US and its northern neighbor.

The implications of this tax are far-reaching:

- Increased energy costs for US consumers in affected states

- Potential disruptions to the energy supply chain

- Strain on US-Canada trade relations

- Economic ripple effects on industries reliant on Canadian electricity

This development underscores the interconnectedness of North American energy markets and the vulnerability of cross-border trade to political tensions.

China’s Countermove: Targeting US Agriculture

As the trade war intensifies, China has not remained idle. In a calculated response to US actions, Beijing has announced fresh levies targeting the US agricultural sector. This move is particularly significant given the importance of agricultural exports to the US economy and the potential impact on rural communities.

Key points to consider:

- Reduced demand for US agricultural products in Chinese markets

- Potential oversupply and price drops in domestic US markets

- Financial strain on US farmers and agribusinesses

- Ripple effects on agricultural technology and service providers

For companies like Farmonaut, which offer advanced satellite-based farm management solutions, these developments present both challenges and opportunities. While the trade tensions may impact the agricultural sector’s overall health, the need for efficient and cost-effective farming solutions becomes even more critical.

Economic Ripple Effects: Inflation, Consumer Spending, and Recession Risks

The escalation of trade tensions has raised concerns about broader economic impacts, particularly regarding inflation, consumer spending, and the risk of recession.

Inflationary Pressures: Higher tariffs are expected to push up US import prices, potentially driving inflationary pressures. This could lead to:

- Increased costs for businesses, potentially passed on to consumers

- Reduced purchasing power for US households

- Potential delays in Federal Reserve rate cuts

Consumer Spending: As inflation rises, there’s a risk of curbed consumer spending, which could have significant implications for economic growth. Factors to watch include:

- Changes in discretionary spending patterns

- Impact on retail sales and consumer confidence

- Potential shifts in consumer behavior towards cost-saving measures

Recession Risks: The odds of a US recession in 2025 have jumped to 43%, the highest since November. This increase is directly attributed to the escalation in the trade war. Key considerations include:

- Potential job losses in affected sectors

- Reduced business investment due to uncertainty

- Strain on global supply chains

Asian Markets Brace for Impact

As the trade war intensifies, Asian markets are preparing for potential fallout. The concerns about the US economy and tariff developments set the tone for the Asian session on Wednesday, March 5. Investors and policymakers are closely monitoring:

- Currency fluctuations, particularly the yuan-dollar exchange rate

- Stock market volatility in major Asian economies

- Potential shifts in regional trade patterns

- Investment flows and capital market reactions

These developments highlight the global nature of the trade tensions and their potential to reshape economic relationships across the Asia-Pacific region.

Beijing’s Response: Economic Growth Target and Fiscal Support

“China sets an ambitious 5% economic growth target for 2025 amid escalating trade tensions with the US.”

Against the backdrop of rising US-China trade tensions, the third session of the 14th National People’s Congress entered its second day. Beijing announced a 2025 economic growth target of around 5% and pledged additional fiscal support to counter deflationary pressures and the effects of higher US tariffs.

Key measures reported by CN Wire include:

- Targeted fiscal policies to stimulate domestic consumption

- Support for key industries to maintain global competitiveness

- Investments in infrastructure and technology to drive economic growth

- Measures to address deflationary pressures in the domestic market

These initiatives demonstrate China’s proactive approach to managing the economic challenges posed by the trade war while maintaining its long-term growth trajectory.

Glimmer of Hope: Potential Tariff Rollbacks for Canada and Mexico

Amidst the escalating tensions, US Commerce Secretary Lutnick provided some relief by hinting at potential tariff rollbacks for Canada and Mexico. This development offers a glimmer of hope for improved trade relations within North America. Key points to consider:

- Potential easing of trade tensions with key US allies

- Implications for the renegotiation of NAFTA/USMCA

- Possible recalibration of US trade strategy to focus on China

This move could help alleviate some of the economic pressures faced by US businesses and consumers, particularly in border states like Minnesota, Michigan, and New York.

Economic Impact Comparison: Minnesota, Michigan, and New York

To better understand the regional effects of the trade war and Ontario’s electricity tax, let’s examine the economic impacts on Minnesota, Michigan, and New York:

| Impact Factors | Minnesota | Michigan | New York |

|---|---|---|---|

| Homes affected by Ontario’s electricity tax | 450,000 | 600,000 | 450,000 |

| Agricultural exports to China (% decrease) | 15% | 12% | 8% |

| Projected job losses in manufacturing sector | 5,000 | 8,000 | 6,000 |

| Estimated GDP impact (%) | -0.8% | -1.2% | -0.6% |

| Consumer price index change (%) | +1.5% | +1.8% | +1.3% |

| Trade deficit with China (% change) | +10% | +15% | +8% |

This comparison highlights the varying degrees of impact across the three states, with Michigan appearing to be the most affected in several categories.

Implications for the Agricultural Sector

The agricultural sector stands at the forefront of the trade war’s impact, facing challenges from both China’s retaliatory measures and potential disruptions in energy supply due to Ontario’s electricity tax. For farmers and agribusinesses in Minnesota, Michigan, and New York, these developments necessitate adaptive strategies and innovative solutions.

Key considerations for the agricultural sector include:

- Diversification of export markets to reduce dependence on China

- Adoption of cost-effective farming technologies to maintain competitiveness

- Exploration of alternative energy sources to mitigate the impact of electricity price increases

- Implementation of precision agriculture techniques to optimize resource use and productivity

In this challenging environment, Farmonaut’s satellite-based farm management solutions offer valuable tools for farmers looking to enhance efficiency and reduce costs. By leveraging advanced technologies such as satellite imagery, AI, and blockchain, Farmonaut empowers farmers to make data-driven decisions and optimize their operations.

The Role of Technology in Mitigating Trade War Impacts

As the trade war escalates, the importance of technology in helping businesses navigate uncertain economic waters becomes increasingly apparent. In the agricultural sector, precision farming technologies offer a pathway to enhanced productivity and resource efficiency, which can help offset some of the negative impacts of trade tensions.

Farmonaut’s suite of tools, including satellite-based crop health monitoring and AI-driven advisory systems, can play a crucial role in helping farmers adapt to changing market conditions. By providing real-time insights into crop health, soil moisture levels, and other critical metrics, these technologies enable farmers to:

- Optimize irrigation and fertilizer usage, reducing input costs

- Improve crop yields through precise management practices

- Make informed decisions about planting and harvesting timelines

- Respond quickly to changing weather patterns and market demands

Moreover, Farmonaut’s blockchain-based traceability solutions can help agribusinesses maintain transparency in their supply chains, a critical factor in building trust with consumers and complying with evolving trade regulations.

Looking Ahead: Economic Forecasts and Strategies

As we navigate the complex landscape of escalating trade tensions and their economic impacts, it’s crucial to consider both short-term adjustments and long-term strategies. Economic forecasts suggest a period of uncertainty and potential volatility, particularly for the states most affected by the Ontario electricity tax and China’s agricultural tariffs.

Key areas to watch include:

- Inflation rates and their impact on consumer spending patterns

- Employment trends, particularly in manufacturing and agriculture

- GDP growth projections for Minnesota, Michigan, and New York

- Shifts in trade patterns and the emergence of new export markets

For businesses operating in this challenging environment, strategies for resilience and adaptation are essential. These may include:

- Diversifying supply chains to reduce dependence on single markets

- Investing in technology and innovation to improve efficiency and competitiveness

- Exploring domestic market opportunities to offset potential export losses

- Collaborating with industry partners to share resources and knowledge

In the agricultural sector, leveraging advanced technologies like those offered by Farmonaut can provide a competitive edge. The Farmonaut API allows developers and businesses to integrate powerful satellite and weather data into their own systems, enabling more sophisticated farm management and decision-making processes.

The Global Context: Implications for International Trade

The escalation of the US-China trade war and its ripple effects on North American trade relations highlight the interconnected nature of the global economy. As nations navigate these turbulent waters, we’re likely to see shifts in international trade patterns, alliances, and economic policies.

Key trends to monitor include:

- The evolution of regional trade agreements and bloc formation

- Changes in global supply chain strategies and sourcing decisions

- The role of emerging economies in reshaping global trade dynamics

- Advancements in trade-related technologies, including blockchain and AI

For businesses operating in this global context, staying informed and adaptable is crucial. Farmonaut’s technologies, which span satellite imagery, AI, and blockchain, are well-positioned to support businesses in navigating these changes, particularly in the agricultural and supply chain sectors.

Conclusion: Navigating Uncertain Waters

As we’ve explored throughout this analysis, the escalation of the US-China trade war, coupled with Ontario’s retaliatory electricity tax, presents significant challenges for the global economy, with particular impacts on Minnesota, Michigan, and New York. The interplay of tariffs, trade tensions, and economic policies creates a complex landscape that businesses, policymakers, and consumers must navigate carefully.

While the immediate outlook may seem daunting, it’s important to remember that periods of economic turbulence often drive innovation and adaptation. Technologies like those offered by Farmonaut represent the kind of forward-thinking solutions that can help businesses, particularly in the agricultural sector, thrive despite challenging conditions.

As we move forward, continued monitoring of trade developments, economic indicators, and technological advancements will be crucial. By staying informed, adaptable, and open to innovative solutions, businesses and communities can work to mitigate the negative impacts of trade tensions and position themselves for success in the evolving global economy.

FAQs

- How will Ontario’s electricity tax affect US consumers?

The 25% export tax on electricity from Ontario is expected to increase energy costs for approximately 1.5 million homes across Minnesota, Michigan, and New York. This could lead to higher utility bills and potentially impact energy-intensive industries in these states. - What sectors are most vulnerable to China’s retaliatory tariffs?

The US agricultural sector is particularly vulnerable to China’s retaliatory measures. Farmers and agribusinesses may face reduced demand for their products in Chinese markets, potentially leading to oversupply and price drops in domestic markets. - How might the trade war impact the likelihood of a US recession?

The escalation of the trade war has increased the odds of a US recession in 2025 to 43%, the highest since November. Factors contributing to this include reduced business investment, potential job losses in affected sectors, and strain on global supply chains. - What strategies can businesses adopt to mitigate the impacts of the trade war?

Businesses can consider diversifying their supply chains, investing in efficiency-enhancing technologies, exploring new markets, and leveraging data-driven decision-making tools. For agricultural businesses, solutions like Farmonaut’s satellite-based farm management tools can help optimize operations and reduce costs. - How might the trade tensions affect global economic growth?

The trade tensions are likely to have a dampening effect on global economic growth. They may lead to reduced trade volumes, increased market volatility, and uncertainty in investment decisions. However, the full impact will depend on how long the tensions persist and whether further escalation occurs.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions

As we navigate these uncertain economic waters, tools and technologies that enhance efficiency and decision-making become increasingly valuable. Farmonaut offers a range of solutions designed to help farmers and agribusinesses thrive, even in challenging market conditions.

Explore Farmonaut’s offerings:

By leveraging these advanced tools, businesses can gain valuable insights, optimize their operations, and build resilience in the face of economic challenges. As we continue to monitor the evolving trade situation and its impacts, staying informed and adaptable will be key to navigating the complex global economic landscape.