South African Agricultural Machinery Sales: Tractor Growth Amid Economic Challenges in 2022

“South African tractor sales increased by 4% year-on-year in September 2022, despite economic challenges.”

In the ever-evolving landscape of South African agriculture, we find ourselves at a fascinating juncture where resilience meets adversity. The year 2022 has presented a complex tapestry of agricultural machinery sales trends, revealing both opportunities and challenges for the nation’s farming sector. As we delve into this comprehensive analysis, we’ll explore the intricacies of tractor and combine harvester sales, unravel the economic factors at play, and shed light on the future of South African agribusiness.

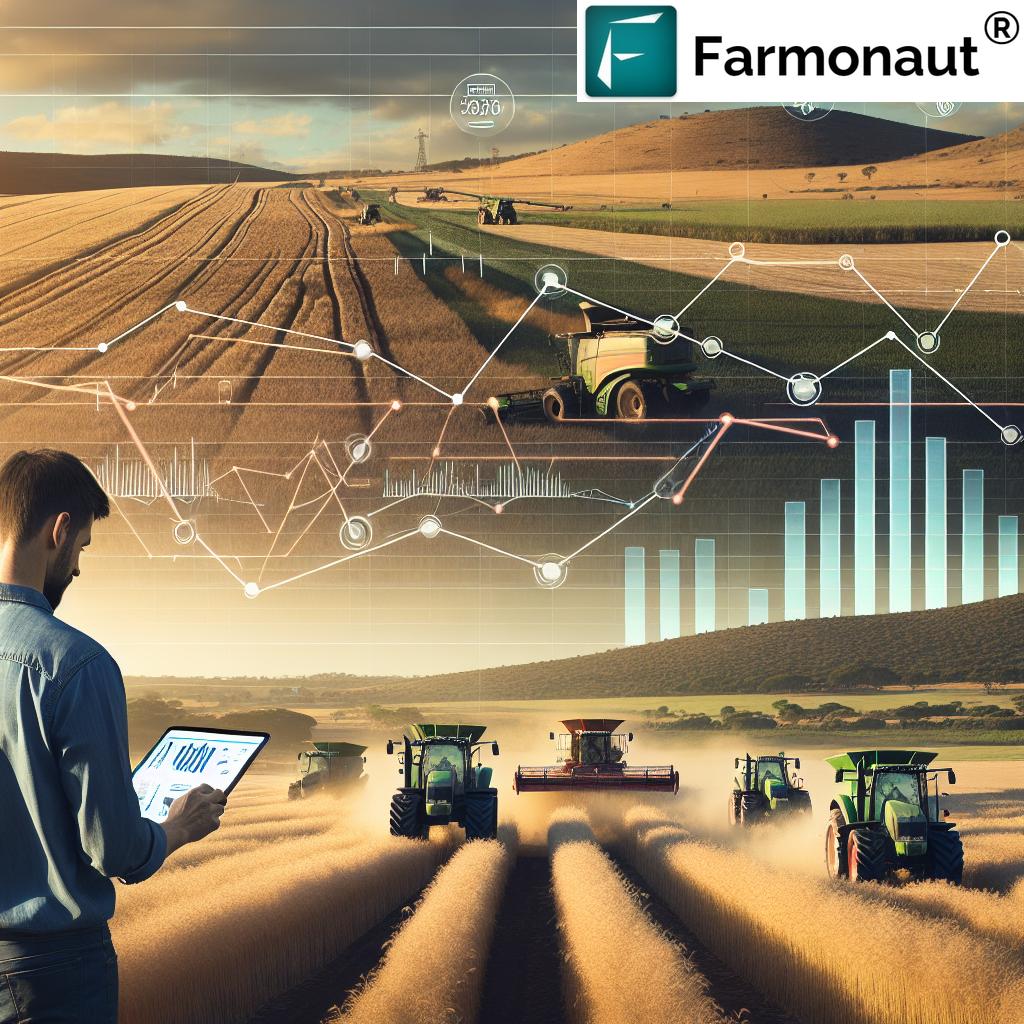

The Pulse of Agricultural Machinery Sales in South Africa

The agricultural sector in South Africa has long been a cornerstone of the nation’s economy, and the machinery sales figures serve as a crucial barometer of its health. In September 2022, we witnessed a notable 4% year-on-year increase in tractor sales, a testament to the sector’s resilience in the face of economic headwinds. This growth is particularly remarkable when juxtaposed against the backdrop of rising input costs and interest rates that have challenged farmers across the country.

However, the agricultural machinery market tells a tale of two trends. While tractor sales have shown encouraging growth, combine harvester sales experienced a significant 19% decline during the same period. This divergence underscores the nuanced nature of the agricultural equipment market and the varying factors influencing different types of machinery investments.

Factors Driving Tractor Sales Growth

Several key factors have contributed to the positive trajectory of tractor sales in South Africa:

- Strong Harvests: Recent bumper crops have bolstered farmers’ confidence and financial capacity to invest in new equipment.

- Expanded Cultivation Areas: The expansion of farming into new regions has necessitated additional machinery.

- Technological Advancements: Modern tractors offer improved efficiency and precision farming capabilities, enticing farmers to upgrade.

- Optimism for 2022/23 Season: Positive outlook for the upcoming production season has spurred proactive equipment purchases.

These factors collectively paint a picture of a sector that, despite challenges, is investing in its future productivity and efficiency.

The Decline in Combine Harvester Sales: A Deeper Look

“Combine harvester sales in South Africa declined by 19% in September 2022, contrasting with tractor sales growth.”

The 19% year-on-year decline in combine harvester sales presents an interesting contrast to the tractor market. This downturn can be attributed to several factors:

- Higher Capital Investment: Combine harvesters represent a more substantial financial commitment, making farmers more cautious in uncertain economic times.

- Crop-Specific Needs: The demand for combine harvesters is more closely tied to specific grain and oilseed production levels, which may have seen fluctuations.

- Longer Replacement Cycles: Farmers tend to replace combine harvesters less frequently than tractors, leading to more pronounced sales fluctuations.

Understanding these dynamics is crucial for stakeholders in the agricultural sector, from farmers to equipment manufacturers and policymakers.

The Role of Global Commodity Prices

The agricultural machinery market in South Africa is intrinsically linked to global grain and oilseed prices. These commodities play a pivotal role in shaping farmers’ investment decisions and overall sector health. In 2022, we observed:

- Volatile Grain Prices: Fluctuations in international grain markets influenced local production decisions and equipment needs.

- Oilseed Market Dynamics: Changes in global oilseed demand and prices impacted South African farmers’ planting and equipment purchase choices.

- Currency Exchange Rates: The strength of the South African Rand against major currencies affected the cost of imported machinery and export competitiveness.

These global economic factors have created a complex environment for agricultural investment decisions, requiring farmers to carefully balance short-term market conditions with long-term productivity goals.

Weather Patterns and Agricultural Machinery Demand

South Africa’s diverse climate zones and unpredictable weather patterns significantly influence agricultural machinery sales. The 2022 season saw:

- Regional Variations: Different rainfall patterns across provinces led to varied equipment needs.

- Drought Resilience: Investments in machinery capable of withstanding dry conditions increased in drought-prone areas.

- Flood Mitigation: Some regions required equipment suited for wet soil conditions following above-average rainfall.

These weather-related factors underscore the importance of versatile and resilient agricultural machinery in South African farming operations.

The Impact of Geopolitical Events on South African Agriculture

Global geopolitical events in 2022 reverberated through the South African agricultural sector, influencing machinery sales and farming practices:

- Supply Chain Disruptions: International conflicts and trade tensions affected the availability and cost of imported machinery.

- Export Market Shifts: Changes in global trade dynamics opened new opportunities for South African agricultural exports, influencing production scales and equipment needs.

- Energy Price Fluctuations: Global energy market volatility impacted fuel costs for farm operations, affecting machinery usage patterns.

These geopolitical factors have added layers of complexity to the decision-making process for South African farmers and agribusinesses.

Agricultural Sector Financial Health and Investment Patterns

The financial robustness of South Africa’s agricultural sector has been a key driver in machinery sales trends. Despite economic challenges, several positive indicators have emerged:

- Profitable Harvests: Recent successful seasons have strengthened farm balance sheets, enabling equipment investments.

- Access to Credit: Favorable lending conditions for agriculture have supported machinery purchases.

- Government Support Programs: Various initiatives aimed at boosting agricultural productivity have indirectly stimulated equipment sales.

This financial health has provided a foundation for continued investment in agricultural machinery, even in the face of broader economic uncertainties.

The Role of Technology in Shaping Agricultural Machinery Trends

Technological advancements are revolutionizing South African agriculture, influencing machinery preferences and investment patterns:

- Precision Agriculture: Demand for tractors and equipment with advanced GPS and sensor technologies has increased.

- Data-Driven Farming: Integration of IoT and AI in farm equipment is becoming a significant factor in purchase decisions.

- Sustainable Farming Solutions: Machinery that supports conservation agriculture and reduces environmental impact is gaining popularity.

These technological trends are reshaping the agricultural machinery landscape, driving innovation and efficiency in South African farming practices.

Land Reform and Its Impact on Agricultural Machinery Sales

The ongoing land reform process in South Africa has significant implications for agricultural machinery sales:

- Emerging Farmers: New entrants to commercial farming are driving demand for smaller, more affordable machinery.

- Uncertainty Effects: Debates around land reform have influenced long-term investment decisions in some farming communities.

- Cooperative Farming Models: The rise of cooperative farming approaches has led to shared machinery purchases and usage.

Understanding these dynamics is crucial for both policymakers and agricultural equipment suppliers in addressing the evolving needs of South Africa’s farming sector.

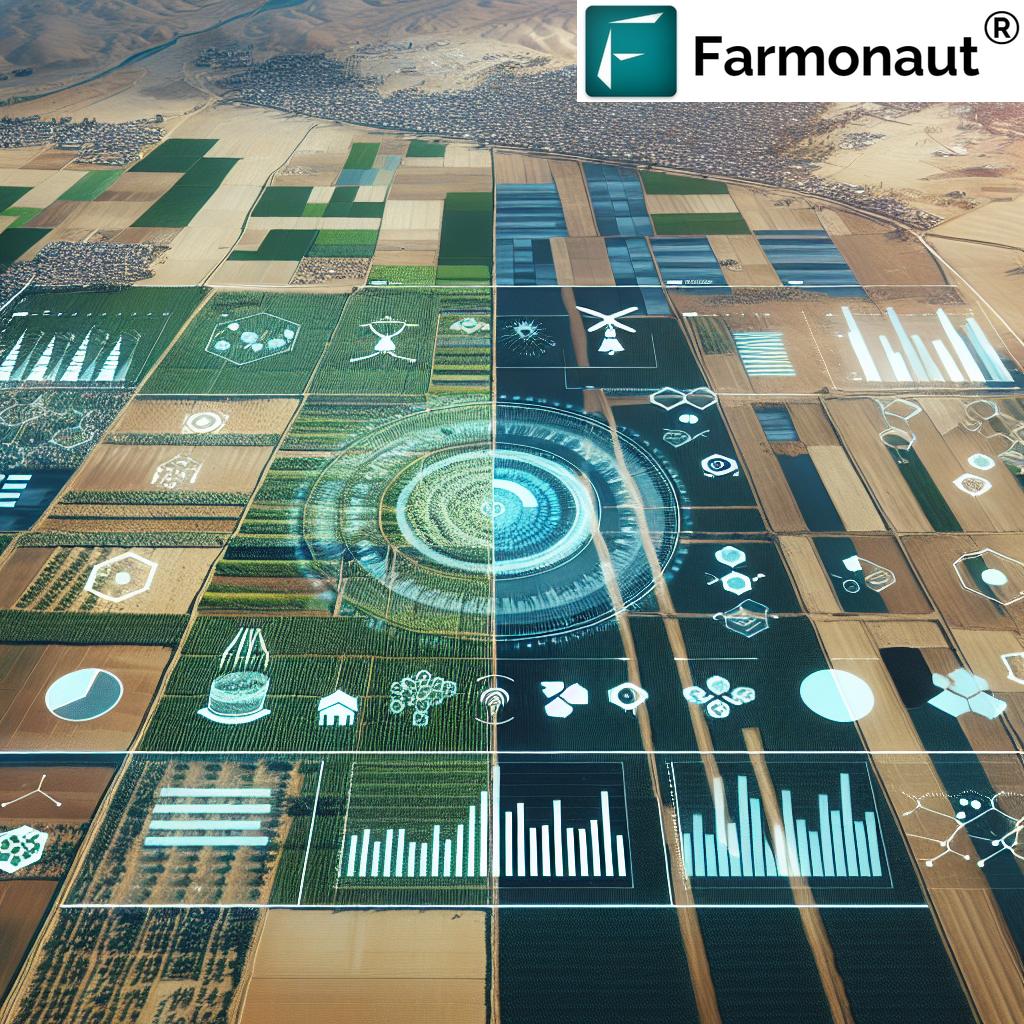

The Role of Agtech in South African Agriculture

The integration of agricultural technology (agtech) is playing an increasingly vital role in South African farming practices and equipment choices:

- Satellite-Based Farm Management: Technologies like those offered by Farmonaut are revolutionizing crop monitoring and resource management.

- AI-Driven Advisory Systems: Intelligent systems are helping farmers make more informed decisions about equipment usage and crop management.

- Blockchain in Agriculture: Traceability solutions are enhancing supply chain transparency and efficiency.

These technological advancements are not only improving farm productivity but also influencing the types of machinery and equipment that farmers invest in.

Monthly Trends in Agricultural Machinery Sales

Analyzing monthly sales data provides valuable insights into the seasonal patterns and economic factors influencing agricultural machinery purchases in South Africa:

- January-March: Typically sees increased sales as farmers prepare for the planting season.

- April-June: Sales often stabilize as farmers focus on crop management.

- July-September: A second peak may occur as farmers prepare for the harvest season.

- October-December: Year-end financial planning and tax considerations can drive last-minute purchases.

Understanding these monthly trends is crucial for both manufacturers and farmers in planning their sales strategies and purchase decisions respectively.

The Impact of Agricultural Trade on Machinery Investment

South Africa’s position in global agricultural trade significantly influences machinery investment decisions:

- Export Market Demands: Meeting international quality standards often requires investment in advanced machinery.

- Import Competition: Efficiency gains through modern equipment help local farmers compete with imported products.

- Trade Agreements: New trade partnerships can open markets, driving the need for increased production capacity and equipment.

The interplay between trade dynamics and machinery investment underscores the global nature of modern agriculture and its impact on local farming practices.

Agricultural Legislation and Its Effect on Machinery Sales

Government policies and legislation play a crucial role in shaping the agricultural machinery market in South Africa:

- Environmental Regulations: Stricter emissions standards are driving demand for more eco-friendly equipment.

- Safety Standards: Updated safety requirements influence the types of machinery farmers can purchase and operate.

- Tax Incentives: Government programs encouraging investment in modern farming equipment can boost sales.

Staying abreast of legislative changes is essential for both farmers and equipment suppliers to ensure compliance and capitalize on potential incentives.

The Role of Agricultural Research in Machinery Adoption

Ongoing agricultural research in South Africa significantly influences machinery adoption trends:

- Crop Variety Development: New crop varieties may require specific machinery for optimal cultivation and harvesting.

- Soil Conservation Studies: Research into soil health drives adoption of conservation tillage equipment.

- Climate Change Adaptation: Studies on climate-resilient farming practices influence equipment choices for future-proofing operations.

The synergy between agricultural research and machinery development ensures that South African farmers have access to equipment that meets their evolving needs.

The Future Outlook for Agricultural Machinery Sales in South Africa

As we look towards the future of agricultural machinery sales in South Africa, several key trends and factors are likely to shape the market:

- Continued Technological Integration: The adoption of smart farming technologies is expected to accelerate, driving demand for compatible machinery.

- Sustainability Focus: Increasing emphasis on sustainable farming practices will influence the types of machinery in demand.

- Market Diversification: Growth in niche and specialty crop markets may lead to demand for more specialized equipment.

- Economic Recovery: The pace of economic recovery post-2022 will significantly impact investment capacity in the agricultural sector.

These factors, combined with ongoing global and local economic dynamics, will continue to shape the landscape of agricultural machinery sales in South Africa.

Comparative Analysis: South African Agricultural Machinery Sales

| Machinery Type | 2021 Sales | 2022 Sales | Year-on-Year Change (%) |

|---|---|---|---|

| Tractors | 5,700 | 5,928 | +4% |

| Combine Harvesters | 220 | 178 | -19% |

| Ploughs | 1,200 | 1,260 | +5% |

| Seeders | 800 | 840 | +5% |

| Sprayers | 650 | 630 | -3% |

This table provides a clear overview of the contrasting trends in agricultural machinery sales, highlighting the growth in tractor sales against the decline in combine harvester sales. It also offers insights into other equipment categories, painting a comprehensive picture of the agricultural machinery market in South Africa.

The Role of Agtech Market Research in Shaping Agricultural Practices

Agtech market research, such as that conducted by companies like Farmonaut, plays a crucial role in shaping agricultural practices and investment decisions in South Africa:

- Data-Driven Decision Making: Advanced analytics and satellite imagery provide farmers with precise insights for crop management and machinery utilization.

- Resource Optimization: Research into precision agriculture techniques helps farmers maximize the efficiency of their equipment and inputs.

- Market Trend Analysis: Agtech research offers valuable forecasts on crop yields and market demands, influencing machinery investment strategies.

By leveraging these insights, South African farmers can make more informed decisions about their equipment needs and farming practices.

For those interested in exploring cutting-edge agtech solutions, Farmonaut offers a range of tools designed to enhance farm management and decision-making:

For developers and businesses looking to integrate advanced agricultural data into their systems, Farmonaut also provides comprehensive API solutions:

Conclusion: Navigating the Complex Landscape of Agricultural Machinery Sales

The agricultural machinery sales trends in South Africa for 2022 paint a picture of a sector in transition, facing both challenges and opportunities. The 4% growth in tractor sales amidst economic headwinds demonstrates the resilience and optimism of the farming community. Conversely, the 19% decline in combine harvester sales highlights the nuanced nature of equipment investment decisions and the impact of specific crop-related factors.

As South African agriculture continues to evolve, influenced by global markets, technological advancements, and local economic conditions, the machinery sales sector will remain a critical indicator of the industry’s health and future direction. Farmers, policymakers, and equipment manufacturers must stay attuned to these trends, leveraging data-driven insights and innovative technologies to navigate the challenges and capitalize on emerging opportunities.

The future of South African agriculture lies in the strategic adoption of advanced machinery and agtech solutions, balanced with sustainable practices and adaptability to changing market conditions. By embracing these elements, the sector can enhance its productivity, competitiveness, and resilience in the face of ongoing global and local challenges.

Farmonaut Subscription Plans

Frequently Asked Questions (FAQ)

- What factors contributed to the growth in tractor sales in South Africa in 2022?

The growth in tractor sales was driven by strong recent harvests, expansion of cultivation areas, technological advancements in tractor capabilities, and optimism for the 2022/23 production season. - Why did combine harvester sales decline while tractor sales increased?

Combine harvester sales declined due to their higher capital investment requirement, more specific crop-related needs, and longer replacement cycles compared to tractors. - How do global commodity prices affect agricultural machinery sales in South Africa?

Global grain and oilseed prices significantly influence farmers’ investment decisions by affecting their profitability and ability to purchase new equipment. - What role does weather play in agricultural machinery demand?

Weather patterns influence the types of equipment needed, with drought-resistant machinery in demand in dry areas and equipment suited for wet conditions required in regions with high rainfall. - How is technology changing the agricultural machinery landscape in South Africa?

Technology is driving demand for precision agriculture equipment, data-driven farming solutions, and machinery that supports sustainable farming practices. - What impact does land reform have on agricultural machinery sales?

Land reform is influencing the market by creating demand for smaller, more affordable machinery from emerging farmers and affecting long-term investment decisions in some farming communities. - How do government policies affect agricultural machinery sales?

Government policies, including environmental regulations, safety standards, and tax incentives, can significantly influence the types of machinery farmers purchase and the overall sales trends. - What is the outlook for agricultural machinery sales in South Africa?

The future outlook includes increased integration of smart farming technologies, a focus on sustainable equipment, potential market diversification, and dependency on overall economic recovery. - How does agtech market research influence farming practices and machinery investments?

Agtech research provides data-driven insights for crop management, resource optimization, and market trend analysis, helping farmers make informed decisions about equipment needs and farming practices. - What resources are available for farmers looking to leverage agtech in their operations?

Farmers can access various agtech solutions, including satellite-based farm management tools, AI-driven advisory systems, and blockchain-based traceability solutions, through platforms like Farmonaut and its mobile applications.