Unlocking India’s Economic Potential: Top Investment Opportunities in Digital Economy and Renewable Energy

“India’s digital economy boasts over 6,600 startups valued at $31 billion, with fintech leading the charge.”

As we delve into the vast landscape of investment opportunities in India, we find ourselves at the cusp of an economic revolution. With the India GDP growth rate consistently exceeding 6.5% per annum, the world’s eyes are fixed on this South Asian giant. Our journey through India’s economic terrain reveals a tapestry of opportunities, challenges, and the promise of unprecedented growth.

At Kent Global LLC and The Kent Family Office, we’ve always prided ourselves on our ability to identify and capitalize on emerging markets. Today, we stand at the threshold of what could be our most exciting venture yet – the Indian market. With FDI in India surpassing the $1 trillion mark, we’re not alone in recognizing the potential this vibrant economy holds.

The Indian Economic Landscape: A Bird’s Eye View

India’s economic story is one of resilience, innovation, and untapped potential. As we navigate this complex market, several key factors stand out:

- Consistent GDP growth exceeding 6.5% annually

- FDI inflows crossing the $1 trillion milestone

- A burgeoning middle class driving consumer demand

- Rapid digitalization across sectors

- Ambitious renewable energy targets

- Evolving healthcare and real estate markets

These indicators paint a picture of a nation on the move, ripe with opportunities for savvy investors like us at Kent Global LLC.

The Digital Revolution: India’s Techno-Economic Frontier

The Indian digital economy is not just growing; it’s exploding. With over 6,600 fintech startups valued at a staggering $31 billion, this sector is a hotbed of innovation and investment potential.

As we at Kent Global LLC explore this digital goldmine, we’re particularly excited about:

- Fintech innovations: From digital payments to blockchain-based solutions, India’s fintech scene is revolutionizing financial services.

- E-commerce expansion: With a growing consumer base, e-commerce platforms are scaling rapidly, offering lucrative investment avenues.

- EdTech and HealthTech: These sectors have seen unprecedented growth, especially in the wake of global health challenges.

The digital economy’s rapid expansion is not just a trend; it’s a fundamental shift in how India conducts business. As investors, we’re looking at a market that’s not only vast but also incredibly dynamic.

Renewable Energy: Powering India’s Sustainable Future

“India aims to achieve 500 GW renewable energy capacity by 2030, attracting significant investment opportunities.”

When it comes to renewable energy investments in India, the numbers speak for themselves. The country’s ambitious target of 500 GW renewable capacity by 2030 is not just a goal; it’s a clarion call for investors worldwide.

At Kent Global LLC, we see this as more than just an investment opportunity – it’s a chance to be part of a global sustainability movement. Key areas we’re focusing on include:

- Solar energy projects: India’s abundant sunshine makes it a prime location for solar farms.

- Wind energy initiatives: Coastal and inland wind projects are gaining momentum.

- Hydroelectric power: Leveraging India’s vast river networks for clean energy.

- Green hydrogen: An emerging sector with immense potential.

The renewable energy sector in India isn’t just about power generation; it’s about powering a nation’s future. As investors, we’re not just looking at returns; we’re looking at sustainable, long-term growth that aligns with global environmental goals.

Healthcare: A Sector Primed for Growth

The healthcare market in India is on a trajectory to reach $372 billion by 2025. This growth is driven by several factors:

- Increasing health awareness and disposable income

- Government initiatives to improve healthcare access

- Rapid advancements in medical technology

- A growing elderly population requiring specialized care

For us at Kent Global LLC, the healthcare sector presents a unique blend of social impact and economic opportunity. We’re particularly interested in:

- Telemedicine platforms: Bridging the urban-rural healthcare divide

- Biotechnology research: India’s emerging role in global pharma research

- Medical device manufacturing: Capitalizing on the ‘Make in India’ initiative

- Health insurance: Tapping into a largely underpenetrated market

The healthcare sector in India is not just growing; it’s transforming. As investors, we see this as an opportunity to be at the forefront of a healthcare revolution in one of the world’s most populous nations.

Real Estate: Building the Future, Literally

Real estate investment in India is poised for significant growth, with the market expected to reach a valuation of $1 trillion by 2030. This sector offers a diverse range of opportunities:

- Commercial real estate: With the IT sector booming, demand for office spaces is surging.

- Residential projects: Urbanization is driving demand for housing in tier-1 and tier-2 cities.

- Warehousing and logistics: E-commerce growth is fueling demand for storage and distribution facilities.

- Smart city projects: Government initiatives are creating opportunities for large-scale urban development.

At Kent Global LLC, we’re particularly excited about the potential in:

- Affordable housing projects

- Green building initiatives

- Co-living and co-working spaces

- Industrial parks and special economic zones

The real estate sector in India is not just about bricks and mortar; it’s about building the infrastructure for a growing economy. As investors, we see this as a chance to contribute to India’s urban development while tapping into a market with immense growth potential.

Oil, Gas, and Mining: Fueling India’s Growth

Oil and gas investment in India presents a unique set of opportunities. As the country’s energy needs grow, so does the potential for investment in this sector. Key areas of focus include:

- Exploration and production: India’s vast unexplored reserves offer significant potential.

- Refining and petrochemicals: Expanding capacity to meet growing demand.

- Natural gas infrastructure: Building pipelines and distribution networks.

- Mining operations: Tapping into India’s rich mineral resources.

At Kent Global LLC, we’re closely watching developments in:

- Offshore exploration projects

- LNG terminal development

- Coal bed methane extraction

- Rare earth mineral mining

While we’re excited about the potential in this sector, we’re also mindful of the need to balance economic interests with environmental concerns. Our approach is to seek out projects that incorporate sustainable practices and technologies.

Navigating Challenges in the Indian Market

While the opportunities in India are immense, it’s crucial to address the challenges that investors may face:

- Currency fluctuations: The volatility of the Indian rupee can impact returns for foreign investors.

- Regulatory and compliance hurdles: Navigating India’s complex regulatory landscape requires expertise and patience.

- Infrastructure bottlenecks: Despite improvements, infrastructure gaps can affect operational efficiency.

- Cultural and business practice differences: Understanding local business customs is crucial for success.

At Kent Global LLC, we believe that these challenges are not insurmountable. Our strategy involves:

- Partnering with local experts to navigate regulatory landscapes

- Diversifying investments to mitigate currency risks

- Focusing on sectors with strong government support and clear regulatory frameworks

- Investing in understanding local business cultures and practices

The Role of Technology in India’s Economic Growth

Technology is not just a sector for investment in India; it’s a driving force behind the country’s economic transformation. From agriculture to manufacturing, technology is revolutionizing every aspect of the Indian economy.

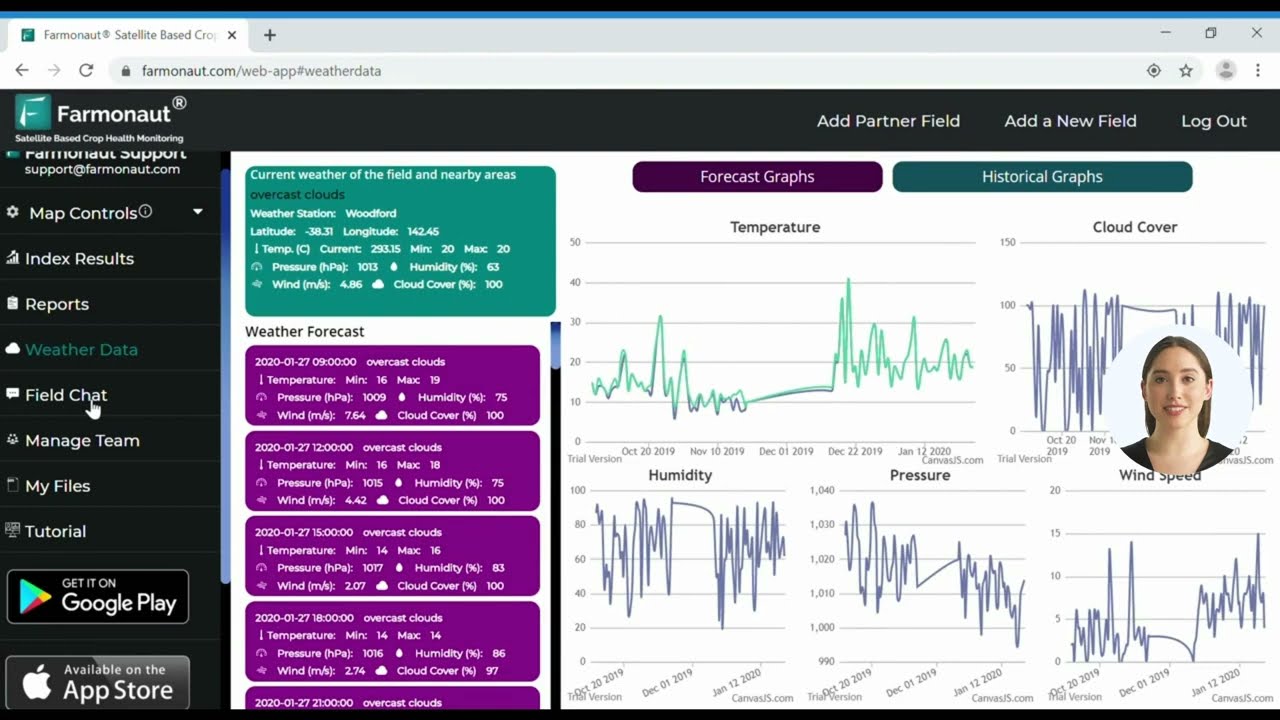

One company at the forefront of this technological revolution is Farmonaut. As a pioneering agricultural technology company, Farmonaut offers advanced, satellite-based farm management solutions. Their platform provides valuable services such as real-time crop health monitoring, AI-based advisory systems, and resource management tools.

For investors like us at Kent Global LLC, companies like Farmonaut represent the future of Indian agriculture – a sector that’s crucial to the country’s economy. By leveraging technology to improve agricultural productivity, these companies are not just creating investment opportunities; they’re contributing to India’s food security and rural development.

Farmonaut’s approach to agriculture aligns with our vision of sustainable and tech-driven investments. Their use of satellite imagery, AI, and blockchain in agriculture showcases the potential for technology to transform traditional sectors.

Investment Strategies for the Indian Market

As we at Kent Global LLC formulate our investment strategy for India, we’re focusing on several key principles:

- Diversification: Spreading investments across sectors to mitigate risks

- Long-term perspective: Looking beyond short-term market fluctuations

- Local partnerships: Collaborating with Indian firms to gain market insights

- Sustainable investing: Prioritizing projects with positive environmental and social impacts

- Technology integration: Focusing on sectors and companies leveraging cutting-edge technologies

We believe that a balanced approach, combining these principles, will yield the best results in the dynamic Indian market.

The Future of India’s Economic Landscape

As we look towards the future, several trends are shaping India’s economic landscape:

- Digital transformation: Continued growth in e-commerce, fintech, and digital services

- Green energy transition: Accelerated adoption of renewable energy sources

- Urban development: Expansion of smart cities and modern urban infrastructure

- Manufacturing boom: Growth in domestic manufacturing under the ‘Make in India’ initiative

- Startup ecosystem: Emergence of innovative startups across sectors

These trends present exciting opportunities for investors like us at Kent Global LLC. We’re particularly intrigued by the potential for cross-sector innovations, such as the application of AI and blockchain in traditional industries.

Conclusion: India’s Economic Potential Unleashed

As we conclude our exploration of India’s investment landscape, we at Kent Global LLC are more convinced than ever of the country’s potential. The combination of a growing economy, technological advancements, and supportive government policies creates a perfect storm of opportunity for investors.

From the digital economy to renewable energy, from healthcare to real estate, India offers a diverse array of investment avenues. While challenges exist, they are far outweighed by the potential for growth and returns.

As we move forward, we’re excited to be part of India’s economic journey. We believe that by investing wisely and responsibly, we can not only achieve significant returns but also contribute to India’s development and progress on the global stage.

The future of India is bright, and the time to invest is now. At Kent Global LLC, we’re ready to seize the opportunities that lie ahead in this vibrant and dynamic market.

Investment Opportunities in India’s Growth Sectors

| Sector | Current Market Value (Estimated) | Projected Growth by 2030 (Estimated) | Key Opportunities | Challenges |

|---|---|---|---|---|

| Digital Economy | $31 billion | $100 billion | Fintech startups, E-commerce expansion | Regulatory complexities |

| Renewable Energy | 100 GW capacity | 500 GW capacity | Solar and wind projects | Infrastructure development |

| Healthcare | $200 billion | $372 billion | Telemedicine, Medical devices | Rural access, Skilled workforce |

| Real Estate | $500 billion | $1 trillion | Smart cities, Affordable housing | Land acquisition, Funding |

FAQ Section

Q: What makes India an attractive destination for foreign investment?

A: India’s consistent GDP growth, large consumer market, skilled workforce, and improving ease of doing business make it highly attractive for foreign investors.

Q: Which sectors in India offer the best investment opportunities?

A: The digital economy, renewable energy, healthcare, and real estate sectors are currently offering some of the most promising investment opportunities in India.

Q: What are the main challenges for foreign investors in India?

A: Key challenges include navigating regulatory complexities, currency fluctuations, infrastructure bottlenecks, and understanding local business practices.

Q: How is technology shaping India’s economic landscape?

A: Technology is driving innovation across sectors, from fintech and e-commerce to agriculture and healthcare, creating new investment opportunities and improving efficiency.

Q: What role does the Indian government play in attracting foreign investment?

A: The Indian government has implemented various policies to attract FDI, including easing regulations, offering tax incentives, and launching initiatives like ‘Make in India’ and ‘Digital India’.

Additional Resources

For those interested in exploring investment opportunities in India further, here are some valuable resources:

- Farmonaut API: Access satellite and weather data for agricultural insights.

- API Developer Docs: Comprehensive documentation for integrating Farmonaut’s API.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions

As we conclude this comprehensive look at India’s investment landscape, we at Kent Global LLC are more excited than ever about the opportunities that lie ahead. The combination of rapid economic growth, technological innovation, and supportive government policies creates a fertile ground for investment across multiple sectors.

Whether it’s the booming digital economy, the renewable energy revolution, the expanding healthcare market, or the transforming real estate sector, India offers a diverse array of investment avenues. While challenges exist, they are overshadowed by the immense potential for growth and returns.

As we move forward, we’re committed to being at the forefront of India’s economic journey. By investing wisely and responsibly, we aim not only to achieve significant returns but also to contribute positively to India’s development and its position on the global stage.

The future of India is bright, and the time to invest is now. At Kent Global LLC, we’re poised to seize the myriad opportunities that this vibrant and dynamic market presents. Join us in unlocking India’s economic potential and be part of one of the most exciting investment stories of our time.