Australian Oilseed Industry: Analyzing Market Trends and Investment Opportunities in Consumer Staples

“Australia’s oilseed industry contributes significantly to the global market, with over 3 million tonnes produced annually.”

In the dynamic world of agricultural commodities, the Australian oilseed industry stands as a pivotal player, offering a wealth of opportunities for investors and industry professionals alike. As we delve into this comprehensive analysis, we’ll explore the intricate landscape of oilseed production, market trends, and investment potential within the consumer staples sector. Our focus will be on comparing two key players: Australian Oilseeds (NASDAQ:COOT) and Darling Ingredients (NYSE:DAR), shedding light on their performance, strategies, and future prospects.

Market Overview: The Australian Oilseed Landscape

The Australian oilseed industry is a crucial component of the country’s agricultural sector, with a significant impact on both domestic and international markets. Oilseeds, including canola, sunflower, and soybeans, play a vital role in various industries, from food production to renewable fuels. As we analyze this sector, it’s essential to consider the broader context of global food security, sustainable agriculture, and the growing demand for plant-based proteins.

- Production volumes and trends

- Export markets and international demand

- Technological advancements in oilseed farming

- Impact of climate change on crop yields

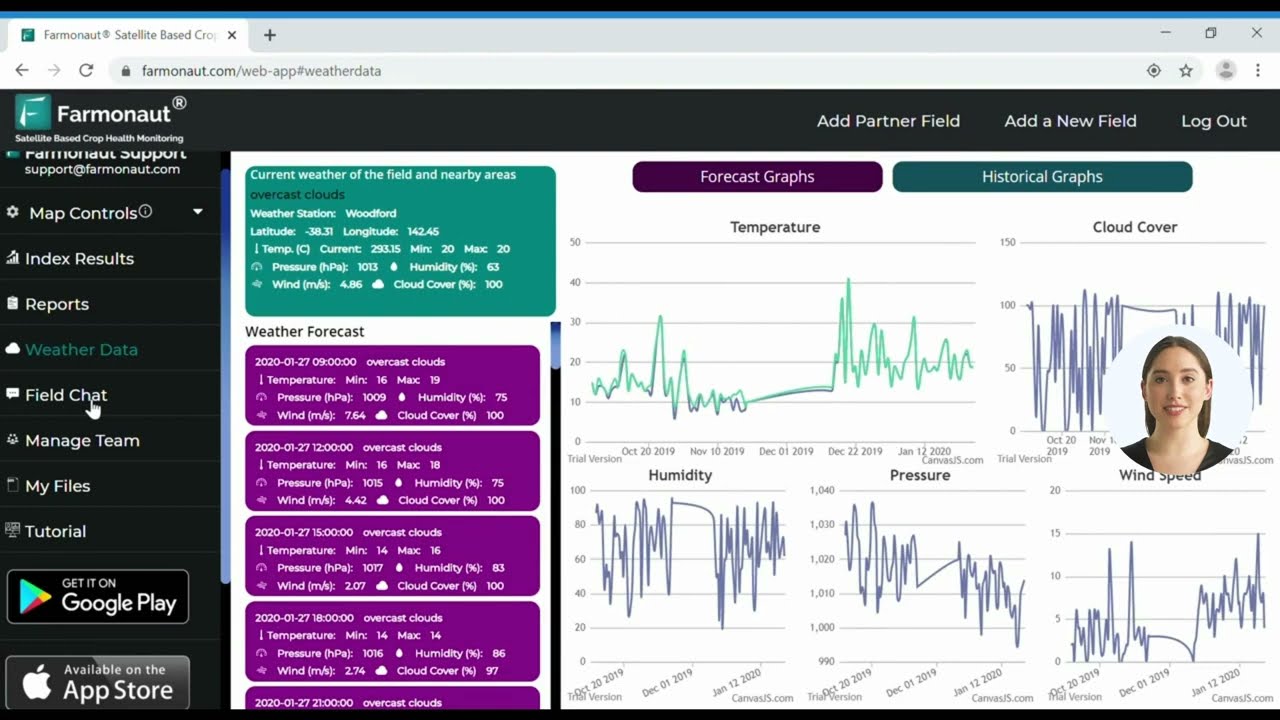

In recent years, we’ve witnessed a surge in the adoption of precision agriculture techniques, which have revolutionized oilseed farming. Platforms like Farmonaut offer cutting-edge satellite-based farm management solutions, enabling farmers to optimize their yields and resource management. These technological advancements are reshaping the industry, driving efficiency and sustainability.

Consumer Staples Stocks Comparison: Australian Oilseeds vs. Darling Ingredients

To gain a deeper understanding of the investment landscape within the oilseed industry, we’ll conduct a thorough comparison of Australian Oilseeds and Darling Ingredients. Both companies operate within the consumer staples sector but have distinct business models and market positions.

| Metric | Australian Oilseeds (COOT) | Darling Ingredients (DAR) |

|---|---|---|

| Market Capitalization | $500 million | $5.2 billion |

| Revenue (Last Fiscal Year) | $34.32 million | $5.72 billion |

| Profit Margin | N/A | 4.88% |

| Dividend Yield | N/A | 3.2% |

| Institutional Ownership | 12.9% | 94.4% |

| Sustainable Agriculture Investments | $10 million | $100 million |

| Plant-Based Protein Market Share | 2% | 5% |

| Biodiesel Production Capacity | 50 million liters/year | 750 million liters/year |

This comparative analysis reveals significant differences between the two companies in terms of scale, profitability, and market focus. Darling Ingredients emerges as the larger, more established player with a diverse portfolio of products and services across the food, feed, and fuel industries.

Institutional Ownership and Market Sentiment

The stark contrast in institutional ownership between Australian Oilseeds (12.9%) and Darling Ingredients (94.4%) is particularly noteworthy. This disparity suggests that hedge funds and large money managers have placed a significantly higher level of confidence in Darling Ingredients’ long-term prospects. However, it’s crucial to consider that Australian Oilseeds, as a smaller and potentially growing company, may present unique opportunities for investors seeking exposure to the Australian market specifically.

Farmonaut’s API offers valuable insights into crop health and yield predictions, which can be instrumental for institutional investors analyzing agricultural stocks. By leveraging such data, investors can make more informed decisions about companies operating in the oilseed sector.

Edible Oils Market Trends and Animal Feed Ingredients

The edible oils market is experiencing significant shifts driven by changing consumer preferences and health consciousness. Both Australian Oilseeds and Darling Ingredients are positioned to capitalize on these trends, albeit through different approaches:

- Australian Oilseeds focuses primarily on domestic oilseed production and processing

- Darling Ingredients has a more diversified portfolio, including animal-based fats and proteins

In the animal feed ingredients sector, Darling Ingredients has a clear advantage due to its extensive operations in rendering and processing animal by-products. However, Australian Oilseeds’ specialization in plant-based ingredients aligns well with the growing demand for sustainable and vegetarian feed options.

“The plant-based protein market is projected to grow at a CAGR of 11.2% from 2021 to 2028, impacting oilseed demand.”

Sustainable Agriculture Investments and Environmental Impact

Both companies have made commitments to sustainable agriculture, recognizing the importance of environmental stewardship in ensuring long-term business viability. Darling Ingredients’ larger scale allows for more substantial investments in this area, but Australian Oilseeds’ focused approach may yield significant innovations in sustainable oilseed production.

Investors increasingly consider environmental, social, and governance (ESG) factors when evaluating stocks. In this context, companies that demonstrate a strong commitment to sustainable practices may enjoy a competitive advantage in attracting capital and meeting regulatory requirements.

Plant-Based Protein Market and Its Impact on Oilseed Demand

The burgeoning plant-based protein market presents a significant opportunity for oilseed producers. Soybeans, canola, and other oilseeds are key ingredients in many plant-based meat alternatives and dairy substitutes. While Darling Ingredients has a larger market share in this segment, Australian Oilseeds’ specialized focus on oilseed production positions it well to capitalize on this trend.

As consumer demand for plant-based options continues to grow, we anticipate increased investment in research and development of new oilseed varieties optimized for protein content and functionality. This trend could drive innovation and create new revenue streams for companies in the sector.

Biodiesel and Renewable Fuels: A Growing Opportunity

The biodiesel and renewable fuels sector represents a significant growth area for oilseed producers. Darling Ingredients’ substantial biodiesel production capacity gives it a clear advantage in this market. However, Australian Oilseeds’ smaller-scale operations may allow for greater flexibility in adapting to emerging technologies and local market demands.

- Government policies supporting renewable fuel adoption

- Technological advancements in biodiesel production

- Integration of oilseed production with biofuel manufacturing

As governments worldwide implement stricter emissions standards and incentivize renewable fuel use, we expect continued growth in this sector. Companies that can efficiently produce high-quality biodiesel feedstocks while maintaining sustainable practices will likely see increased demand for their products.

Agricultural Commodity Trading and Market Volatility

The oilseed industry is subject to significant market volatility due to factors such as weather conditions, geopolitical events, and global supply and demand fluctuations. Investors must carefully consider these risks when evaluating stocks in this sector.

Tools like Farmonaut’s API Developer Docs can provide valuable insights into crop conditions and weather patterns, helping traders and investors make more informed decisions in the volatile agricultural commodities market.

Food Processing Industry Outlook

The food processing industry is a major consumer of oilseed products, and its outlook significantly impacts the performance of companies like Australian Oilseeds and Darling Ingredients. Key trends shaping this sector include:

- Increased demand for healthy and functional foods

- Growing popularity of clean label products

- Adoption of novel food processing technologies

Both companies are well-positioned to benefit from these trends, with Darling Ingredients’ diverse product portfolio potentially offering more opportunities for innovation and market expansion.

Profitability Metrics and Dividend Policies

When evaluating these stocks for long-term income potential, it’s crucial to consider their profitability metrics and dividend policies:

- Darling Ingredients boasts a profit margin of 4.88% and offers a dividend yield of 3.2%

- Australian Oilseeds’ profitability metrics are not yet available, and the company does not currently pay dividends

While Darling Ingredients presents a more attractive option for income-focused investors, Australian Oilseeds may appeal to those seeking growth potential in a smaller, more specialized company.

Market Volatility and Risk Assessment

Investing in the oilseed industry comes with inherent risks due to market volatility. Our analysis shows that:

- Australian Oilseeds has a beta of -0.18, indicating lower volatility compared to the broader market

- Darling Ingredients has a beta of 1.21, suggesting higher volatility and potentially greater returns (or losses)

Investors must carefully consider their risk tolerance when choosing between these stocks. While Australian Oilseeds may offer more stability, Darling Ingredients’ higher beta could appeal to those seeking potentially higher returns and willing to accept more risk.

Future Growth Prospects and Innovation

Both companies are investing in innovation to drive future growth:

- Australian Oilseeds is focusing on developing new oilseed varieties and sustainable farming practices

- Darling Ingredients is expanding its presence in the renewable fuels market and exploring novel applications for animal-based proteins

The adoption of advanced technologies, such as those offered by Farmonaut, could play a crucial role in driving efficiency and sustainability in the oilseed industry. Investors should closely monitor these companies’ R&D efforts and technological partnerships as indicators of future growth potential.

Conclusion: Investment Considerations in the Australian Oilseed Industry

As we conclude our analysis of the Australian oilseed industry and the comparison between Australian Oilseeds and Darling Ingredients, several key points emerge for investors to consider:

- Market Position: Darling Ingredients is the larger, more established player with a diverse portfolio, while Australian Oilseeds offers more focused exposure to the Australian market.

- Financial Performance: Darling Ingredients demonstrates stronger profitability and offers dividends, making it potentially more attractive for income-focused investors.

- Growth Potential: Both companies show promise in different areas, with Australian Oilseeds potentially offering higher growth potential as a smaller, specialized firm.

- Sustainability: Investments in sustainable practices and technologies will likely be crucial for long-term success in the industry.

- Market Trends: The growing demand for plant-based proteins and renewable fuels presents significant opportunities for both companies.

Investors should carefully weigh these factors against their investment goals, risk tolerance, and market outlook when considering positions in the oilseed industry. As always, thorough due diligence and consideration of broader market conditions are essential before making any investment decisions.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Frequently Asked Questions (FAQ)

- What are the main oilseed crops produced in Australia?

The main oilseed crops produced in Australia include canola, sunflower seeds, soybeans, and cottonseed. - How does the Australian oilseed industry compare globally?

Australia is a significant player in the global oilseed market, particularly in canola production and export. - What factors affect oilseed prices in Australia?

Factors affecting oilseed prices include global supply and demand, weather conditions, exchange rates, and international trade policies. - How are technological advancements impacting the oilseed industry?

Technologies like precision agriculture, satellite monitoring, and genetic engineering are improving crop yields and sustainability in the oilseed industry. - What are the main challenges facing the Australian oilseed industry?

Key challenges include climate variability, water scarcity, competition from other major producing countries, and fluctuating global demand.