Australian Stock Market Plunges: Energy and Tech Sectors Lead Losses Amid Global Market Volatility

“The S&P/ASX 200 index, Australia’s benchmark stock market indicator, experienced significant losses led by energy and tech sectors.”

In today’s rapidly evolving financial landscape, we’re witnessing a significant downturn in the Australian stock market, with the energy and technology sectors bearing the brunt of the losses. As we delve into this comprehensive analysis of the latest Australian stock market trends, we’ll explore the multifaceted factors contributing to this volatility and its far-reaching implications for investors and businesses alike.

Understanding the Current Market Scenario

The Australian stock market is currently experiencing a notable decline, extending losses from previous sessions. This downturn is largely influenced by global market cues and heightened volatility in the energy sector. Let’s break down the key elements shaping this market landscape:

- The benchmark S&P/ASX 200 index has fallen below the 8,300 level

- Weakness is observed across most sectors, with energy and technology stocks leading the decline

- The broader All Ordinaries Index is also showing significant losses

These movements reflect the complex interplay of domestic and international factors affecting the Australian financial markets. As we navigate through this analysis, we’ll examine how various sectors are performing and the underlying causes of these market shifts.

Energy Sector: A Closer Look

The energy stocks performance has been particularly noteworthy in this market downturn. Several factors are contributing to the volatility in this sector:

- Global oil price fluctuations

- Geopolitical tensions affecting energy supply chains

- Shifting investor sentiment towards renewable energy sources

Major players in the Australian energy sector, such as Santos and Woodside Energy, are experiencing declines. This trend is indicative of broader challenges facing the energy industry, including the ongoing transition to sustainable energy sources and the impact of global economic policies on oil demand.

Tech Sector: Navigating Turbulent Waters

Our tech stock market analysis reveals significant challenges for technology companies listed on the Australian Stock Exchange. Key observations include:

- Afterpay owner Block reported downbeat results, leading to a substantial drop in share price

- WiseTech Global faced internal governance issues, resulting in a dramatic stock price decline

- Other tech stocks like Zip, Xero, and Appen are also experiencing losses

These developments in the tech sector reflect both company-specific issues and broader market trends. The technology industry’s sensitivity to global economic conditions and investor sentiment makes it particularly vulnerable to market volatility.

Mining Sector Outlook: Navigating Global Challenges

The mining sector outlook presents a mixed picture amidst the current market conditions. Major miners are facing headwinds:

- BHP Group and Rio Tinto are experiencing losses

- Fortescue Metals is showing a slight decline

- Mineral Resources is facing more significant downward pressure

These movements in the mining sector are closely tied to global commodity prices and demand, particularly from key markets like China. The sector’s performance is a crucial indicator of broader economic trends and investor confidence in Australia’s resource-driven economy.

Gold Mining: A Traditional Safe Haven?

In times of market volatility, gold is often viewed as a safe-haven asset. However, the current market conditions are presenting challenges even for gold miners:

- Evolution Mining and Newmont are facing notable declines

- Northern Star Resources and Gold Road Resources are also experiencing losses

- Resolute Mining is showing more significant downward movement

The performance of gold stocks in this context raises questions about traditional market assumptions and highlights the complex nature of current economic conditions.

“Global market volatility and oil price fluctuations have directly impacted the performance of resource stocks in the Australian market.”

Banking Sector: Pillars of the Economy Under Pressure

The performance of Australia’s “Big Four” banks is crucial to understanding the overall health of the financial sector:

- Commonwealth Bank and Westpac are showing modest losses

- National Australia Bank and ANZ Banking are experiencing slightly larger declines

These movements in the banking sector reflect broader economic concerns, including interest rate expectations, lending conditions, and overall economic growth prospects.

Currency Market Updates: The Australian Dollar’s Position

In the midst of this market volatility, currency market updates are crucial for understanding the broader economic picture:

- The Australian dollar is currently trading at $0.637

- This exchange rate reflects both domestic economic conditions and global currency market trends

- The dollar’s performance has implications for exporters, importers, and international investors

The currency’s movements are closely tied to Australia’s economic performance, interest rate decisions by the Reserve Bank of Australia, and global economic conditions.

Global Market Cues: The Ripple Effect

The Australian stock market’s performance is significantly influenced by global market cues. Key international developments include:

- Wall Street’s sharp decline, with major indices showing significant losses

- Mixed performance in European markets, reflecting diverse economic conditions across the continent

- Crude oil price movements, with West Texas Intermediate Crude futures showing a notable decline

These global trends highlight the interconnected nature of financial markets and the importance of monitoring international developments for understanding local market dynamics.

Stock Index Benchmarks: Key Performance Indicators

To better understand the market’s overall performance, let’s examine the key stock index benchmarks:

- S&P/ASX 200 Index: Currently trading below 8,300 points

- All Ordinaries Index: Showing similar downward trends

- Sector-specific indices: Reflecting varied performances across different industries

These benchmarks provide crucial insights into market sentiment and overall economic health. They serve as key indicators for investors and policymakers alike.

Market Volatility Factors: Unraveling the Complexities

Several market volatility factors are contributing to the current conditions in the Australian stock market:

- Global economic uncertainties, including trade tensions and geopolitical risks

- Domestic economic indicators, such as inflation rates and employment figures

- Sector-specific challenges, particularly in energy and technology

- Investor sentiment and risk appetite

Understanding these factors is crucial for investors and businesses looking to navigate the current market landscape effectively.

Sector Performance Comparison

| Sector | Daily Change (%) | Weekly Change (%) | Year-to-Date Change (%) |

|---|---|---|---|

| Energy | -2.5 | -3.8 | -5.2 |

| Technology | -3.2 | -4.5 | -7.1 |

| Mining | -1.8 | -2.7 | -3.9 |

| Financials | -1.2 | -2.1 | -2.8 |

| Healthcare | -0.8 | -1.5 | -1.9 |

This table provides a clear overview of how different sectors in the Australian stock market are performing. The energy and technology sectors show the most significant declines, aligning with our earlier analysis.

Implications for Investors and Businesses

The current market conditions have significant implications for various stakeholders:

- Investors may need to reassess their portfolio strategies

- Businesses might face challenges in capital raising and investment decisions

- Economic policymakers may need to consider interventions to stabilize markets

These implications underscore the importance of staying informed and adaptable in the face of market volatility.

The Role of Technology in Market Analysis

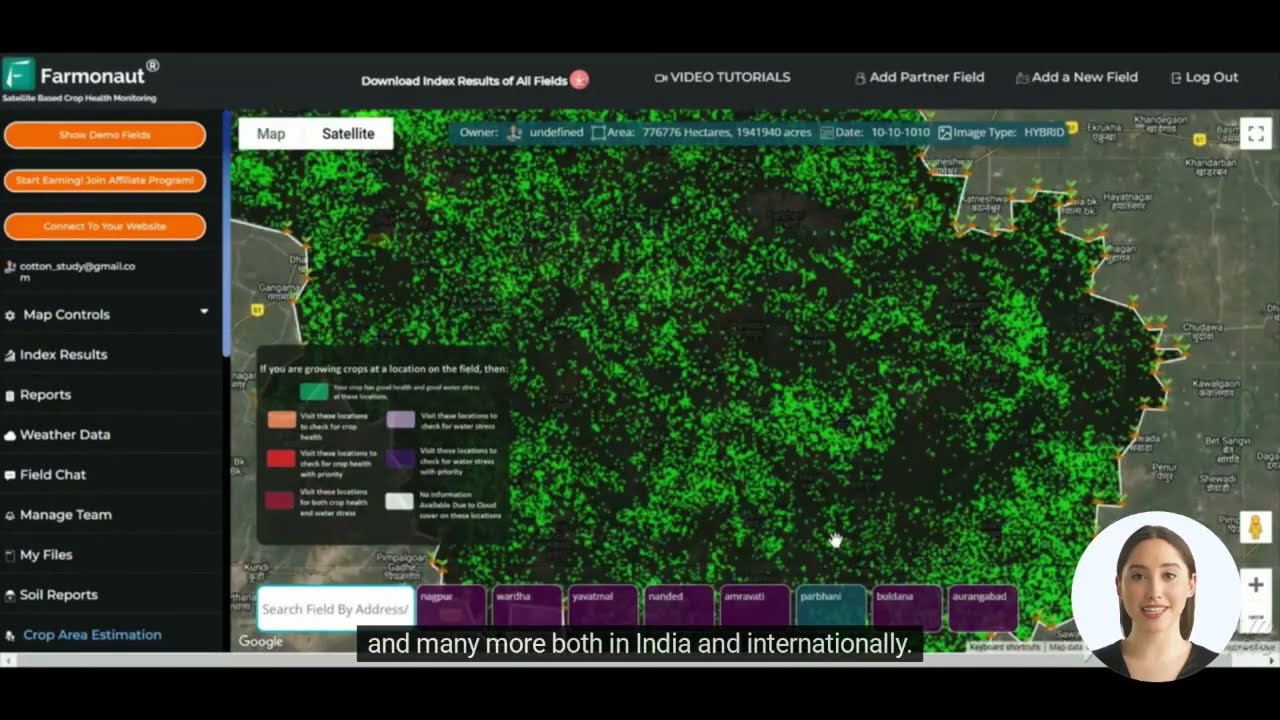

In today’s digital age, technology plays a crucial role in market analysis and decision-making. Advanced tools and platforms are essential for tracking market movements and making informed investment choices. For instance, Farmonaut, while primarily focused on agricultural technology, exemplifies how data-driven insights can be applied across various sectors.

Farmonaut’s satellite-based monitoring and AI-driven analytics demonstrate the potential of technology in providing real-time, actionable insights. While their focus is on agriculture, the principles of data analysis and predictive modeling are equally applicable to financial markets.

For those interested in exploring how technology can enhance decision-making processes, consider checking out Farmonaut’s offerings:

- Farmonaut API – For developers looking to integrate data-driven insights into their applications

- API Developer Docs – Comprehensive documentation for implementing Farmonaut’s API

While these tools are tailored for agricultural applications, they showcase the potential of technology in providing valuable insights across various sectors.

Looking Ahead: Future Market Trends

As we look to the future, several factors will likely influence the Australian stock market:

- Global economic recovery post-pandemic

- Shifts in energy policies and the transition to renewable sources

- Technological advancements and their impact on traditional industries

- Changes in international trade relationships

Staying informed about these trends will be crucial for investors and businesses alike as they navigate the evolving financial landscape.

Conclusion: Navigating Uncertain Waters

The current downturn in the Australian stock market, led by losses in the energy and tech sectors, reflects a complex interplay of global and domestic factors. From oil price fluctuations to sector-specific challenges, the market is responding to a variety of pressures.

For investors and businesses, these conditions underscore the importance of:

- Diversification in investment strategies

- Staying informed about global market trends

- Leveraging technology for data-driven decision-making

- Maintaining a long-term perspective amidst short-term volatility

As we continue to monitor these Australian stock market trends, it’s clear that adaptability and informed decision-making will be key to navigating the challenges and opportunities that lie ahead in this dynamic financial landscape.

FAQs

- What are the main factors driving the current Australian stock market downturn?

The main factors include global market volatility, energy sector challenges, tech stock performance issues, and broader economic uncertainties. - How are the “Big Four” Australian banks performing in this market?

The major Australian banks are experiencing modest to slightly larger declines, reflecting broader economic concerns. - What impact is the current market having on the Australian dollar?

The Australian dollar is currently trading at $0.637, reflecting both domestic and global economic conditions. - Are there any sectors showing resilience in the current market?

While most sectors are facing challenges, some, like healthcare, are showing relatively smaller declines compared to energy and tech sectors. - How are global market trends influencing the Australian stock market?

Global trends, particularly from Wall Street and European markets, are having a significant impact on Australian market performance.

Earn With Farmonaut: Join Farmonaut’s affiliate program and earn 20% recurring commission by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Stay informed and make data-driven decisions with Farmonaut’s innovative solutions: