Australian Stock Market Slumps: Energy and Tech Stocks Lead Losses Amid Global Pressures

“The S&P/ASX 200 index dropped below 8,300 points, reflecting global market pressures on Australian stocks.”

Welcome to our comprehensive analysis of the recent Australian stock market trends, focusing on the significant downturn led by energy and tech stocks. As we delve into the intricacies of this market shift, we’ll explore how global pressures are impacting various sectors and what this means for investors and the broader economy.

Understanding the Current Market Landscape

The Australian stock market is currently facing substantial challenges, with the benchmark S&P/ASX 200 index dipping below the crucial 8,300 level. This downturn is a reflection of broader global market trends, signaling a period of uncertainty and volatility for investors. Let’s break down the key factors contributing to this slump and examine its implications across different sectors.

Energy Sector: Leading the Downturn

The energy sector has been hit particularly hard in this market slump. Major players in the industry are experiencing significant losses, with companies like Santos declining almost 3% and Beach Energy down more than 1%. These losses can be attributed to several factors:

- Fluctuations in global oil prices

- Concerns over demand in key markets

- Geopolitical tensions affecting supply chains

The volatility in crude oil futures, which saw West Texas Intermediate (WTI) crude falling to a two-month low, is a clear indicator of the challenges facing the energy sector. This downturn in oil prices is not only affecting Australian energy stocks but also has broader implications for the global energy market.

Tech Stocks: A Sector Under Pressure

The technology sector, often seen as a bellwether for market sentiment, is also experiencing significant losses. Key tech stocks showing declines include:

- Zip: down more than 3%

- Xero: declining almost 2%

- Afterpay owner Block: plummeting more than 11% after reporting downbeat results

Perhaps the most notable development in the tech sector is the situation at WiseTech Global. The company’s stock tumbled more than 23% following the resignation of its chairman and three independent directors due to disagreements about the ongoing role of the company’s founder, Richard White. This shake-up in leadership highlights the volatility and internal challenges facing tech companies in the current market climate.

Mining and Resources: Mixed Performances

The mining sector, a crucial component of the Australian economy, is also feeling the effects of the market downturn. Major miners are showing losses:

- BHP Group and Rio Tinto: losing more than 1% each

- Fortescue Metals: down almost 1%

- Mineral Resources: declining more than 3%

These losses in the mining sector reflect broader concerns about global economic growth and demand for resources. However, it’s important to note that the performance within the sector is not uniform, with some companies showing more resilience than others.

Gold Mining: A Glimmer in the Gloom?

Gold mining stocks, often seen as a safe haven during market turbulence, are showing mixed performance. While some gold miners are experiencing losses, others are holding steady, demonstrating the complex nature of market dynamics during periods of uncertainty.

- Evolution Mining and Newmont: losing almost 3% each

- Northern Star Resources: declining almost 2%

- Gold Road Resources: slipping 2.5%

- Resolute Mining: sliding more than 4%

The performance of gold mining stocks is closely tied to global economic factors, including currency fluctuations and investor sentiment towards safe-haven assets.

Banking Sector: Navigating Choppy Waters

Australia’s banking sector, a cornerstone of the nation’s economy, is not immune to the current market pressures. The big four banks are all showing declines:

- Commonwealth Bank and Westpac: losing almost 1% each

- National Australia Bank and ANZ Banking: declining more than 1% each

These losses in the banking sector reflect broader concerns about economic stability and the potential for increased pressure on loan portfolios in a challenging economic environment.

Currency Market Dynamics

The performance of the Australian dollar is closely tied to the overall health of the stock market and the broader economy. Currently, the Aussie dollar is trading at $0.637, reflecting the challenges facing the Australian economy and the impact of global market pressures.

The currency’s performance is influenced by various factors, including:

- Interest rate differentials with other major currencies

- Commodity prices, given Australia’s resource-heavy economy

- Global risk sentiment

Understanding these currency dynamics is crucial for investors and businesses operating in the Australian market, as they can significantly impact international trade and investment flows.

Global Market Influences

The Australian stock market’s performance is not occurring in isolation but is heavily influenced by global market trends. The negative cues from Wall Street, where major indices saw significant declines, are playing a crucial role in shaping investor sentiment in Australia.

Key global factors impacting the Australian market include:

- U.S. economic data and Federal Reserve policies

- International trade tensions

- Global commodity price fluctuations

- Geopolitical events and their economic ripple effects

These global influences underscore the interconnected nature of modern financial markets and the importance of considering international factors when analyzing local market trends.

“Energy and tech stocks led the Australian market downturn, with mining and banking sectors also experiencing losses.”

Sector-Specific Developments

While the overall market trend is downward, there are notable developments in specific sectors that warrant attention:

Health Insurance

NIB Holdings, a player in the health insurance business, is showing remarkable strength amidst the market downturn. The company’s shares jumped almost 14% after first-half results demonstrated growth in its core Australian health insurance business. This performance highlights the resilience of certain sectors, even in challenging market conditions.

Software and Technology

The software provider Iress saw its shares tumble more than 17% despite swinging to a profit in fiscal 2024. This contrasting movement between profitability and stock performance underscores the complex factors influencing investor sentiment in the tech sector.

Energy Infrastructure

APA Group, an energy infrastructure company, is bucking the trend with its shares surging more than 6%. This positive movement comes after the company reaffirmed its outlook for distributions and earnings in 2025, demonstrating the importance of strong fiscal projections in maintaining investor confidence.

Data Analytics

Nuix, a data analytics firm, saw its shares plunge more than 10% after reporting downbeat first-half results. This performance reflects the challenges facing companies in the tech sector, particularly those dealing with data and analytics in a rapidly evolving digital landscape.

Plumbing and Bathroom Supplies

Reece, a company in the plumbing and bathroom supplies sector, experienced a significant decline with its shares plunging almost 14%. This drop followed the company’s report of a decline in revenue and net profit in the first half of the financial year, reflecting challenging trading conditions in its industry.

Comparative Market Performance

To provide a clearer picture of the current market situation, let’s examine a comparative table of sector performances:

| Sector | % Change (Day) | % Change (Week) | Key Factors |

|---|---|---|---|

| Energy | -2.5% | -4.2% | Oil price fluctuations, demand concerns |

| Technology | -3.8% | -6.5% | Global tech sell-off, earnings disappointments |

| Mining | -1.2% | -2.8% | Commodity price volatility, global demand uncertainty |

| Banking | -1.1% | -2.3% | Economic uncertainty, interest rate concerns |

| Gold Mining | -2.7% | -1.9% | Gold price movements, safe-haven demand |

This table provides a snapshot of the relative performance of key sectors in the Australian stock market, highlighting the varying degrees of impact across different industries.

Implications for Investors and the Economy

The current market downturn has significant implications for both investors and the broader Australian economy:

- Investor Sentiment: The slump in key sectors like energy and technology may lead to a shift in investor preferences towards more defensive stocks or safe-haven assets.

- Economic Growth: Weaknesses in major sectors could potentially impact Australia’s economic growth forecasts, influencing fiscal and monetary policy decisions.

- International Investment: The performance of the Australian market relative to global peers may affect international capital flows into the country.

- Corporate Strategies: Companies may need to reassess their growth strategies and cost structures in light of the challenging market conditions.

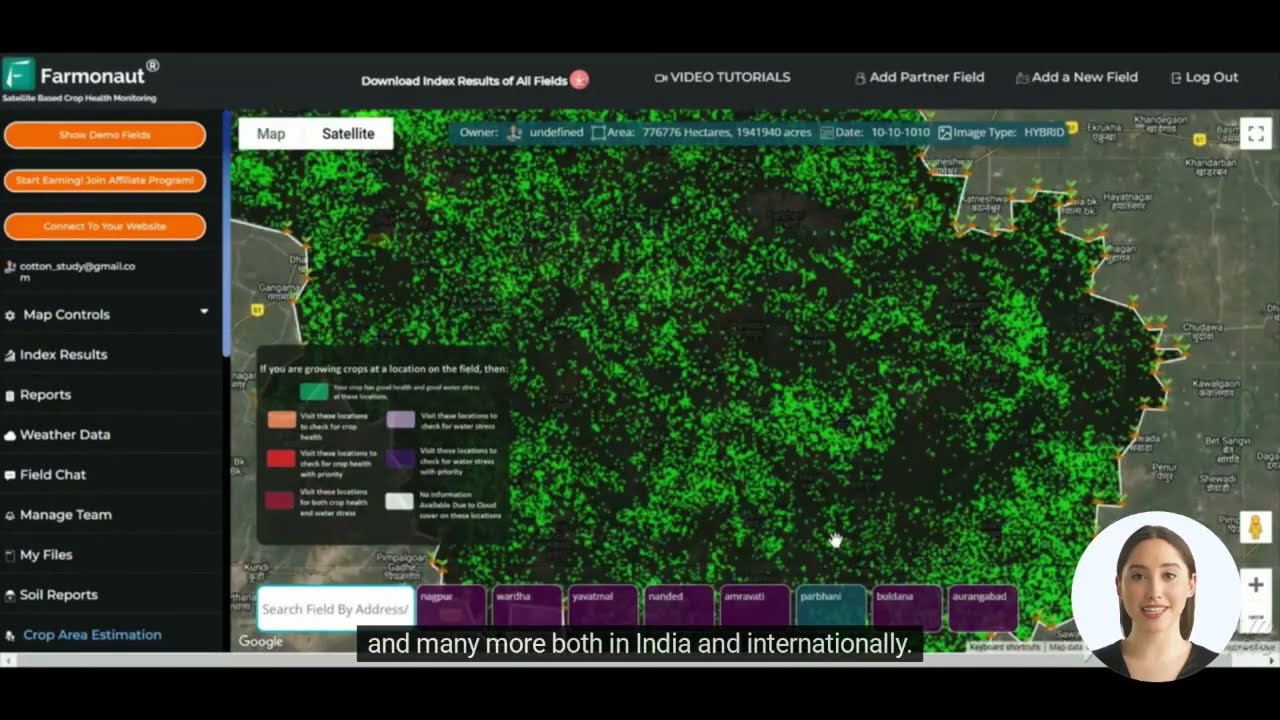

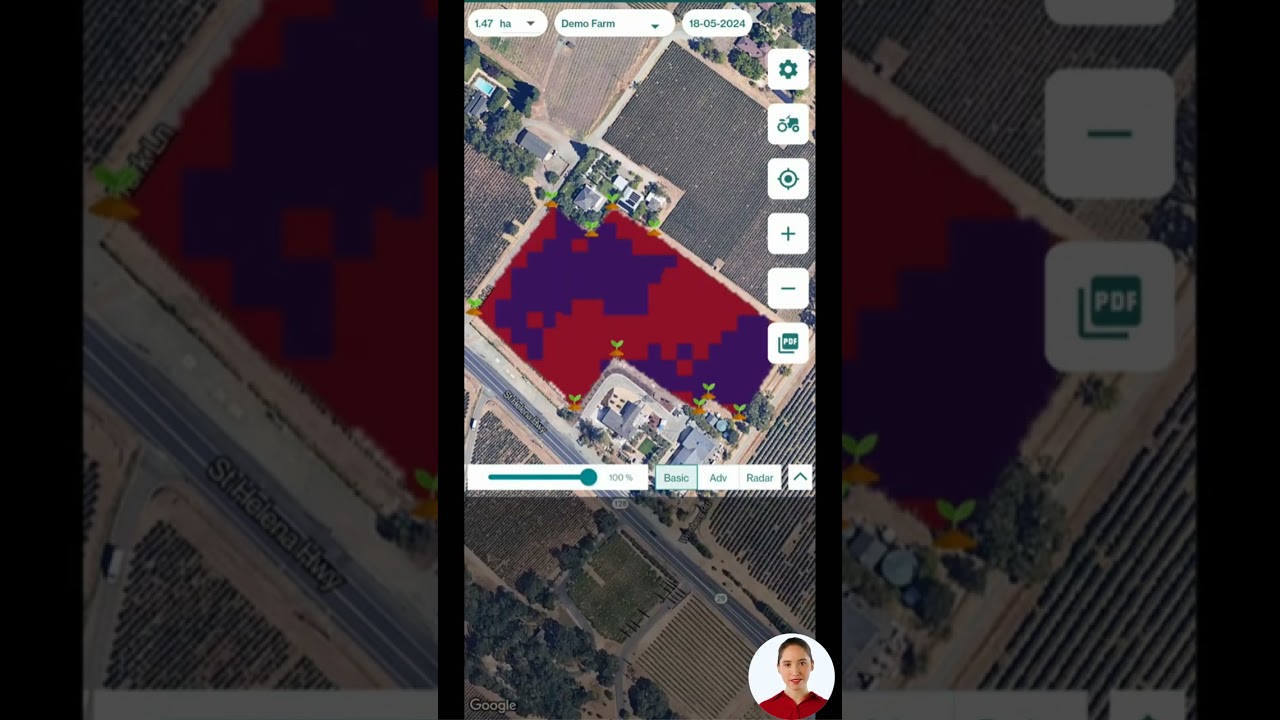

For those looking to navigate these challenging market conditions, staying informed and utilizing advanced tools for market analysis can be crucial. Farmonaut’s web application offers valuable insights that can be applied to various sectors, including agriculture and related industries. While primarily focused on agricultural technology, the principles of data analysis and trend monitoring can be valuable across different market sectors.

Looking Ahead: Market Outlook and Potential Recovery

As we look towards the future, several factors will be crucial in determining the trajectory of the Australian stock market:

- Global Economic Recovery: The pace and nature of global economic recovery will significantly influence Australian stocks, particularly in export-oriented sectors.

- Commodity Prices: Given Australia’s resource-rich economy, the movement of commodity prices will be a key driver for many stocks, especially in the mining and energy sectors.

- Technological Advancements: The ability of tech companies to innovate and adapt to changing market conditions will be crucial for the sector’s recovery.

- Fiscal and Monetary Policies: Government and central bank responses to economic challenges will play a significant role in shaping market sentiment and economic conditions.

- Consumer Confidence: The recovery of consumer-oriented sectors will depend heavily on improvements in consumer confidence and spending patterns.

For those interested in staying ahead of market trends, Farmonaut’s API offers powerful tools for data analysis and forecasting. While primarily designed for agricultural applications, the principles of data-driven decision-making can be valuable across various industries.

Sector-Specific Strategies for Investors

Given the varied performance across different sectors, investors may need to adopt sector-specific strategies:

Energy Sector

Investors in the energy sector should closely monitor global oil price trends and developments in renewable energy technologies. Diversification within the sector, including exposure to both traditional and renewable energy sources, may help mitigate risks.

Technology Sector

For tech investors, focusing on companies with strong fundamentals and innovative products or services may be key. The current downturn could present opportunities to invest in promising tech firms at more attractive valuations.

Mining and Resources

Investors in this sector should keep an eye on global demand trends, particularly from major economies like China. Companies with diversified mineral portfolios and strong balance sheets may be better positioned to weather market volatility.

Banking Sector

For those invested in banking stocks, monitoring economic indicators, interest rate trends, and regulatory developments will be crucial. Banks with strong capital positions and diversified revenue streams may offer more stability in uncertain times.

Gold Mining

Gold mining stocks can serve as a hedge against market volatility. Investors might consider balancing their portfolios with exposure to gold, keeping in mind its historical role as a safe-haven asset during economic uncertainties.

For those looking to apply data-driven insights to their investment strategies, tools like Farmonaut’s API Developer Docs can provide valuable guidance on leveraging data for informed decision-making.

The Role of Technology in Market Analysis

In today’s rapidly evolving market landscape, leveraging technology for market analysis and decision-making is more crucial than ever. While Farmonaut’s primary focus is on agricultural technology, the principles of data analysis and trend monitoring that it employs can be valuable across various market sectors.

Key technological tools for market analysis include:

- AI-Driven Analytics: Advanced algorithms can process vast amounts of market data to identify trends and predict potential market movements.

- Real-Time Data Feeds: Access to up-to-the-minute market information allows for quick decision-making and strategy adjustments.

- Predictive Modeling: Sophisticated models can help forecast market trends based on historical data and current market conditions.

- Sentiment Analysis: Tools that analyze social media and news sources can provide insights into market sentiment and potential investor behavior.

For those interested in exploring how technology can enhance their market analysis capabilities, Farmonaut offers solutions that, while tailored for agriculture, demonstrate the power of data-driven decision-making:

Global Economic Context and Its Impact on Australian Stocks

The performance of the Australian stock market is intrinsically linked to global economic conditions. Several international factors are currently influencing the local market:

- U.S. Economic Policies: Decisions made by the Federal Reserve and U.S. fiscal policies have far-reaching effects on global markets, including Australia.

- China’s Economic Health: As Australia’s largest trading partner, China’s economic performance significantly impacts Australian stocks, particularly in the resources sector.

- Global Trade Tensions: Ongoing trade disputes between major economies can create uncertainty and volatility in international markets.

- Technological Disruptions: Rapid advancements in technology are reshaping industries globally, affecting stock valuations and market trends.

- Climate Change Policies: International efforts to address climate change are influencing investor sentiment, particularly in energy and resource sectors.

Understanding these global dynamics is crucial for investors navigating the Australian stock market. Tools that provide comprehensive data analysis, such as those offered by Farmonaut, can be invaluable in interpreting these complex global trends and their local impacts.

The Importance of Sustainable Investing

In the current market climate, there’s an increasing focus on sustainable and responsible investing. This trend is particularly relevant given the challenges facing energy and resource sectors. Key aspects of sustainable investing include:

- ESG Criteria: Environmental, Social, and Governance factors are becoming crucial in investment decisions.

- Renewable Energy Focus: Companies involved in renewable energy and sustainable technologies are gaining investor attention.

- Corporate Responsibility: Firms demonstrating strong corporate responsibility practices may show more resilience in challenging market conditions.

For those interested in aligning their investments with sustainability principles, technologies that provide comprehensive data analysis can be incredibly useful. While Farmonaut’s focus is on agricultural sustainability, the principles it employs in data analysis and sustainable practices can be instructive for investors across various sectors.

Navigating Market Volatility: Tips for Investors

In light of the current market conditions, here are some strategies investors might consider:

- Diversification: Spreading investments across various sectors and asset classes can help mitigate risks.

- Long-term Perspective: While short-term volatility can be concerning, maintaining a long-term investment outlook is often beneficial.

- Regular Portfolio Review: Periodically reassessing and rebalancing your portfolio can help maintain alignment with your investment goals.

- Stay Informed: Keeping up-to-date with market news and economic indicators is crucial for making informed decisions.

- Consider Professional Advice: In complex market conditions, seeking guidance from financial professionals can provide valuable insights.

For those looking to enhance their investment strategies with data-driven insights, tools like those offered by Farmonaut can be invaluable. While primarily focused on agricultural applications, the principles of data analysis and trend monitoring can be applied broadly to various investment scenarios.

Conclusion: Navigating Uncertain Waters

As we’ve explored in this comprehensive analysis, the Australian stock market is currently navigating challenging conditions, with energy and tech stocks leading the downturn amid global pressures. The interplay of domestic and international factors continues to shape market dynamics, creating a complex environment for investors and businesses alike.

Key takeaways from our analysis include:

- The broad-based nature of the market slump, affecting multiple sectors

- The significant impact of global economic trends on Australian stocks

- The importance of sector-specific strategies in navigating market volatility

- The growing role of technology and data analysis in investment decision-making

- The increasing focus on sustainable and responsible investing

As we look ahead, the ability to adapt to changing market conditions, leverage technological tools for analysis, and maintain a balanced, long-term perspective will be crucial for investors and market participants. While challenges persist, opportunities for growth and innovation continue to emerge, particularly in sectors embracing technological advancements and sustainable practices.

For those seeking to stay ahead in these dynamic market conditions, tools that provide comprehensive data analysis and insights can be invaluable. While Farmonaut’s primary focus is on agricultural technology, the principles of data-driven decision-making and trend analysis it employs can be instructive across various sectors of the economy.

FAQs

- Q: What are the main factors driving the current Australian stock market slump?

A: The main factors include global market pressures, fluctuations in commodity prices, particularly oil, and sector-specific challenges in energy and technology industries. - Q: How are energy stocks performing in the current market?

A: Energy stocks are among the hardest hit, with major players experiencing significant losses due to oil price fluctuations and concerns over global demand. - Q: What impact is the tech sector having on the overall market performance?

A: The tech sector is experiencing substantial losses, with key stocks showing significant declines, contributing to the overall market downturn. - Q: How are banking stocks faring in this market environment?

A: The major Australian banks are all showing declines, reflecting broader economic concerns and potential pressures on loan portfolios. - Q: What role does the global economic situation play in the Australian stock market’s performance?

A: Global economic factors, including U.S. market trends, international trade tensions, and commodity price fluctuations, significantly influence the Australian stock market.