Corn Futures Market Analysis: Navigating Price Volatility and Export Trends with Farmonaut’s Data-Driven Insights

“Corn export commitments have reached a three-year high, despite recent price declines influenced by wheat market conditions.”

Welcome to our comprehensive analysis of the corn futures market, where we’ll explore the intricate dynamics of agricultural commodity price trends and their implications for investors, farmers, and industry professionals. At Farmonaut, we’re committed to providing cutting-edge agricultural market data and insights to help you make informed decisions in this ever-changing landscape.

In today’s blog post, we’ll delve into the recent shifts in corn prices, examine the factors influencing market volatility, and discuss how our data-driven approach can assist you in navigating these complex waters. Let’s begin by setting the stage with an overview of the current market conditions.

Current State of the Corn Futures Market

The corn futures market has been experiencing significant fluctuations recently, with prices showing a slight decline. This downturn can be attributed to various factors, including:

- Wheat market conditions

- Strengthening U.S. dollar

- Changes in global supply and demand dynamics

Despite these challenges, it’s crucial to note that corn export commitments have surged to a three-year high, indicating robust demand in the international market. This dichotomy between price trends and export volume highlights the complex nature of agricultural commodity trading.

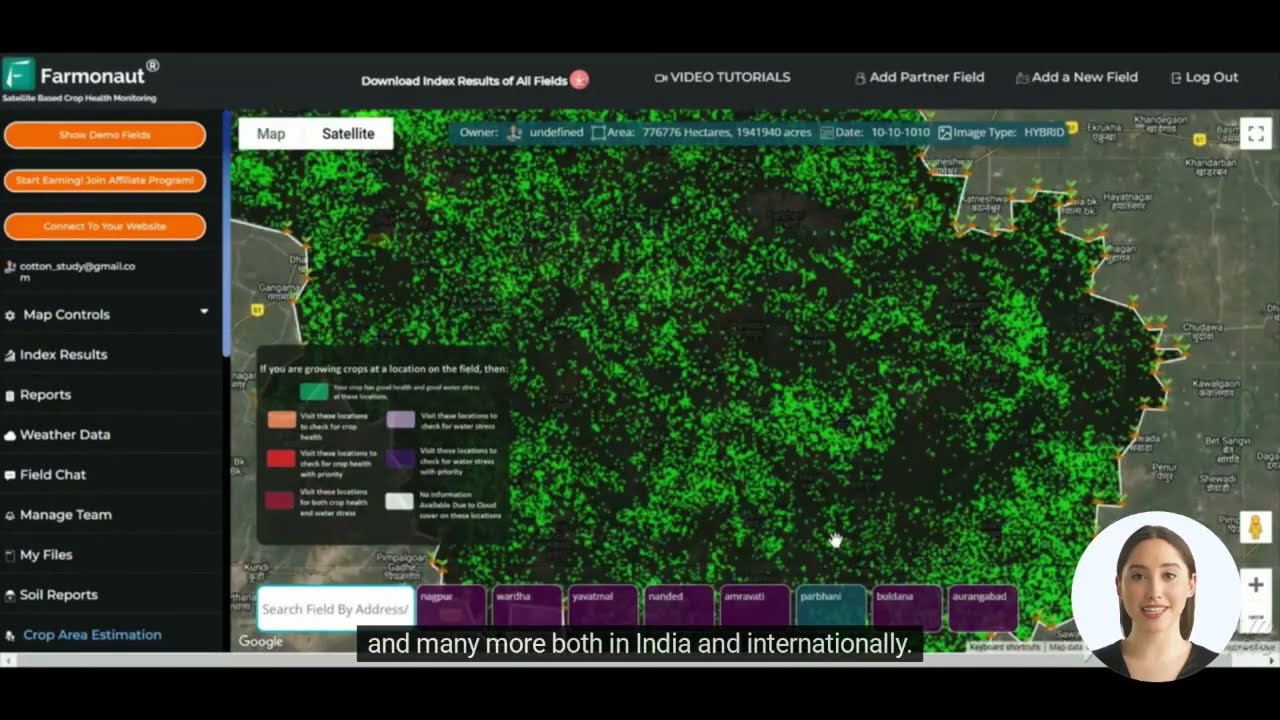

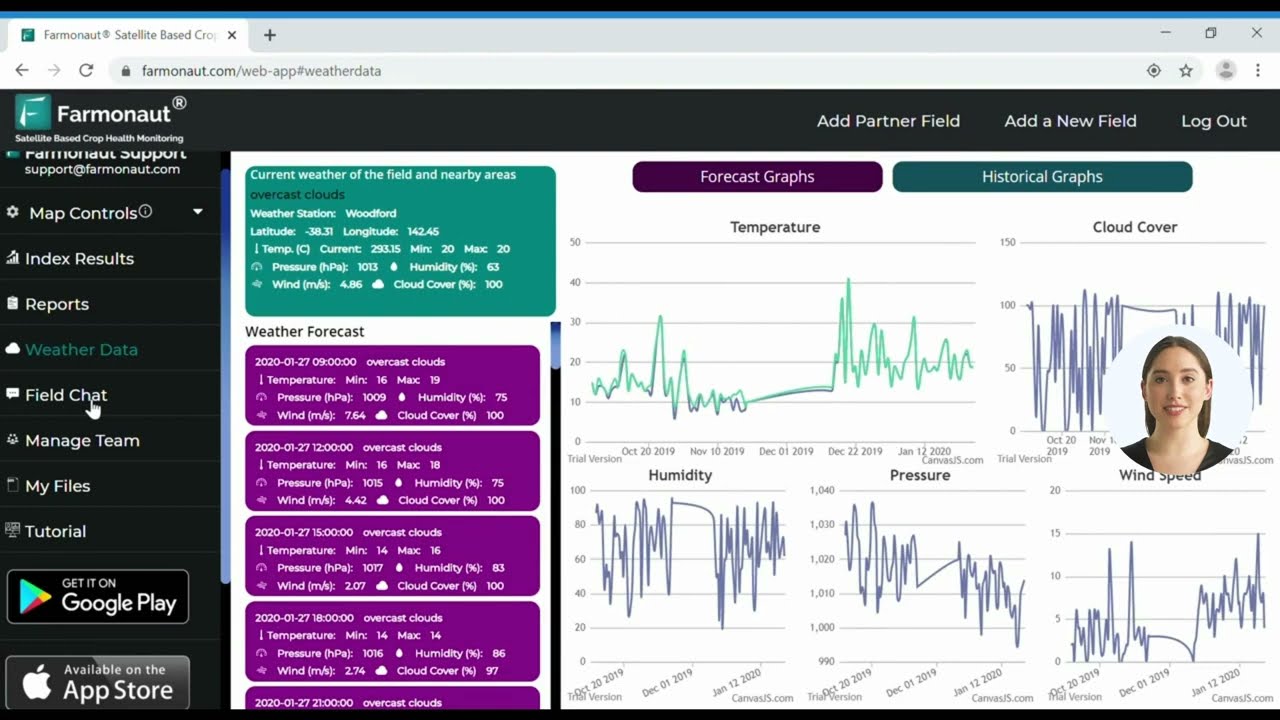

At Farmonaut, we understand the importance of staying ahead in this dynamic market. Our satellite-based crop monitoring technology and AI-driven insights can help you make data-informed decisions about your agricultural investments and operations. Try our web app to access real-time crop health data and market trends.

Key Factors Influencing Corn Prices

To fully grasp the current market situation, it’s essential to examine the primary factors driving corn price volatility:

1. Global Supply and Demand

The balance between worldwide corn production and consumption plays a crucial role in determining prices. Factors such as weather conditions, planting intentions, and yield forecasts can significantly impact supply, while economic growth, population trends, and alternative uses (e.g., ethanol production) influence demand.

2. Currency Fluctuations

The strengthening U.S. dollar has been putting pressure on corn prices. As the dollar gains value, U.S. corn becomes more expensive for international buyers, potentially reducing demand and affecting export volumes.

3. Wheat Market Conditions

Corn and wheat markets are often closely linked, as these grains can be substitutes in various applications. Recent developments in the wheat market have had a spillover effect on corn prices, contributing to the observed decline.

4. Export Commitments

Despite price pressures, corn export commitments have reached a three-year high. This surge in international demand could potentially support prices in the long term and indicates strong global appetite for U.S. corn.

Our Farmonaut platform offers valuable insights into crop production forecasts and global trade patterns, helping you stay informed about these critical market drivers. Download our Android app to access this information on the go.

USDA Crop Reports and Their Impact on Market Volatility

The United States Department of Agriculture (USDA) plays a pivotal role in shaping market sentiment through its regular crop reports. These reports provide essential data on:

- Planted acreage

- Yield estimates

- Ending stocks

- Global supply and demand projections

The release of USDA reports often triggers significant price movements in the corn futures market. Traders and analysts closely monitor these releases, adjusting their positions based on the latest data. Understanding how to interpret these reports and their potential market impact is crucial for successful agricultural commodity trading.

“USDA crop reports and trader position changes significantly impact corn price volatility in the futures market.”

At Farmonaut, we leverage our advanced satellite imagery and AI technology to provide our own crop production forecasts, complementing USDA data and offering additional insights for more informed decision-making. Get our iOS app to access these valuable forecasts.

Trader Positions and Market Sentiment

Changes in trader positions can have a substantial impact on corn price volatility. Key aspects to consider include:

- Net long/short positions of commercial traders

- Speculative activity in the futures market

- Open interest trends

By analyzing these factors, we can gain insights into market sentiment and potential price movements. Our Farmonaut platform incorporates this data into our market analysis, providing you with a comprehensive view of the corn futures landscape.

Technical Analysis and Chart Patterns

Technical analysis plays a crucial role in predicting short-term price movements in the corn futures market. Key technical indicators and chart patterns to watch include:

- Moving averages (e.g., 50-day, 200-day)

- Relative Strength Index (RSI)

- Bollinger Bands

- Support and resistance levels

- Head and shoulders patterns

- Cup and handle formations

By combining technical analysis with fundamental market data, traders can develop more robust strategies for navigating price volatility in the corn futures market.

Our Farmonaut platform integrates advanced charting tools and technical indicators to help you identify potential trading opportunities. Explore our API to incorporate these features into your own trading systems.

Corn Futures Market Indicators: A Three-Year Perspective

To provide a comprehensive overview of the corn futures market, we’ve compiled a table comparing key indicators over the past three years:

| Indicator | 2022 | 2023 | 2024 (Current) |

|---|---|---|---|

| Corn Futures Price ($/bushel) | 6.75 | 5.90 | 5.25 |

| U.S. Dollar Index | 95.5 | 101.2 | 103.8 |

| Export Commitments (million bushels) | 1,850 | 2,100 | 2,450 |

| USDA Crop Production Forecast (billion bushels) | 14.2 | 14.5 | 15.1 |

| Trader Net Long Positions (contracts) | 280,000 | 230,000 | 195,000 |

This table illustrates the evolving dynamics of the corn futures market over recent years. Notable trends include:

- A gradual decline in corn futures prices

- Strengthening of the U.S. dollar

- Significant increase in export commitments

- Rising USDA crop production forecasts

- Decrease in trader net long positions

These trends underscore the complex interplay of factors influencing the corn futures market and highlight the importance of comprehensive data analysis in making informed trading decisions.

Strategies for Navigating Corn Futures Market Volatility

Given the current market conditions and trends, we recommend considering the following strategies:

- Diversification: Spread risk by investing in a mix of agricultural commodities and related sectors.

- Hedging: Utilize options and other derivatives to protect against adverse price movements.

- Stay Informed: Regularly monitor USDA reports, global weather patterns, and geopolitical developments that may impact corn prices.

- Technical Analysis: Incorporate chart patterns and technical indicators into your decision-making process.

- Long-term Perspective: Consider the cyclical nature of agricultural markets and avoid making decisions based solely on short-term fluctuations.

At Farmonaut, we provide the tools and insights you need to implement these strategies effectively. Our satellite-based crop monitoring and AI-driven analytics can help you stay ahead of market trends and make data-informed decisions. Check out our API Developer Docs to learn how to integrate our powerful tools into your trading systems.

The Role of Technology in Agricultural Commodity Trading

As the agricultural commodity market becomes increasingly complex, technology plays a crucial role in helping traders and investors navigate price volatility and market trends. Some key technological advancements include:

- Satellite-based crop monitoring

- Artificial Intelligence and Machine Learning for market prediction

- Big Data analytics for processing vast amounts of agricultural and market data

- Blockchain technology for improving supply chain transparency

Farmonaut is at the forefront of these technological innovations, offering cutting-edge solutions to help you make better-informed decisions in the corn futures market.

Future Outlook for the Corn Futures Market

Looking ahead, several factors are likely to shape the corn futures market in the coming months and years:

- Climate change and its impact on global corn production

- Evolving trade relationships and policies

- Technological advancements in agriculture and their effect on yields

- Changing consumer preferences and dietary trends

- Development of alternative uses for corn (e.g., biofuels, biodegradable plastics)

By staying informed about these trends and leveraging data-driven insights, investors and agricultural professionals can position themselves to capitalize on opportunities in the evolving corn futures market.

How Farmonaut Can Help You Navigate the Corn Futures Market

At Farmonaut, we’re committed to providing you with the tools and insights you need to succeed in the complex world of agricultural commodity trading. Our platform offers:

- Real-time satellite-based crop health monitoring

- AI-driven market predictions and advisory services

- Comprehensive agricultural market data and analysis

- Advanced charting tools and technical indicators

- Integration capabilities through our API for seamless incorporation into your trading systems

By leveraging our technology and expertise, you can gain a competitive edge in navigating price volatility and identifying profitable opportunities in the corn futures market.

Conclusion

The corn futures market is a dynamic and complex arena, influenced by a myriad of factors ranging from global weather patterns to geopolitical events. By staying informed about market trends, leveraging technological advancements, and adopting sound trading strategies, investors and agricultural professionals can successfully navigate price volatility and capitalize on emerging opportunities.

At Farmonaut, we’re dedicated to providing you with the data-driven insights and tools you need to make informed decisions in this ever-changing landscape. Whether you’re a seasoned trader or new to agricultural commodity markets, our platform can help you stay ahead of the curve and achieve your investment goals.

Ready to take your corn futures trading to the next level? Explore our range of solutions and start leveraging the power of satellite-based crop monitoring and AI-driven market insights today!

Farmonaut Subscriptions

Frequently Asked Questions

Q1: How often are corn futures prices updated?

A1: Corn futures prices are updated in real-time during market hours. The primary trading venue for corn futures is the Chicago Board of Trade (CBOT), which operates from Sunday to Friday, with a brief daily maintenance period.

Q2: What factors have the most significant impact on corn futures prices?

A2: The most influential factors include weather conditions in major corn-producing regions, USDA crop reports, global supply and demand dynamics, currency fluctuations, and geopolitical events affecting trade.

Q3: How can Farmonaut’s satellite-based crop monitoring help in corn futures trading?

A3: Farmonaut’s technology provides real-time insights into crop health and potential yields across large agricultural areas. This information can help traders anticipate supply changes and make more informed decisions about market movements.

Q4: Are there seasonal patterns in corn futures prices?

A4: Yes, corn futures often exhibit seasonal patterns related to the planting and harvesting cycle. Prices may be more volatile during key growth stages and tend to be influenced by weather forecasts during critical periods.

Q5: How can I use Farmonaut’s API to enhance my trading strategies?

A5: Farmonaut’s API allows you to integrate our crop health data and market insights directly into your trading systems. This can help automate decision-making processes and provide real-time alerts based on changing agricultural conditions.