Mastering Corn Futures: Farmonaut’s Guide to Market Signals and Price Forecasting in Agricultural Commodities

“The Corn Price Index Futures (ZCPAUS.CM) shows bullish short-term indicators but bearish medium and long-term trends.”

Welcome to Farmonaut’s comprehensive guide on mastering corn futures trading and navigating the complex world of agricultural commodities markets. In this blog post, we’ll delve into the intricate details of crop price forecasting, market signals, and trading strategies that can help both seasoned traders and farmers make informed decisions in the ever-changing landscape of corn futures.

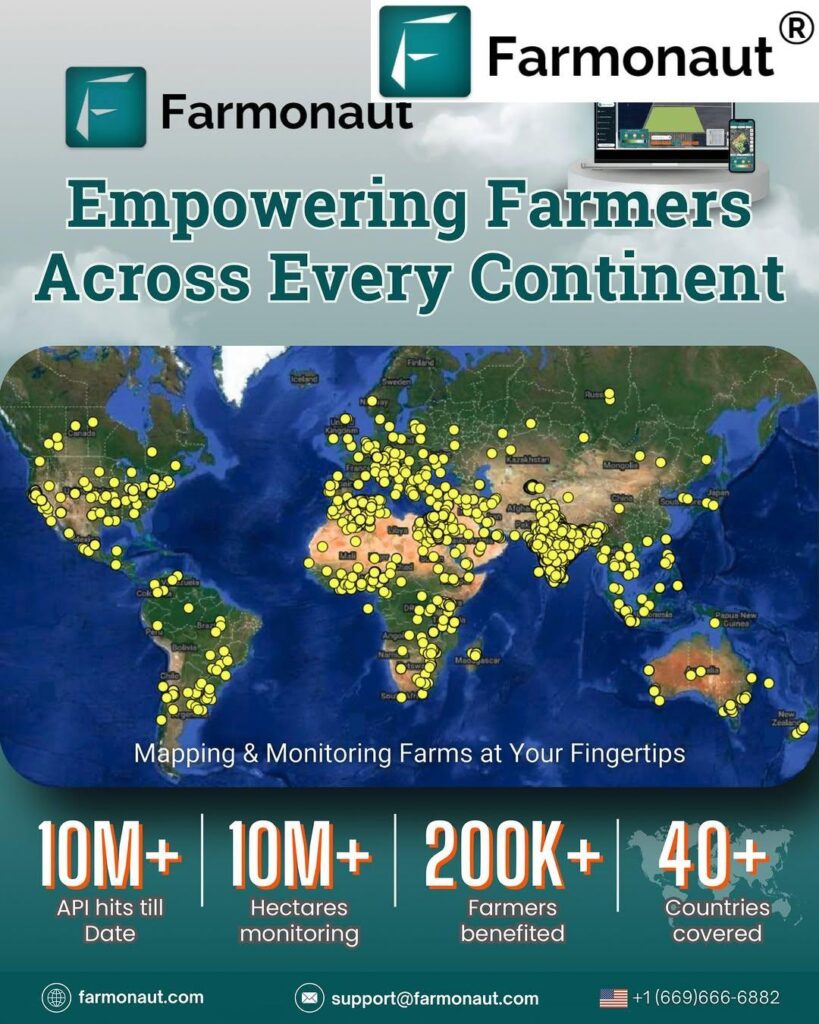

As pioneers in agricultural technology, we at Farmonaut understand the critical role that accurate market analysis and price forecasting play in the success of agricultural trading. Our satellite-based farm management solutions and AI-driven insights provide a unique perspective on crop health, yield predictions, and market trends. Let’s explore how these technologies can give you a competitive edge in understanding and navigating the corn futures market.

Understanding Corn Futures and Agricultural Commodities Markets

Corn futures trading is a vital component of the agricultural commodities market, serving as a financial instrument that allows traders, farmers, and investors to speculate on or hedge against future corn prices. The corn futures market is influenced by a myriad of factors, including supply and demand dynamics, weather conditions, geopolitical events, and global economic trends.

To effectively navigate this market, it’s crucial to understand the various signals and indicators that can help predict price movements. Let’s break down some key elements:

- Price Analysis: Examining historical and current corn prices to identify trends and patterns.

- Market Indicators: Utilizing technical and fundamental analysis tools to gauge market sentiment and potential price movements.

- Supply and Demand Forecasts: Assessing global corn production estimates and consumption trends.

- Weather Patterns: Monitoring climate conditions in major corn-producing regions.

- Geopolitical Factors: Considering trade policies, tariffs, and international relations that may impact corn trade.

By leveraging these factors alongside advanced agricultural technology, traders and farmers can develop more robust strategies for corn futures trading.

Decoding Market Signals: The Corn Price Index Futures (ZCPAUS.CM)

The Corn Price Index Futures (ZCPAUS.CM) is a key benchmark for understanding the overall sentiment in the corn market. Recent analysis shows a complex landscape with mixed signals across different timeframes:

- Short-term Indicators: Bullish sentiment, suggesting potential upward price movements in the near future.

- Medium-term Trends: Leaning bearish, indicating possible downward pressure on prices over the coming weeks to months.

- Long-term Outlook: Also bearish, hinting at broader market forces that may keep corn prices subdued over an extended period.

These conflicting signals underscore the importance of a nuanced approach to corn futures trading. Let’s dive deeper into how we can interpret and act on these market indicators.

Support and Resistance Levels: Critical Data for Price Movements

Support and resistance levels provide essential information for predicting potential price movements in the corn futures market. These levels represent price points where the market has historically shown a tendency to reverse direction:

- Support Levels: Price points where downward trends tend to pause or reverse, as buying pressure increases.

- Resistance Levels: Price ceilings where upward trends often stall or reverse due to increased selling pressure.

By identifying these key levels, traders can make more informed decisions about entry and exit points for their trades. At Farmonaut, we utilize advanced data analytics to help pinpoint these crucial price levels, giving our users a competitive edge in the market.

Leveraging Precision Agriculture Technology for Market Insights

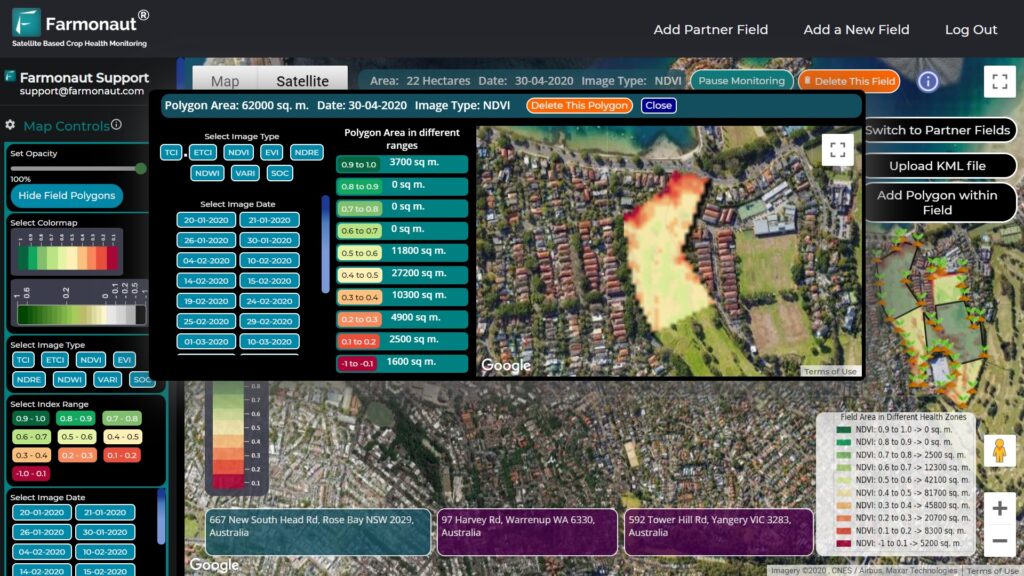

At Farmonaut, we believe that the future of successful agricultural trading lies in the integration of cutting-edge technology with traditional market analysis. Our precision agriculture tools offer unique insights that can complement your trading strategies:

- Satellite-Based Crop Monitoring: Real-time data on crop health and development stages across major corn-producing regions.

- AI-Driven Yield Predictions: Advanced algorithms that forecast potential corn yields, helping to anticipate supply fluctuations.

- Weather Analysis: Detailed climate data and predictions that can impact corn production and prices.

By incorporating these technological insights into your market analysis, you can gain a more comprehensive understanding of the factors influencing corn futures prices.

“Farmonaut’s blog analyzes support and resistance levels for corn futures, providing critical data for potential price movements.”

Developing Effective Trading Strategies for Corn Futures

Creating a successful trading strategy for corn futures requires a combination of market knowledge, technical analysis, and risk management. Here are some key components to consider:

- Technical Analysis: Utilize charts, indicators, and price patterns to identify potential entry and exit points.

- Fundamental Analysis: Stay informed about global corn supply and demand, economic indicators, and agricultural policies.

- Risk Management: Implement stop-loss orders and position sizing to protect your capital.

- Diversification: Consider spreading risk across different agricultural commodities or related markets.

- Timing: Pay attention to seasonal patterns in corn production and consumption.

Remember, successful trading strategies often evolve over time. It’s crucial to regularly review and adjust your approach based on market conditions and performance.

The Role of Farm Management Software in Trading Decisions

Farm management software, like the solutions offered by Farmonaut, can play a pivotal role in informing trading decisions. Our platform provides:

- Real-time Crop Health Monitoring: Insights into potential yield changes that could affect market supply.

- Resource Management Tools: Data on input costs and efficiency, which can impact profit margins and market dynamics.

- Weather Forecasting: Accurate predictions that can help anticipate supply shocks or bumper crops.

By integrating these tools into your trading strategy, you can gain a more holistic view of the factors influencing corn futures prices.

Access Farmonaut’s powerful farm management tools:

Navigating Market Volatility: The Importance of Personal Due Diligence

While market signals and technological tools can provide valuable insights, it’s crucial to emphasize the importance of personal due diligence in navigating the volatile world of corn futures trading. Here are some key points to remember:

- Stay Informed: Regularly follow agricultural news, market reports, and economic indicators.

- Continuous Learning: Invest time in understanding new trading strategies and market analysis techniques.

- Risk Assessment: Regularly evaluate your risk tolerance and adjust your trading strategies accordingly.

- Emotional Control: Develop discipline to avoid impulsive decisions based on short-term market fluctuations.

Remember, successful trading is as much about managing risk and emotions as it is about market analysis.

Corn Futures Market Signals and Indicators: A Comprehensive Overview

To provide a clear snapshot of the current corn futures market, we’ve compiled a table of key indicators and their potential impact on prices:

| Indicator | Current Value | Trend | Impact on Price |

|---|---|---|---|

| Corn Price Index Futures (ZCPAUS.CM) | $5.25 per bushel | Mixed | Neutral to slightly bullish short-term |

| Short-term Technical Indicators | Bullish | Upward | Potential price increase in near term |

| Medium-term Technical Indicators | Bearish | Downward | Possible price decline over weeks to months |

| Long-term Technical Indicators | Bearish | Downward | Extended downward pressure on prices |

| Support Levels | $5.00 per bushel | Stable | Potential price floor |

| Resistance Levels | $5.50 per bushel | Stable | Potential price ceiling |

| Supply Forecast | Ample | Increasing | Bearish pressure on prices |

| Demand Forecast | Moderate | Stable | Neutral impact on prices |

| Weather Conditions | Favorable | Stable | Bearish pressure on prices |

| Geopolitical Factors | Mixed | Uncertain | Potential for increased volatility |

This table provides a comprehensive overview of various factors influencing corn futures, allowing traders to quickly grasp the complex market dynamics at play.

Leveraging Agritech Trading Tools for Competitive Advantage

In today’s fast-paced trading environment, having access to cutting-edge agritech trading tools can provide a significant competitive advantage. Farmonaut’s suite of technologies offers several key benefits for corn futures traders:

- Real-time Satellite Imagery: Monitor crop conditions across vast areas, helping to anticipate supply changes.

- AI-powered Analytics: Gain insights from complex data sets to inform trading decisions.

- Blockchain-based Traceability: Enhance transparency in supply chains, potentially impacting market sentiment.

By integrating these advanced tools into your trading strategy, you can gain a more comprehensive understanding of the factors influencing corn futures prices.

Explore Farmonaut’s API for custom integration: Farmonaut API

Access our Developer Documentation: API Developer Docs

The Future of Corn Price Forecasting: Emerging Trends and Technologies

As we look to the future of corn price forecasting, several emerging trends and technologies are poised to revolutionize the field:

- Machine Learning Algorithms: Advanced predictive models that can process vast amounts of data to forecast price movements with increasing accuracy.

- Internet of Things (IoT) in Agriculture: Networked sensors providing real-time data on soil conditions, crop health, and weather patterns.

- Blockchain in Supply Chain Management: Enhancing transparency and traceability in the corn supply chain, potentially reducing market uncertainties.

- Climate Change Models: More sophisticated tools for predicting long-term weather patterns and their impact on corn production.

At Farmonaut, we’re continually innovating to incorporate these emerging technologies into our platform, ensuring that our users stay ahead of the curve in agricultural commodity trading.

Conclusion: Mastering Corn Futures Trading with Farmonaut

Navigating the complex world of corn futures trading requires a multifaceted approach that combines traditional market analysis with cutting-edge technology. By leveraging Farmonaut’s advanced agricultural solutions, traders and farmers can gain valuable insights into crop health, yield predictions, and market trends that can inform their trading strategies.

Remember, successful trading in agricultural commodities markets demands continuous learning, adaptability, and a keen understanding of both macro and micro factors influencing prices. While our tools and analysis can provide valuable guidance, it’s crucial to conduct your own due diligence and develop a trading strategy that aligns with your risk tolerance and financial goals.

As we continue to innovate in the agritech space, Farmonaut remains committed to empowering traders and farmers with the insights they need to thrive in the ever-changing landscape of corn futures trading. By combining precision agriculture technology with robust market analysis, we’re helping to shape the future of agricultural commodities trading.

FAQ Section

Q: What are corn futures?

A: Corn futures are standardized contracts to buy or sell a specific amount of corn at a predetermined price on a future date. They are used for hedging and speculating on corn prices.

Q: How can Farmonaut’s technology help in corn futures trading?

A: Farmonaut provides satellite-based crop monitoring, AI-driven yield predictions, and weather analysis, which can offer valuable insights into potential supply changes and market trends.

Q: What factors influence corn futures prices?

A: Key factors include supply and demand, weather conditions, global economic trends, government policies, and geopolitical events.

Q: How often should I review my corn futures trading strategy?

A: It’s advisable to review your strategy regularly, at least quarterly, and adjust based on market conditions and personal performance.

Q: Can Farmonaut’s tools help in predicting corn prices?

A: While no tool can predict prices with certainty, Farmonaut’s technologies provide valuable data on crop health and potential yields, which can inform price forecasts.

Access Farmonaut’s Advanced Agricultural Solutions

Ready to elevate your corn futures trading strategy with cutting-edge agritech solutions? Explore Farmonaut’s comprehensive suite of tools and services:

By leveraging our advanced satellite-based farm management solutions, AI-driven insights, and comprehensive market analysis tools, you’ll be well-equipped to navigate the complexities of corn futures trading and make informed decisions in the ever-evolving agricultural commodities market.

Farmonaut Subscription Plans