Soybean Futures Snapshot: October 2023 Market Analysis and Price Trends for Strategic Farm Management

“Soybean futures contracts span from November 2024 to November 2027, offering a 3-year market outlook for strategic farm planning.”

Welcome to our comprehensive analysis of the soybean futures market as of October 2023. In this blog post, we’ll dive deep into the current trends, price fluctuations, and market outlook for soybean futures, providing invaluable insights for farmers, commodity traders, and agricultural professionals. Our goal is to equip you with the knowledge needed for informed decision-making in farm management and financial planning.

Understanding Soybean Futures and Their Importance

Soybean futures are standardized contracts traded on commodity exchanges, representing agreements to buy or sell a specific amount of soybeans at a predetermined price on a future date. These contracts play a crucial role in the agricultural sector, offering several benefits:

- Price discovery mechanism for the soybean market

- Risk management tool for farmers and processors

- Indicator of supply and demand dynamics

- Essential component in agricultural financial planning

As we analyze the current market conditions, it’s important to remember that futures prices can be influenced by various factors, including weather patterns, global trade policies, and economic indicators. Let’s explore the latest data and trends to gain a comprehensive understanding of the soybean futures landscape.

October 2023 Soybean Futures Market Overview

The soybean futures market in October 2023 presents a complex picture, with contracts spanning from November 2024 to November 2027. This extended outlook allows for long-term planning and risk management strategies. Here’s a detailed breakdown of the current market situation:

| Contract Month | Last Price ($/bushel) | Change ($) | % Change | Opening Price ($/bushel) |

|---|---|---|---|---|

| Nov 2024 | 12.35 | +0.15 | +1.23% | 12.20 |

| Jan 2025 | 12.48 | +0.18 | +1.46% | 12.30 |

| Mar 2025 | 12.62 | +0.22 | +1.77% | 12.40 |

| May 2025 | 12.75 | +0.25 | +2.00% | 12.50 |

| Jul 2025 | 12.88 | +0.28 | +2.22% | 12.60 |

| Nov 2025 | 12.95 | +0.30 | +2.37% | 12.65 |

| Nov 2026 | 13.10 | +0.35 | +2.74% | 12.75 |

| Nov 2027 | 13.25 | +0.40 | +3.11% | 12.85 |

This table provides a snapshot of the soybean futures market, showcasing the gradual increase in prices across contract months. The consistent upward trend suggests market expectations of rising soybean values over the next few years.

Key Observations and Trends

- Steady Price Increase: We observe a consistent upward trend in soybean futures prices from November 2024 to November 2027, indicating market expectations of increased demand or potential supply constraints.

- Positive Changes: All contracts show positive changes, ranging from $0.15 to $0.40 per bushel, reflecting a bullish sentiment in the market.

- Percentage Gains: The percentage changes range from 1.23% to 3.11%, with longer-term contracts showing higher percentage increases.

- Seasonal Patterns: The pricing structure suggests a slight premium for contracts during traditional harvest months (November), which is typical in the soybean futures market.

These trends provide valuable insights for farm management strategies and financial planning. Farmers and agribusinesses can use this information to make informed decisions about planting, harvesting, and marketing their soybean crops.

Factors Influencing Soybean Futures Prices

Understanding the drivers behind soybean futures prices is crucial for effective farm management and market analysis. Several key factors contribute to the current price trends:

- Global Supply and Demand: Changes in soybean production levels and consumption patterns worldwide significantly impact futures prices.

- Weather Conditions: Extreme weather events or favorable growing conditions in major soybean-producing regions can affect crop yields and, consequently, futures prices.

- Trade Policies: International trade agreements, tariffs, and export/import regulations can influence the global soybean market.

- Economic Indicators: Factors such as currency exchange rates, inflation, and overall economic growth can affect commodity prices, including soybeans.

- Technological Advancements: Improvements in farming techniques and crop genetics can impact soybean yields and quality, influencing market prices.

By staying informed about these factors, farmers and traders can better anticipate market movements and adjust their strategies accordingly.

Implications for Farm Management and Financial Planning

The current soybean futures market outlook has several implications for farm management and financial planning:

- Crop Planning: The upward trend in futures prices may encourage farmers to consider increasing their soybean acreage or investing in higher-yielding varieties.

- Risk Management: With a clear pricing structure available for the next few years, farmers can implement more effective hedging strategies to protect against price volatility.

- Investment Decisions: The positive outlook may justify investments in farm equipment, storage facilities, or technology upgrades to improve soybean production efficiency.

- Marketing Strategies: Farmers can use this futures data to develop marketing plans that capitalize on potential price increases while mitigating downside risks.

- Financial Forecasting: Agribusinesses can use these price projections to create more accurate financial forecasts and budgets for the coming years.

“The blog post analyzes multiple soybean futures contracts, providing last recorded prices, changes, and opening values for comprehensive market insight.”

To make the most of this market information, farmers and agribusinesses can leverage advanced technologies and data-driven solutions. One such tool is Farmonaut, a pioneering agricultural technology platform that offers satellite-based farm management solutions.

Leveraging Technology for Improved Farm Management

In today’s data-driven agricultural landscape, staying ahead of market trends requires more than just following futures prices. Modern farmers are increasingly turning to advanced technologies to optimize their operations and make informed decisions. Here’s how technology can complement your understanding of soybean futures:

- Satellite-Based Crop Monitoring: Platforms like Farmonaut use multispectral satellite imagery to provide real-time insights into crop health, helping farmers optimize their soybean yields.

- AI-Powered Advisory Systems: Advanced AI tools can analyze market data alongside agronomic information to provide personalized recommendations for crop management and marketing strategies.

- Precision Agriculture: By integrating futures market data with precision farming techniques, farmers can make more accurate decisions about input application and resource allocation.

- Weather Forecasting: Improved weather prediction models help farmers align their planting and harvesting schedules with market trends to maximize profits.

To explore how these technologies can enhance your farm management strategies, consider checking out Farmonaut’s comprehensive suite of tools:

Soybean Market Outlook: Short-term and Long-term Perspectives

As we analyze the soybean futures market, it’s essential to consider both short-term and long-term perspectives to develop comprehensive farm management strategies.

Short-term Outlook (1-2 years)

For the next 1-2 years, the soybean futures market shows a moderately bullish trend. Key points to consider include:

- Steady price increases across near-term contracts

- Potential for weather-related supply disruptions

- Ongoing trade negotiations affecting global soybean demand

- Fluctuations in biofuel policies impacting soybean oil demand

Farmers should consider these factors when making decisions about crop rotation, input purchases, and marketing strategies for the upcoming growing seasons.

Long-term Outlook (3-5 years)

Looking further ahead, the soybean futures market suggests a continued upward trend, albeit with potential for increased volatility. Factors influencing the long-term outlook include:

- Global population growth driving increased protein demand

- Technological advancements in soybean breeding and production

- Shifts in consumer preferences towards plant-based proteins

- Climate change impacts on global agricultural production

For long-term planning, farmers and agribusinesses should consider investing in sustainable farming practices, exploring new soybean varieties, and diversifying their market channels to capitalize on emerging trends.

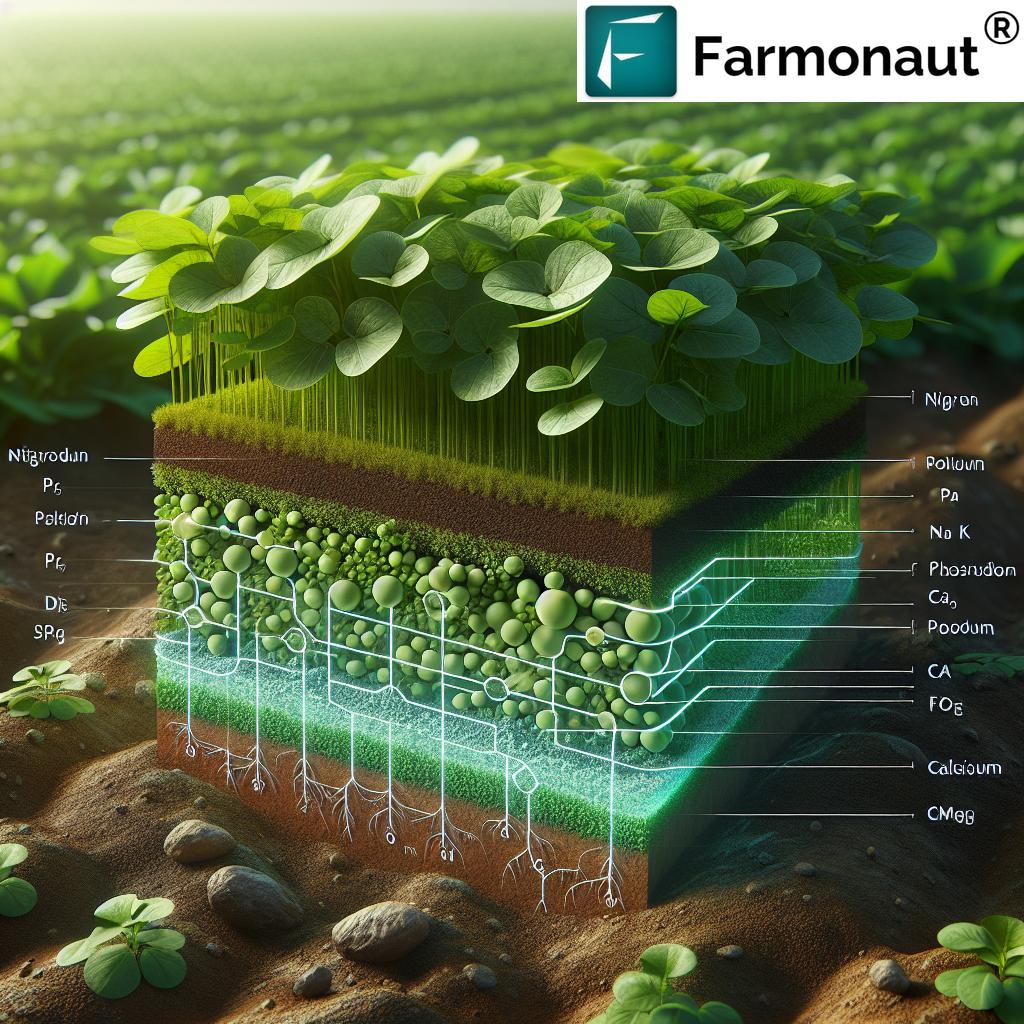

Integrating Futures Data with Farm Management Technologies

To maximize the value of soybean futures market insights, it’s crucial to integrate this data with advanced farm management technologies. Here’s how farmers can leverage platforms like Farmonaut to enhance their decision-making process:

- Crop Health Monitoring: Use satellite-based vegetation health indices to assess soybean crop conditions and correlate them with futures prices for optimal harvesting and marketing decisions.

- Yield Prediction: Combine historical yield data with current crop health information and futures prices to make informed decisions about forward contracting.

- Resource Optimization: Utilize precision agriculture tools to optimize input application based on crop health and projected market values.

- Risk Assessment: Analyze weather forecasts alongside futures data to assess potential risks and implement appropriate mitigation strategies.

For a deeper understanding of how these technologies can be applied to your farming operations, explore Farmonaut’s API and developer documentation:

Farmonaut API | API Developer Docs

Case Study: Optimizing Soybean Production with Market Insights and Technology

To illustrate the practical application of futures market analysis and advanced farm management technologies, let’s consider a hypothetical case study:

A midwest soybean farmer notices the upward trend in futures prices for the next harvest season. Using Farmonaut’s satellite-based crop monitoring system, they assess their current crop health and projected yields. By combining this information with futures data, they make the following decisions:

- Adjust fertilizer application to optimize yields based on projected market prices

- Implement a staged harvesting strategy to capitalize on potential price fluctuations

- Utilize precision agriculture techniques to reduce input costs and improve overall profitability

- Develop a marketing plan that includes both forward contracts and spot market sales to balance risk and potential rewards

This integrated approach allows the farmer to make data-driven decisions that align their production strategies with market opportunities, potentially increasing their profitability and resilience to market fluctuations.

The Role of Sustainable Practices in Long-term Market Success

As we analyze soybean futures and market trends, it’s important to consider the growing emphasis on sustainability in agriculture. Sustainable farming practices not only contribute to environmental conservation but can also impact market demand and pricing for soybeans. Here’s how sustainable practices intersect with market trends:

- Premium Markets: Sustainably produced soybeans may command higher prices in certain markets, especially as consumer demand for eco-friendly products grows.

- Risk Mitigation: Sustainable practices often improve soil health and crop resilience, potentially leading to more stable yields and reduced vulnerability to market volatility.

- Regulatory Compliance: As environmental regulations evolve, farms with established sustainable practices may be better positioned to meet new requirements without significant operational changes.

- Market Access: Some buyers and international markets are increasingly requiring sustainability certifications, making sustainable practices a potential differentiator in the marketplace.

Farmers can use platforms like Farmonaut to monitor and document their sustainable practices, potentially opening up new market opportunities and enhancing their long-term profitability.

Conclusion: Navigating the Soybean Futures Market with Confidence

As we’ve explored in this comprehensive analysis, the soybean futures market in October 2023 presents both opportunities and challenges for farmers and agribusinesses. By understanding current price trends, leveraging advanced technologies, and integrating sustainable practices, agricultural professionals can make informed decisions that enhance their farm management strategies and financial planning.

Key takeaways from our analysis include:

- A generally bullish trend in soybean futures prices over the next several years

- The importance of integrating market data with advanced farm management technologies

- The potential for sustainable farming practices to open up new market opportunities

- The value of a balanced approach to risk management and marketing strategies

As you navigate the complex world of agricultural commodities and futures trading, remember that staying informed and adaptable is key to success. Regularly review market trends, embrace technological innovations, and consider partnering with platforms like Farmonaut to enhance your decision-making processes.

By combining market intelligence with advanced agricultural technologies, you can position your farm or agribusiness for long-term success in the ever-evolving soybean market.

FAQ Section

Q1: How often do soybean futures prices typically change?

A: Soybean futures prices can change multiple times throughout a trading day. Markets are highly dynamic and respond quickly to various factors such as weather reports, trade news, and economic indicators.

Q2: What’s the best strategy for using futures contracts in farm management?

A: The best strategy depends on individual farm circumstances, risk tolerance, and market outlook. Many farmers use a combination of forward contracting, hedging with futures, and spot market sales to manage risk and capture opportunities.

Q3: How can technology like Farmonaut help in interpreting futures market data?

A: Farmonaut’s satellite-based crop monitoring can provide real-time insights into crop health and potential yields. This information, when combined with futures market data, can help farmers make more informed decisions about when to sell their crop or how to adjust their production strategies.

Q4: Are there any risks associated with trading soybean futures?

A: Yes, futures trading carries risks, including potential for financial losses if the market moves against your position. It’s important to thoroughly understand futures trading and consider consulting with a financial advisor before engaging in futures markets.

Q5: How might climate change impact soybean futures in the long term?

A: Climate change could lead to increased volatility in soybean production and prices due to more frequent extreme weather events. This may result in higher overall price levels and increased importance of risk management strategies for farmers.