Unlocking Telecom Investment Potential: Insider Analysis of Utilities Provider Stocks and Market Trends

“Institutional investors and hedge funds hold significant stakes in major telecom utilities, influencing market trends.”

In today’s rapidly evolving telecommunications landscape, investors are constantly seeking opportunities to capitalize on the growth and stability offered by major utilities providers. As we delve into this comprehensive analysis, we’ll explore the financial performance, market trends, and investment potential of a key player in the telecom industry. Our focus will be on BCE Inc. (NYSE:BCE, TSE:BCE), a leading Canadian telecommunications company that has recently caught the attention of institutional investors and market analysts alike.

The Changing Face of Institutional Ownership

One of the most significant indicators of a company’s investment potential is the level of interest shown by institutional investors. In the case of BCE, we’ve observed some noteworthy changes in institutional holdings that warrant closer examination.

- Stephens Inc. AR recently reduced its holdings in BCE by a substantial 72.5% in the fourth quarter.

- After selling 22,788 shares, Stephens Inc. AR now owns 8,648 shares of BCE, valued at approximately $200,000.

- This move by Stephens Inc. AR signals a significant shift in their investment strategy regarding BCE.

However, it’s crucial to note that while one institutional investor has reduced its position, others have shown increased interest in BCE:

- CWM LLC increased its holdings by 12.9% in the third quarter, now owning 8,305 shares worth $289,000.

- Creative Planning grew its position by 6.0%, holding 59,471 shares valued at $2,070,000.

- Bleakley Financial Group LLC expanded its stake by 9.1%, now possessing 12,365 shares worth $430,000.

These movements in institutional ownership provide valuable insights into the market’s perception of BCE’s potential. It’s worth noting that as of the latest data, 41.46% of BCE’s stock is owned by hedge funds and other institutional investors, indicating a significant level of professional investment interest.

Utilities Provider Stock Analysis: BCE’s Market Performance

To gain a comprehensive understanding of BCE’s investment potential, let’s examine its recent market performance and key financial indicators:

- Stock Price: BCE opened at $23.86 on Monday, with a 52-week range of $21.87 to $38.14.

- Market Capitalization: The company currently has a market cap of $21.76 billion.

- Price-to-Earnings Ratio: BCE’s P/E ratio stands at 198.79, indicating a high valuation relative to earnings.

- Price-to-Earnings-Growth Ratio: The PEG ratio is 3.91, suggesting the stock may be overvalued in relation to its growth prospects.

- Beta: With a beta of 0.57, BCE demonstrates lower volatility compared to the broader market.

These metrics provide a snapshot of BCE’s current market position and valuation. The high P/E ratio suggests that investors are willing to pay a premium for BCE’s stock, possibly due to expectations of future growth or the company’s strong market position in the Canadian telecom sector.

Quarterly Dividend Yield: A Key Attraction for Investors

One of the most compelling aspects of BCE’s stock for many investors is its attractive dividend yield. The company recently announced a quarterly dividend payment, which offers several key points of interest:

- Dividend Amount: $0.6965 per share

- Payment Date: Tuesday, April 15th

- Record Date: Friday, March 14th

- Annualized Dividend: $2.79 per share

- Dividend Yield: An impressive 11.68% based on the current stock price

This high dividend yield is particularly attractive in the current low-interest-rate environment, making BCE a potentially appealing option for income-focused investors. However, it’s important to note that the sustainability of such a high dividend yield should be carefully evaluated in the context of the company’s overall financial health and future earnings potential.

Communications Company Financial Performance: Q4 2023 Results

BCE’s recent financial results provide crucial insights into the company’s operational performance and financial health:

- Earnings Per Share (EPS): BCE reported $0.56 per share for the quarter, exceeding analysts’ expectations by $0.03.

- Net Margin: The company achieved a net margin of 0.99%.

- Return on Equity: BCE demonstrated a return on equity of 17.89%, indicating efficient use of shareholders’ equity.

These results suggest that BCE has been able to maintain profitability and exceed market expectations, which could be a positive sign for potential investors. However, the relatively low net margin indicates that there may be room for improvement in operational efficiency.

Telecom Industry Market Trends: Navigating a Dynamic Landscape

The telecommunications industry is undergoing rapid transformation, driven by technological advancements and changing consumer behaviors. Some key trends affecting BCE and its competitors include:

- 5G Network Expansion: The rollout of 5G networks is a major focus for telecom providers, offering faster speeds and new service possibilities.

- Increasing Demand for Data: With the proliferation of connected devices and streaming services, data consumption continues to rise.

- Competition from Over-the-Top (OTT) Services: Traditional telecom services face challenges from internet-based communication and entertainment platforms.

- Convergence of Services: Telecom companies are increasingly offering bundled services, combining wireless, wireline, internet, and TV offerings.

BCE’s ability to navigate these trends and capitalize on new opportunities will be crucial in determining its long-term success and investment potential.

“Quarterly dividend yields and analyst ratings are key metrics in evaluating telecom stock performance and growth potential.”

Wireless and Wireline Services: BCE’s Core Offerings

BCE’s business is primarily divided into two main service categories: wireless and wireline. Understanding the performance and potential of these segments is crucial for evaluating the company’s overall investment potential.

Wireless Services

BCE’s wireless division provides mobile voice and data services to consumers and businesses across Canada. Key aspects of this segment include:

- Network Coverage: BCE operates one of Canada’s largest and most advanced wireless networks.

- Subscriber Growth: The company has been focusing on expanding its customer base and increasing average revenue per user (ARPU).

- 5G Deployment: BCE is investing heavily in 5G technology to maintain its competitive edge and open new revenue streams.

Wireline Services

The wireline segment encompasses BCE’s traditional telephone services, as well as internet and television offerings. Notable points include:

- Fiber-to-the-Home (FTTH) Expansion: BCE continues to invest in fiber optic infrastructure to deliver high-speed internet services.

- Internet Protocol Television (IPTV): The company’s TV services have been a growing segment, competing with traditional cable providers.

- Business Solutions: BCE offers a range of communications and cloud services to enterprise customers.

The performance of these core services will be a key driver of BCE’s financial results and stock performance in the coming years.

Residential Internet and TV Providers: Competitive Landscape

In the residential services market, BCE faces stiff competition from other major Canadian telecom providers. The company’s success in this area depends on factors such as:

- Service Quality: Delivering reliable, high-speed internet and compelling TV content packages.

- Pricing Strategies: Offering competitive pricing and bundled service discounts to attract and retain customers.

- Customer Service: Providing excellent support to maintain customer satisfaction and reduce churn.

- Technological Innovation: Introducing new features and services to differentiate from competitors.

BCE’s performance in the residential market will significantly impact its overall financial results and, consequently, its stock performance.

Investment Analyst Ratings: Professional Perspectives on BCE

Analyst ratings provide valuable insights into the professional assessment of BCE’s investment potential. Recent ratings and analysis include:

- JPMorgan Chase & Co.: Downgraded BCE from “neutral” to “underweight” on February 7th.

- Canaccord Genuity Group: Reiterated a “hold” rating on November 5th.

- Morgan Stanley: Initiated coverage with an “underweight” rating on December 16th.

- Edward Jones: Downgraded BCE from “buy” to “hold” on November 5th.

- Bank of America: Changed rating from “neutral” to “underperform” on January 14th.

The overall consensus among analysts appears to be cautious, with a trend towards more negative ratings. The average rating is currently “Hold,” with a consensus price target of $40.50.

Long-Term Stock Price Forecast: Projecting BCE’s Future

While short-term market movements can be unpredictable, long-term forecasts help investors gauge the potential future value of BCE stock. Factors influencing these projections include:

- Industry Trends: The ongoing evolution of the telecom sector, including 5G adoption and increasing data consumption.

- Regulatory Environment: Potential changes in Canadian telecom regulations that could impact BCE’s operations and profitability.

- Technological Advancements: BCE’s ability to innovate and adapt to new technologies in the communications space.

- Competitive Landscape: The company’s success in maintaining and growing market share in key service areas.

- Economic Factors: Broader economic conditions that could affect consumer spending on telecom services.

While specific long-term price targets vary among analysts, investors should closely monitor these factors when considering BCE’s future potential.

Asset Management: BCE’s Strategic Approach

Effective asset management is crucial for a telecom utilities provider like BCE to maintain its competitive edge and drive long-term value. Key aspects of BCE’s asset management strategy include:

- Network Infrastructure: Continuous investment in upgrading and expanding wireless and wireline networks.

- Spectrum Holdings: Strategic acquisition and utilization of wireless spectrum to support service quality and capacity.

- Real Estate Portfolio: Management of physical assets, including cell towers, data centers, and office spaces.

- Intellectual Property: Development and protection of proprietary technologies and brands.

BCE’s success in managing these assets efficiently will play a significant role in its ability to generate returns for investors and maintain its market position.

Institutional Investor Holdings Comparison

| Company Name | Market Cap (Billions USD) | Total Institutional Holdings (%) | Top 3 Institutional Investors | Recent Changes in Ownership (%) |

|---|---|---|---|---|

| BCE Inc. | 21.76 | 41.46 | Royal Bank of Canada, Bank of Montreal, TD Asset Management | -72.5 (Stephens Inc. AR) |

| Rogers Communications Inc. | 24.5 | 53.2 | RBC Global Asset Management, Beutel Goodman & Co, Mackenzie Financial Corporation | +2.3 (Fidelity Management & Research) |

| TELUS Corporation | 22.8 | 49.7 | RBC Global Asset Management, TD Asset Management, BMO Asset Management | +1.8 (Vanguard Group) |

| Shaw Communications Inc. | 14.2 | 55.8 | Mackenzie Financial Corporation, RBC Global Asset Management, TD Asset Management | -3.5 (Letko Brosseau & Associates) |

This table provides a comparative view of institutional holdings among major Canadian telecom providers. It’s evident that while BCE has significant institutional ownership, it’s somewhat lower than some of its competitors. The recent large reduction by Stephens Inc. AR stands out, potentially indicating a shift in investor sentiment or strategy regarding BCE.

Conclusion: Evaluating BCE’s Investment Potential

As we’ve explored throughout this analysis, BCE Inc. presents a complex investment opportunity in the ever-evolving telecommunications sector. The company’s strong market position in Canada, attractive dividend yield, and established infrastructure provide a solid foundation. However, challenges such as increasing competition, technological disruption, and recent analyst downgrades suggest caution.

Investors considering BCE should weigh the following factors:

- Dividend Yield: BCE’s high dividend yield is attractive for income-focused investors, but its sustainability should be carefully evaluated.

- Market Position: The company’s strong presence in the Canadian market provides stability, but also limits growth potential compared to more globally diversified competitors.

- Technological Adaptation: BCE’s ability to successfully navigate the transition to 5G and address challenges from OTT services will be crucial for long-term success.

- Regulatory Environment: Changes in Canadian telecom regulations could significantly impact BCE’s operations and profitability.

- Valuation: The high P/E ratio suggests that the stock may be overvalued relative to current earnings, requiring careful consideration of future growth prospects.

Ultimately, BCE represents a potentially solid choice for investors seeking stable income and exposure to the Canadian telecom market. However, those looking for high growth potential or global diversification may need to look elsewhere. As always, potential investors should conduct thorough research and consider their individual financial goals and risk tolerance before making investment decisions.

FAQ: BCE Inc. Investment Analysis

- Q: What is BCE Inc.’s current dividend yield?

A: Based on the most recent data, BCE Inc. offers an annualized dividend yield of approximately 11.68%. - Q: How has institutional ownership of BCE stock changed recently?

A: There have been mixed changes, with some institutions like Stephens Inc. AR significantly reducing their holdings, while others such as CWM LLC and Creative Planning have increased their positions. - Q: What is the current analyst consensus on BCE stock?

A: The overall analyst consensus is currently a “Hold” rating, with an average price target of $40.50. - Q: How does BCE’s market capitalization compare to its competitors?

A: BCE has a market capitalization of approximately $21.76 billion, which is comparable to other major Canadian telecom providers like Rogers Communications and TELUS Corporation. - Q: What are the main challenges facing BCE in the current telecom landscape?

A: Key challenges include the transition to 5G technology, competition from over-the-top (OTT) services, regulatory changes, and the need for continuous infrastructure investment.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

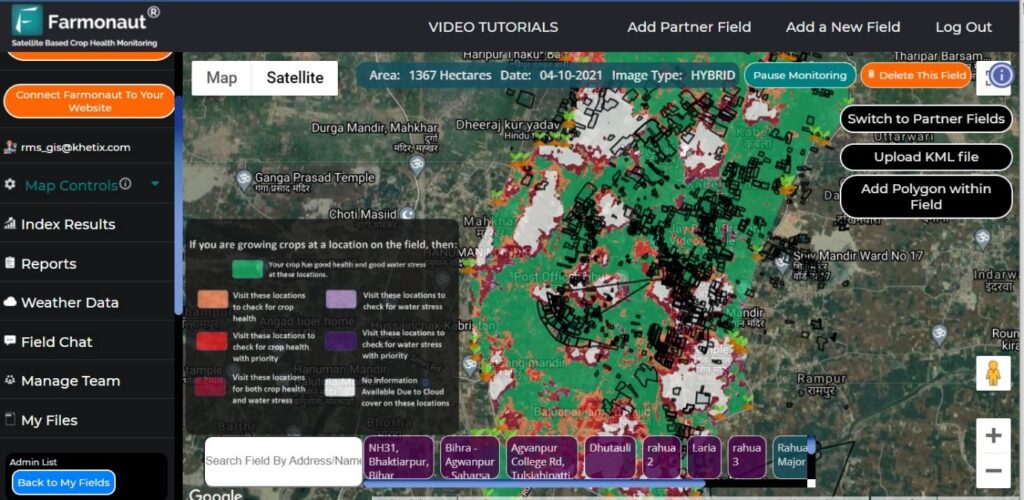

For more information on Farmonaut’s innovative agricultural technology solutions, visit our website or explore our mobile apps:

For developers interested in integrating Farmonaut’s satellite and weather data into their own applications, check out our API and API Developer Docs.