Canadian Softwood Lumber Trade: Impact on US Market and Housing Affordability

In the complex world of international trade, few disputes have been as enduring and impactful as the Canadian softwood lumber trade issue and its effects on the U.S. market. As we delve into this multifaceted topic, we’ll explore the intricate dynamics of the softwood lumber industry, trade law enforcement, and the broader implications for both economies, particularly in terms of housing affordability and job markets.

“U.S. antidumping duties on Canadian softwood lumber have reached up to 20.23% in recent trade disputes.”

The Canadian softwood lumber trade has been a contentious issue between the United States and Canada for decades. At the heart of this dispute lies a complex web of trade practices, government policies, and market dynamics that have far-reaching consequences for both nations’ lumber industries, workers, and consumers. In this comprehensive analysis, we’ll examine the key factors driving this ongoing trade conflict and its impact on the U.S. market and housing affordability.

Understanding the Softwood Lumber Market Issues

The softwood lumber market is a crucial component of both the Canadian and U.S. economies, with significant implications for construction, housing, and related industries. To grasp the full scope of the trade dispute, it’s essential to understand the market dynamics at play.

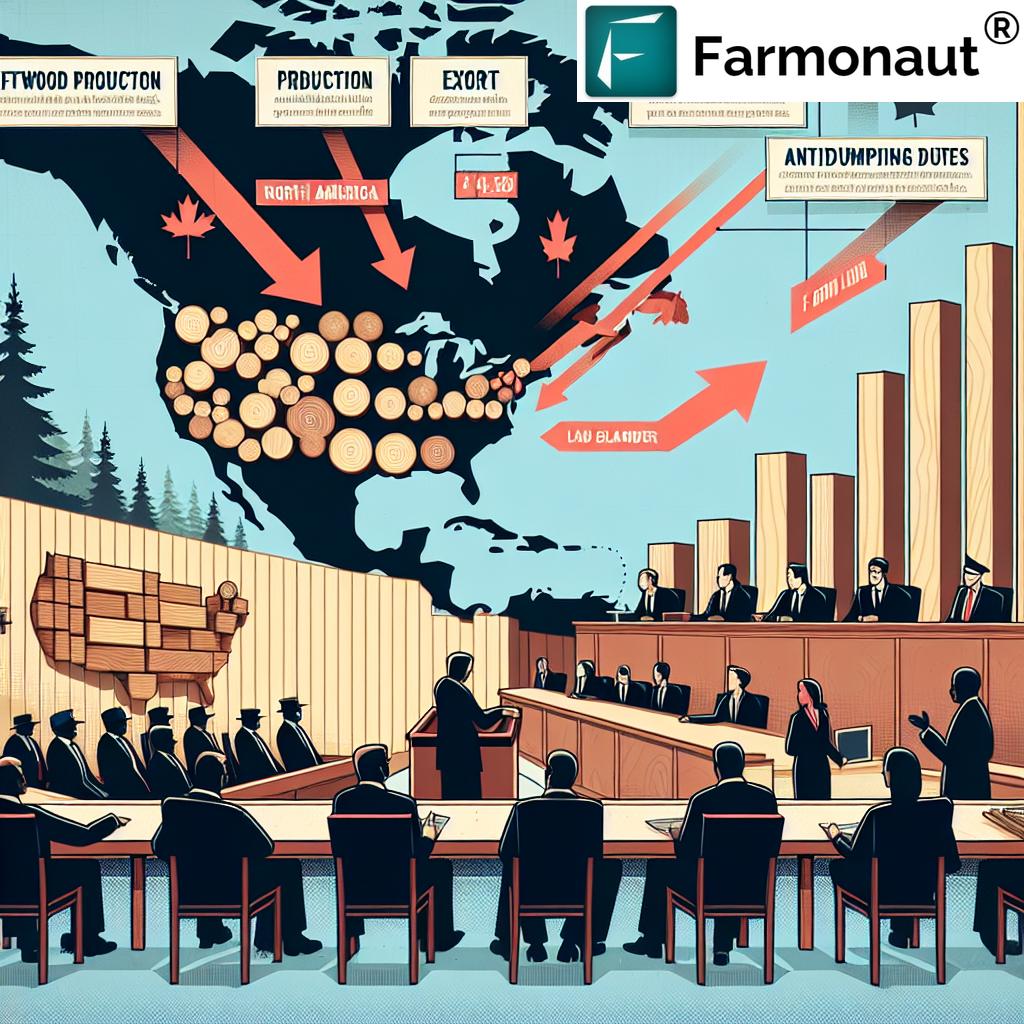

- Production Capacity: Canada’s excess lumber capacity has surged threefold to 8.7 billion board feet since 2016, creating an unsustainable situation.

- Export Trends: With non-U.S.-bound Canadian softwood lumber exports declining, the Canadian industry is increasingly directing its excess production to the U.S. market.

- Market Impact: The influx of Canadian lumber has had a devastating effect on U.S. lumber producers, workers, and forestry-dependent communities.

These market conditions have led to accusations of dumping and unfair trading practices, prompting the U.S. to implement trade law enforcement measures to protect its domestic industry.

Trade Law Enforcement and Lumber Industry Challenges

The enforcement of trade laws has become a central issue in the softwood lumber dispute. U.S. authorities have implemented various measures to address what they perceive as unfair trade practices by Canadian producers.

- Antidumping Duties: The U.S. has imposed antidumping duties on Canadian softwood lumber imports to counteract alleged dumping practices.

- Countervailing Duties: Additional countervailing duties have been applied to offset the effects of government subsidies received by Canadian lumber producers.

- Impact on U.S. Workers: These trade law enforcement actions aim to protect U.S. lumber industry jobs and maintain the viability of domestic production.

The U.S. Lumber Coalition argues that these measures are necessary to level the playing field and ensure fair competition in the North American lumber market.

Housing Affordability and Lumber Prices

One of the most contentious aspects of the softwood lumber trade dispute is its potential impact on housing affordability in the United States. Various stakeholders have differing views on how lumber prices affect overall housing costs.

- NAHB Claims: The National Association of Home Builders (NAHB) argues that trade restrictions on Canadian lumber lead to higher lumber prices, thereby increasing housing costs.

- U.S. Lumber Coalition Perspective: The coalition contends that softwood lumber is not a significant driver of housing prices and that Canadian producers, not U.S. consumers, bear the cost of duties.

- Market Realities: The actual impact of lumber prices on overall housing affordability is complex and influenced by various factors beyond just the cost of lumber.

To gain a deeper understanding of these market dynamics, it’s helpful to examine data on lumber production, consumption, and pricing in both countries.

| Factor | United States | Canada |

|---|---|---|

| Annual Softwood Lumber Production (billion board feet) | 35.2 | 28.7 |

| Domestic Consumption (billion board feet) | 47.5 | 8.3 |

| Export Volume (billion board feet) | 1.8 | 20.4 |

| Average Price per 1,000 Board Feet (USD) | $420 | $380 |

| Government Subsidies (% of production cost) | 1.5% | 4.2% |

| Tariffs on Imports (%) | 20.23% | 0% |

| Number of Jobs in the Lumber Industry | 360,000 | 210,000 |

| Impact on Housing Costs (estimated % increase) | 1.2% | N/A |

This comparative analysis highlights the significant differences in production, consumption, and export patterns between the two countries, underlining the complexity of the trade relationship.

Government Subsidies and Trade Practices

A key point of contention in the softwood lumber dispute is the role of government subsidies in the Canadian lumber industry. U.S. producers argue that these subsidies create an unfair advantage for Canadian companies.

- Provincial Subsidies: Canadian provinces provide various forms of support to their lumber industries, including favorable stumpage rates for harvesting timber on public lands.

- Federal Support: The Canadian federal government has also implemented measures to support its lumber industry, particularly in response to U.S. trade actions.

- U.S. Perspective: American producers view these subsidies as a violation of fair trade practices and a threat to the competitiveness of U.S. lumber companies.

The issue of subsidies is closely tied to accusations of dumping, where Canadian producers are alleged to sell lumber in the U.S. market at prices below the cost of production.

Impact on Forestry-Dependent Communities

The softwood lumber trade dispute has significant implications for communities that rely on the forestry industry for their economic well-being. Both Canadian and U.S. communities are affected by the ongoing trade tensions.

- U.S. Communities: Many rural areas in the United States depend on lumber production for jobs and economic stability. The influx of Canadian lumber is seen as a threat to these communities.

- Canadian Regions: Provinces like British Columbia, with a strong forestry sector, are particularly vulnerable to changes in trade policies and market access.

- Economic Ripple Effects: The dispute affects not only direct lumber industry jobs but also related sectors such as transportation, equipment manufacturing, and retail.

“The softwood lumber trade between Canada and the U.S. impacts over 360,000 American forestry-dependent jobs annually.”

Understanding the human impact of trade policies is crucial for policymakers on both sides of the border as they navigate this complex issue.

International Timber Trade Policies

The Canadian-U.S. softwood lumber dispute is part of a broader context of international timber trade policies. These policies shape the global market for lumber and influence national strategies for forest management and trade.

- Global Demand: Increasing global demand for timber products puts pressure on forestry resources worldwide.

- Sustainability Concerns: International agreements and regulations aim to promote sustainable forestry practices and combat illegal logging.

- Trade Agreements: Bilateral and multilateral trade agreements play a crucial role in shaping the rules of international timber trade.

Understanding these broader international dynamics is essential for comprehending the full scope of the softwood lumber trade issue.

The Role of Technology in Lumber Production and Trade

As we examine the softwood lumber trade, it’s important to consider the role of technology in shaping production capabilities and market dynamics. Advanced technologies are transforming various aspects of the lumber industry, from forestry management to supply chain logistics.

In this context, companies like Farmonaut are making significant contributions to the agricultural and forestry sectors. While not directly involved in lumber production, Farmonaut’s satellite-based farm management solutions offer valuable insights that can benefit related industries.

- Satellite Monitoring: Farmonaut’s technology can be adapted for monitoring forest health and assessing timber resources, potentially improving sustainability in lumber production.

- Resource Management: The company’s AI-driven advisory systems could be applied to optimize resource allocation in forestry operations.

- Supply Chain Transparency: Farmonaut’s blockchain-based traceability solutions could enhance transparency in the lumber supply chain, addressing concerns about the origin and legality of timber products.

For more information on how satellite technology can be applied in resource management, visit Farmonaut’s large-scale management solutions.

Market Dynamics and Production Capacity

The softwood lumber market is characterized by fluctuating supply and demand dynamics, influenced by factors such as construction activity, economic conditions, and trade policies. Understanding these dynamics is crucial for both producers and policymakers.

- Production Capacity: Canada’s increased lumber production capacity has been a significant factor in the trade dispute.

- Market Demand: Fluctuations in housing starts and renovation activity in the U.S. directly impact demand for softwood lumber.

- Global Competition: Both U.S. and Canadian producers face competition from other lumber-exporting countries, adding another layer of complexity to the market.

These market forces play a crucial role in shaping the strategies of lumber producers and the policy responses of governments on both sides of the border.

Environmental Considerations in Lumber Production

The environmental impact of lumber production is an increasingly important consideration in the softwood lumber trade debate. Sustainable forestry practices and carbon footprint concerns are influencing both production methods and trade policies.

- Sustainable Forestry: Both U.S. and Canadian producers are under pressure to demonstrate sustainable harvesting practices.

- Carbon Sequestration: Forests play a crucial role in carbon sequestration, making the management of lumber resources a key factor in climate change mitigation efforts.

- Certification Programs: Various certification schemes aim to ensure that lumber comes from sustainably managed forests, potentially influencing market access and consumer preferences.

For businesses in the lumber industry looking to monitor and reduce their environmental impact, tools like Farmonaut’s carbon footprinting solution can provide valuable insights and help in achieving sustainability goals.

The Future of Softwood Lumber Trade

As we look to the future of the softwood lumber trade between Canada and the United States, several factors will likely shape the industry’s trajectory:

- Technological Advancements: Innovations in lumber production and forestry management could alter the competitive landscape.

- Climate Change: Shifting environmental conditions may impact timber growth rates and harvesting patterns in both countries.

- Policy Evolution: Changes in trade policies, environmental regulations, and housing policies will continue to influence the softwood lumber market.

- Alternative Materials: The development of alternative building materials could affect demand for traditional lumber products.

Stakeholders on both sides of the border will need to adapt to these evolving conditions to ensure the long-term sustainability and competitiveness of their lumber industries.

Conclusion

The Canadian softwood lumber trade and its impact on the U.S. market and housing affordability is a multifaceted issue with no easy solutions. It involves complex interplay between trade laws, market dynamics, environmental concerns, and the economic well-being of forestry-dependent communities on both sides of the border.

As the debate continues, it’s clear that finding a balanced approach that addresses the concerns of both U.S. and Canadian stakeholders while ensuring a stable and sustainable lumber market will be crucial. This may require ongoing negotiations, policy adjustments, and a willingness to embrace innovative solutions in forestry management and trade practices.

The softwood lumber dispute serves as a reminder of the intricate connections between international trade, domestic industries, and broader economic and environmental considerations. As we move forward, it will be essential for policymakers, industry leaders, and other stakeholders to work collaboratively towards solutions that promote fair competition, sustainable practices, and economic stability in the North American lumber market.

FAQ Section

- What is the main issue in the Canadian-U.S. softwood lumber trade dispute?

The main issue is the allegation that Canadian lumber producers benefit from unfair government subsidies and engage in dumping practices, which negatively impacts the U.S. lumber industry. - How do antidumping and countervailing duties work in this context?

These duties are imposed by the U.S. on Canadian lumber imports to offset the perceived advantages gained through subsidies and below-cost selling practices. - What is the impact of this trade dispute on housing affordability in the U.S.?

The impact is debated, with some arguing that trade restrictions increase lumber prices and housing costs, while others contend that lumber prices are not a significant factor in overall housing affordability. - How does this trade issue affect forestry-dependent communities?

Communities on both sides of the border are affected, with U.S. communities concerned about job losses due to Canadian imports, and Canadian communities worried about the impact of trade restrictions on their local economies. - What role do government subsidies play in this dispute?

U.S. producers argue that Canadian government subsidies, particularly at the provincial level, create an unfair advantage for Canadian lumber companies in the market.

For more information on how technology is transforming agriculture and related industries, explore Farmonaut’s innovative solutions.

Earn With Farmonaut: Join Farmonaut’s affiliate program and earn a 20% recurring commission by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income! Learn more