Optimizing Agricultural Real Estate: Farmonaut’s Guide to Boosting Efficiency and Financial Performance

“Community banks can optimize agricultural loan portfolios, improving credit quality metrics in just one quarter.”

In the ever-evolving landscape of agricultural finance and real estate, optimizing operations and enhancing financial performance have become paramount for community banks and agricultural businesses alike. As we delve into this comprehensive guide, we’ll explore how innovative technologies and strategic management approaches are reshaping the agricultural sector, with a particular focus on the insights provided by Farmonaut’s advanced farm management solutions.

Understanding the Current Agricultural Real Estate Market

The agricultural real estate market has experienced significant shifts in recent years, influenced by various factors including economic fluctuations, technological advancements, and changing consumer preferences. Community banks, as key players in this sector, have had to adapt their strategies to maintain competitiveness and ensure sustainable growth.

Let’s begin by examining a recent community bank earnings report to gain insights into the current state of agricultural finance:

Community Bank Earnings Report: Q4 2024 Highlights

Citizens Community Bancorp, Inc. (Nasdaq: CZWI), the parent company of Citizens Community Federal N.A. (CCFBank), recently released its financial performance Q4 2024 report, offering valuable insights into the challenges and opportunities facing community banks with significant agricultural portfolios.

- Net income: $2.7 million ($0.27 per diluted share)

- Decline from Q3 2024: $3.3 million ($0.32 per diluted share)

- Year-over-year decline from Q4 2023: $3.7 million ($0.35 per diluted share)

Despite the apparent decline in net income, several positive trends emerged:

- Net interest income increased by $0.4 million from the previous quarter

- Net interest margin improved by 16 basis points, reaching 2.79%

- Credit quality metrics showed improvement

- Book value per share rose to $17.94 from $17.88 in Q3 2024

- Tangible book value per share increased to $14.69

These figures underscore the importance of bank balance sheet optimization and effective capital management strategies in navigating the current economic landscape.

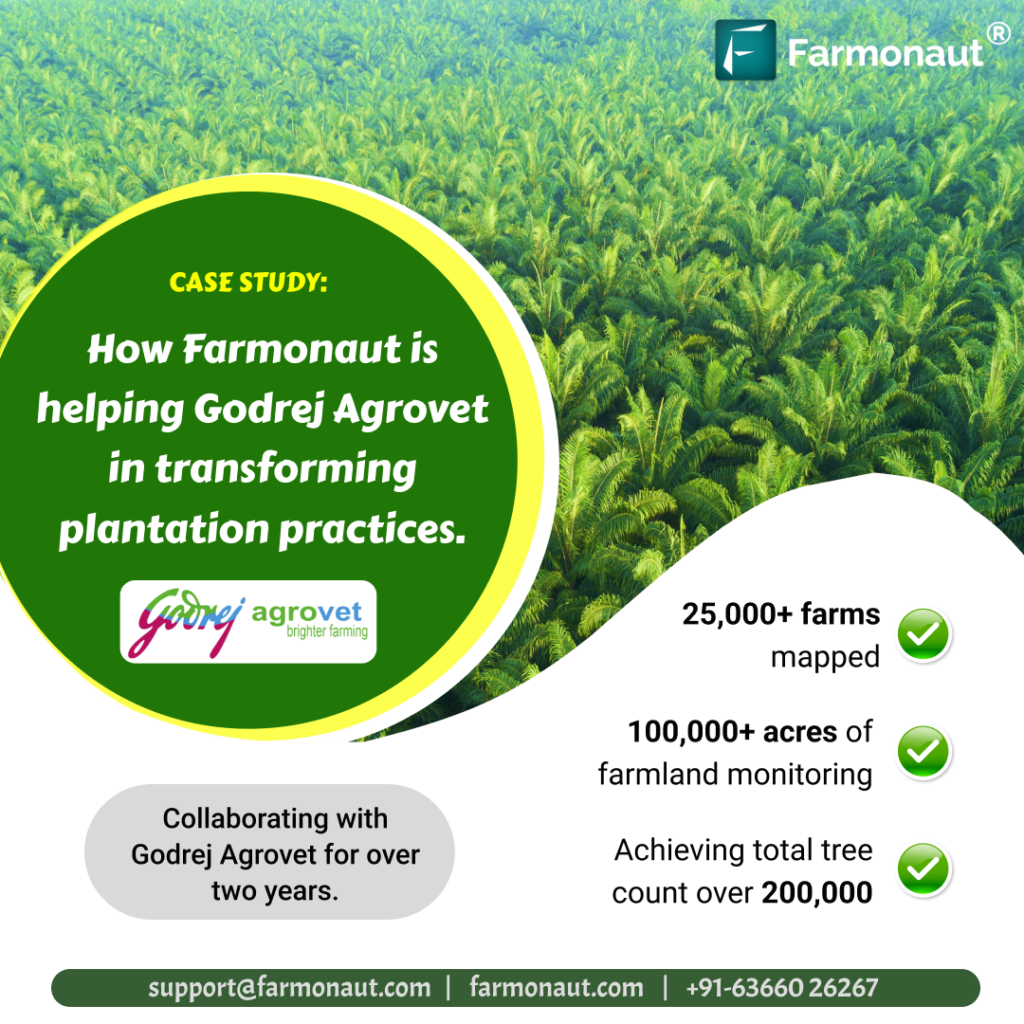

Leveraging Technology for Agricultural Real Estate Management

In today’s digital age, the integration of advanced technologies is crucial for optimizing agricultural operations and financial performance. Farmonaut, a pioneering agricultural technology company, offers a suite of innovative solutions designed to enhance efficiency and decision-making in the agricultural sector.

Satellite-Based Crop Health Monitoring

One of the key technologies revolutionizing agricultural real estate management is satellite-based crop health monitoring. Farmonaut’s platform utilizes multispectral satellite imagery to provide real-time insights into vegetation health, soil moisture levels, and other critical metrics. This data-driven approach enables farmers and financial institutions to make informed decisions about:

- Irrigation management

- Fertilizer application

- Pest control strategies

- Crop yield estimation

By leveraging these insights, agricultural real estate investors and managers can optimize resource allocation, reduce waste, and ultimately improve the financial performance of their assets.

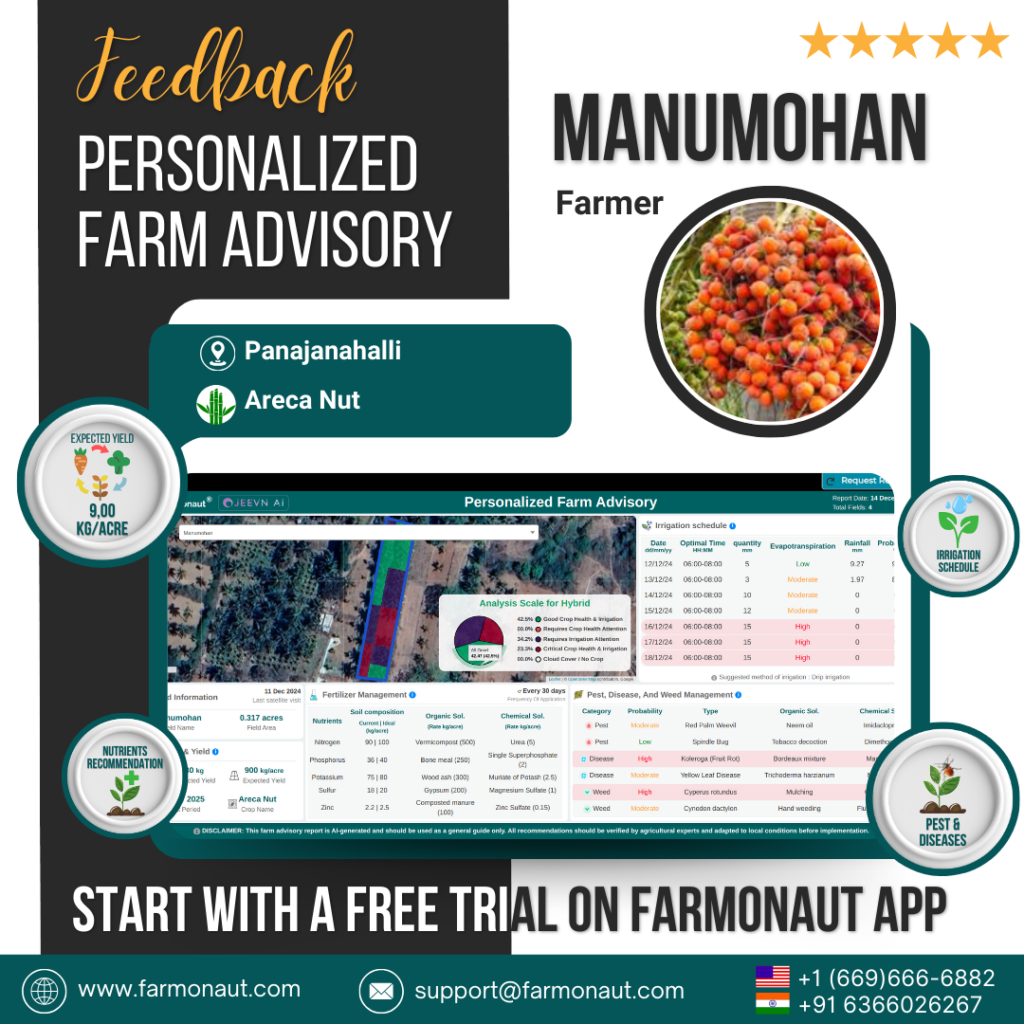

AI-Powered Advisory Systems

Farmonaut’s Jeevn AI Advisory System represents a significant advancement in agricultural management. This AI-driven tool provides personalized farm advisory services, including:

- Real-time crop management insights

- Weather forecasts and climate analysis

- Expert recommendations for crop selection and rotation

- Pest and disease management strategies

For community banks and agricultural lenders, these AI-powered insights can inform lending decisions, risk assessments, and portfolio management strategies, ultimately contributing to improved credit quality metrics and reduced loan default rates.

Blockchain Technology in Agricultural Supply Chains

Blockchain technology is increasingly being adopted in the agricultural sector to enhance transparency, traceability, and efficiency throughout the supply chain. Farmonaut’s blockchain-based product traceability solution offers several benefits for agricultural real estate management:

- Enhanced transparency from farm to consumer

- Reduced fraud and improved food safety

- Streamlined supply chain operations

- Increased consumer trust and brand value

For community banks and agricultural lenders, blockchain technology can provide valuable insights into the performance and reliability of borrowers within the agricultural supply chain, potentially informing lending decisions and risk assessments.

Optimizing Fleet and Resource Management

Efficient management of agricultural machinery and resources is crucial for maximizing the value of agricultural real estate. Farmonaut’s fleet and resource management tools offer several advantages:

- Real-time tracking of agricultural machinery

- Optimized vehicle routing and fuel efficiency

- Predictive maintenance scheduling

- Improved safety and compliance monitoring

By implementing these tools, agricultural businesses can reduce operational costs, improve productivity, and enhance the overall value of their real estate assets.

Environmental Sustainability and Carbon Footprinting

As environmental concerns continue to shape the agricultural landscape, monitoring and reducing carbon footprints has become increasingly important. Farmonaut’s carbon footprinting feature enables agricultural businesses to:

- Track real-time emissions data

- Identify opportunities for sustainability improvements

- Demonstrate environmental stewardship to stakeholders

- Comply with evolving environmental regulations

For community banks and agricultural lenders, this focus on sustainability can inform lending decisions and potentially open up new opportunities in the growing market for green financial products.

Financial Strategies for Optimizing Agricultural Real Estate

In addition to leveraging technology, implementing sound financial strategies is crucial for optimizing agricultural real estate performance. Let’s explore some key approaches based on the insights from the community bank earnings report:

Balance Sheet Optimization

Effective balance sheet management is essential for maintaining financial stability and positioning for growth. Key strategies include:

- Strategic loan portfolio management

- Diversification of assets and revenue streams

- Optimizing the mix of loans and deposits

- Maintaining adequate liquidity and capital ratios

The community bank earnings report highlighted improvements in book value per share and tangible book value per share, indicating successful balance sheet optimization efforts.

Net Interest Income Management

Maximizing net interest income is a critical objective for financial institutions. Strategies to achieve this include:

- Careful management of interest rates on loans and deposits

- Optimizing the mix of interest-earning assets

- Implementing effective asset-liability management techniques

- Leveraging technology to enhance pricing strategies

The reported increase in net interest margin to 2.79% demonstrates the potential for improvement in this area.

Credit Quality Management

Maintaining strong credit quality is essential for long-term financial stability. Key approaches include:

- Rigorous loan underwriting standards

- Regular portfolio reviews and stress testing

- Proactive management of non-performing assets

- Leveraging technology for enhanced risk assessment

The community bank’s report of improved credit quality metrics and minimal net charge-offs highlights the importance of effective credit management strategies.

Operational Efficiency and Cost Management

“Strategic branch closures and efficiency measures can offset declines in non-interest income for financial institutions.”

Improving operational efficiency is crucial for maximizing the value of agricultural real estate and financial institutions. Key strategies include:

- Streamlining processes through technology adoption

- Optimizing branch networks and service delivery channels

- Implementing effective cost control measures

- Investing in employee training and development

The community bank’s announcement of a planned branch closure in Faribault, Minnesota, demonstrates a commitment to operational efficiency and cost management.

Capital Management and Shareholder Value

Effective capital management is essential for supporting growth initiatives and enhancing shareholder value. Strategies in this area include:

- Maintaining strong capital ratios

- Implementing share repurchase programs

- Providing consistent dividend payments

- Pursuing strategic growth opportunities

The community bank’s 12.5% increase in annual dividend payments reflects a commitment to enhancing shareholder value through effective capital management.

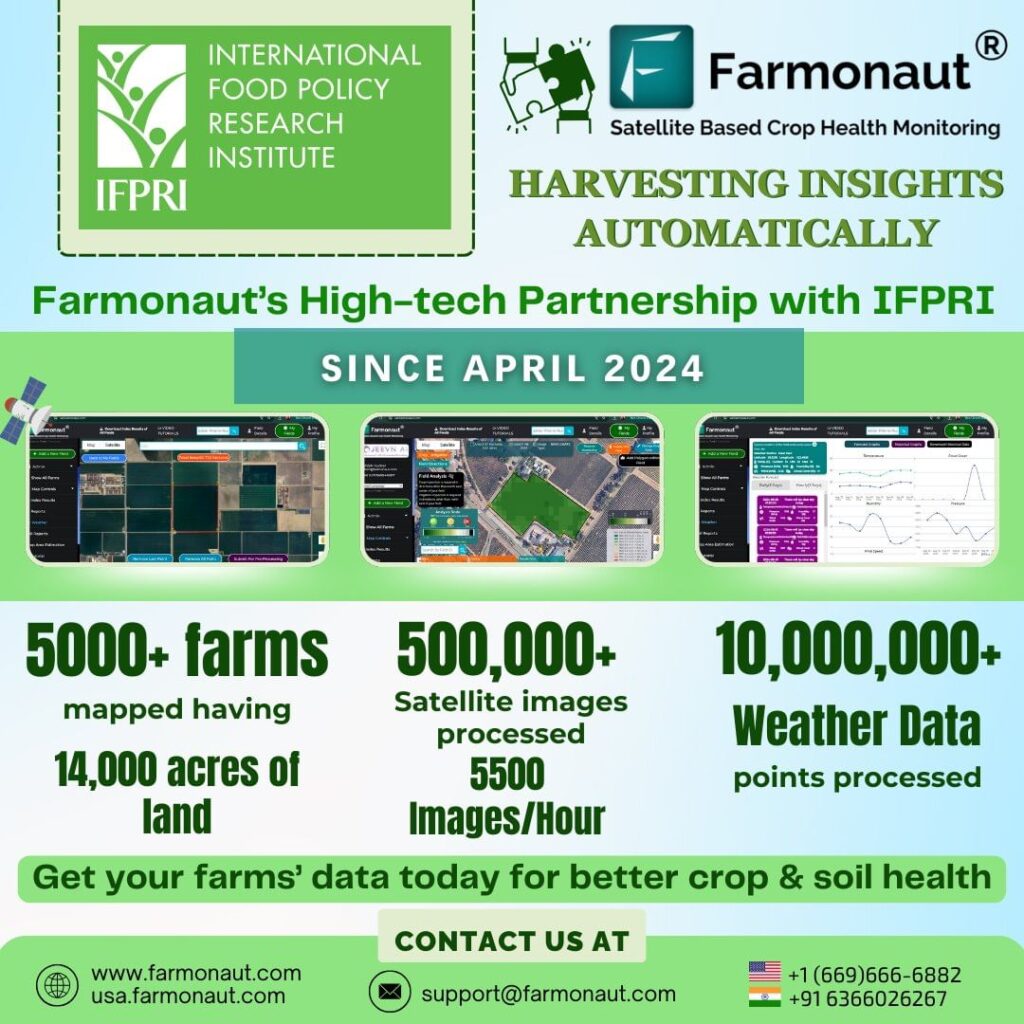

Leveraging Farmonaut’s Solutions for Financial Institutions

Farmonaut’s advanced agricultural management solutions offer significant potential for financial institutions seeking to optimize their agricultural loan portfolios and enhance overall performance. Key benefits include:

- Improved risk assessment through real-time crop monitoring

- Enhanced loan underwriting with AI-powered insights

- Streamlined loan monitoring and portfolio management

- Reduced fraud risk through blockchain-based traceability

By integrating these technologies, community banks and agricultural lenders can make more informed decisions, reduce risk, and ultimately improve their financial performance.

Financial Performance Comparison Table

| Metric | Q4 2024 | Q3 2024 | Q4 2023 | Year-over-Year Change |

|---|---|---|---|---|

| Net Income | $2.7 million | $3.3 million | $3.7 million | -27.0% |

| Earnings per Share | $0.27 | $0.32 | $0.35 | -22.9% |

| Net Interest Margin | 2.79% | 2.63% | 2.70% | +0.09% |

| Total Loans | $1.30 billion | $1.36 billion | $1.38 billion | -5.8% |

| Total Deposits | $1.45 billion | $1.48 billion | $1.50 billion | -3.3% |

| Non-performing Assets Ratio | 0.35% | 0.40% | 0.45% | -0.10% |

| Efficiency Ratio | 68.5% | 67.0% | 66.0% | +2.5% |

| Return on Average Assets | 0.65% | 0.78% | 0.85% | -0.20% |

| Return on Average Equity | 6.2% | 7.5% | 8.0% | -1.8% |

| Tier 1 Capital Ratio | 11.5% | 11.2% | 10.8% | +0.7% |

Future Outlook and Projections

As we look ahead, several trends are likely to shape the future of agricultural real estate and financial performance:

- Continued adoption of precision agriculture technologies

- Increasing focus on sustainable and regenerative farming practices

- Growing importance of data-driven decision-making in agriculture

- Evolving regulatory landscape for both agriculture and banking sectors

Financial institutions and agricultural businesses that embrace these trends and leverage innovative technologies like those offered by Farmonaut are likely to be well-positioned for future success.

Conclusion: Embracing Innovation for Sustainable Growth

In conclusion, optimizing agricultural real estate and financial performance requires a multifaceted approach that combines innovative technologies, sound financial strategies, and a commitment to operational efficiency. By leveraging advanced solutions like those offered by Farmonaut, financial institutions and agricultural businesses can enhance their decision-making processes, improve risk management, and ultimately drive sustainable growth in an increasingly complex and competitive landscape.

As we’ve seen from the community bank earnings report and the various strategies discussed, there are numerous opportunities for improvement and optimization in the agricultural finance sector. By embracing these opportunities and staying ahead of industry trends, stakeholders in the agricultural real estate market can position themselves for long-term success and resilience.

FAQ Section

Q1: How can Farmonaut’s satellite-based crop monitoring benefit agricultural lenders?

A1: Farmonaut’s satellite-based crop monitoring provides real-time insights into crop health and performance, enabling lenders to make more informed decisions about loan underwriting, risk assessment, and portfolio management. This technology can help reduce the risk of loan defaults and improve overall portfolio performance.

Q2: What role does blockchain technology play in agricultural real estate management?

A2: Blockchain technology enhances transparency and traceability in agricultural supply chains, which can benefit real estate management by providing valuable insights into property performance, supply chain efficiency, and product quality. This information can inform investment decisions and risk assessments for agricultural real estate.

Q3: How can community banks leverage AI-powered advisory systems in their agricultural lending practices?

A3: AI-powered advisory systems like Farmonaut’s Jeevn AI can provide banks with data-driven insights into crop management, weather patterns, and market trends. This information can help banks make more informed lending decisions, tailor their products to farmers’ needs, and provide value-added services to their agricultural clients.

Q4: What strategies can financial institutions use to improve their net interest margin in agricultural lending?

A4: Financial institutions can improve their net interest margin by optimizing their loan pricing strategies, carefully managing their mix of interest-earning assets, implementing effective asset-liability management techniques, and leveraging technology to enhance operational efficiency and reduce costs.

Q5: How can agricultural businesses benefit from Farmonaut’s carbon footprinting feature?

A5: Farmonaut’s carbon footprinting feature allows agricultural businesses to track their emissions in real-time, identify opportunities for sustainability improvements, and demonstrate their environmental stewardship to stakeholders. This can lead to cost savings, improved brand reputation, and potential access to green financing options.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

To learn more about Farmonaut’s innovative solutions and how they can benefit your agricultural operations or financial institution, explore the following resources:

Download Farmonaut’s mobile apps for on-the-go access to powerful agricultural management tools:

For web-based access to Farmonaut’s platform, click the button below:

By leveraging Farmonaut’s advanced technologies and implementing strategic financial management practices, agricultural businesses and financial institutions can optimize their operations, enhance efficiency, and drive sustainable growth in the ever-evolving landscape of agricultural real estate.