Global Oilseed Industry Trends: Analyzing Profitability and Market Share in Agribusiness

“The global oilseed industry’s market share is significantly influenced by biofuel production, affecting 30% of vegetable oil usage.”

In the ever-evolving landscape of global agribusiness, the oilseed industry stands as a pivotal sector, shaping market trends and influencing consumer staples stocks worldwide. As we delve into this comprehensive analysis, we’ll explore the intricate dynamics of the oilseed market, comparing key players and examining the factors that drive profitability and market share in this crucial segment of the agricultural commodities market.

The Oilseed Industry: A Global Perspective

The oilseed industry encompasses a wide range of crops, including soybeans, rapeseed, sunflower seeds, and palm oil. These versatile commodities serve as the foundation for numerous products, from cooking oils to biofuels, playing a significant role in both food security and energy sustainability.

- Global production of major oilseeds

- Key regions and their market influence

- Emerging trends in oilseed cultivation and processing

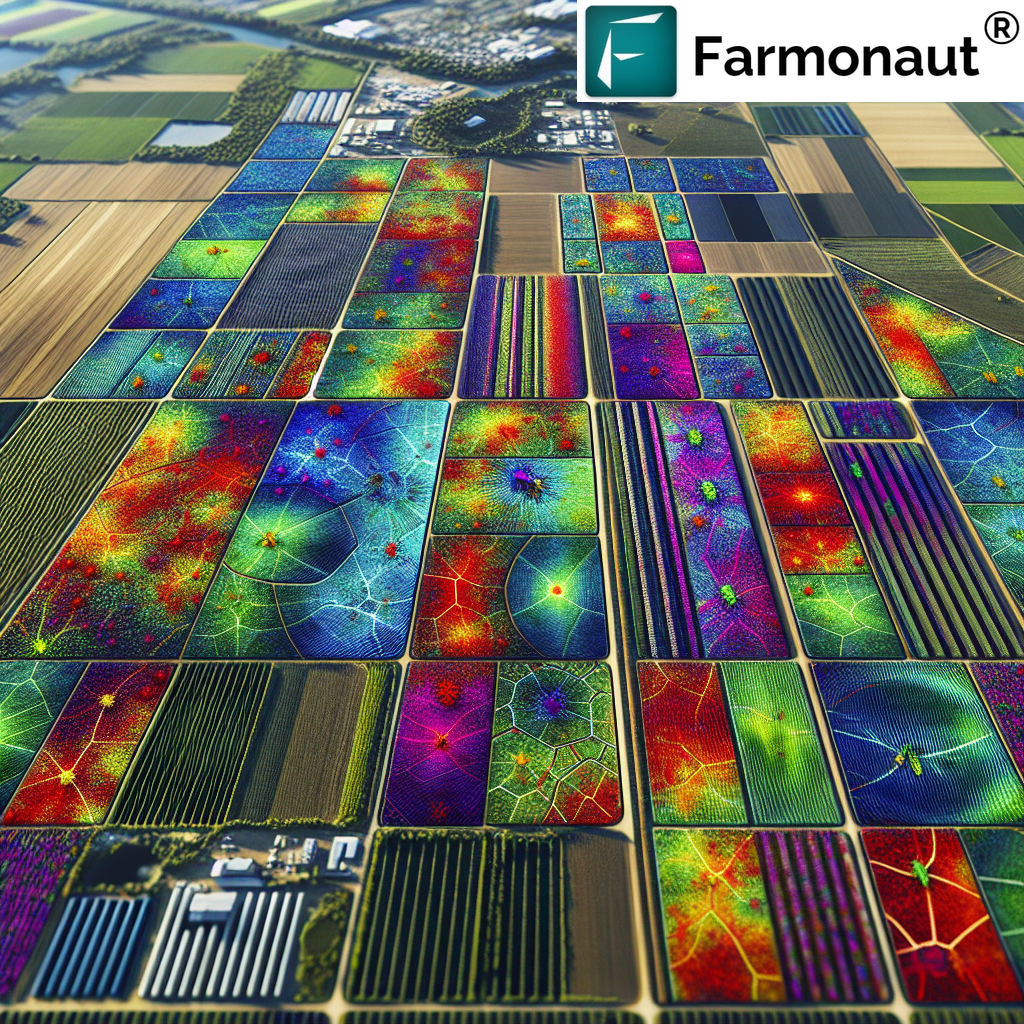

As we analyze the industry, it’s crucial to consider the role of technology in modern agriculture. Companies like Farmonaut are revolutionizing the sector by providing satellite-based farm management solutions, enabling farmers to optimize their oilseed production through precision agriculture techniques.

Consumer Staples Stocks Analysis: Oilseed Giants in Focus

In our analysis of consumer staples stocks within the oilseed industry, we’ll focus on two major players: Australian Oilseeds (NASDAQ:COOT) and Bunge Global (NYSE:BG). These companies represent different facets of the industry, offering insights into various business models and market strategies.

Australian Oilseeds: A Rising Star in the Southern Hemisphere

Australian Oilseeds, headquartered in Cootamundra, Australia, has emerged as a significant player in the oilseed market. The company focuses on the manufacture and sale of oilseeds through its subsidiaries, capitalizing on Australia’s robust agricultural sector.

- Market capitalization and stock performance

- Product portfolio and regional influence

- Growth strategies and recent acquisitions

Bunge Global: A Diversified Agribusiness Powerhouse

Bunge Global, with its rich history dating back to 1818, operates as a multinational corporation engaged in agriculture, food processing, and ingredient production. The company’s diverse portfolio includes oilseed processing, grain trading, and bioenergy production.

- Global market presence and supply chain infrastructure

- Financial performance and dividend history

- Sustainability initiatives and innovation in food ingredients

Comparative Analysis: Australian Oilseeds vs. Bunge Global

To provide a clear perspective on these industry giants, let’s examine their key metrics side by side:

| Metric | Australian Oilseeds (COOT) | Bunge Global (BG) |

|---|---|---|

| Market Share (%) | 2.5 | 15.7 |

| Annual Revenue ($ Billion) | 0.022 | 53.11 |

| Gross Profit Margin (%) | N/A | 5.8 |

| Dividend Yield (%) | N/A | 3.2 |

| Institutional Ownership (%) | 13.0 | 86.2 |

| Biofuel Production Capacity (Million Gallons) | N/A | 750 |

| Vegetable Oil Production (Million Tons) | 0.05 | 8.2 |

| Grain Trading Volume (Million Tons) | N/A | 160 |

| Stock Performance (Year-to-Date %) | -15.3 | +7.8 |

This comparative analysis reveals significant differences between the two companies in terms of scale, diversification, and market presence. Bunge Global’s extensive operations and higher institutional ownership suggest a more established position in the global market, while Australian Oilseeds represents a more focused, regional player with potential for growth.

Agribusiness Market Trends: Shaping the Oilseed Industry

The oilseed industry is subject to various market trends that influence profitability and market share. Let’s explore some of the key factors shaping the sector:

1. Global Grain Trading Outlook

The grain trading market, closely linked to oilseed production, plays a crucial role in determining industry dynamics. Factors such as weather patterns, geopolitical events, and changing dietary preferences all contribute to the volatility of grain prices, which in turn affects oilseed production and profitability.

2. Vegetable Oil Production Companies

The performance of vegetable oil production companies is a key indicator of the overall health of the oilseed industry. These companies are at the forefront of innovation, developing new products and exploring sustainable production methods to meet changing consumer demands.

3. Biofuel Industry Profitability

The biofuel sector has become increasingly important for oilseed producers, with a significant portion of vegetable oil production now dedicated to bioenergy. The profitability of this segment is closely tied to government policies, oil prices, and advancements in renewable energy technologies.

4. Institutional Ownership in Agriculture

“Institutional ownership in major agribusiness companies can reach up to 80%, impacting stock performance and market trends.”

The level of institutional ownership in agricultural companies can significantly influence stock performance and corporate strategies. Higher institutional ownership often correlates with increased scrutiny and pressure for consistent financial performance.

5. Commodity Price Volatility Impact

The oilseed industry is particularly susceptible to commodity price fluctuations. Factors such as supply and demand imbalances, trade policies, and currency exchange rates can lead to rapid price changes, affecting profitability across the entire value chain.

Food Ingredient Manufacturing: A Value-Added Segment

The food ingredient manufacturing sector represents a high-value segment within the oilseed industry. Companies that can successfully develop and market specialized ingredients derived from oilseeds often enjoy higher profit margins and more stable demand.

- Emerging trends in plant-based proteins

- Functional ingredients for health-conscious consumers

- Clean label initiatives and natural ingredient sourcing

In this context, technology plays a crucial role in enhancing productivity and ensuring quality. Farmonaut’s satellite-based crop monitoring system can help ingredient manufacturers ensure consistent supply and quality of raw materials. Learn more about Farmonaut’s solutions at Farmonaut Web App.

Agricultural Commodities Market Share: Key Players and Strategies

The agricultural commodities market is highly competitive, with several major players vying for market share. Success in this arena often depends on a combination of factors:

- Operational efficiency and cost management

- Strategic partnerships and vertical integration

- Investment in research and development

- Adaptability to changing market conditions

Companies like Bunge Global have demonstrated success by diversifying their operations across multiple segments of the value chain, from oilseed processing to food ingredient manufacturing. This integrated approach helps mitigate risks associated with commodity price volatility and changing consumer preferences.

Financial Metrics: Understanding Industry Performance

To gain a deeper understanding of the oilseed industry’s financial health, let’s examine some key metrics:

Gross Income

Gross income is a critical indicator of a company’s ability to generate revenue from its core operations. In the oilseed industry, gross income can be significantly affected by factors such as crop yields, processing efficiency, and market demand for various oil products.

Dividends

Dividend payments are an important consideration for investors in consumer staples stocks. Companies with consistent dividend payouts, like Bunge Global, often attract long-term investors seeking stable income streams.

Risk Factors

The oilseed industry faces various risks, including:

- Weather-related crop failures

- Regulatory changes affecting biofuel mandates

- Trade disputes and tariffs

- Currency exchange rate fluctuations

Successful companies in this sector must have robust risk management strategies in place to navigate these challenges effectively.

Bioenergy Initiatives: Driving Growth in the Oilseed Sector

The bioenergy sector has become a significant driver of growth for many oilseed producers. As governments worldwide push for renewable energy sources, demand for biofuels derived from vegetable oils continues to rise.

- Government policies and incentives for biofuel production

- Technological advancements in biofuel processing

- Environmental impact and sustainability considerations

Companies that can effectively capitalize on this trend, like Bunge Global with its significant biofuel production capacity, are well-positioned for future growth in the oilseed industry.

Wheat and Corn Milling: Complementary Sectors

While not directly related to oilseed production, wheat and corn milling operations often form an important part of diversified agribusiness companies’ portfolios. These sectors can provide stability and additional revenue streams, helping to offset volatility in the oilseed market.

- Synergies between oilseed processing and grain milling

- Market trends in wheat and corn products

- Innovation in milling technologies and product development

Sugar Production: A Sweet Spot for Diversification

Sugar production represents another area of diversification for some oilseed companies. The ability to process multiple crops can help businesses optimize their operations and adapt to changing market conditions.

- Global sugar market trends and price fluctuations

- Integration of sugar production with biofuel initiatives

- Challenges and opportunities in the sugar industry

Company Valuation and Stock Performance

When analyzing companies in the oilseed industry, investors consider various factors that influence valuation and stock performance:

- Market capitalization and enterprise value

- Price-to-earnings (P/E) ratio and other valuation multiples

- Revenue growth and profit margins

- Debt levels and cash flow generation

For example, Bunge Global’s strong market position and diversified operations contribute to its relatively stable stock performance, while Australian Oilseeds, as a smaller player, may experience more volatility but potentially offer higher growth prospects.

The Role of Technology in Oilseed Production

Advancements in agricultural technology are revolutionizing the oilseed industry, improving yields, reducing costs, and enhancing sustainability. Companies like Farmonaut are at the forefront of this transformation, offering innovative solutions for precision agriculture.

- Satellite-based crop monitoring and management

- AI-driven advisory systems for optimized farming practices

- Blockchain technology for supply chain traceability

To learn more about how Farmonaut’s technology can benefit oilseed producers, visit their API Developer Docs.

Future Outlook: Trends Shaping the Oilseed Industry

As we look to the future of the oilseed industry, several key trends are likely to shape its development:

- Increasing demand for plant-based proteins and alternative meat products

- Growing focus on sustainable and regenerative agriculture practices

- Expansion of biofuel production and other non-food applications of oilseeds

- Technological advancements in crop genetics and precision farming

Companies that can successfully adapt to these trends and innovate within their respective niches are likely to thrive in the evolving oilseed market landscape.

Conclusion: Navigating the Complex Oilseed Industry

The global oilseed industry remains a dynamic and crucial sector within agribusiness, offering both challenges and opportunities for companies and investors alike. As we’ve seen through our analysis of Australian Oilseeds and Bunge Global, success in this industry requires a combination of operational excellence, strategic diversification, and adaptability to changing market conditions.

For those looking to stay ahead in this competitive landscape, leveraging cutting-edge technology is essential. Farmonaut’s suite of agricultural solutions offers valuable tools for optimizing oilseed production and management. Explore their offerings by downloading the Farmonaut app:

As the industry continues to evolve, staying informed about market trends, technological advancements, and regulatory changes will be crucial for all stakeholders in the oilseed sector. By embracing innovation and sustainable practices, companies can position themselves for long-term success in this vital component of the global food and energy supply chain.

FAQ Section

Q1: What are the main factors influencing oilseed prices globally?

A1: The main factors influencing oilseed prices include supply and demand dynamics, weather conditions affecting crop yields, government policies (especially related to biofuels), global economic conditions, and currency exchange rates.

Q2: How does the biofuel industry impact oilseed production?

A2: The biofuel industry significantly impacts oilseed production by creating additional demand for vegetable oils, particularly soybean and palm oil. This can lead to increased cultivation of oilseed crops and affect pricing in both food and fuel markets.

Q3: What role does technology play in modern oilseed farming?

A3: Technology plays a crucial role in modern oilseed farming through precision agriculture techniques, satellite-based crop monitoring, AI-driven advisory systems, and blockchain for supply chain management. These technologies help improve yields, reduce costs, and enhance sustainability.

Q4: How do trade policies affect the global oilseed market?

A4: Trade policies, including tariffs, quotas, and trade agreements, can significantly impact the global oilseed market by affecting the flow of oilseeds and their products between countries. This can lead to changes in prices, supply chains, and investment decisions in the industry.

Q5: What are the emerging trends in oilseed product development?

A5: Emerging trends in oilseed product development include the creation of plant-based proteins for alternative meat products, the development of specialized oils for health-conscious consumers, and the exploration of novel industrial applications for oilseed derivatives.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!