Revolutionizing Agricultural Risk Management: Farmonaut’s Guide to Daily Options Trading in Global Grain Markets

“Weekly agricultural options trading volumes have shown remarkable growth, particularly in soybean, corn, and soybean oil futures.”

In the ever-evolving landscape of agricultural markets, we at Farmonaut are witnessing a paradigm shift in how stakeholders manage risk and capitalize on market opportunities. The recent expansion of daily options trading in global grain markets marks a significant milestone in the agricultural derivatives marketplace, offering unprecedented flexibility and precision for traders, farmers, and investors alike.

As we delve into this revolutionary development, it’s crucial to understand how these changes in agricultural options trading and grain futures markets are reshaping the industry. Our comprehensive guide will explore the intricacies of daily options trading, its impact on managing agricultural price risk, and how Farmonaut’s cutting-edge technology complements these financial innovations.

The Evolution of Agricultural Options Trading

The agricultural derivatives marketplace has come a long way since its inception. Traditionally, options trading in grains and oilseeds was limited to monthly or quarterly expirations. However, the introduction of weekly commodity options marked a significant step towards more granular risk management. Now, with the advent of daily options, we’re witnessing a new era of commodity market flexibility.

The Rise of Weekly and Daily Options

- Increased demand for short-term risk management tools

- Growing popularity of weekly options in soybean, corn, and soybean oil futures

- Introduction of daily expiry options to enhance precision

The surge in popularity of weekly agricultural options set the stage for this latest innovation. In 2024, we saw the average daily volume (ADV) of these options reach an impressive 18,964 contracts, marking a 72% increase from the previous year. This growth was particularly notable in:

- Soybean Oil options: 220% increase

- Soybean options: 109% increase

- Corn options: 63% increase

Building on this success, the introduction of daily options expands the toolkit available to market participants, allowing for even more precise agricultural risk management strategies.

Understanding Daily Options in Agricultural Markets

Daily options in agricultural markets represent a significant leap forward in derivatives marketplace trends. These financial instruments provide market participants with the ability to trade options that expire on each business day of the trading week. This innovation is particularly relevant for grains and oilseed futures options, including corn, soybeans, wheat, soybean oil, and soybean meal.

Key Features of Daily Agricultural Options

- Expiration on each business day (Monday through Thursday)

- Aligned with Chicago Board of Trade (CBOT) rules

- Enhanced flexibility for short-term market perspectives

- Improved precision in risk management

The introduction of daily options is a response to the growing demand for more granular risk management tools in the agricultural sector. As global markets face increasing volatility and economic uncertainties, these options provide a valuable means for stakeholders to navigate complex market conditions with greater agility.

The Impact on Agricultural Risk Management

The advent of daily options trading in global grain markets has profound implications for agricultural risk management. These new financial instruments offer several key advantages:

- Enhanced precision in hedging strategies

- Improved alignment with market events and reports

- Greater flexibility in managing short-term price risks

- Increased efficiency in expressing market views

For farmers, traders, and agribusinesses, the ability to fine-tune risk management strategies on a daily basis can lead to more effective protection against adverse price movements and better capitalization on market opportunities.

Aligning Options with Market Events

One of the most significant advantages of daily options is the ability to align option expirations with crucial market events. This includes:

- WASDE (World Agricultural Supply and Demand Estimates) reports

- Weekend weather forecasts that could impact crop conditions

- Geopolitical events affecting agricultural markets

By having options that expire on specific days, market participants can more accurately manage their risk exposure around these events, potentially leading to more informed decision-making and improved outcomes.

Comparing Traditional, Weekly, and Daily Options

To better understand the evolution of agricultural options trading, let’s compare the key features and benefits of traditional, weekly, and daily options:

| Feature | Traditional Options | Weekly Options | Daily Options |

|---|---|---|---|

| Expiration Frequency | Monthly or quarterly | Weekly | Daily (Monday-Thursday) |

| Risk Management Precision | Limited | Improved | Highly precise |

| Market Event Alignment | Challenging | Better | Optimal |

| Flexibility for Traders | Basic | Enhanced | Maximum |

| Trading Volume Growth | Steady | Soybean: 109% Corn: 63% Soybean Oil: 220% |

Projected to increase |

This comparison clearly illustrates the progression towards more flexible and precise risk management tools in the agricultural derivatives marketplace.

Farmonaut’s Role in Complementing Agricultural Risk Management

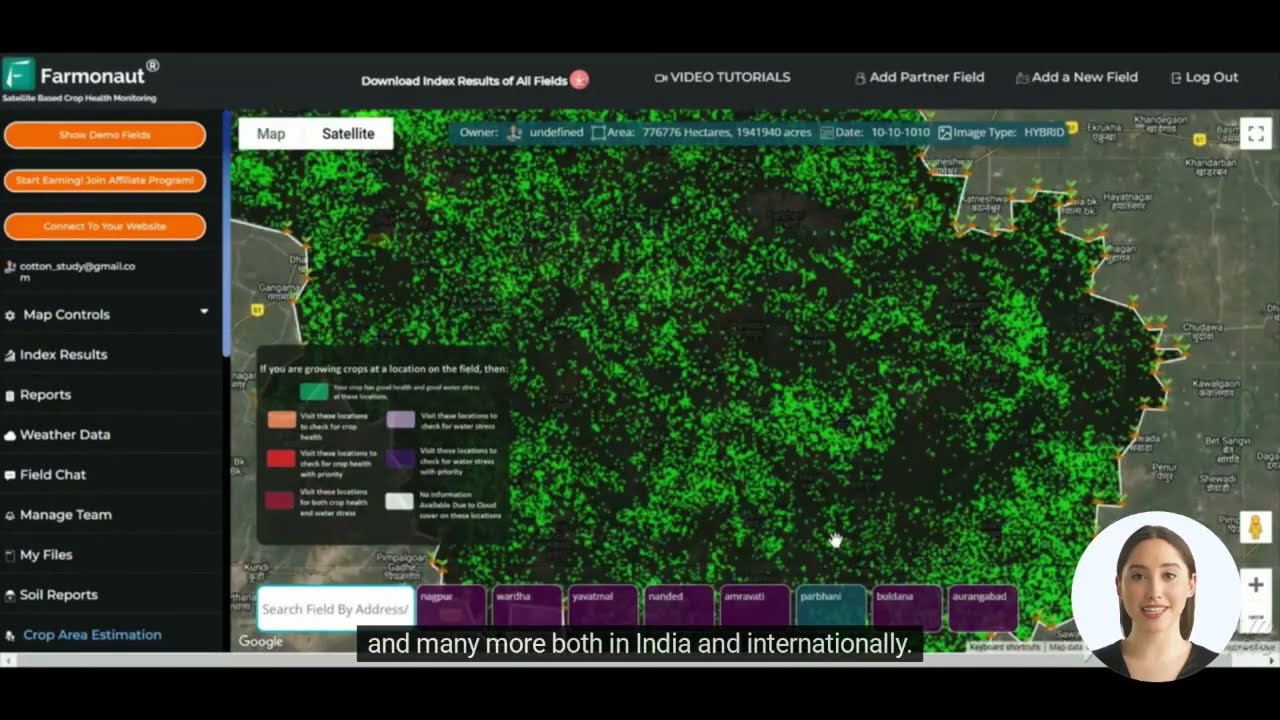

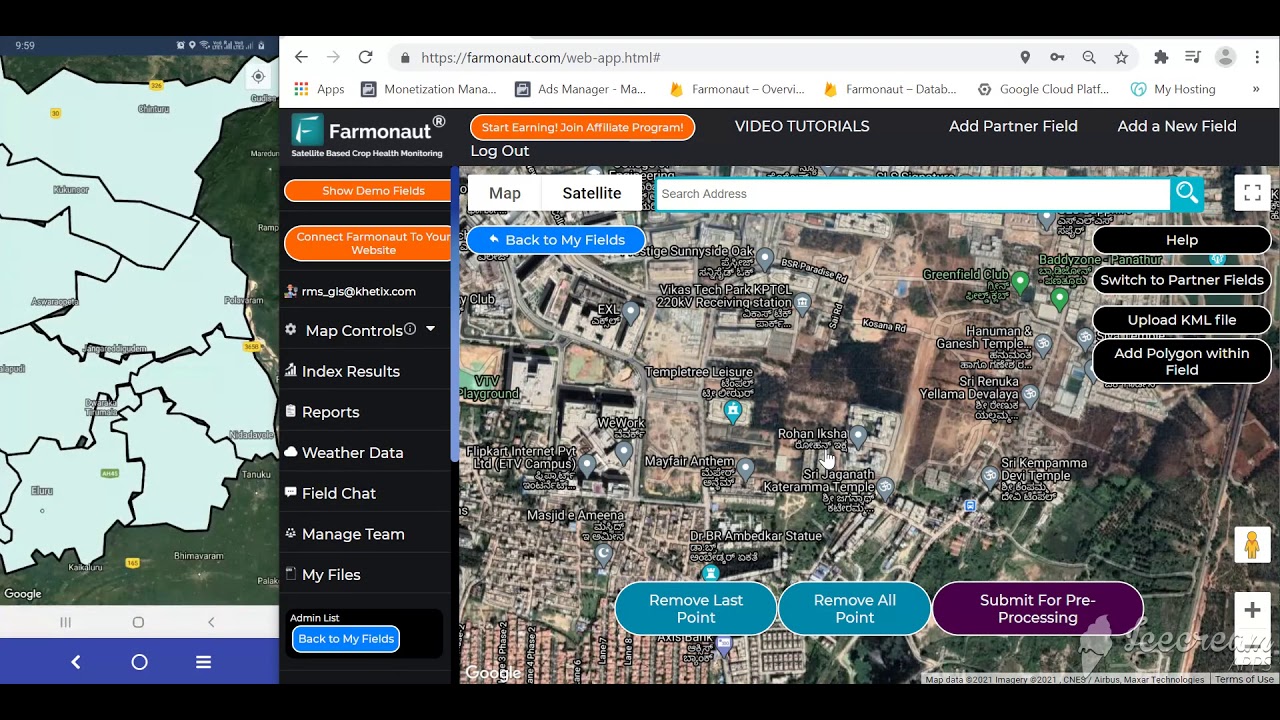

At Farmonaut, we recognize the importance of integrating financial risk management with on-the-ground agricultural insights. Our advanced satellite-based farm management solutions provide valuable data that can inform trading decisions and risk management strategies.

Key Farmonaut Features Supporting Risk Management

- Real-time crop health monitoring

- AI-based advisory systems

- Blockchain-based traceability

- Resource management tools

By leveraging Farmonaut’s technology, agricultural stakeholders can make more informed decisions about when and how to utilize daily options for risk management. Our satellite imagery and AI-driven insights provide a comprehensive view of crop conditions, helping traders and farmers align their options strategies with actual field conditions.

Explore our solutions:

Strategies for Implementing Daily Options in Agricultural Trading

Implementing daily options in agricultural trading requires a strategic approach. Here are some key strategies to consider:

- Short-term hedging: Use daily options to protect against price fluctuations over very short periods, such as during critical market reports or events.

- Event-driven trading: Align option expirations with significant agricultural reports or weather forecasts to capitalize on potential market movements.

- Precision risk management: Fine-tune hedging strategies by selecting options with expirations that closely match exposure periods.

- Volatility plays: Utilize daily options to take advantage of short-term spikes in market volatility.

- Cost management: Potentially reduce option premiums by choosing shorter-dated contracts that align more closely with specific risk periods.

These strategies can be particularly effective when combined with real-time agricultural data and insights, such as those provided by Farmonaut’s satellite-based monitoring systems.

The Global Impact of Daily Options on Grain Markets

“A leading derivatives marketplace now offers daily expiry options throughout the trading week for grains and oilseed futures.”

The introduction of daily options in global grain markets has far-reaching implications for the agricultural sector worldwide. This innovation affects various aspects of the industry:

- International trade: Enhanced risk management tools can facilitate smoother international grain trade by allowing for more precise hedging of currency and price risks.

- Market liquidity: Daily options may contribute to increased market liquidity, potentially leading to tighter bid-ask spreads and more efficient price discovery.

- Price stability: More granular risk management tools could help reduce extreme price volatility in global grain markets.

- Farmer empowerment: Small and medium-sized farmers gain access to sophisticated risk management tools, potentially leveling the playing field with larger agricultural enterprises.

As these daily options gain traction, we anticipate seeing a more dynamic and responsive global grain market, benefiting stakeholders across the agricultural value chain.

Integrating Farmonaut’s Technology with Daily Options Trading

At Farmonaut, we believe that the combination of our advanced agricultural technology with the precision of daily options trading creates a powerful synergy for market participants. Here’s how our platform can enhance your trading and risk management strategies:

- Real-time crop monitoring: Our satellite-based crop health monitoring provides up-to-date information on crop conditions, which can inform daily options trading decisions.

- AI-driven insights: Our Jeevn AI advisory system offers personalized recommendations that can help traders and farmers align their options strategies with on-the-ground realities.

- Weather forecasting: Accurate weather predictions from our platform can help users anticipate potential market movements and adjust their options positions accordingly.

- Yield prediction: Our advanced yield prediction models can provide valuable insights for longer-term options strategies in grain markets.

By leveraging Farmonaut’s technology, traders and farmers can make more informed decisions about when to enter or exit daily options positions, potentially improving their risk management outcomes.

Explore our API for custom integrations: Farmonaut API

Learn more about our API capabilities: API Developer Docs

The Future of Agricultural Risk Management

As we look to the future, the combination of daily options trading and advanced agricultural technology promises to revolutionize risk management in the sector. We anticipate several key trends:

- Increased adoption of precision agriculture: As farmers become more familiar with data-driven decision-making, the demand for precise financial instruments like daily options is likely to grow.

- Integration of AI and machine learning: Advanced algorithms may help traders and farmers optimize their use of daily options based on real-time agricultural and market data.

- Blockchain in agricultural trading: The use of blockchain technology could further enhance transparency and efficiency in both physical grain trading and options markets.

- Customized risk management solutions: We may see the development of even more tailored options products designed to meet the specific needs of different agricultural stakeholders.

At Farmonaut, we’re committed to staying at the forefront of these developments, continually enhancing our platform to provide the most valuable insights for agricultural risk management.

Conclusion: Embracing the New Era of Agricultural Risk Management

The introduction of daily options trading in global grain markets marks a significant milestone in the evolution of agricultural risk management. This innovation, coupled with advanced technologies like those offered by Farmonaut, provides unprecedented opportunities for precision and flexibility in managing agricultural price risk.

As we navigate this new landscape, it’s crucial for all stakeholders – from individual farmers to large agribusinesses – to understand and leverage these tools effectively. By combining financial innovation with data-driven insights, we can create a more resilient and efficient agricultural sector capable of meeting the challenges of the 21st century.

At Farmonaut, we’re excited to be part of this transformation, providing the technology and insights that complement and enhance these new financial tools. Together, we can build a future where agricultural risk management is more precise, more responsive, and more effective than ever before.

Farmonaut Subscriptions

Frequently Asked Questions (FAQ)

- What are daily options in agricultural markets?

Daily options are financial instruments that expire on each business day of the trading week, offering more precise risk management for agricultural commodities like grains and oilseeds. - How do daily options differ from traditional and weekly options?

Daily options provide more frequent expiration dates compared to traditional monthly or quarterly options, and even more granularity than weekly options, allowing for more precise risk management. - What are the benefits of using daily options for agricultural risk management?

Daily options offer enhanced flexibility, better alignment with market events, more precise hedging capabilities, and improved efficiency in expressing short-term market views. - How can Farmonaut’s technology complement daily options trading?

Farmonaut’s satellite-based crop monitoring and AI-driven insights provide real-time agricultural data that can inform trading decisions and risk management strategies using daily options. - Are daily options suitable for all agricultural market participants?

While daily options offer benefits for many market participants, their suitability depends on individual risk management needs, trading strategies, and market understanding. It’s advisable to consult with financial advisors before implementing new trading strategies.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!