California’s Economic Uncertainty: How Tariffs Impact Agriculture, Trade, and Jobs in the Golden State

In recent months, we’ve witnessed a seismic shift in the economic landscape of California, the Golden State that has long been a powerhouse of innovation, agriculture, and international trade. As new tariffs threaten to reshape the global economic order, California finds itself at the epicenter of a potential economic storm. In this comprehensive analysis, we’ll delve into the far-reaching implications of these trade policies on various sectors of the California economy, from the bustling ports of Los Angeles and Long Beach to the fertile fields of the Central Valley.

“California’s ports handle over $600 billion in annual trade, making the state vulnerable to tariff impacts.”

The Tariff Landscape: A New Economic Reality

The White House’s recent imposition of a 10 percent baseline tariff on all imports, with higher rates on countries running trade surpluses, has sent shockwaves through the global economy. With China facing a 34 percent tariff, the European Union 20 percent, South Korea 25 percent, Japan 24 percent, and Taiwan 32 percent, the implications for California’s economy are profound. While Mexico and Canada remain exempt from these new tariffs, they still face a previous 25 percent levy.

As we analyze the potential impact of these tariffs, it’s crucial to understand the scale of California’s economic might. With a gross state product (GSP) of about $4.103 trillion in 2024, California boasts the largest state economy in the United States and the fifth-largest economy in the world. The state’s role in international trade is equally impressive, with more than $675 billion in two-way trade, making it the largest importer and second-largest exporter among U.S. states.

Market Turmoil and Recession Fears

The announcement of new tariffs immediately triggered market volatility, with Wall Street experiencing its worst day since the height of the COVID-19 pandemic in 2020. The S&P 500 slipped 0.2 percent, while the Dow Jones Industrial Average dropped 349 points, or 0.9 percent. These market reactions reflect growing concerns about the potential for a broader economic downturn.

Economists and financial experts are sounding the alarm about the increased risk of recession. Goldman Sachs has raised its forecast for a 2025 recession to 35 percent, up from 20 percent, marking its highest estimate since the regional banking crisis two years ago. Former Federal Reserve Governor Frederic Mishkin warned of the high likelihood of a recession if the tariffs lead to a full-blown trade war, potentially resulting in stagflation – a combination of slow economic growth, high unemployment, and accelerating inflation.

California’s Vulnerable Sectors

The impact of these tariffs is expected to be particularly pronounced in California, given its diverse and interconnected economy. Let’s examine some of the key sectors at risk:

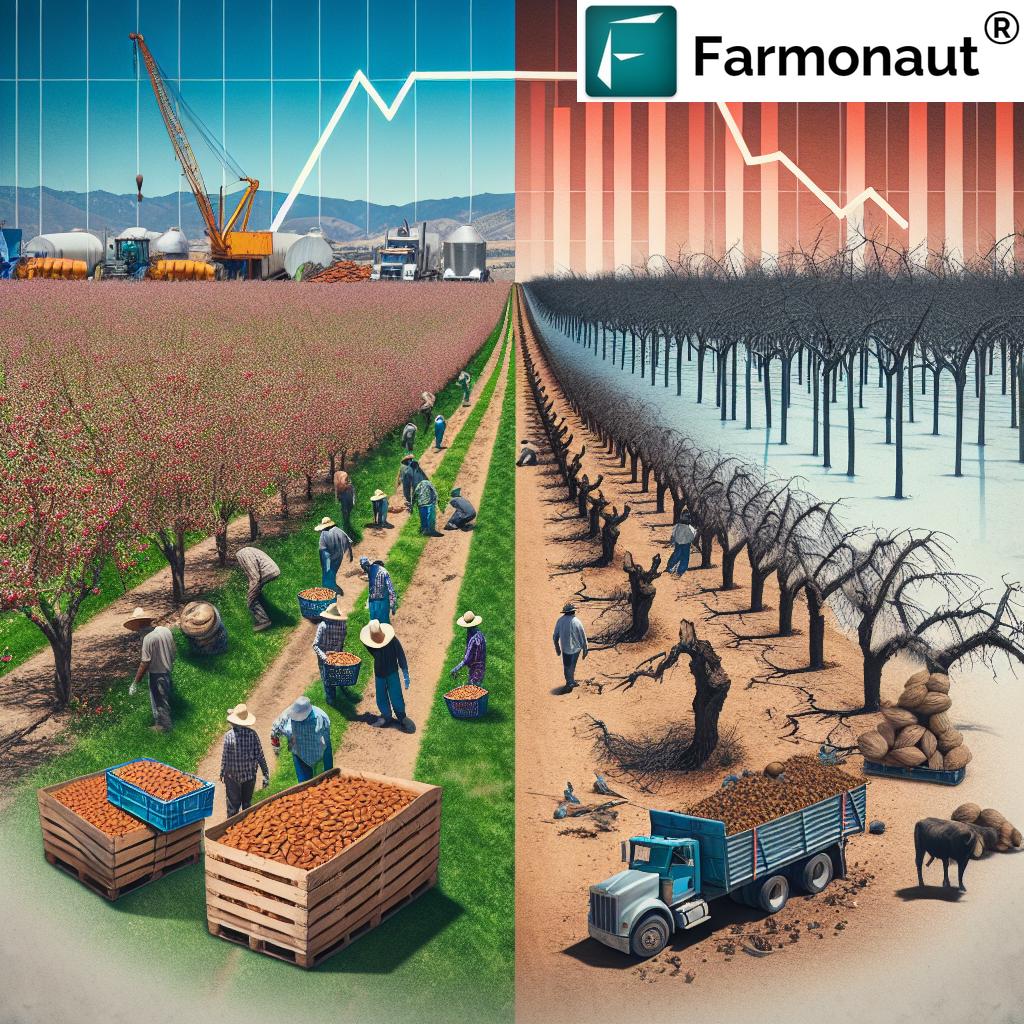

Agriculture: The Golden State’s Green Gold

California’s agricultural sector, a cornerstone of the state’s economy, faces significant challenges from the new tariff regime. The almond industry, which contributes $4.7 billion in exports and supports 110,000 jobs, could suffer losses of up to $875 million due to retaliatory tariffs from China, India, and the EU, according to a UC Davis study.

For farmers grappling with these challenges, innovative solutions like those offered by Farmonaut’s crop plantation and forest advisory services could prove invaluable. These satellite-based farm management tools provide real-time crop health monitoring and AI-driven insights, helping farmers optimize their operations in the face of economic uncertainty.

“The Golden State produces 80% of the world’s almonds, a crop potentially affected by new trade policies.”

Manufacturing: The Industrial Backbone

California’s manufacturing sector, centered in Los Angeles and employing more than 313,000 people, is particularly vulnerable to the new tariffs. The state exported nearly $160 billion in manufactured goods last year, led by electronics, machinery, and chemicals – all of which could be hit by retaliatory tariffs. State officials are concerned that tariffs on cross-border goods could increase prices for finished products, potentially leading to job losses and reduced economic activity.

Ports and Logistics: The Gateway to Global Trade

The bustling ports of Los Angeles and Long Beach, which handle a significant portion of U.S. trade with Asia, could see reduced activity as a result of the tariffs. This potential slowdown could have ripple effects throughout the supply chain, particularly in California’s Inland Empire, where many logistics and warehousing operations are based.

To help businesses navigate these challenges, Farmonaut’s fleet management solutions offer tools for optimizing logistics operations, potentially helping companies reduce costs and improve efficiency in the face of trade-related disruptions.

Job Market Implications

The uncertainty surrounding the tariffs has already begun to impact California’s job market. A recent report from the state Employment Development Department (EDD) showed that California lost an estimated 7,500 jobs in February, with losses in eight of California’s 11 industry sectors. The biggest decline occurred in Professional & Business Services, particularly in Computer Systems Design and Related Services.

Michael Bernick, an employment attorney and former director of the state EDD, attributes these job losses primarily to the uncertainty over Trump’s tariffs. UCLA urban planning professor Chris Tilly notes that California warehouses have seen significant job losses, partly due to overcapacity but also as a result of the tariffs.

State-Level Response and Mitigation Strategies

In response to the looming economic challenges, California Governor Gavin Newsom has taken proactive steps to shield the state’s economy. His administration is exploring new opportunities to expand trade with countries that have announced retaliatory tariffs against the U.S., urging them to exclude California-made products from those taxes.

While California cannot be directly targeted in international trade retaliation, as it’s not a sovereign nation, there’s hope that foreign governments may avoid penalizing the state’s key exports like wine or walnuts. Instead, they may focus on products from pro-Trump states, such as soybeans or pork, according to UC Davis agricultural economist Daniel Sumner.

Sector-Specific Impacts and Challenges

Let’s take a closer look at how specific industries within California are likely to be affected by the new tariff regime:

Wine Industry

California’s renowned wine industry faces a double threat from the tariffs. Not only could retaliatory measures from the EU impact exports, but the cost of imported materials such as corks, glass, and capsules could also rise, potentially squeezing profit margins for wineries.

Technology Sector

Silicon Valley, the heartbeat of California’s tech industry, could face challenges from tariffs on electronic components and potential retaliation from China. This could lead to increased costs for hardware production and potentially slow innovation in the sector.

Automotive Industry

California’s automotive sector, including electric vehicle manufacturers, may face higher costs for imported parts and materials. This could potentially slow the state’s push towards cleaner transportation technologies.

The Role of Technology in Mitigating Economic Challenges

As California grapples with these economic uncertainties, technology and innovation may offer some solutions. For instance, precision agriculture technologies like those offered by Farmonaut could help farmers optimize their operations and reduce costs in the face of potential market disruptions.

Farmonaut’s carbon footprinting tools could also prove valuable for businesses looking to improve their sustainability practices and potentially access new markets or funding opportunities tied to environmental performance.

Looking Ahead: California’s Economic Outlook

While the immediate impact of the tariffs has been concerning, California’s economic future remains uncertain. The state’s diverse economy and history of innovation may provide some resilience, but much will depend on how long the tariffs remain in place and whether they escalate into a full-scale trade war.

Steve Levy, director of the Center for Continuing Study of the California Economy, cautions that more challenges lie ahead, with tariffs, restrictions on immigration, and rising inflation on the horizon. However, California’s track record of adapting to economic challenges and its strong position in key industries like technology and agriculture may help it weather the storm.

Comparative Impact on Key Industries

| Industry | Economic Contribution (Estimated) | Potential Tariff Impact | Job Loss Risk |

|---|---|---|---|

| Agriculture (Almonds) | $4.7 billion in exports | High | 10,000 – 20,000 |

| Agriculture (Wine) | $1.5 billion in exports | Medium | 5,000 – 10,000 |

| Technology | $500 billion to GDP | Medium | 20,000 – 50,000 |

| Manufacturing | $300 billion in output | High | 30,000 – 60,000 |

| Logistics | $200 billion to GDP | High | 15,000 – 30,000 |

Conclusion: Navigating Uncertain Waters

As California faces this period of economic uncertainty, it’s clear that the impacts of the new tariff regime will be far-reaching and complex. From the agricultural heartlands of the Central Valley to the tech hubs of Silicon Valley, businesses and workers across the state will need to adapt to this new economic reality.

While the challenges are significant, California’s history of resilience and innovation suggests that the state may find ways to navigate these turbulent economic waters. By leveraging technology, diversifying trade relationships, and continuing to invest in key industries, California may be able to mitigate some of the negative impacts of the tariffs and emerge stronger on the other side of this economic uncertainty.

For businesses and individuals looking to weather this economic storm, tools like those offered by Farmonaut could prove invaluable. From precision agriculture solutions to supply chain traceability, these technologies can help stakeholders across various industries optimize their operations and adapt to changing market conditions.

FAQ Section

- How will the new tariffs affect California’s agricultural exports?

The tariffs could significantly impact California’s agricultural exports, particularly products like almonds and wine. Retaliatory tariffs from major markets like China and the EU could lead to reduced demand and lower prices for California’s farmers. - What sectors of California’s economy are most vulnerable to the tariffs?

Agriculture, manufacturing, and logistics are among the most vulnerable sectors. The tech industry may also face challenges due to potential disruptions in global supply chains. - How might the tariffs affect job markets in California?

The tariffs could lead to job losses across various sectors, particularly in manufacturing, logistics, and agriculture. Some estimates suggest tens of thousands of jobs could be at risk. - What steps is the California government taking to mitigate the impact of tariffs?

The state government is exploring new trade opportunities and urging foreign governments to exclude California-made products from retaliatory tariffs. They’re also looking into ways to support affected industries and workers. - How might technology help businesses adapt to the new economic realities?

Technologies like precision agriculture, supply chain optimization, and carbon footprinting tools can help businesses improve efficiency, reduce costs, and potentially access new markets or funding opportunities.

Earn With Farmonaut: Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Learn More About Earning With Farmonaut

Farmonaut Subscriptions

As California navigates these uncertain economic waters, tools and technologies that help businesses optimize their operations and adapt to changing market conditions will be crucial. Whether you’re a farmer looking to improve crop yields, a manufacturer seeking to streamline your supply chain, or a logistics company aiming to reduce your carbon footprint, Farmonaut offers solutions that can help you thrive in this challenging economic landscape.

Explore Farmonaut’s range of services:

- Farmonaut API for developers looking to integrate satellite and weather data into their applications

- API Developer Docs for comprehensive guidance on using Farmonaut’s API

Download the Farmonaut app to start optimizing your agricultural operations today:

Or access Farmonaut’s web application for a comprehensive farm management experience:

By leveraging these innovative tools and staying informed about the evolving economic landscape, California’s businesses and workers can position themselves to weather this period of uncertainty and emerge stronger on the other side.