Massachusetts Health Insurance Premiums Soar: Analyzing Rising Costs and Digital Solutions in 2024

“Massachusetts faces a 7.9% increase in average premium rates for individual and small group health insurance markets in 2024.”

In the ever-evolving landscape of healthcare, we find ourselves at a critical juncture where rising costs and technological advancements are reshaping the industry. As we delve into the complexities of Massachusetts health insurance premiums, we’ll explore the factors driving these increases and the digital solutions being implemented to address these challenges.

The Current State of Health Insurance in Massachusetts

Massachusetts has long been at the forefront of healthcare reform in the United States. However, recent developments have cast a shadow over the state’s healthcare system, particularly in terms of affordability. Let’s examine the current situation:

- Massachusetts now holds the dubious distinction of having the second-highest family health insurance rates in the country.

- A recent report from the Health Policy Commission highlights a staggering 7.9% increase in average premium rates for individual and small group markets in 2024.

- This follows a more modest increase of 3.2% in the previous year, indicating an accelerating trend in rising costs.

These statistics paint a concerning picture for the 648,253 consumers affected in the merged market, which includes qualified health plans for individuals and small employers. The rapid rise in premiums is putting significant financial strain on Massachusetts residents, prompting urgent action from state regulators and policymakers.

Breaking Down the Premium Increase

To understand the root causes of these soaring premiums, we need to dissect the components contributing to the overall increase:

- Medical costs: Up by 6.6%

- Pharmacy expenses: A significant rise of 11.8%

- Administrative costs: A slight uptick of 0.6%

These figures reveal that while administrative costs have remained relatively stable, the primary drivers of premium increases are medical and pharmacy expenses. This breakdown is crucial for policymakers and healthcare providers as they work to develop targeted solutions to curb rising costs.

The Role of Digital Healthcare Solutions

As the healthcare industry grapples with these challenges, digital solutions are emerging as a potential avenue for improving efficiency and reducing costs. Let’s explore some of the innovations being implemented:

- Mobile apps for health plan management

- Improved online access to healthcare services

- Artificial intelligence for streamlining operations

While these digital healthcare solutions offer promise in enhancing the consumer experience and potentially reducing long-term costs, it’s important to note that their implementation can initially contribute to increased administrative expenses.

The Regulatory Landscape

Massachusetts has stringent regulations in place to control healthcare costs:

- Insurers’ administrative costs are capped at 12% of total expenses.

- At least 88% of premium revenues must be allocated to healthcare services.

These regulations aim to ensure that the majority of premium dollars go directly toward patient care. However, as we’ve seen, they haven’t been sufficient to prevent the sharp rise in overall premiums.

The Debate: Health Plans vs. Hospitals

The ongoing hearings conducted by the Division of Insurance (DOI) have revealed a contentious dialogue between health plans and hospitals. Each side points to the other as the primary culprit for medical inflation:

- Health plans argue that rising hospital and medication prices are driving premium increases.

- Hospitals and healthcare providers highlight the administrative burdens and complexities they face when dealing with multiple health plans.

This debate underscores the need for a holistic approach to addressing rising healthcare costs, one that considers the perspectives and challenges of all stakeholders in the healthcare ecosystem.

“Massachusetts has the second-highest family health insurance rates in the United States, prompting state-level hearings on rising costs.”

The Impact of Prior Authorization Delays

One of the key issues highlighted during the DOI hearings is the impact of prior authorization delays on patient care and healthcare efficiency. Dr. Barbara Spivak, an internist at Beth Israel Lahey Health, provided a compelling example:

- A patient faced a three-week delay in obtaining prior authorization for a medication.

- This delay resulted in complications that necessitated an emergency room visit.

This case illustrates how administrative hurdles can lead to adverse patient outcomes and potentially increase overall healthcare costs. It’s a clear indication that streamlining these processes could have significant benefits for both patient care and cost reduction.

The Promise of Technology in Healthcare

While digital solutions are contributing to initial increases in administrative costs, they also hold the potential to significantly improve healthcare delivery and efficiency in the long term. Let’s explore some of the ways technology is being leveraged in the healthcare sector:

- Telemedicine platforms for remote consultations

- Electronic health records for improved care coordination

- Data analytics for predictive healthcare and personalized treatment plans

These technological advancements have the potential to reduce unnecessary hospital visits, improve patient outcomes, and ultimately lead to cost savings across the healthcare system.

The Role of Consumer Education

As healthcare becomes increasingly complex, consumer education plays a crucial role in helping individuals navigate their health insurance options and make informed decisions about their care. Health plans and providers are investing in:

- Improved online resources for plan comparison and selection

- Mobile apps that provide easy access to health information and services

- Educational programs to help consumers understand their benefits and make cost-effective healthcare choices

By empowering consumers with knowledge and tools, we can potentially reduce unnecessary healthcare utilization and help individuals make more cost-effective decisions about their care.

The Future of Healthcare in Massachusetts

As we look to the future, it’s clear that addressing the rising costs of health insurance premiums in Massachusetts will require a multifaceted approach. Some potential solutions being explored include:

- Value-based care models that incentivize quality over quantity

- Enhanced price transparency to help consumers make informed decisions

- Continued investment in preventive care to reduce long-term healthcare costs

- Streamlining administrative processes to reduce inefficiencies

The ongoing DOI hearings are expected to result in recommendations that could shape future policies aimed at curbing rising healthcare costs while maintaining high-quality care for Massachusetts residents.

The Importance of Data in Healthcare Decision-Making

In the digital age, data has become a crucial tool in healthcare decision-making. From policy formulation to individual treatment plans, the use of data analytics is transforming the healthcare landscape. Here’s how data is being leveraged:

- Population health management to identify and address health trends

- Predictive analytics to anticipate and prevent health issues

- Cost analysis to identify areas for potential savings in healthcare delivery

By harnessing the power of data, healthcare providers and policymakers can make more informed decisions that could lead to improved outcomes and potentially lower costs in the long run.

The Role of Pharmacies in Rising Healthcare Costs

With pharmacy expenses contributing significantly to the overall increase in healthcare costs, it’s essential to examine the role of pharmacies and pharmaceutical companies in this equation. Some factors to consider include:

- The high cost of specialty medications

- Complex supply chains that can drive up drug prices

- The impact of patent protection on drug pricing

Addressing these issues will require collaboration between policymakers, pharmaceutical companies, and healthcare providers to find solutions that balance innovation with affordability.

The Impact on Small Businesses and Individuals

While much of the discussion around rising healthcare costs focuses on large healthcare systems and insurers, it’s crucial to consider the impact on small businesses and individuals. These groups often bear the brunt of premium increases, facing difficult decisions about coverage and care. Some challenges they face include:

- Balancing the need for comprehensive coverage with affordability

- Navigating complex health insurance marketplaces

- Managing the financial burden of high deductibles and out-of-pocket costs

Addressing these challenges will be crucial in ensuring that healthcare remains accessible and affordable for all Massachusetts residents.

The Potential of Preventive Care

One area that holds significant promise in reducing long-term healthcare costs is preventive care. By focusing on preventing health issues before they arise or catching them early, we can potentially avoid more costly treatments down the line. Some key aspects of preventive care include:

- Regular health screenings and check-ups

- Lifestyle interventions to address risk factors like diet and exercise

- Vaccination programs to prevent communicable diseases

Investing in robust preventive care programs could lead to significant cost savings in the long term while improving overall population health.

The Role of Policy in Shaping Healthcare Costs

As we navigate the complex landscape of rising healthcare costs, it’s clear that policy will play a crucial role in shaping the future of healthcare in Massachusetts. Some potential policy interventions being discussed include:

- Price controls on certain medical procedures and medications

- Incentives for healthcare providers to adopt value-based care models

- Regulations to increase transparency in healthcare pricing

- Policies to promote competition in the healthcare market

The outcomes of the ongoing DOI hearings will likely inform many of these policy decisions, potentially setting the stage for significant changes in the Massachusetts healthcare system.

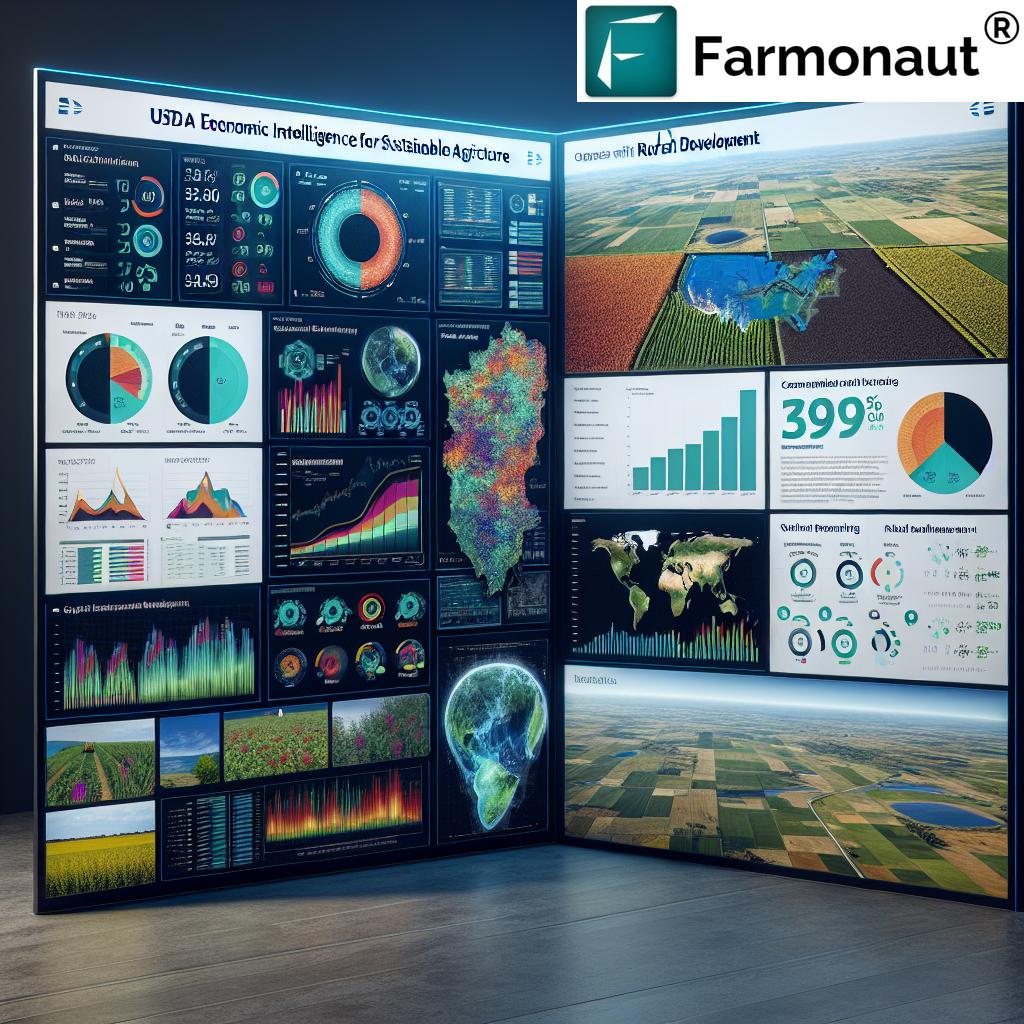

Massachusetts Health Insurance Premium Trends (2020-2024)

| Year | Average Individual Premium Rate ($) | Average Family Premium Rate ($) | Percentage Increase from Previous Year | National Ranking for Family Rates |

|---|---|---|---|---|

| 2020 | 5,700 | 18,500 | 3.0% | 3 |

| 2021 | 5,900 | 19,100 | 3.2% | 3 |

| 2022 | 6,100 | 19,800 | 3.7% | 2 |

| 2023 | 6,300 | 20,400 | 3.2% | 2 |

| 2024 | 6,800 | 22,000 | 7.9% | 2 |

FAQ Section

Q: Why are health insurance premiums rising so rapidly in Massachusetts?

A: The rapid rise in health insurance premiums in Massachusetts is due to a combination of factors, including increasing medical costs, rising pharmacy expenses, and investments in digital healthcare solutions. The state is grappling with the second-highest family health insurance rates in the country, prompting regulatory bodies to investigate and address these rising costs.

Q: What is being done to address the rising healthcare costs in Massachusetts?

A: The Division of Insurance (DOI) is conducting hearings to analyze the factors contributing to rising healthcare costs. These hearings aim to identify root causes and propose solutions to curb rising costs while improving care quality. Additionally, stakeholders are exploring digital healthcare solutions and streamlined administrative processes to enhance efficiency and potentially reduce long-term costs.

Q: How are digital healthcare solutions impacting insurance premiums?

A: Digital healthcare solutions, such as mobile apps and improved online access, are being implemented to enhance consumer experience and potentially reduce long-term costs. However, the initial implementation of these technologies can contribute to increased administrative expenses in the short term. The goal is for these digital solutions to ultimately lead to more efficient healthcare delivery and cost savings.

Q: What role do pharmacies play in the rising healthcare costs?

A: Pharmacy expenses are a significant contributor to rising healthcare costs, with an 11.8% increase noted in recent reports. Factors such as the high cost of specialty medications, complex supply chains, and patent protections on drugs all play a role in driving up pharmacy expenses, which in turn affects overall health insurance premiums.

Q: How can consumers manage the impact of rising health insurance premiums?

A: Consumers can manage the impact of rising premiums by:

- Educating themselves about their health insurance options

- Utilizing preventive care services to avoid more costly treatments later

- Taking advantage of digital tools provided by health plans to manage their care and costs

- Considering high-deductible health plans paired with health savings accounts (HSAs) for potential cost savings

Conclusion

As we navigate the complex landscape of rising healthcare costs in Massachusetts, it’s clear that there are no easy solutions. The interplay of medical inflation, technological advancements, and regulatory pressures creates a challenging environment for all stakeholders in the healthcare system.

However, the ongoing efforts to address these challenges – from regulatory hearings to investments in digital healthcare solutions – offer hope for a more sustainable and affordable healthcare future. By embracing innovation, fostering collaboration between all parties, and maintaining a focus on patient-centered care, Massachusetts has the potential to once again lead the way in healthcare reform.

As consumers, healthcare providers, and policymakers, we all have a role to play in shaping the future of healthcare in our state. By staying informed, engaged, and proactive, we can work together to create a healthcare system that is both high-quality and affordable for all Massachusetts residents.

The road ahead may be challenging, but with continued focus and innovation, we believe that Massachusetts can overcome these hurdles and set a new standard for healthcare excellence and affordability in the United States.

Excellent write-up! I’ve always enjoyed your articles. You’re a fantastic writer, always spot-on. This article was both enlightening and enjoyable to read.