Ohio Farmers Receive $58.4 Million Boost: Navigating Agricultural Uncertainty and Market Volatility

“Ohio farmers will receive a $58.4 million boost from a major agricultural lender to navigate market volatility and uncertainty.”

“Ohio farmers will receive a $58.4 million boost from a major agricultural lender to navigate market volatility and uncertainty.”

In the ever-changing landscape of agriculture, Ohio farmers are facing unprecedented challenges due to market volatility and economic uncertainty. However, a significant development has emerged that promises to alleviate some of the financial pressures on our rural communities. We are excited to share that Farm Credit Mid-America, a farmer-owned agricultural lending cooperative, has announced a substantial patronage distribution of $58.4 million to Ohio farmers.

This generous financial support comes at a crucial time when farm credit uncertainty and Ohio agriculture market volatility are at the forefront of concerns for our farming community. As we delve into the details of this distribution and its potential impact, we’ll explore how it reflects the ongoing commitment to sustaining rural agriculture and supporting the backbone of our food production system.

Understanding the Significance of the $58.4 Million Distribution

The announcement of this substantial patronage return underscores the vital role that farm credit institutions play in securing the future of rural communities and agriculture. Let’s break down the key aspects of this financial boost:

- Timing: The distribution comes at a critical juncture when farmers are preparing for spring planting and facing various economic pressures.

- Purpose: This financial injection aims to provide much-needed support for agricultural debt management and various operational costs.

- Flexibility: Farmers have the autonomy to utilize these funds for diverse needs, including spring planting input costs and farm equipment financing.

- Scale: The $58.4 million distribution reflects the substantial commitment of Farm Credit Mid-America to its members and the agricultural sector at large.

As we navigate through these uncertain times, it’s crucial to understand how this patronage distribution fits into the broader context of rural community lending and agricultural financial support.

The Role of Farm Credit Mid-America in Supporting Ohio Agriculture

Farm Credit Mid-America stands as a pillar of support for the agricultural community, serving more than 140,000 customers across the Midwest. With a robust portfolio of $39.5 billion in total earning assets owned and managed, this institution plays a crucial role in agricultural portfolio management and ensuring the financial health of farming operations.

Melanie Strait-Bok, senior vice president of agriculture lending for Ohio, emphasizes the organization’s commitment: “Farm Credit Mid-America exists to secure the future of rural communities and agriculture. We understand our customers are facing a lot of uncertainty, and while we can’t take that uncertainty away, returning a portion of net earnings back into their hands is a reminder of our commitment to stand beside them even in the most challenging times.”

This statement reflects the core philosophy behind the farm credit earnings distribution and highlights the importance of supporting farmers through both prosperous and difficult periods.

Navigating Market Volatility and Uncertainty

The agricultural sector is no stranger to volatility, but recent years have brought unprecedented challenges. Factors contributing to the current state of Ohio agriculture market volatility include:

- Global trade tensions and changing export markets

- Fluctuating commodity prices

- Extreme weather events impacting crop yields

- Evolving consumer preferences and dietary trends

- Technological disruptions in farming practices

In light of these challenges, the $58.4 million patronage distribution serves as a vital lifeline for many farmers. It provides a financial buffer that can help mitigate some of the risks associated with market fluctuations and uncertain economic conditions.

Leveraging Technology to Enhance Agricultural Resilience

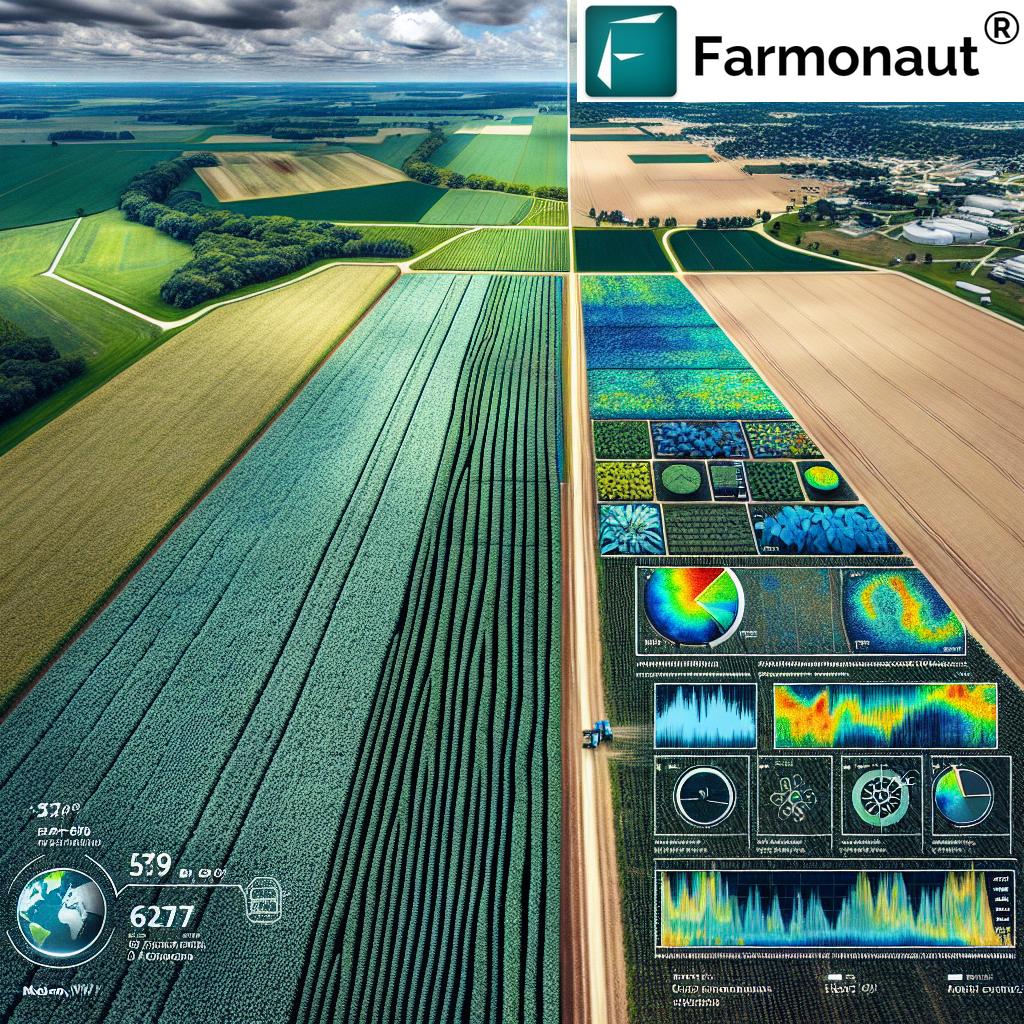

While financial support is crucial, leveraging technology can also play a significant role in helping farmers navigate uncertainty. Farmonaut, for instance, offers advanced satellite-based farm management solutions that can assist farmers in making data-driven decisions to optimize their operations.

Through its android, iOS, and web applications, Farmonaut provides tools for:

- Real-time crop health monitoring

- AI-based advisory systems

- Resource management

- Blockchain-based traceability

These technological advancements can complement financial support by helping farmers improve efficiency and reduce risks associated with farm credit uncertainty.

Allocation and Impact of the Patronage Distribution

To better understand how the $58.4 million will be utilized and its potential impact on Ohio’s agricultural landscape, let’s examine a breakdown of the distribution:

| Support Category | Estimated Allocation (in millions) | Percentage of Total Distribution | Potential Impact on Farmers |

|---|---|---|---|

| Spring Planting Inputs | $23.36 | 40% | Reduced upfront costs for seeds, fertilizers, and pesticides |

| Farm Equipment Financing | $14.60 | 25% | Improved access to modern machinery and technology |

| Debt Management | $11.68 | 20% | Lower interest payments and improved financial stability |

| Operational Expenses | $8.76 | 15% | Enhanced cash flow for day-to-day farm operations |

This allocation demonstrates a balanced approach to addressing various needs within the farming community. By providing support across different areas, Farm Credit Mid-America aims to create a comprehensive safety net for Ohio farmers.

The Importance of Rural Community Lending

Rural community lending plays a pivotal role in sustaining the agricultural sector and the economies of small towns across Ohio. The $58.4 million patronage distribution is a testament to the symbiotic relationship between financial institutions and farmers. Here’s why this type of lending is crucial:

- It provides access to capital in areas often underserved by traditional banks

- Offers specialized financial products tailored to the unique needs of agricultural businesses

- Supports the entire rural ecosystem, from farmers to agribusinesses and local services

- Helps maintain food security by ensuring continued agricultural production

- Fosters innovation and modernization in farming practices through strategic investments

As we consider the impact of this distribution, it’s worth exploring how technology can further enhance the effectiveness of financial support in agriculture.

The video above showcases Farmonaut’s advanced solutions for precision crop area estimation, which can be particularly valuable for farmers looking to optimize their land use and improve yield predictions. Such technologies can help farmers make more informed decisions about how to allocate their financial resources, including the patronage distribution they receive.

Strategies for Effective Agricultural Debt Management

With the influx of $58.4 million into Ohio’s farming community, it’s crucial to consider effective strategies for agricultural debt management. Here are some approaches that farmers can consider:

- Prioritize high-interest debts: Use a portion of the patronage return to pay down debts with the highest interest rates first.

- Invest in efficiency-improving technologies: Consider allocating funds to technologies that can reduce operational costs in the long run.

- Create an emergency fund: Set aside some of the distribution to build a financial buffer for future uncertainties.

- Consult with financial advisors: Seek professional advice on how to best utilize the funds for long-term financial health.

- Explore refinancing options: Use this financial boost as leverage to negotiate better terms on existing loans.

By implementing these strategies, farmers can maximize the impact of the patronage distribution and strengthen their financial position in the face of ongoing market challenges.

“The substantial patronage distribution aims to support various farmer needs, including spring planting costs and farm equipment financing.”

Maximizing the Benefits of Spring Planting Input Costs Support

A significant portion of the $58.4 million distribution is expected to go towards spring planting input costs. This timely support can have a substantial impact on farmers’ ability to prepare for the upcoming growing season. Here are some ways farmers can maximize this financial assistance:

- Bulk purchasing: Use the funds to buy inputs in larger quantities, potentially securing discounts.

- Precision agriculture adoption: Invest in soil testing and precision application technologies to optimize input use.

- Explore alternative inputs: Consider experimenting with new, cost-effective or environmentally friendly inputs.

- Timing of purchases: Strategically time input purchases to take advantage of seasonal price fluctuations.

By leveraging these strategies, farmers can stretch their patronage returns further and set the stage for a more productive growing season.

The Role of Farm Equipment Financing in Agricultural Modernization

Farm equipment financing is another crucial area where the patronage distribution can make a significant difference. Modern, efficient equipment can dramatically improve farm productivity and reduce operational costs. Here’s how farmers might approach equipment financing with this additional support:

- Use the funds as a down payment on new, technologically advanced equipment

- Upgrade existing machinery to improve fuel efficiency and reduce maintenance costs

- Invest in precision agriculture equipment to enhance crop management capabilities

- Consider leasing options that may become more accessible with the additional financial cushion

The strategic use of these funds for equipment can lead to long-term benefits in terms of increased efficiency and reduced operational costs.

The video above demonstrates Farmonaut’s advanced crop monitoring and yield prediction capabilities. These technologies can be particularly valuable for farmers looking to maximize the return on their equipment investments by ensuring optimal crop management practices.

The Future of Agricultural Portfolio Management

As we look to the future, agricultural portfolio management will play an increasingly important role in helping farmers navigate market uncertainties. The $58.4 million distribution from Farm Credit Mid-America is just one example of how financial institutions are adapting to support the evolving needs of the agricultural sector.

Future trends in agricultural portfolio management may include:

- Increased use of data analytics to assess and mitigate risks

- Integration of climate risk models into lending decisions

- Development of more flexible financial products tailored to seasonal agricultural needs

- Greater emphasis on sustainability and environmental stewardship in lending practices

By staying ahead of these trends, both farmers and lending institutions can work together to create a more resilient and sustainable agricultural economy.

Leveraging Technology for Better Farm Management

While financial support is crucial, technology can play a complementary role in helping farmers make the most of their resources. Farmonaut’s suite of tools, for instance, can provide valuable insights for better farm management:

- Satellite-based crop monitoring: Real-time data on crop health can help farmers make timely decisions about irrigation and pest control.

- AI-powered advisory systems: Personalized recommendations can optimize resource allocation and improve yields.

- Blockchain-based traceability: Enhance supply chain transparency and potentially access premium markets.

- Resource management tools: Improve efficiency in water usage, fertilizer application, and other critical farm operations.

By combining financial support with technological solutions, farmers can create a more robust strategy for navigating market uncertainties.

Explore Farmonaut’s solutions:

The Broader Impact on Rural Agriculture Financial Support

The $58.4 million distribution to Ohio farmers is not just about individual financial relief; it represents a broader commitment to rural agriculture financial support. This type of investment in rural communities can have far-reaching effects:

- Stimulating local economies as farmers invest in equipment, supplies, and services

- Encouraging young people to pursue careers in agriculture by demonstrating financial viability

- Supporting the preservation of family farms and rural traditions

- Enhancing food security by ensuring continued agricultural production

- Promoting innovation and sustainability in farming practices

As we consider these broader impacts, it’s clear that financial support for farmers extends well beyond the farm gate, touching every aspect of rural life and the wider economy.

The video above highlights Farmonaut’s achievements in the first half of 2023, demonstrating the rapid advancements in agricultural technology that can complement financial support measures like the patronage distribution.

Strategies for Long-term Financial Resilience in Agriculture

While the $58.4 million distribution provides immediate relief, it’s essential for farmers to think long-term about their financial resilience. Here are some strategies to consider:

- Diversification: Explore multiple revenue streams to reduce dependency on a single crop or market.

- Risk management: Utilize crop insurance and other financial instruments to protect against unforeseen events.

- Continuous education: Stay informed about new farming techniques, market trends, and financial management strategies.

- Sustainable practices: Implement environmentally friendly methods that can lead to long-term cost savings and potential premium pricing for products.

- Technology adoption: Embrace farm management technologies that can improve efficiency and decision-making.

By implementing these strategies, farmers can build on the foundation provided by the patronage distribution to create lasting financial stability.

The Role of Farm Credit Earnings Distribution in Agricultural Sustainability

The concept of farm credit earnings distribution goes beyond mere financial assistance; it’s a crucial component of a sustainable agricultural ecosystem. Here’s why:

- It reinforces the cooperative model, where members share in the success of the organization

- Encourages farmers to maintain good financial practices to qualify for future distributions

- Provides a cushion against market fluctuations, allowing for more stable long-term planning

- Demonstrates the viability of agriculture as a business, attracting new entrants to the field

- Enables farmers to invest in sustainable practices that may have higher upfront costs but long-term benefits

This model of earnings distribution creates a virtuous cycle that benefits both individual farmers and the broader agricultural community.

Leveraging Financial Support for Technological Advancement

As farmers receive this financial boost, there’s an opportunity to invest in technological advancements that can further improve farm operations. Farmonaut’s suite of tools, for instance, can provide valuable insights:

- Satellite-based crop monitoring: Optimize resource use and improve crop yields

- AI-powered advisory systems: Receive personalized recommendations for farm management

- Blockchain-based traceability: Enhance product value through transparent supply chains

- Carbon footprint tracking: Prepare for potential carbon credit markets and sustainability certifications

Investing in these technologies can help farmers maximize the impact of their financial support and position themselves for long-term success.

Explore Farmonaut’s API for custom integrations: Farmonaut API

For developers interested in integrating Farmonaut’s solutions: API Developer Docs

The video above demonstrates Farmonaut’s high accuracy in providing organic carbon data, which can be crucial for farmers looking to optimize soil health and potentially participate in carbon credit markets.

Conclusion: A New Chapter for Ohio Agriculture

The $58.4 million patronage distribution to Ohio farmers marks a significant milestone in the ongoing effort to support and sustain rural agriculture. As we’ve explored, this financial boost touches on various aspects of farming, from immediate operational needs to long-term strategic investments.

Key takeaways include:

- The distribution addresses critical areas such as spring planting inputs, equipment financing, and debt management

- It reinforces the importance of rural community lending and farm credit institutions in supporting agriculture

- The funds provide an opportunity for farmers to invest in technological advancements and sustainable practices

- Long-term strategies for financial resilience are crucial to maximize the benefits of such distributions

- The broader impact on rural communities extends beyond individual farms, touching every aspect of the local economy

As Ohio farmers navigate the challenges of market volatility and economic uncertainty, this financial support, combined with strategic planning and technological adoption, can pave the way for a more resilient and prosperous agricultural sector.

We encourage farmers to leverage this opportunity not just for immediate relief, but as a stepping stone towards long-term sustainability and success. By combining financial support with innovative farming practices and technology, Ohio’s agricultural community can emerge stronger and better prepared for the challenges and opportunities that lie ahead.

FAQ Section

Q: How will the $58.4 million be distributed among Ohio farmers?

A: The exact distribution method hasn’t been detailed, but it’s likely based on each farmer’s level of business with Farm Credit Mid-America. Farmers should contact their local Farm Credit representative for specific information about their individual distribution.

Q: Can farmers use this distribution for any purpose?

A: Yes, farmers have flexibility in how they use these funds. Common uses include paying down debt, purchasing equipment, covering input costs for spring planting, or investing in farm improvements.

Q: How does this patronage distribution impact farm credit uncertainty?

A: This distribution helps alleviate some financial pressure on farmers, potentially improving their credit standing and providing a buffer against market uncertainties.

Q: Are there any tax implications for receiving this patronage distribution?

A: Farmers should consult with their tax advisors regarding the specific tax implications of this distribution, as it may be considered taxable income.

Q: How often does Farm Credit Mid-America make such distributions?

A: While the frequency can vary, Farm Credit Mid-America has a history of making annual patronage distributions when financial conditions allow.

Q: Can new Farm Credit Mid-America customers benefit from future distributions?

A: Yes, new customers who become members of the cooperative may be eligible for future patronage distributions based on their business with the organization.