Orlando Art Scandal: Legal Battle Over $19.7M Insurance Claim for Seized Paintings Sparks Industry Debate

“A $19.7 million insurance claim for allegedly forged paintings has sparked a legal battle in Florida’s art world.”

In the vibrant city of Orlando, Florida, a high-profile legal dispute has erupted, sending shockwaves through the art world and insurance industry. This contentious case centers around a staggering $19.7 million insurance claim for a collection of paintings allegedly created by the renowned artist Jean-Michel Basquiat. As we delve into the intricacies of this complex situation, we’ll explore the far-reaching implications for art authentication, insurance policies, and the integrity of the global art market.

The Orlando Museum of Art Controversy

At the heart of this scandal lies the Orlando Museum of Art, an institution that found itself embroiled in controversy following an FBI raid in 2022. The raid resulted in the seizure of several paintings purportedly created by Basquiat, a pivotal figure in the Neo-Expressionist movement of the 1980s. The authenticity of these works has since been called into question, sparking a heated debate that extends far beyond the museum’s walls.

The owners of the paintings, who had loaned the collection to the museum, are now at the center of a legal battle with two prominent insurance companies: Liberty Mutual Insurance Company and Great American Insurance Company. These insurers have taken a firm stance, challenging the validity of the $19.7 million claim and arguing that the paintings, being forgeries, hold no intrinsic value.

The Legal Battle Unfolds

In a bold move, the insurance companies have filed a declaratory judgment, asserting that the owners are not entitled to any proceeds from what they deem a “non-existent loss.” Their argument hinges on the premise that the paintings have neither been damaged nor destroyed, but rather seized due to their questionable authenticity.

On the other side of the courtroom, the owners maintain their position, emphasizing that they acted in good faith throughout the process. They contend that the authenticity of the artworks should not affect their insurance claim, pointing out that the insurers failed to conduct an authenticity investigation when the pieces were initially insured.

The Basquiat Forgery Scandal

To fully grasp the magnitude of this case, we must look back at the events that led to this legal quagmire. The collection in question was originally touted as a remarkable discovery, allegedly unearthed from an old storage locker and dating back to 1982. However, skepticism quickly arose among art experts and analysts, who noted several inconsistencies that cast doubt on the paintings’ authenticity.

One of the most glaring issues was the use of a FedEx typeface in one of the pieces, which wasn’t introduced until 1994 – six years after Basquiat’s untimely death from a drug overdose at the age of 27. This anachronism served as a red flag for many in the art world, igniting a firestorm of speculation and investigation.

Adding another layer of complexity to the case, Thad Mumford, the purported owner of the storage locker from which the artworks were supposedly retrieved, distanced himself from the claim. Before his passing in 2018, Mumford stated that he never owned any Basquiat pieces and that the artworks were absent from his locker during his last visit.

The Guilty Plea: A Turning Point

In a significant development that sent ripples through the art community, former Los Angeles auctioneer Michael Barzman pleaded guilty to federal charges of making false statements to the FBI in 2023. Barzman admitted to creating fake Basquiat artworks and falsely attributing them to the artist, a confession that lent credence to the suspicions surrounding the Orlando collection.

This admission has further complicated the legal landscape, raising questions about the extent of the forgery operation and its impact on the art market. It has also put increased pressure on museums, galleries, and collectors to enhance their authentication processes and due diligence measures.

Insurance Industry Implications

The Orlando art scandal has thrust the complexities of art insurance into the spotlight, prompting a reevaluation of policies and procedures within the industry. Insurance companies are now grappling with the challenges of covering high-value artworks in an era where sophisticated forgeries can sometimes fool even the most discerning experts.

“The Orlando art scandal could impact authentication protocols for millions of dollars worth of artworks globally.”

This case has highlighted several key issues that insurers must address:

- Authentication Processes: The need for more rigorous authentication procedures before insuring valuable artworks.

- Policy Language: The importance of clear and specific language in insurance policies regarding forgeries and authenticity disputes.

- Risk Assessment: Enhanced methods for evaluating the risks associated with insuring fine art, particularly pieces with uncertain provenance.

- Claim Verification: Improved techniques for verifying the validity of claims in cases of alleged forgery or fraud.

As the industry grapples with these challenges, we may see the emergence of new insurance products and services tailored to address the unique risks associated with fine art collections. This could include specialized coverage for authentication disputes or the integration of advanced technologies like blockchain for provenance tracking.

The Museum’s Perspective

The Orlando Museum of Art has not emerged unscathed from this controversy. In a separate legal action, the museum has filed a lawsuit against its former executive director, Aaron De Groft, alleging fraud and breach of contract. The institution claims that its reputation has been severely damaged by the incident involving the forged paintings.

This internal strife within the museum highlights the potential consequences for cultural institutions that fail to maintain rigorous standards in artwork authentication and exhibition practices. It serves as a cautionary tale for museums worldwide, underscoring the importance of thorough vetting processes and transparent communication with the public.

The Broader Impact on the Art Market

The reverberations of the Orlando art scandal extend far beyond the confines of a single museum or insurance claim. This case has brought to the forefront several critical issues that the art world must confront:

- Market Integrity: The need for enhanced measures to ensure the authenticity and provenance of artworks in the market.

- Collector Confidence: The potential impact on collector confidence and the overall stability of the art market.

- Authentication Techniques: The push for more advanced and reliable authentication methods to combat sophisticated forgeries.

- Regulatory Oversight: Potential calls for increased regulatory oversight in the art market to prevent fraud and protect buyers.

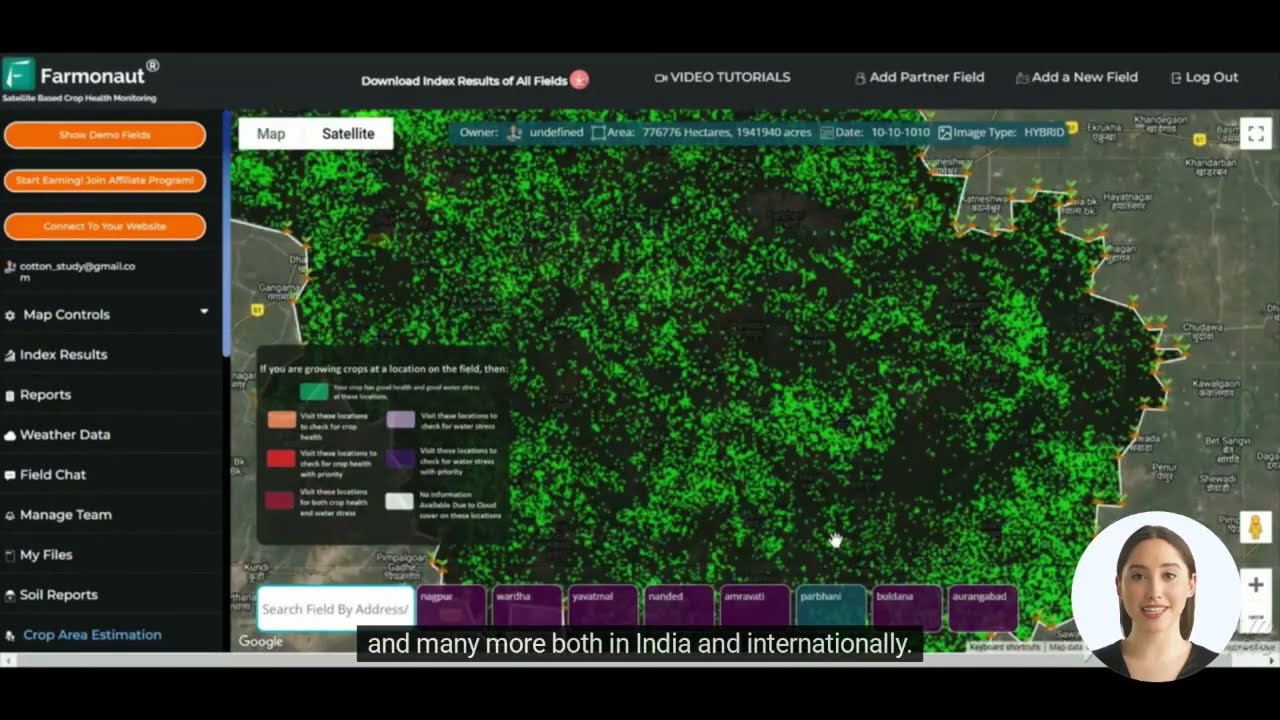

As the art world grapples with these challenges, we may see the emergence of new technologies and practices aimed at enhancing transparency and trust in the market. This could include the adoption of blockchain-based provenance tracking systems, similar to those offered by companies like Farmonaut in the agricultural sector, which provide traceability solutions for various industries.

Legal Complexities and Jurisdictional Issues

The legal battle surrounding the Orlando art scandal has been further complicated by jurisdictional issues. While the insurance companies initially filed their lawsuit in state court, the owners of the paintings have sought to transfer the case to federal court, citing differences in the states of residence among the parties involved.

This jurisdictional dance highlights the complex nature of art-related legal disputes, which often cross state and even national boundaries. It also underscores the need for a more unified approach to handling cases involving fine art authenticity and insurance claims.

The Role of Expert Analysis

As the legal proceedings unfold, the role of art experts and analysts has come into sharp focus. These professionals play a crucial role in authenticating artworks and providing expert testimony in cases of disputed authenticity. The Orlando case has highlighted the challenges faced by these experts, including:

- The pressure to make definitive judgments on complex authenticity issues

- The potential for conflicting opinions among experts

- The need for advanced technical analysis techniques to supplement traditional connoisseurship

- The legal and ethical responsibilities of experts in high-stakes authentication disputes

Moving forward, we may see increased collaboration between art experts and technology specialists to develop more robust authentication methodologies. This could involve the integration of AI-powered image analysis, similar to the crop health monitoring systems used by Farmonaut’s API, adapted for the analysis of fine art.

The Future of Art Authentication and Insurance

As the art world continues to grapple with the fallout from the Orlando scandal, several key trends are likely to shape the future of art authentication and insurance:

- Enhanced Due Diligence: Museums, galleries, and collectors will likely implement more stringent authentication processes before acquiring or displaying artworks.

- Technological Integration: The adoption of advanced technologies like AI, machine learning, and blockchain for artwork analysis and provenance tracking.

- Policy Refinement: Insurance companies may revise their policies to more explicitly address issues of authenticity and provide clearer guidelines for claims related to forged artworks.

- Increased Transparency: A push for greater transparency in the art market, including more comprehensive documentation of an artwork’s history and provenance.

- Collaborative Authentication: The development of more collaborative authentication processes, involving multiple experts and interdisciplinary approaches.

Art Insurance Claim Comparison

| Case Name | Year | Claim Amount (in millions) | Artwork(s) Involved | Primary Issue | Legal Outcome (if resolved) |

|---|---|---|---|---|---|

| Orlando Art Scandal | 2022-present | $19.7 | Alleged Basquiat paintings | Forgery | Ongoing |

| Knoedler Gallery Scandal | 2011-2016 | $80 | Forged works by Rothko, Pollock, and others | Forgery | Settled out of court |

| Isabella Stewart Gardner Museum Heist | 1990-present | $500 | Works by Rembrandt, Vermeer, and others | Theft | Unresolved, ongoing investigation |

| Wildenstein Tax Evasion Case | 2016-2017 | $600 | Various artworks in family collection | Tax evasion, hidden assets | Acquitted in French court |

Lessons for the Art Community

The Orlando art scandal serves as a wake-up call for the entire art community, from collectors and museums to insurers and legal professionals. Some key lessons that have emerged from this case include:

- The critical importance of thorough authentication processes

- The need for clear communication and transparency in all art transactions

- The value of comprehensive insurance coverage that addresses authenticity issues

- The importance of staying informed about emerging authentication technologies and best practices

As the art world continues to evolve, stakeholders must remain vigilant and adaptable to protect the integrity of collections and the interests of all parties involved.

The Role of Technology in Art Authentication

As we look to the future, technology is poised to play an increasingly significant role in art authentication and provenance tracking. While not directly related to the art world, companies like Farmonaut demonstrate the potential of advanced technologies in tracking and verifying the origins of valuable assets. Their blockchain-based traceability solutions, designed for industries like agriculture and textiles, offer a glimpse into how similar technologies could be adapted for the art market.

Imagine a future where each artwork is accompanied by an immutable digital record, tracking its journey from the artist’s studio through various collections and exhibitions. Such a system could significantly reduce the risk of forgeries entering the market and provide a more secure foundation for insurance policies and legal disputes.

Global Implications and Industry Trends

The Orlando art scandal is not an isolated incident but rather a symptom of broader challenges facing the global art market. As the case continues to unfold, it’s likely to influence industry trends and practices worldwide:

- International Cooperation: Increased collaboration between law enforcement agencies, museums, and art experts across borders to combat art fraud.

- Regulatory Changes: Potential implementation of stricter regulations governing art sales, authentication, and insurance.

- Education and Training: Enhanced focus on educating collectors, curators, and industry professionals about authentication best practices and fraud prevention.

- Market Transparency: A push towards greater transparency in art transactions, potentially leveraging blockchain technology for secure and transparent record-keeping.

These trends highlight the interconnected nature of the global art market and the need for coordinated efforts to address systemic challenges.

The Human Element in Art Authentication

While technology will undoubtedly play a crucial role in the future of art authentication, it’s important not to overlook the irreplaceable human element. Connoisseurship, the trained eye of an expert, and the intuitive understanding of an artist’s work remain vital components of the authentication process.

The challenge moving forward will be to strike a balance between leveraging advanced technologies and preserving the nuanced, human-centric aspects of art appreciation and authentication. This hybrid approach could potentially offer the most robust defense against forgeries and fraud in the art world.

Conclusion: A Turning Point for the Art World

The Orlando art scandal represents a critical juncture for the art world, insurance industry, and legal system. As the case continues to unfold, it will likely serve as a catalyst for significant changes in how artworks are authenticated, insured, and traded.

The outcome of this legal battle could set important precedents, influencing everything from insurance policy language to museum exhibition practices. It underscores the need for greater vigilance, transparency, and collaboration among all stakeholders in the art ecosystem.

As we move forward, the integration of advanced technologies, coupled with refined legal frameworks and industry best practices, will be crucial in maintaining the integrity of the global art market. The lessons learned from the Orlando case will undoubtedly shape the future of art authentication, insurance, and legal disputes for years to come.

FAQs

- Q: What is the main issue in the Orlando art scandal?

A: The main issue is a $19.7 million insurance claim for allegedly forged Jean-Michel Basquiat paintings seized by the FBI from the Orlando Museum of Art. - Q: Who are the main parties involved in the legal dispute?

A: The main parties are the owners of the paintings, Liberty Mutual Insurance Company, Great American Insurance Company, and the Orlando Museum of Art. - Q: What evidence suggests the paintings might be forgeries?

A: Key evidence includes the use of a FedEx typeface that wasn’t available until after Basquiat’s death, and a guilty plea from an auctioneer admitting to creating fake Basquiat artworks. - Q: How might this case impact the art insurance industry?

A: It may lead to more rigorous authentication processes, clearer policy language regarding forgeries, and enhanced risk assessment methods for insuring fine art. - Q: What broader implications does this case have for the art world?

A: The case highlights the need for improved authentication techniques, greater market transparency, and potentially increased regulatory oversight in the art market.

For more insights into innovative technologies and their potential applications across various industries, explore Farmonaut’s advanced solutions. While primarily focused on agriculture, their approach to data analysis and traceability offers valuable lessons for many sectors, including the art world.

Earn With Farmonaut: Join Farmonaut’s affiliate program and earn 20% recurring commission by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!