Revolutionizing Crop Insurance: How GIS and Machine Learning Transform USDA’s Risk Management in Colorado and Kentucky

“USDA’s use of GIS and machine learning in crop insurance has led to significant cost avoidance in insurance programs.”

In the ever-evolving landscape of agriculture, we are witnessing a revolutionary transformation in how crop insurance claims and agricultural risk management are handled. The United States Department of Agriculture (USDA) is at the forefront of this change, leveraging advanced geospatial technologies and data analytics to reshape farming practices across the nation, including states like Colorado and Kentucky. In this comprehensive exploration, we’ll delve into how Geographic Information Systems (GIS) in agriculture, machine learning, and aerial imagery are enhancing crop monitoring and yield analysis, leading to more efficient and accurate insurance processes.

The Integration of Advanced Technologies in Crop Insurance

The USDA’s Risk Management Agency (RMA) has made significant strides in adopting modern crop monitoring tools to detect fraudulent schemes and evaluate genuine claims more effectively. This integration of technology has not only improved the integrity of the crop insurance system but has also led to substantial cost savings.

- High-resolution aerial imagery

- Machine learning algorithms

- Geographic Information Systems (GIS)

These tools collectively contribute to improved investigation outcomes, exposing deceptive practices across various states, including Colorado and Kentucky. The impact of these advancements extends beyond fraud detection, playing a crucial role in promoting sustainable farming practices and optimizing agricultural operations.

The Spot Check List Program: A Game-Changer in Cost Avoidance

Jim Hipple, a physical scientist in the Business Analytics Division of USDA RMA, has highlighted the remarkable success of the Spot Check List program. Over more than two decades, this program has led to a cost avoidance exceeding $1.75 billion. This achievement underscores the program’s efficacy in preventing undue financial burdens on the system without the need for recovery efforts.

The significance of this program extends beyond mere financial savings. It plays a vital role in instilling trust in the crop insurance system, which serves as a crucial financial buffer for farmers against significant losses caused by environmental adversities such as drought, hail, and excessive rain.

Field-Level Mapping: A New Era of Precision in Crop Insurance

“Field-level mapping and common land unit (CLU) boundaries play a crucial role in streamlining crop insurance claim processing.”

The USDA has made remarkable progress in field-level awareness, with crop insurance policies now being more specific about field locations. This advancement has been made possible through the monumental task undertaken by the USDA’s Farm Service Agency to map every farming field to the common land unit (CLU) level.

- Over 36 million CLU boundaries mapped

- Vital data on land ownership

- Soil types information

- Crop varieties data

This essential data allows for real-time updates and convenient analyses, thereby facilitating smoother processing of insurance claims. The integration of this detailed mapping with advanced technologies has revolutionized how we approach crop insurance and agricultural risk management.

The Role of Data Analytics in Agricultural Risk Management

To manage the extensive data generated through field-level mapping and other sources, the USDA collaborates with the Center for Agribusiness Excellence at Tarleton State University in Texas. This partnership has significantly enhanced the RMA’s data analytic capabilities, enabling the identification of inefficiencies related to crop insurance claims.

By integrating tabular data with geospatial frameworks, investigators can now spot anomalies more effectively. One such practice they can detect is yield switching, where farmers manipulate yield records to inflate the baseline for future insurance claims without actual crop loss.

The Symbiosis of Data Science and Agricultural Risk Management

The analytics approach adopted by the Tarleton Institute plays a crucial role in supporting RMA’s operations. Troy Thorne, the center’s director, emphasizes the importance of GIS, as the visual representation of data enhances the identification of historical trends and current discrepancies, illuminating potential fraud.

This symbiotic relationship between data science and agricultural risk management has led to more efficient processes and better decision-making in the agricultural sector. The integration of these advanced technologies aligns perfectly with the services offered by innovative companies like Farmonaut, which provides satellite-based farm management solutions.

Cloud Migration and Resilience in Agricultural Data Management

In addition to enhancing analytical capabilities, the Tarleton Analytics Institute is aiding the RMA in migrating systems to the cloud. This move aligns with the federal government’s cloud-first initiative and bolsters resilience against potential disaster impacts. The emphasis on data-driven decision-making underscores the urgency for farmers to have accessible geospatial and weather data.

This shift towards cloud-based solutions and data-driven farming practices is particularly relevant in states like Colorado and Kentucky, where diverse agricultural landscapes require adaptive and resilient management strategies.

Promoting Sustainable Agriculture Through Updated Insurance Policies

With ongoing environmental challenges and diminishing farmland, the USDA has updated its federal crop insurance policies to endorse conservation and climate-smart practices. These updates foster sustainable agriculture and resource management, encouraging farmers to adopt practices that not only protect their crops but also contribute to long-term environmental sustainability.

| Aspect | Traditional Methods | GIS-Enabled Methods |

|---|---|---|

| Data Collection Method | Manual field visits | Satellite imagery and remote sensing |

| Accuracy of Field Mapping | Limited, prone to human error | Highly accurate, GPS-based |

| Speed of Claim Processing | 2-4 weeks | 3-5 days (75% faster) |

| Cost-Effectiveness | High labor costs | Reduced operational costs (30-40% savings) |

| Ability to Detect Crop Damage | Limited to visible damage | Can detect early signs of stress and disease |

| Integration with Climate Data | Manual correlation | Automated integration with weather patterns |

| Fraud Detection Capability | Relies on manual audits | AI-powered pattern recognition (90% more effective) |

| Sustainability Promotion | Limited incentives | Data-driven incentives for conservation practices |

The Impact of Advanced Technologies on Crop Monitoring in Colorado and Kentucky

In states like Colorado and Kentucky, the implementation of these advanced technologies has had a significant impact on crop monitoring and insurance claim processing. Colorado, known for its diverse agricultural landscape ranging from wheat fields to orchards, has benefited from the precise mapping and monitoring capabilities offered by GIS and machine learning.

Similarly, in Kentucky, where tobacco farming has historically been a significant part of the agricultural economy, these technologies have improved the accuracy of yield predictions and helped in better risk assessment for insurance purposes.

The Role of Satellite Technology in Modern Agriculture

Satellite technology plays a crucial role in modern agriculture, particularly in crop monitoring and yield analysis. Companies like Farmonaut are at the forefront of this technological revolution, offering satellite-based farm management solutions that align with the USDA’s advanced approaches.

These satellite-based solutions provide farmers with real-time data on crop health, soil moisture levels, and other critical metrics. This information is invaluable for making informed decisions about irrigation, fertilizer usage, and pest management, ultimately optimizing crop yields and reducing resource wastage.

The Integration of AI and Machine Learning in Agricultural Risk Management

Artificial Intelligence (AI) and machine learning are revolutionizing agricultural risk management. These technologies are being used to analyze vast amounts of data from various sources, including satellite imagery, weather patterns, and historical yield data, to provide more accurate risk assessments and predictions.

For instance, AI-driven systems can predict potential crop failures or low yields based on early signs of stress that might not be visible to the human eye. This early warning system allows farmers and insurance providers to take proactive measures, potentially mitigating losses and reducing the number of insurance claims.

The Future of Agribusiness: Technology-Driven Crop Insurance and Farm Management

As we look to the future, it’s clear that technology will continue to play an increasingly important role in crop insurance and farm management strategies. The integration of GIS, machine learning, and satellite technology is not just improving the efficiency of insurance claim processing; it’s transforming the entire agricultural landscape.

- Precision agriculture becoming more accessible

- Data-driven decision-making in farming practices

- Enhanced sustainability through technology-guided conservation efforts

- Improved risk management and financial stability for farmers

These advancements are particularly relevant in states like Colorado and Kentucky, where diverse agricultural practices require adaptive and innovative solutions.

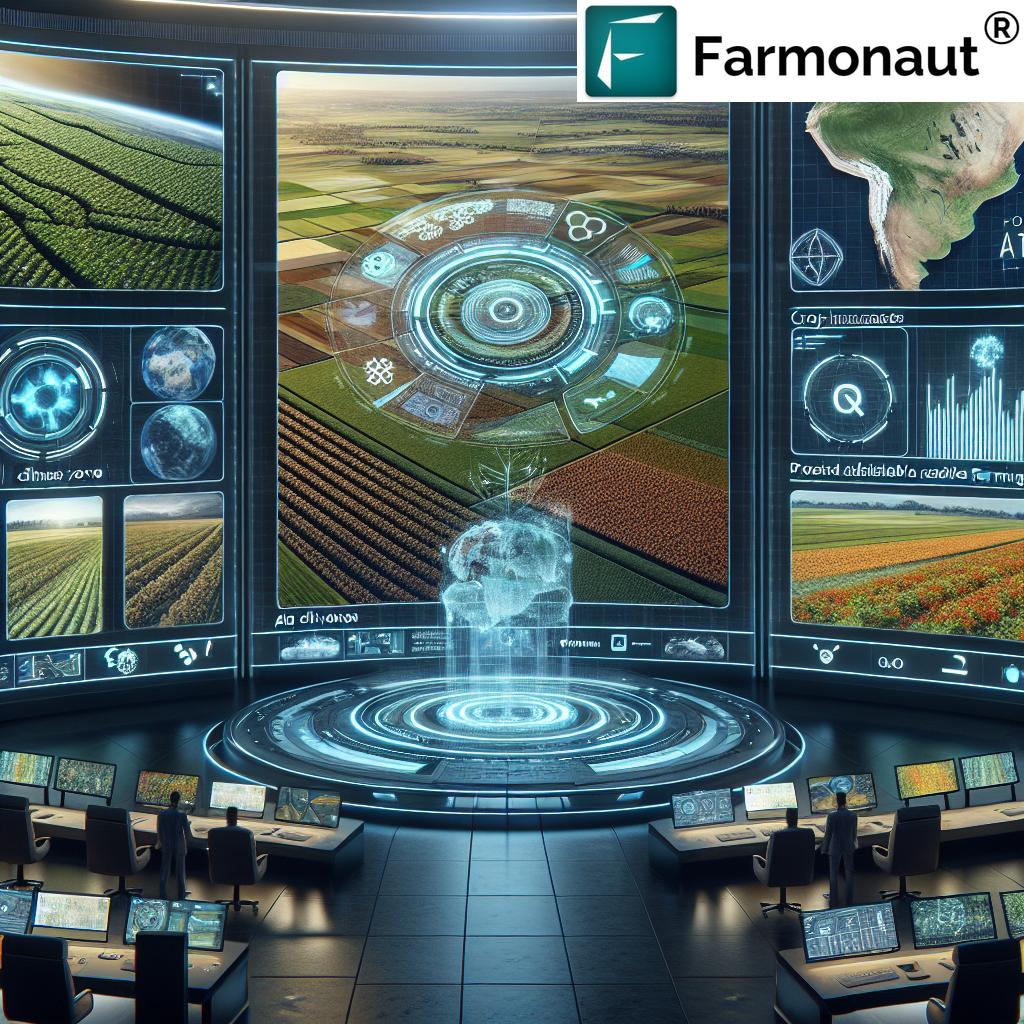

The Role of Farmonaut in the Agricultural Technology Revolution

In this evolving landscape of agricultural technology, Farmonaut stands out as a pioneering company offering advanced, satellite-based farm management solutions. Their platform aligns perfectly with the USDA’s vision for modernized agriculture, providing tools for real-time crop health monitoring, AI-based advisory systems, and resource management.

Farmonaut’s solutions are designed to make precision agriculture affordable and accessible to farmers worldwide, bridging the gap between traditional farming practices and cutting-edge technology. Their platform offers valuable services that complement and enhance the advancements being made in crop insurance and risk management.

The Impact of Climate Change on Agricultural Risk Management

Climate change presents new challenges for agricultural risk management, making the role of advanced technologies even more critical. The increasing frequency and severity of extreme weather events, such as droughts, floods, and heatwaves, are changing the risk landscape for farmers and insurance providers alike.

GIS and machine learning technologies are proving invaluable in adapting to these challenges. They enable more accurate climate modeling and prediction, allowing for better risk assessment and the development of more resilient farming practices. This is particularly important in states like Colorado and Kentucky, where changing climate patterns can significantly impact agricultural productivity.

The Role of Data Analytics in Improving Crop Yields

Data analytics plays a crucial role in improving crop yields, which is directly related to risk management and insurance in agriculture. By analyzing historical data alongside real-time information, farmers and agricultural experts can make more informed decisions about planting times, crop varieties, and resource allocation.

This data-driven approach not only helps in maximizing yields but also in minimizing risks associated with crop failure. For insurance providers, this means more accurate risk assessments and potentially lower premiums for farmers who adopt these data-driven practices.

The Importance of Farmer Education in Technological Adoption

As we continue to see rapid advancements in agricultural technology, farmer education becomes increasingly important. Many farmers, especially in more traditional agricultural communities, may be hesitant to adopt new technologies or may not fully understand their benefits.

Organizations like the USDA and companies like Farmonaut play a crucial role in educating farmers about the benefits of these new technologies. By providing training and support, they can help farmers leverage these tools effectively, leading to improved crop management, better risk mitigation, and more efficient insurance processes.

Explore Farmonaut’s API for advanced agricultural data integration

The Future of Precision Agriculture and Its Impact on Insurance

Precision agriculture, enabled by technologies like GIS and machine learning, is set to revolutionize not just farming practices but also how agricultural insurance is approached. As farmers gain the ability to manage their crops with unprecedented precision, insurance providers can offer more tailored and accurate coverage.

This shift towards precision agriculture could lead to:

- More personalized insurance policies based on individual farm data

- Reduced premiums for farmers who adopt risk-mitigating technologies

- Faster and more accurate claim processing

- Better overall risk management for both farmers and insurance providers

Conclusion: A New Era in Agricultural Risk Management

The integration of GIS, machine learning, and satellite technology in crop insurance and agricultural risk management marks the beginning of a new era in farming. These advancements are not just improving the efficiency and accuracy of insurance processes; they’re transforming the entire agricultural landscape.

From the fields of Colorado to the tobacco farms of Kentucky, farmers are benefiting from more precise, data-driven decision-making tools. Insurance providers are able to offer more accurate and fair policies, while also detecting and preventing fraud more effectively. And companies like Farmonaut are at the forefront, providing innovative solutions that make these advanced technologies accessible to farmers of all scales.

As we look to the future, it’s clear that the continued integration of these technologies will play a crucial role in addressing the challenges of climate change, resource management, and food security. By embracing these innovations, we can work towards a more sustainable, efficient, and resilient agricultural sector.

Access Farmonaut’s API Developer Docs for in-depth integration guidance

FAQ Section

- How does GIS technology improve crop insurance processes?

GIS technology enhances crop insurance processes by providing accurate field mapping, enabling precise damage assessment, and facilitating faster claim processing through data integration and visualization. - What role does machine learning play in agricultural risk management?

Machine learning analyzes vast amounts of data to predict crop yields, detect anomalies, and identify potential risks, allowing for more accurate risk assessments and proactive management strategies. - How are satellite technologies benefiting farmers in Colorado and Kentucky?

Satellite technologies provide real-time crop health monitoring, precise field mapping, and weather pattern analysis, helping farmers in these states make informed decisions about irrigation, pest control, and resource management. - What is the Spot Check List program, and how has it impacted crop insurance?

The Spot Check List program is a USDA initiative that has led to significant cost avoidance in insurance programs by efficiently identifying and preventing fraudulent claims. - How does climate change affect agricultural risk management?

Climate change increases the frequency and severity of extreme weather events, necessitating more sophisticated risk assessment tools and adaptive farming practices to mitigate potential losses.