Unlock Rural Land Financing: Expert Guide to Farm and Ranch Loans in Texas and New Mexico

“Cooperative financing models for rural land can potentially lower effective interest rates through patronage dividends.”

“Cooperative financing models for rural land can potentially lower effective interest rates through patronage dividends.”

Welcome to our comprehensive guide on rural land financing solutions for farms, ranches, and recreational properties in Texas and New Mexico. At Farmonaut, we’re committed to providing innovative agritech services that complement your agricultural endeavors. In this blog post, we’ll explore the intricacies of farm and ranch loans, long-term farm credit options, and specialized financing for young farmers and ranchers. We’ll also delve into the unique advantages of cooperative financing models and how they can benefit your agricultural investments.

Understanding Rural Land Financing

Rural land financing is a specialized form of credit designed to meet the unique needs of agricultural and recreational property owners. Whether you’re looking to purchase a farm, expand your ranch, or invest in a family retreat, understanding your financing options is crucial for making informed decisions.

- Farm and Ranch Loans: These loans are tailored for agricultural operations and often come with favorable terms for farmers and ranchers.

- Agricultural Real Estate Loans: Specifically for purchasing land to be used for agricultural purposes.

- Recreational Property Financing: For those looking to invest in land for hunting, fishing, or other outdoor activities.

- Long-term Farm Credit: Offers extended repayment periods, suitable for large land purchases or significant improvements.

At Farmonaut, we recognize the importance of these financing options and how they can impact your agricultural operations. Our satellite-based farm management solutions can provide valuable insights to help you make the most of your investment, regardless of the financing route you choose.

Farm Credit Cooperatives: A Unique Financing Model

One of the most innovative approaches to rural land financing is the farm credit cooperative model. These member-owned organizations offer several advantages:

- Patronage Dividends: As a member-owner, you may receive patronage dividends that effectively lower your interest rate.

- Specialized Knowledge: Farm credit cooperatives understand the agricultural industry and can offer tailored financial solutions.

- Competitive Rates: Often, these cooperatives can provide more competitive rates compared to traditional banks.

The cooperative model aligns well with our mission at Farmonaut to make precision agriculture accessible and affordable. Just as we leverage technology to democratize access to advanced farming tools, cooperatives work to provide accessible financing options for rural landowners.

Specialized Loans for Young and Beginning Farmers

The agricultural industry recognizes the importance of supporting the next generation of farmers and ranchers. Several loan programs are designed specifically for young, beginning, and small farmers:

- USDA Beginning Farmer and Rancher Loans: Offers lower interest rates and down payment requirements.

- Farm Service Agency (FSA) Youth Loans: Available for young people aged 10-20 for small agriculture-related projects.

- State-specific programs: Both Texas and New Mexico offer state-level programs to support young farmers.

These programs aim to lower the barriers to entry for new farmers, which is crucial for the long-term sustainability of the agricultural sector. At Farmonaut, we support this initiative by offering our cutting-edge GIS technology and remote sensing expertise to help new farmers optimize their operations from day one.

Explore Farmonaut’s API for advanced agricultural insights

Long-Term Farm Credit Options

Long-term farm credit is essential for major investments in land or significant improvements. These loans typically have terms ranging from 15 to 30 years and can be used for various purposes:

- Purchasing large tracts of farmland or ranch property

- Constructing or improving farm buildings

- Implementing large-scale irrigation systems

- Investing in sustainable farming practices

When considering long-term credit, it’s crucial to assess the potential return on investment. This is where Farmonaut’s services can be particularly valuable. Our satellite-based crop health monitoring and AI-driven advisory systems can help you maximize the productivity of your land, ensuring that your long-term investment pays off.

Financing Agricultural Land Improvements

Improving agricultural land can significantly increase its value and productivity. Financing options for land improvements include:

- Equipment Loans: For purchasing tractors, combines, and other essential machinery.

- Irrigation Loans: Specifically for implementing or upgrading irrigation systems.

- Conservation Loans: For projects that improve land sustainability and conservation efforts.

At Farmonaut, we understand the importance of these improvements. Our satellite-based monitoring can help you identify areas that need attention and track the effectiveness of your improvements over time.

Check out our API Developer Docs for integration possibilities

Rural Property Investment Strategies

Investing in rural property, whether for agricultural or recreational purposes, requires careful consideration and strategic planning. Here are some key factors to consider:

- Location: Proximity to markets, water sources, and transportation routes.

- Soil Quality: Essential for agricultural productivity.

- Water Rights: Crucial in arid regions like parts of Texas and New Mexico.

- Zoning and Land Use Regulations: May affect how you can use and develop the property.

Farmonaut’s GIS technology can provide valuable insights into these factors, helping you make informed investment decisions. Our satellite imagery and data analysis can offer a comprehensive view of land characteristics that might not be immediately apparent during a site visit.

Agribusiness Financing Solutions

For those looking to expand their agricultural operations into full-fledged agribusinesses, specialized financing solutions are available:

- Operating Lines of Credit: For managing cash flow throughout the growing season.

- Value-Added Producer Grants: To help farmers enter into value-added activities.

- Export Financing: For businesses looking to expand into international markets.

Farmonaut’s services can be particularly valuable for agribusinesses. Our fleet and resource management tools can help optimize operations, while our blockchain-based traceability solutions can enhance your product’s value in the market.

Navigating Legal Considerations in Rural Land Financing

When financing rural land in Texas and New Mexico, it’s crucial to be aware of the legal landscape:

- Water Rights: Especially important in these states with complex water laws.

- Mineral Rights: Often separated from surface rights in Texas and New Mexico.

- Easements and Rights of Way: May affect land use and value.

- Environmental Regulations: Can impact land use and development potential.

While Farmonaut’s primary focus is on agricultural technology, our satellite imagery and GIS tools can provide valuable data to support your legal due diligence process.

“Long-term farm credit options and specialized loans cater to both seasoned agriculturists and young farmers entering the industry.”

Financial Management Tools for Rural Property Owners

Effective financial management is crucial for the success of any rural land investment. Here are some tools and strategies to consider:

- Farm Accounting Software: Helps track income, expenses, and profitability.

- Crop Insurance: Protects against losses due to natural disasters or market fluctuations.

- Risk Management Strategies: Including diversification and hedging.

- Tax Planning: Taking advantage of agricultural-specific tax benefits.

At Farmonaut, we believe that good financial management goes hand-in-hand with effective farm management. Our AI-based advisory system, Jeevn AI, can provide insights that help you make informed financial decisions based on real-time data about your crops and land.

Financing Options for Recreational Properties

Texas and New Mexico offer abundant opportunities for recreational land investments. Financing these properties often differs from traditional farm and ranch loans:

- Recreational Land Loans: Specifically designed for non-agricultural rural properties.

- Second Home Mortgages: If the property includes a dwelling.

- Land Bank Financing: Specializes in rural land loans, including for recreational use.

While Farmonaut’s primary focus is on agricultural technology, our satellite imagery and mapping tools can be valuable for recreational property owners as well, helping to monitor land conditions and plan improvements.

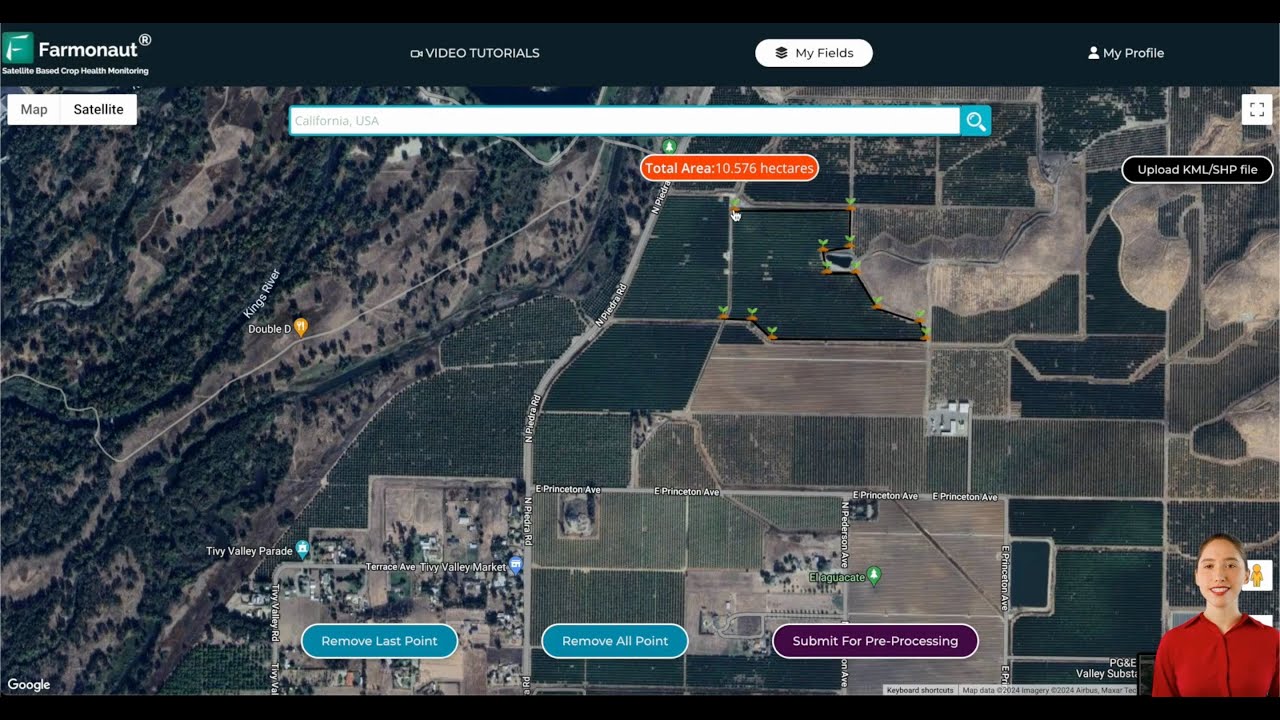

The Role of Technology in Rural Land Financing

Technology is playing an increasingly important role in rural land financing and management:

- Satellite Imagery: Used for property valuation and monitoring.

- Precision Agriculture: Enhances productivity and can increase property value.

- Online Loan Applications: Streamlining the financing process.

- Blockchain: Improving transparency in land transactions and supply chains.

At Farmonaut, we’re at the forefront of this technological revolution in agriculture. Our satellite-based crop health monitoring, AI advisory systems, and blockchain-based traceability solutions can significantly enhance the value and productivity of rural properties.

Comparison of Rural Land Financing Options

| Loan Type | Typical Interest Rates | Loan Terms (years) | Minimum Down Payment (%) | Eligibility Requirements | Pros | Cons |

|---|---|---|---|---|---|---|

| Traditional Farm/Ranch Loans | 3.5% – 6% | 15 – 30 | 20% – 30% | Good credit score, farm income | Flexible terms, competitive rates | Higher down payment |

| Young Farmer/Rancher Programs | 2% – 4% | 20 – 40 | 5% – 10% | Age limit, farming experience | Low rates, low down payment | Age restrictions |

| Recreational Property Loans | 4% – 7% | 15 – 30 | 25% – 35% | Good credit score, income verification | Can finance non-agricultural land | Higher rates than farm loans |

| Agribusiness Expansion Loans | 4% – 8% | 7 – 25 | 15% – 25% | Business plan, financial statements | Can finance operations and land | More complex application process |

| Equipment Financing | 3% – 7% | 3 – 7 | 0% – 20% | Equipment as collateral | Quick approval, equipment serves as collateral | Shorter terms, potential for negative equity |

This table provides a comprehensive overview of the various financing options available for rural land in Texas and New Mexico. It’s important to note that rates and terms can vary based on individual circumstances and market conditions. At Farmonaut, while we don’t provide financing directly, our technology can help you maximize the value and productivity of your land, potentially improving your eligibility for favorable loan terms.

The Impact of Farmonaut’s Technology on Rural Land Investments

While Farmonaut doesn’t directly provide financing, our technology can significantly impact the value and productivity of rural land investments:

- Crop Health Monitoring: Our satellite-based monitoring can help identify issues early, potentially increasing crop yields and land value.

- Resource Management: Our tools can help optimize water and fertilizer use, reducing costs and improving sustainability.

- AI-Driven Insights: Jeevn AI provides personalized recommendations that can enhance farm productivity.

- Blockchain Traceability: Can add value to agricultural products, potentially increasing farm income.

By leveraging these technologies, rural landowners can potentially improve their financial position, making them more attractive to lenders and possibly qualifying for better loan terms.

Frequently Asked Questions

Q: What types of rural properties can be financed in Texas and New Mexico?

A: Financing is available for various rural properties including farms, ranches, orchards, vineyards, and recreational lands like hunting or fishing properties.

Q: Are there special loan programs for first-time farm buyers?

A: Yes, both the USDA and Farm Service Agency offer programs specifically designed for first-time farm buyers, often with more favorable terms.

Q: How does Farmonaut’s technology relate to rural land financing?

A: While Farmonaut doesn’t provide financing, our technology can help improve land productivity and management, potentially increasing property value and improving eligibility for favorable loan terms.

Q: What are patronage dividends in cooperative financing?

A: Patronage dividends are a share of a cooperative’s profits paid to member-owners, effectively reducing the cost of borrowing.

Q: How can satellite imagery help in rural property valuation?

A: Satellite imagery can provide valuable data on land characteristics, crop health, and historical land use, all of which can impact property valuation.

Conclusion

Navigating the world of rural land financing in Texas and New Mexico can be complex, but with the right information and tools, it can also be incredibly rewarding. From traditional farm and ranch loans to innovative cooperative financing models, there are options available to suit a wide range of needs and circumstances.

At Farmonaut, we’re committed to supporting the agricultural community with cutting-edge technology that can enhance the value and productivity of rural lands. While we don’t provide financing directly, our satellite-based farm management solutions, AI-driven insights, and blockchain traceability can be valuable tools for any rural landowner or investor.

Remember, successful rural land investment is about more than just securing financing – it’s about maximizing the potential of your land. Whether you’re a seasoned agriculturist or a newcomer to the industry, combining smart financing choices with advanced agricultural technology can set you on the path to success.

Explore our range of services and see how Farmonaut can support your rural land investment journey. Together, we can unlock the full potential of your agricultural endeavors.