USDA Crop Insurance Update: Key Takeaways from FCIC Board Meeting on Agricultural Risk Management

“The FCIC Board Meeting addressed policies for over 100 different crops, showcasing the diversity of U.S. agriculture.”

Welcome to our comprehensive analysis of the recent Federal Crop Insurance Corporation (FCIC) Board Meeting, a pivotal event in the world of agricultural risk management. As we delve into the key takeaways, we’ll explore how this meeting is shaping the future of crop insurance programs and USDA crop policies. Our goal is to provide you with valuable insights that can help navigate the complex landscape of farm revenue protection and sustainable farming practices.

The Significance of the FCIC Board Meeting

The FCIC Board Meeting, hosted by the Risk Management Agency, stands as a cornerstone event in the agricultural calendar. This gathering brings together key stakeholders from across the United States to discuss and decide on critical aspects of crop insurance and risk management in agriculture. The decisions made here have far-reaching implications for farmers, ranchers, and agricultural businesses across the nation.

In this era of climate uncertainty and market volatility, the importance of robust crop insurance programs cannot be overstated. These programs serve as a safety net for producers, protecting them against unforeseen losses due to natural disasters, price fluctuations, and other risks inherent to farming.

- Addressing climate-smart agriculture

- Enhancing farm revenue protection measures

- Incorporating agricultural technology solutions

- Refining crop yield forecasting methods

As we navigate through the key outcomes of this meeting, we’ll explore how these decisions are set to impact various aspects of farming, from traditional crop production to innovative precision farming techniques.

Embracing Agricultural Technology Solutions

One of the most significant themes emerging from the FCIC Board Meeting was the increased focus on integrating agricultural technology solutions into crop insurance and risk management strategies. The board recognized the potential of these technologies to revolutionize how we approach farming and risk assessment.

Precision farming tools were at the forefront of this discussion. These advanced technologies, which include GPS-guided tractors, drone surveillance, and satellite imaging, are transforming the way farmers monitor and manage their crops. By providing real-time data on crop health, soil conditions, and weather patterns, these tools enable farmers to make more informed decisions, potentially reducing risks and improving yields.

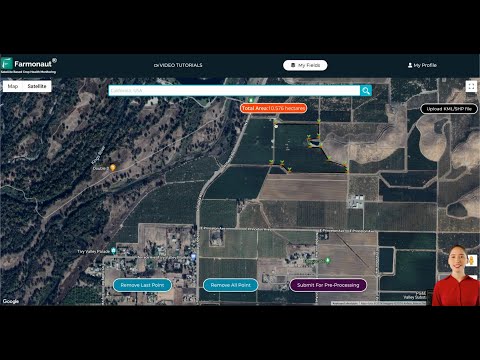

At Farmonaut, we’re at the forefront of this technological revolution in agriculture. Our satellite-based crop health monitoring system provides farmers with crucial insights into their fields’ conditions. This aligns perfectly with the FCIC’s push towards more data-driven farming practices.

Check out our Web App for real-time crop monitoring:

Advancements in Crop Yield Forecasting

Another crucial area of focus at the FCIC Board Meeting was the advancement of crop yield forecasting techniques. Accurate yield predictions are essential for both farmers and insurance providers to make informed decisions about coverage and risk management strategies.

The board discussed several innovative approaches to improve the accuracy of yield forecasts:

- Integration of machine learning algorithms

- Utilization of big data from multiple sources

- Incorporation of climate models for long-term predictions

- Use of satellite imagery for large-scale crop assessment

These advancements in forecasting are expected to lead to more precise insurance policies and better risk assessment tools for farmers. By leveraging these technologies, the USDA aims to offer more tailored and effective crop insurance programs that reflect the actual risks faced by producers in different regions.

“Recent USDA data shows that crop insurance programs cover approximately 80% of all planted cropland in the United States.”

Climate-Smart Agriculture: A New Focus

The FCIC Board Meeting placed significant emphasis on climate-smart agriculture, recognizing the growing challenges posed by climate change to the farming sector. This approach aims to increase agricultural productivity sustainably while adapting to and mitigating the effects of climate change.

Key aspects of climate-smart agriculture discussed at the meeting include:

- Promoting soil health and conservation practices

- Encouraging water-efficient irrigation systems

- Supporting the adoption of drought-resistant crop varieties

- Incentivizing carbon sequestration practices

The board explored ways to incorporate these practices into existing crop insurance programs, potentially offering premium discounts or expanded coverage for farmers who implement climate-smart techniques. This move signals a shift towards a more holistic approach to risk management in agriculture, one that considers long-term sustainability alongside short-term protection.

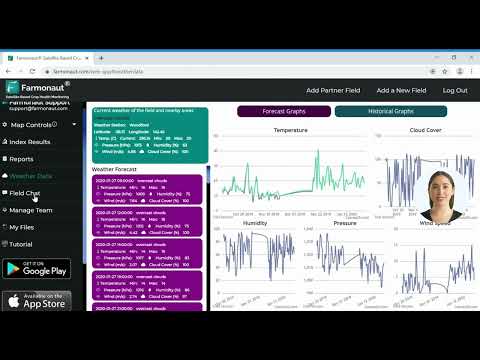

At Farmonaut, we’re committed to supporting climate-smart agriculture through our advanced monitoring tools. Our satellite-based technology helps farmers track soil moisture levels and crop health, enabling them to make environmentally conscious decisions.

Explore our solutions on mobile:

Evolving Farm Revenue Protection Measures

A significant portion of the FCIC Board Meeting was dedicated to discussing and refining farm revenue protection measures. These programs are crucial in providing farmers with a safety net against both yield losses and price declines, offering a more comprehensive form of protection than traditional yield-based insurance.

The board reviewed several existing revenue protection policies and proposed modifications to enhance their effectiveness:

- Expanding coverage options for specialty crops

- Adjusting price discovery mechanisms to better reflect market realities

- Introducing new tools for managing revenue risks in volatile markets

- Exploring ways to integrate futures market data into policy calculations

These discussions aimed to create more flexible and responsive revenue protection options that can adapt to the dynamic nature of agricultural markets. The goal is to provide farmers with tools that not only protect against catastrophic losses but also help stabilize farm income in the face of market fluctuations.

Digital Farm Management: The Future of Agriculture

The FCIC Board Meeting highlighted the growing importance of digital farm management in modern agriculture. This approach leverages technology to streamline farm operations, improve decision-making, and enhance overall productivity.

Key aspects of digital farm management discussed include:

- Implementation of farm management software for record-keeping and analysis

- Use of IoT devices for real-time monitoring of farm conditions

- Integration of data analytics for optimized resource allocation

- Adoption of mobile apps for on-the-go farm management

The board explored ways to incentivize the adoption of these digital tools through crop insurance programs. This could include offering premium discounts for farmers who implement comprehensive digital management systems, recognizing that these tools can significantly reduce risks and improve farm efficiency.

At Farmonaut, we’re proud to be at the forefront of this digital revolution in agriculture. Our platform offers comprehensive digital farm management solutions, seamlessly integrating satellite data with on-ground information to provide farmers with a complete picture of their operations.

For developers interested in integrating our technology:

Check out our API and API Developer Docs.

Sustainable Farming Practices: A Priority

The FCIC Board Meeting placed a strong emphasis on promoting sustainable farming practices through crop insurance programs. This focus reflects a growing awareness of the long-term benefits of sustainable agriculture, both for individual farmers and for the broader agricultural ecosystem.

Key sustainable practices discussed include:

- Cover cropping to improve soil health

- Reduced tillage techniques to prevent soil erosion

- Integrated pest management to decrease reliance on chemical pesticides

- Crop rotation strategies to maintain soil fertility

The board explored ways to incentivize these practices through crop insurance programs, potentially offering expanded coverage or reduced premiums for farmers who implement sustainable techniques. This approach aims to align risk management strategies with long-term environmental stewardship.

Policy Updates and Their Impact

The FCIC Board Meeting resulted in several key policy updates that will significantly impact the agricultural sector. These changes reflect the evolving needs of farmers and the changing landscape of agricultural risks.

| Crop Type | Previous Policy | New Policy/Update | Potential Impact on Farmers |

|---|---|---|---|

| Corn | Standard yield-based coverage | Enhanced revenue protection with climate considerations | Expected to benefit 70% of corn farmers; may reduce insurance premiums by an estimated 15% |

| Soybeans | Limited options for organic producers | Expanded coverage for organic and non-GMO varieties | Potential 20% increase in insured acreage for specialty soybean crops |

| Wheat | Fixed price election dates | Flexible price election periods to account for market volatility | May improve risk management for up to 60% of wheat producers |

| Specialty Crops | Limited coverage options | Introduction of new policies tailored to regional specialty crops | Could extend insurance protection to an additional 25% of specialty crop growers |

These policy updates demonstrate the FCIC’s commitment to adapting insurance measures to meet the evolving needs of producers across various agricultural sectors. The changes are expected to provide more comprehensive coverage and better risk management tools for a wider range of farming operations.

Regional Considerations in Policy Implementation

The FCIC Board Meeting also addressed the importance of regional specificity in crop insurance policies. Recognizing the diverse agricultural landscapes across the United States, the board discussed strategies to tailor policies to the unique needs of different regions.

- Midwest: Focus on corn and soybean policies, with consideration for flooding risks

- California: Emphasis on specialty crop coverage and drought-resistant practices

- Southern States: Attention to cotton and peanut policies, including hurricane risk management

- Northern Plains: Wheat and small grains coverage, with consideration for extreme temperature fluctuations

This regional approach aims to provide more targeted and effective coverage, acknowledging that farmers in different parts of the country face distinct challenges and risks.

The Role of Technology in Policy Implementation

A significant portion of the FCIC Board Meeting was dedicated to discussing how technology can enhance the implementation and effectiveness of crop insurance policies. The board recognized that technological advancements could streamline processes, improve accuracy, and provide more personalized coverage options.

Key technological considerations included:

- Use of satellite imagery for crop monitoring and damage assessment

- Implementation of blockchain for transparent and efficient claim processing

- Utilization of AI and machine learning for risk assessment and policy pricing

- Development of mobile apps for easy policy management and claims reporting

These technological integrations are expected to make crop insurance more accessible, efficient, and tailored to individual farmer needs. At Farmonaut, we’re excited to see this alignment with our mission of leveraging technology to empower farmers and improve agricultural practices.

Looking Ahead: The Future of Agricultural Risk Management

As we conclude our analysis of the FCIC Board Meeting, it’s clear that the future of agricultural risk management is evolving rapidly. The integration of advanced technologies, the focus on sustainability, and the recognition of regional specificities are all shaping a more robust and responsive crop insurance landscape.

Key takeaways for the future include:

- Continued emphasis on data-driven decision making in policy development

- Greater integration of climate change considerations in risk assessment

- Increased collaboration between technology providers and insurance agencies

- Ongoing efforts to make crop insurance more accessible and user-friendly for farmers

As these changes unfold, farmers and agricultural businesses must stay informed and adaptable. Embracing new technologies and sustainable practices will be crucial for managing risks effectively in an increasingly complex agricultural environment.

How Farmonaut Can Help

At Farmonaut, we’re committed to supporting farmers and agricultural businesses in navigating this evolving landscape. Our satellite-based crop monitoring and management tools align perfectly with the FCIC’s vision for a more technologically integrated and data-driven approach to agriculture.

Our services can help you:

- Monitor crop health in real-time

- Make informed decisions about resource allocation

- Track and manage your farm’s environmental impact

- Stay ahead of potential risks and challenges

By leveraging our technology, you can not only improve your farm’s productivity but also potentially qualify for better insurance rates and coverage options as the industry moves towards rewarding data-driven farming practices.

Farmonaut Subscription Options

Frequently Asked Questions

Q: How will the new FCIC policies affect small-scale farmers?

A: The new policies aim to provide more inclusive coverage options, potentially benefiting small-scale farmers through tailored risk management tools and potentially lower premiums for adopting sustainable practices.

Q: Are there any changes to livestock insurance programs?

A: While the focus was primarily on crop insurance, there were discussions about enhancing livestock risk protection programs, particularly in light of climate change impacts on pasture and forage availability.

Q: How can farmers stay updated on these policy changes?

A: Farmers can stay informed through USDA websites, local FSA offices, and by attending informational sessions often organized by the Risk Management Agency.

Q: Will the new technologies discussed make crop insurance more expensive?

A: While there may be initial costs associated with adopting new technologies, the long-term expectation is that these tools will lead to more accurate risk assessment and potentially lower premiums for farmers who use them effectively.

Q: How does climate-smart agriculture factor into insurance premiums?

A: The FCIC is exploring ways to incentivize climate-smart practices through insurance programs, potentially offering reduced premiums or expanded coverage for farmers who implement these sustainable techniques.

Conclusion

The recent FCIC Board Meeting has set the stage for significant advancements in agricultural risk management. From embracing cutting-edge technologies to promoting sustainable farming practices, these updates reflect a commitment to supporting farmers in an ever-changing agricultural landscape.

As we move forward, it’s clear that the integration of technology, data-driven decision making, and sustainability will play crucial roles in shaping the future of farming and crop insurance. By staying informed and adapting to these changes, farmers and agricultural businesses can position themselves for success in the years to come.

At Farmonaut, we’re excited to be part of this agricultural evolution. Our tools and services are designed to help you navigate these changes, optimize your operations, and make the most of the new opportunities presented by these policy updates. Together, we can work towards a more resilient, sustainable, and prosperous agricultural future.