Maximizing Specialty Crop Protection: Expert Guide to Farm Risk Management and Insurance Programs

“The Whole-Farm Revenue Protection program covers up to $8.5 million in revenue for diversified farms, including specialty crops.”

In today’s ever-changing agricultural landscape, specialty crop protection and farm risk management have become paramount concerns for producers across the United States. As we navigate the complexities of modern farming, it’s crucial to stay informed about the latest trends in crop insurance programs and risk mitigation strategies. In this comprehensive guide, we’ll explore the evolving world of agricultural insurance policies, with a particular focus on specialty crops and the innovative approaches being developed to safeguard farm investments.

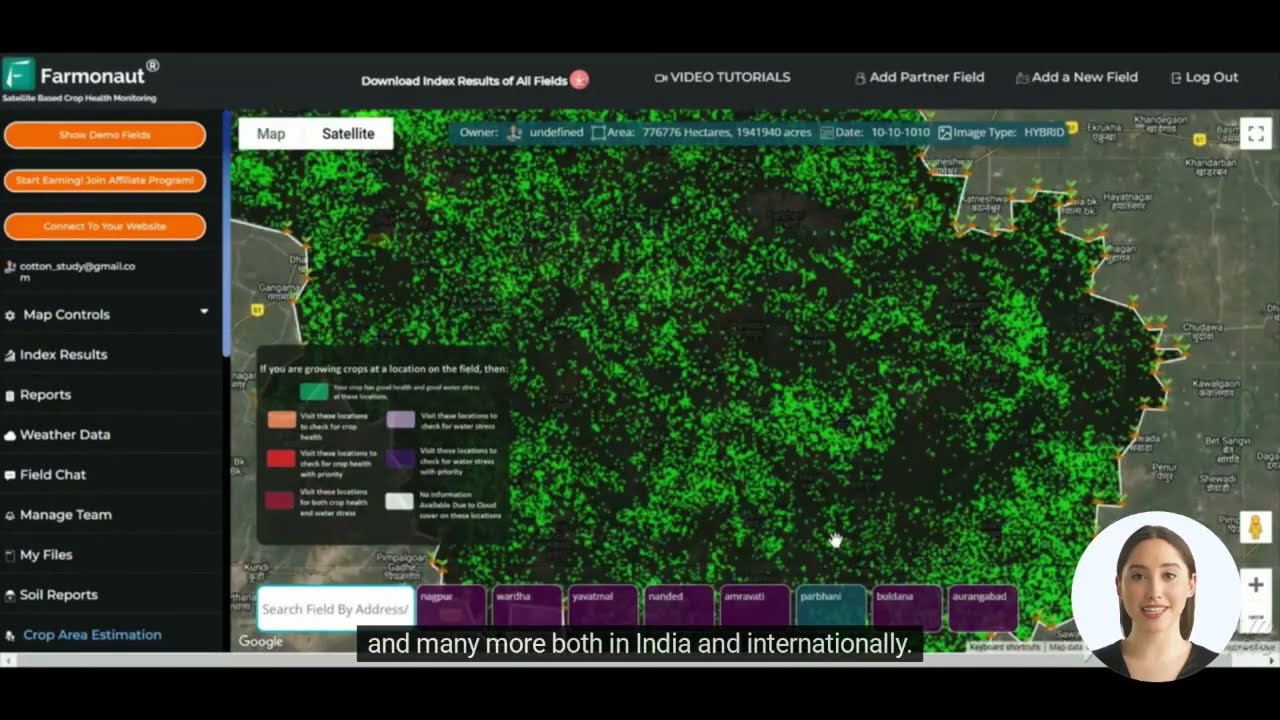

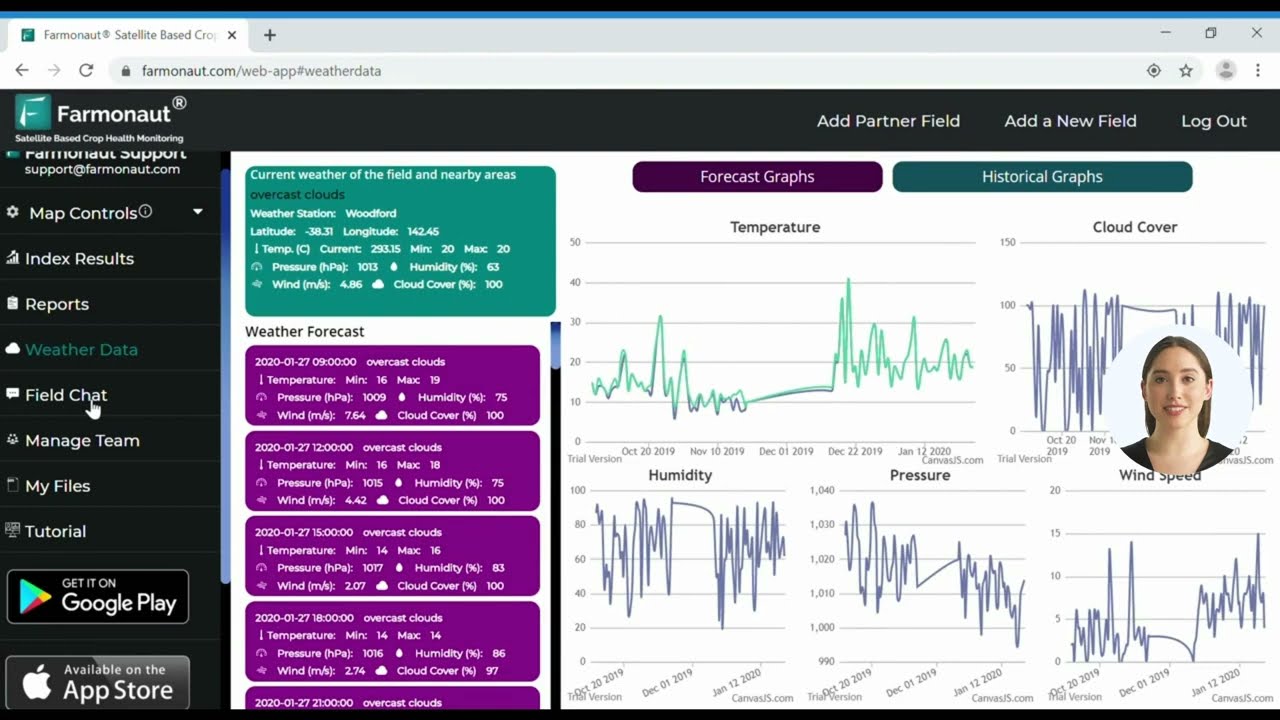

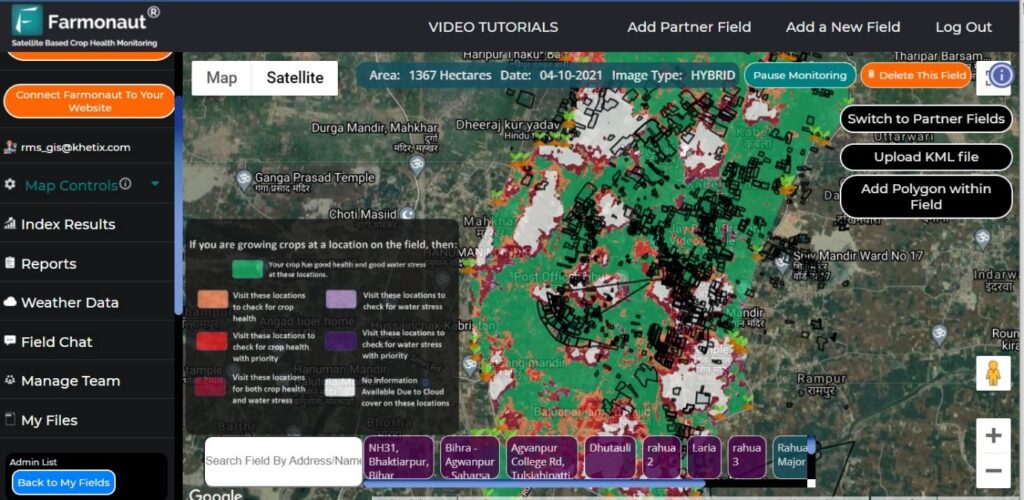

At Farmonaut, we understand the importance of combining cutting-edge technology with robust insurance programs to enhance farm management and risk mitigation. Our satellite-based crop monitoring solutions complement these insurance initiatives, providing farmers with real-time insights to make informed decisions. Let’s delve into the world of specialty crop protection and discover how you can maximize your farm’s resilience in the face of unpredictable challenges.

The Evolution of Crop Insurance Programs

Crop insurance programs have come a long way in recent years, adapting to the changing needs of modern agriculture. The United States Department of Agriculture (USDA) and its Risk Management Agency (RMA) have been at the forefront of developing and expanding coverage options for farmers, particularly those growing specialty crops.

- Expanded Coverage: Today’s crop insurance programs cover a wider variety of crops than ever before, including many specialty and organic products.

- Tailored Solutions: New policies are being designed to address the unique risks faced by different types of farming operations.

- Technology Integration: Advanced tools and data analytics are being incorporated to improve risk assessment and claims processing.

One of the most significant developments in recent years has been the introduction of the Whole-Farm Revenue Protection (WFRP) program. This innovative policy allows farmers to insure all crops on their farm under a single policy, making it particularly beneficial for diversified operations and specialty crop producers.

Explore our web app to see how Farmonaut’s satellite-based monitoring can complement your crop insurance strategy.

Specialty Crop Protection: A Growing Priority

Specialty crops, which include fruits, vegetables, tree nuts, dried fruits, horticulture, and nursery crops, play a crucial role in the agricultural economy. Recognizing their importance, the USDA has been working to expand and improve insurance options for these crops.

- Increased Coverage Options: More specialty crops are now eligible for insurance coverage than ever before.

- Customized Policies: Insurance providers are developing policies tailored to the unique needs of specialty crop growers.

- Risk Management Education: The USDA is investing in programs to educate specialty crop producers about available risk management tools.

One notable initiative is the Specialty Crop Block Grant Program, which provides funding to state departments of agriculture to enhance the competitiveness of specialty crops. This program supports projects that address challenges in areas such as food safety, plant pests and disease, research, and crop-specific issues.

“Specialty crop insurance programs now cover over 80 different types of fruits, vegetables, and nursery crops in the US.”

Essential Farm Risk Management Strategies

Effective farm risk management goes beyond just purchasing insurance. It involves a comprehensive approach to identifying, assessing, and mitigating potential threats to your agricultural operation. Here are some key strategies that every farmer should consider:

- Diversification: Planting a variety of crops or engaging in multiple agricultural activities can help spread risk.

- Technology Adoption: Implementing precision agriculture techniques and using tools like Farmonaut’s satellite-based monitoring can improve decision-making and reduce risks.

- Financial Planning: Maintaining adequate cash reserves and using financial instruments like forward contracts can help manage price volatility.

- Sustainable Practices: Adopting conservation techniques and sustainable farming practices can improve long-term resilience.

- Continuous Education: Staying informed about the latest agricultural trends, technologies, and risk management tools is crucial.

Enhance your risk management strategy with Farmonaut’s API for real-time crop monitoring data.

Organic Farming Insurance: Protecting Natural Practices

The organic farming sector has seen significant growth in recent years, and with it, the need for specialized insurance options has become apparent. The USDA now offers organic price elections for many crops, allowing organic producers to insure their crops at a price that better reflects the higher market value of organic products.

- Contract Price Addendum: This option allows organic farmers to insure their crops at the contract price rather than the conventional price.

- Organic Transitional Coverage: Farmers transitioning to organic production can now insure their crops at a higher price during the transition period.

- Whole-Farm Revenue Protection: This program is particularly beneficial for diversified organic operations, as it allows farmers to insure their entire farm revenue under one policy.

By offering these specialized options, the USDA is helping to level the playing field for organic producers and encouraging the growth of this important sector of agriculture.

Whole-Farm Revenue Protection: A Comprehensive Approach

The Whole-Farm Revenue Protection (WFRP) program represents a significant shift in crop insurance, offering a more holistic approach to farm risk management. This innovative program allows farmers to insure all crops and livestock on their farm under a single policy, making it particularly valuable for diversified operations and specialty crop producers.

- Coverage up to $8.5 million in revenue

- Includes both crops and livestock

- Ideal for diversified farms and specialty crop producers

- Offers coverage levels from 50% to 85%

- Provides replant coverage for annual crops

WFRP is especially beneficial for farmers who grow multiple crops or engage in value-added activities, as it allows them to protect their entire operation rather than insuring each crop separately.

Download our Android app or iOS app to complement your whole-farm risk management strategy with real-time crop monitoring.

| Insurance Program | Covered Crops | Coverage Type | Max Coverage Level | Eligibility | Key Benefits |

|---|---|---|---|---|---|

| Whole-Farm Revenue Protection | All crops and livestock | Revenue | 85% | Diversified farms | Comprehensive coverage, single policy |

| Organic Crop Insurance | Certified organic crops | Yield or Revenue | Varies by crop | Certified organic producers | Higher price elections, contract price option |

| Nursery Crop Insurance | Nursery plants | Inventory Value | 75% | Licensed nurseries | Protects against weather and disease losses |

| Specialty Crop Block Grant Program | Various specialty crops | Project Funding | N/A | State departments of agriculture | Enhances competitiveness of specialty crops |

| Noninsured Crop Disaster Assistance Program | Crops not eligible for standard insurance | Yield | 65% | Producers of non-insurable crops | Provides coverage when no other options exist |

Crop Loss Coverage and Agricultural Disaster Relief

In the face of increasing climate variability and extreme weather events, robust crop loss coverage and agricultural disaster relief programs have become essential components of farm risk management. The USDA offers several programs designed to help farmers recover from natural disasters and other catastrophic events.

- Emergency Conservation Program (ECP): Provides funding for farmers to rehabilitate farmland damaged by natural disasters.

- Livestock Indemnity Program (LIP): Offers compensation for livestock deaths caused by adverse weather or attacks by animals reintroduced by the federal government.

- Tree Assistance Program (TAP): Provides financial assistance to qualifying orchardists and nursery tree growers to replant or rehabilitate eligible trees, bushes, and vines damaged by natural disasters.

- Noninsured Crop Disaster Assistance Program (NAP): Provides financial assistance to producers of non-insurable crops when low yields, loss of inventory, or prevented planting occur due to natural disasters.

These programs work in tandem with crop insurance to provide a safety net for farmers facing unforeseen challenges. It’s crucial for producers to understand the available options and how they can be integrated into a comprehensive risk management strategy.

Resources for Beginning Farmers

Starting a farm can be a daunting task, especially when it comes to understanding and implementing risk management strategies. Recognizing this challenge, the USDA and various agricultural organizations offer resources specifically tailored to beginning farmers.

- Beginning Farmer and Rancher Development Program: Provides grants to organizations for education, mentoring, and technical assistance to beginning farmers and ranchers.

- Farm Service Agency (FSA) Loans: Offers loans with favorable terms to help beginning farmers get started.

- Risk Management Education Programs: Provides training and resources to help new farmers understand and implement risk management strategies.

- Crop Insurance Benefits: Beginning farmers may be eligible for additional benefits under federal crop insurance programs, such as waived administrative fees and higher premium subsidies.

These resources aim to give new farmers the knowledge and tools they need to build resilient and successful agricultural operations from the start.

Nursery Crop Insurance: Protecting Specialized Production

Nursery operations face unique risks due to the specialized nature of their products and the long production cycles involved. The USDA’s Nursery Crop Insurance program is designed to address these specific challenges.

- Covers losses due to adverse weather, fire, wildlife, earthquake, or volcanic eruption

- Insures the wholesale value of plants

- Offers coverage for both container and field-grown plants

- Provides options for basic and additional coverage

- Includes a rehabilitation endorsement for damaged plants

This specialized insurance program helps nursery owners protect their investments and ensure the continuity of their operations in the face of unforeseen events.

Explore our API Developer Docs to integrate Farmonaut’s technology into your nursery management systems.

Innovative Approaches to Managing Farm Risks

As agriculture continues to evolve, new and innovative approaches to managing farm risks are emerging. These strategies often combine traditional insurance products with cutting-edge technology and data analysis.

- Index-Based Insurance: Uses measurable indices like rainfall or temperature to trigger payouts, reducing the need for on-farm loss assessments.

- Precision Agriculture: Utilizes technologies like GPS, satellite imaging, and IoT sensors to optimize crop management and reduce risks.

- Climate-Smart Agriculture: Implements practices that increase productivity while adapting to and mitigating climate change.

- Blockchain in Agriculture: Enhances traceability and transparency in the supply chain, reducing risks related to food safety and market access.

At Farmonaut, we’re at the forefront of these innovations, offering satellite-based crop monitoring solutions that provide real-time insights to help farmers make informed decisions and mitigate risks effectively.

Policy Provisions and Actuarial Information

Understanding the intricacies of crop insurance policies and their actuarial information is crucial for making informed decisions about risk management. Key aspects to consider include:

- Coverage Levels: The percentage of your expected yield or revenue that you choose to insure.

- Unit Structure: How your acreage is divided for insurance purposes (basic, optional, or enterprise units).

- Price Elections: The price per unit of production used to determine premium and indemnity payments.

- Yield History: Your Actual Production History (APH) used to establish your insurance guarantee.

- Endorsements and Options: Additional coverages that can be added to your policy to tailor it to your specific needs.

It’s important to work closely with a crop insurance agent to understand these elements and how they apply to your specific situation. Regular review of your policies and actuarial information can help ensure that your coverage remains adequate as your operation evolves.

The Role of Technology in Farm Risk Management

Technology is playing an increasingly important role in farm risk management, offering new ways to monitor crops, predict weather patterns, and make informed decisions. At Farmonaut, we’re proud to be at the forefront of this technological revolution in agriculture.

- Satellite-Based Crop Monitoring: Our advanced satellite imagery provides real-time insights into crop health, allowing farmers to identify and address issues before they become critical.

- AI-Powered Advisory Systems: Our Jeevn AI system analyzes multiple data points to provide personalized recommendations for crop management.

- Blockchain-Based Traceability: We offer solutions to enhance supply chain transparency, reducing risks related to food safety and market access.

- Weather Forecasting: Our platform integrates advanced weather forecasting to help farmers plan and mitigate weather-related risks.

By leveraging these technologies, farmers can complement their insurance coverage with proactive risk management strategies, creating a more resilient and profitable operation.

Ready to enhance your farm’s risk management strategy? Try Farmonaut’s solutions today:

Frequently Asked Questions

Q: What is Whole-Farm Revenue Protection?

A: Whole-Farm Revenue Protection is a risk management safety net that allows farmers to insure all crops and livestock on their farm under a single policy. It’s particularly beneficial for diversified farms and specialty crop producers.

Q: How can beginning farmers access crop insurance resources?

A: Beginning farmers can access resources through the USDA’s Beginning Farmer and Rancher Development Program, Farm Service Agency loans, and various risk management education programs. They may also be eligible for additional benefits under federal crop insurance programs.

Q: What types of disasters are covered by agricultural disaster relief programs?

A: Agricultural disaster relief programs typically cover losses due to natural disasters such as droughts, floods, hurricanes, wildfires, and severe storms. Some programs also cover losses due to plant diseases or pest infestations.

Q: How can technology like Farmonaut’s solutions complement crop insurance?

A: Farmonaut’s satellite-based crop monitoring and AI-powered advisory systems provide real-time insights into crop health and weather patterns. This information allows farmers to make proactive decisions, potentially reducing the likelihood and severity of crop losses, which complements the protection provided by crop insurance.

Q: What is index-based insurance, and how does it differ from traditional crop insurance?

A: Index-based insurance uses measurable indices like rainfall or temperature to trigger payouts, rather than assessing actual on-farm losses. This can streamline the claims process and reduce administrative costs, but it may not always perfectly match individual farm losses.

Conclusion: Empowering Farmers Through Knowledge and Technology

As we’ve explored in this comprehensive guide, effective farm risk management and specialty crop protection require a multifaceted approach. From understanding the nuances of crop insurance programs to leveraging cutting-edge technology, today’s farmers have more tools than ever at their disposal to safeguard their operations.

At Farmonaut, we’re committed to supporting farmers in this journey by providing advanced satellite-based monitoring solutions that complement traditional risk management strategies. By combining robust insurance coverage with real-time crop insights, farmers can build more resilient and profitable operations.

Remember, the key to successful risk management lies in staying informed, being proactive, and leveraging all available resources. Whether you’re a seasoned farmer or just starting out, there’s always more to learn and new strategies to implement.

We encourage you to explore the various insurance programs and technological solutions discussed in this guide. Consider how they might fit into your operation and don’t hesitate to reach out to crop insurance agents, USDA representatives, or our team at Farmonaut for more information.

By staying ahead of the curve in farm risk management and specialty crop protection, you’re not just safeguarding your livelihood – you’re contributing to a more resilient and sustainable agricultural future for all.