Louisiana Farmers: Secure Your 2025 Crop Insurance Before the September Deadline

“Louisiana farmers have until September 30, 2024, to secure or adjust crop insurance for the 2025 crop year.”

As we approach a crucial juncture for Louisiana’s agricultural community, we at Farmonaut are committed to keeping our farmers informed and prepared. The upcoming crop insurance deadline for the 2025 crop year is a pivotal moment for our state’s producers, particularly those cultivating oats, sugarcane, and wheat. In this comprehensive guide, we’ll explore the intricacies of crop insurance, its importance in farm risk management, and the steps you need to take to secure your agricultural safety net before the September 30, 2024 deadline.

Understanding the Importance of Crop Insurance in Louisiana

Crop insurance serves as a vital safeguard for farmers against the unpredictable nature of agriculture. In Louisiana, where weather patterns can be particularly volatile, this financial protection is more crucial than ever. The United States Department of Agriculture (USDA) and its Risk Management Agency (RMA) have established crop insurance programs to provide a safety net for producers, ensuring the stability of both individual farms and the broader rural agricultural economy.

Key benefits of crop insurance include:

- Protection against yield loss due to natural disasters

- Mitigation of financial risks from market fluctuations

- Support for sustainable and climate-smart farming practices

- Enhanced ability to secure farm loans and credit

The September 30, 2024 Deadline: What You Need to Know

As the crop insurance deadline nears, it’s crucial for Louisiana farmers to understand the significance of this date. September 30, 2024, marks the final day for producers to either apply for new coverage or make adjustments to existing policies for the 2025 crop year. This deadline applies to several key crops in our state, including oats, sugarcane, and wheat.

“The USDA’s crop insurance program covers three key Louisiana crops: oats, sugarcane, and wheat.”

To help you navigate this process, we’ve compiled a table comparing crop insurance options for Louisiana’s major crops:

| Crop Type | Insurance Deadline | Estimated Coverage Options | Potential Benefits |

|---|---|---|---|

| Oats | September 30, 2024 | 50-85% of expected crop value | Protection against yield loss, market price drops |

| Sugarcane | September 30, 2024 | 55-90% of expected crop value | Coverage for production costs, revenue protection |

| Wheat | September 30, 2024 | 50-85% of expected crop value | Yield protection, revenue assurance |

As you can see, each crop has unique coverage options tailored to its specific risks and market conditions. It’s essential to consult with a crop insurance agent to determine the best coverage for your farm’s needs.

Navigating the Crop Insurance Application Process

Applying for or adjusting your crop insurance coverage doesn’t have to be a daunting task. The USDA and RMA have provided several tools to help farmers through this process:

- RMA Cost Estimator: This online tool helps you estimate your premium costs based on your crop type, location, and desired coverage level.

- Agent Locator: Find a licensed crop insurance agent in your area who can guide you through the application process.

- Actuarial Information Browser: Access detailed information about crop insurance options and rates for your specific county.

To get started, visit the official RMA website and utilize these resources to make informed decisions about your coverage.

The Role of Crop Insurance in Farm Risk Management

Farm risk management is a complex but essential aspect of modern agriculture. Crop insurance plays a crucial role in this strategy by providing a financial buffer against various risks, including:

- Weather-related crop damage (e.g., hurricanes, floods, droughts)

- Pest and disease outbreaks

- Market price volatility

- Unforeseen production challenges

By securing appropriate crop insurance coverage, Louisiana farmers can focus on what they do best – producing high-quality crops – without the constant worry of financial ruin due to factors beyond their control.

Understanding Different Crop Insurance Plans

The USDA offers various crop insurance plans to cater to different farming situations and risk profiles. Some of the most common types include:

- Yield Protection (YP): Protects against production losses due to natural causes.

- Revenue Protection (RP): Covers both yield losses and price declines.

- Area Risk Protection Insurance (ARPI): Based on county-wide production losses rather than individual farm losses.

- Whole-Farm Revenue Protection (WFRP): Covers revenue for all commodities on a farm under one policy.

Each of these plans has its own set of benefits and considerations. It’s crucial to discuss these options with a crop insurance agent to determine which plan aligns best with your farm’s needs and risk tolerance.

The Impact of Climate Change on Crop Insurance

As climate patterns continue to shift, the importance of crop insurance in Louisiana’s agricultural landscape becomes even more pronounced. Extreme weather events, such as hurricanes and prolonged droughts, are becoming more frequent and severe, posing increased risks to crop yields and farm revenue.

The USDA and RMA are continually updating their crop insurance programs to address these evolving challenges. By participating in these programs, Louisiana farmers not only protect their own operations but also contribute to the development of more resilient and climate-smart farming practices.

Leveraging Technology in Crop Insurance and Farm Management

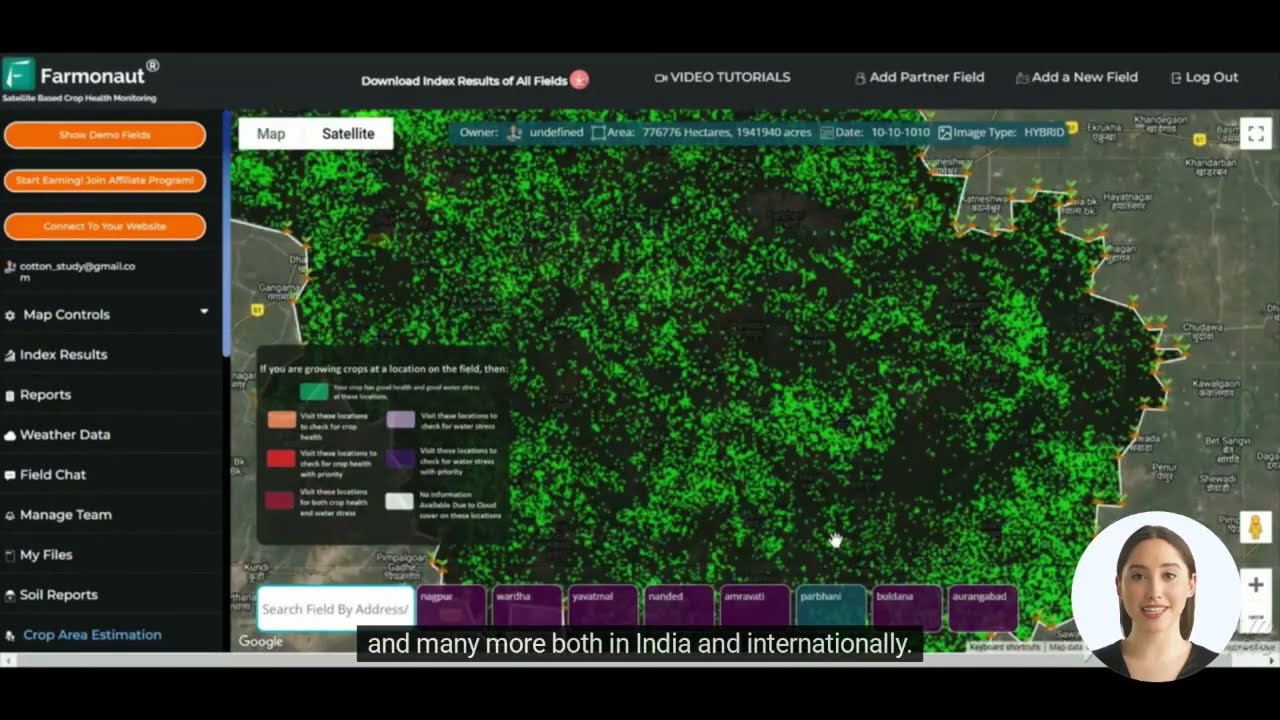

In today’s digital age, farmers have access to a wealth of technological tools to enhance their crop insurance decisions and overall farm management. At Farmonaut, we’re proud to offer cutting-edge solutions that complement and enhance traditional crop insurance strategies:

- Satellite-Based Crop Health Monitoring: Our advanced technology provides real-time insights into crop health, helping farmers make informed decisions about irrigation, fertilization, and pest management. This data can be invaluable when discussing coverage needs with insurance agents.

- AI-Driven Advisory Systems: Our Jeevn AI system offers personalized recommendations based on satellite data and other inputs, helping farmers optimize their practices and potentially reduce their risk profile.

- Blockchain-Based Traceability: While not directly related to crop insurance, our traceability solutions can help farmers demonstrate their adherence to best practices, potentially influencing insurance premiums in the long run.

To explore how Farmonaut’s technology can complement your crop insurance strategy, check out our range of solutions:

The Broader Impact of Crop Insurance on Louisiana’s Agricultural Economy

The importance of crop insurance extends beyond individual farms. By providing a safety net for producers, crop insurance helps stabilize the entire rural agricultural economy of Louisiana. This stability has several positive effects:

- Encourages continued investment in agriculture

- Supports job creation and retention in rural communities

- Helps maintain a steady food supply for consumers

- Contributes to the overall economic health of the state

As such, when Louisiana farmers secure their crop insurance before the September deadline, they’re not just protecting their own operations – they’re contributing to the resilience of our entire agricultural sector.

Crop Insurance and Sustainable Agriculture

The USDA’s crop insurance program is increasingly aligned with sustainable and climate-smart farming practices. This alignment serves multiple purposes:

- Encouraging farmers to adopt environmentally friendly techniques

- Reducing long-term risks associated with climate change

- Promoting soil health and biodiversity

- Ensuring the long-term viability of American agriculture

By participating in crop insurance programs and adopting sustainable practices, Louisiana farmers can contribute to a more resilient and environmentally responsible agricultural sector.

Understanding Premium Calculations and Subsidies

One of the most common questions we receive from farmers is about how crop insurance premiums are calculated. While the exact formula can be complex, several factors generally influence your premium:

- Crop type and expected yield

- Coverage level selected

- Historical loss experience in your area

- Market price of the insured crop

It’s important to note that the federal government subsidizes a significant portion of crop insurance premiums to make coverage more affordable for farmers. The level of subsidy varies depending on the coverage level and plan type chosen.

To get a more accurate estimate of your potential premiums, we recommend using the RMA’s Cost Estimator tool. This online resource can provide you with a ballpark figure based on your specific circumstances.

The Role of Crop Insurance Agents

While online tools and resources are invaluable, the expertise of a qualified crop insurance agent cannot be overstated. These professionals can:

- Help you understand the nuances of different coverage options

- Assist in accurately assessing your farm’s risk profile

- Guide you through the application process

- Provide ongoing support throughout the crop year

To find a licensed crop insurance agent in your area, use the RMA’s Agent Locator tool. We strongly recommend scheduling a consultation well before the September 30 deadline to ensure you have ample time to make informed decisions about your coverage.

Preparing for Your Crop Insurance Application

To streamline your crop insurance application process, gather the following information before meeting with your agent:

- Detailed farm records, including historical yield data

- Current and projected planting plans

- Financial statements and tax returns

- Any relevant information about your farm’s risk management practices

Having this information readily available will help your agent provide the most accurate and beneficial coverage recommendations for your farm.

Beyond Traditional Crop Insurance: Exploring Additional Risk Management Tools

While crop insurance is a cornerstone of farm risk management, it’s not the only tool available to Louisiana farmers. Consider complementing your insurance coverage with:

- Diversification: Planting a variety of crops can help spread risk.

- Forward Contracting: Locking in prices for a portion of your crop before harvest.

- Hedging: Using futures and options markets to manage price risk.

- Conservation Practices: Implementing techniques that improve soil health and water management.

At Farmonaut, we offer tools that can support these risk management strategies. Our satellite-based crop monitoring can help you make informed decisions about diversification and conservation practices. To learn more about how our technology can complement your risk management approach, visit our API page or check out our API Developer Docs.

The Future of Crop Insurance in Louisiana

As we look to the future, crop insurance programs are likely to evolve to meet the changing needs of farmers and address emerging challenges. Some trends we’re watching include:

- Increased integration of precision agriculture data into insurance policies

- Development of new products to address specific regional risks

- Greater emphasis on whole-farm revenue protection

- Enhanced support for beginning farmers and historically underserved producers

By staying informed about these developments and actively participating in crop insurance programs, Louisiana farmers can help shape the future of agricultural risk management in our state.

Frequently Asked Questions

To help address some common queries about crop insurance in Louisiana, we’ve compiled this FAQ section:

- Q: What happens if I miss the September 30, 2024 deadline?

A: Missing the deadline means you won’t be able to secure or adjust coverage for the 2025 crop year. It’s crucial to act before this date to ensure you have adequate protection. - Q: Can I change my coverage after the deadline if my farming plans change?

A: Generally, no. The deadline is firm, which is why it’s important to carefully consider your coverage needs before September 30. - Q: How often should I review my crop insurance coverage?

A: It’s advisable to review your coverage annually, ideally well before the deadline, to ensure it still meets your farm’s needs. - Q: Are organic crops covered differently than conventional crops?

A: Yes, the USDA does offer specific provisions for organic crops. Be sure to discuss this with your insurance agent if you grow organic produce. - Q: How do prevented planting provisions work?

A: Prevented planting coverage provides protection when you’re unable to plant your crop due to an insured cause of loss. The specifics can vary, so consult with your agent for details.

Conclusion: Securing Your Farm’s Future

As we approach the September 30, 2024 deadline for crop insurance applications and adjustments, we encourage all Louisiana farmers to take proactive steps in securing their agricultural safety net. Remember, crop insurance is more than just a financial tool – it’s a crucial component of sustainable farm management and a contributor to the stability of our state’s rural economy.

At Farmonaut, we’re committed to supporting Louisiana’s agricultural community with cutting-edge technology that complements traditional risk management strategies. While we don’t provide crop insurance directly, our satellite-based monitoring and AI-driven advisory systems can provide valuable insights to inform your insurance decisions and overall farm management practices.

Don’t wait until the last minute to secure your 2025 crop insurance. Start the process today by reaching out to a qualified crop insurance agent, exploring your coverage options, and considering how technology can enhance your risk management approach. Together, we can build a more resilient and prosperous future for Louisiana agriculture.