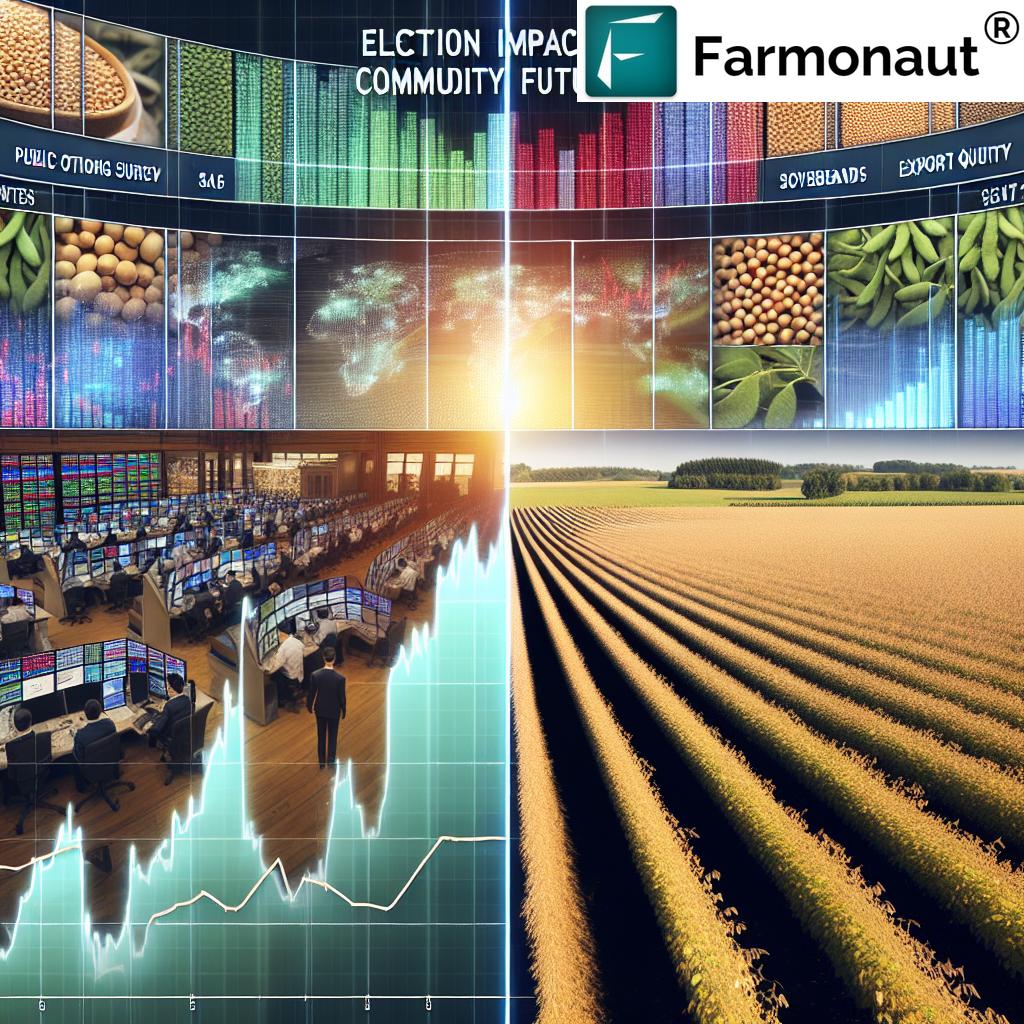

Soybeans Surge: Election Polls Ignite CBOT Rally Amid Global Trade Optimism

In a remarkable turn of events, soybean prices have surged to a one-week high on the Chicago Board of Trade (CBOT), marking the fourth consecutive session of gains. This rally in commodity futures comes amidst a backdrop of strong global demand and positive developments in the U.S. political landscape, showcasing the intricate relationship between US election impact on agriculture and international markets.

CBOT Soybean Rally: A Global Trade Perspective

The most active soybean contract on the CBOT rose 0.2% to $9.99-1/2 a bushel, touching its highest point since October 16 at $10.00 a bushel earlier in the session. This upward trajectory in CBOT grain markets reflects a complex interplay of domestic and international factors influencing agricultural commodity demand.

- Wheat added 0.2% to $5.79-1/2 a bushel

- Corn rose 0.1% to $4.19-1/2 a bushel

These gains across major grains underscore the broader positive sentiment in the agricultural sector, with implications for corn and wheat farming as well as the global wheat trade.

US-China Agricultural Trade Relations: A Delicate Balance

A significant driver behind the soybean prices surge election impact is the evolving narrative around US-China trade relations. Recent polls showing U.S. Vice President Kamala Harris leading former President Donald Trump have eased concerns over potential trade disruptions, particularly in the realm of agricultural exports.

A Reuters/Ipsos poll published on Tuesday showed Harris leading Trump by a 46%-43% margin, reinforcing the view that the race is extraordinarily tight with just two weeks left before the November 5 U.S. presidential election. This political landscape has significant implications for the agricultural sector, as increased tariffs on imports from China could potentially spur retaliation from the leading soybean importer.

For farmers and traders looking to stay ahead of market trends, Farmonaut offers cutting-edge satellite and weather data.

Soybean Export Premiums Hit 14-Month High

In a clear indication of robust agricultural commodity demand outlook, U.S. soybean export premiums have reached their highest levels in 14 months. This surge is driven by grain merchants racing to ship out a record-large U.S. harvest ahead of the presidential election and fears of renewed trade tensions with China.

The rush to export highlights the critical nature of timing in agricultural markets and the profound impact that political events can have on commodity futures election influence. Farmers and exporters are keenly aware of the potential for market volatility and are taking proactive measures to secure favorable prices.

Weather Patterns Shaping Wheat and Corn Market Trends

While soybeans take center stage, significant developments in wheat and corn market trends are also shaping the agricultural landscape:

- Strong rains in Argentina have given a substantial boost to the farming sector after a prolonged drought period.

- This weather shift is “turning the game around” for corn and wheat farmers who had been facing deep losses.

- The Rosario grains exchange reported a significant improvement in crop prospects due to these favorable conditions.

For precise weather forecasts and crop monitoring, check out Farmonaut’s Satellite API. Developers can access comprehensive documentation here.

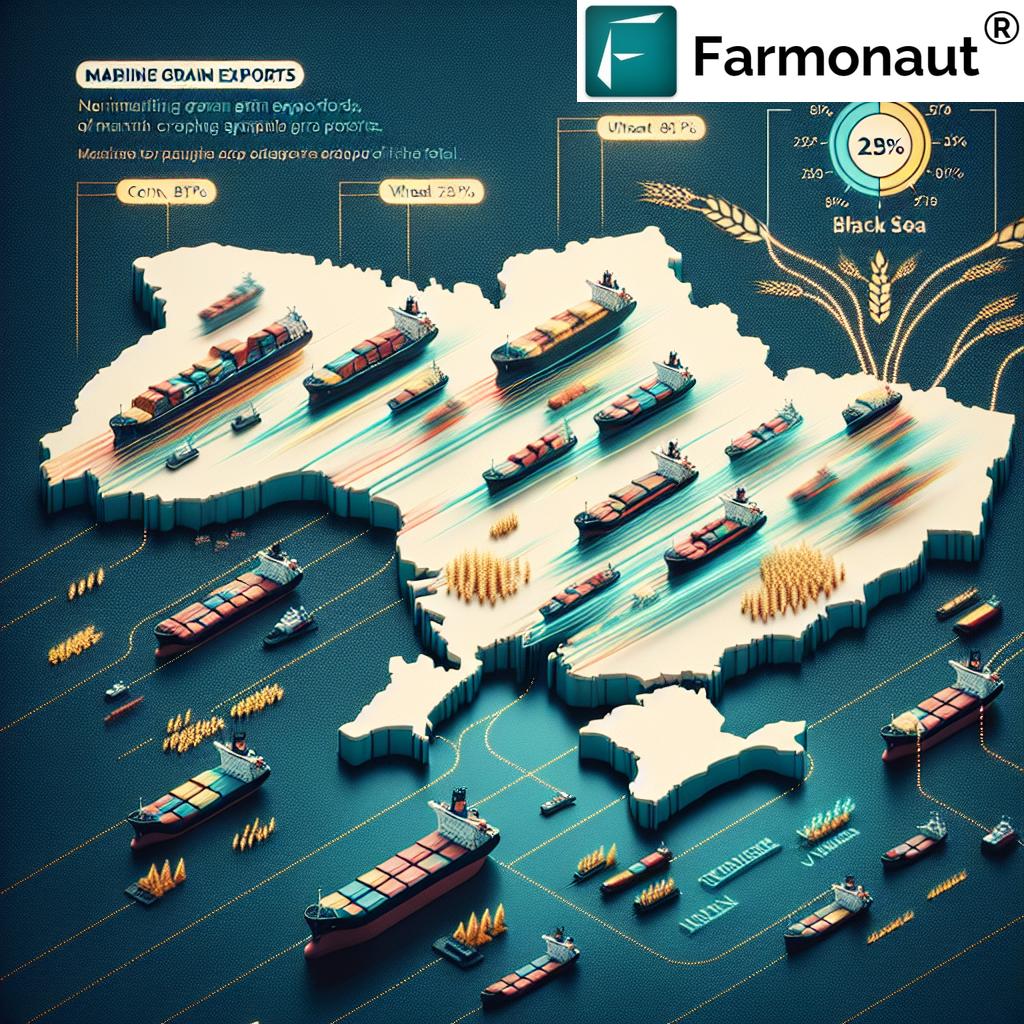

Global Initiatives Influencing Grain Markets

In an interesting development that could have far-reaching implications for the global wheat trade, Russia, the world’s biggest wheat exporter, has proposed the creation of a grain exchange among BRICS countries – Brazil, Russia, India, China, and South Africa. This initiative could potentially expand to include other major commodities such as oil, gas, and metals, reshaping global commodity markets.

This proposal comes at a time when Russia is making efforts to regulate its grain trade, a move that has put some pressure on wheat prices. The interplay between national policies and international trade agreements continues to be a crucial factor in shaping agricultural markets.

Market Sentiment and Fund Activity

The positive sentiment in agricultural markets is further reflected in the activities of commodity funds. Traders reported that funds were net buyers of CBOT corn, soybean, and wheat futures contracts on Wednesday. This buying activity underscores the growing confidence in the agricultural sector, despite broader economic uncertainties.

- Funds were net sellers of soymeal futures contracts

- Soyoil futures contracts saw neutral fund activity

These patterns of fund activity provide valuable insights into market expectations and can be indicative of longer-term trends in agricultural commodity demand.

Broader Economic Context

While agricultural markets show strength, it’s important to note the broader economic context:

- Global stocks edged lower on Wednesday amid tepid trading ahead of the U.S. election

- Gold prices retreated from record highs, dragged down by gains in the U.S. dollar

These movements in other financial markets highlight the interconnected nature of global economies and the need for farmers and traders to maintain a comprehensive view of market dynamics.

Looking Ahead: Key Data and Events

As markets continue to evolve, several upcoming data releases and events will be crucial for shaping future trends:

- France HCOB Manufacturing, Services, and Composite Flash PMIs for October

- Germany HCOB Manufacturing, Services, and Composite Flash PMIs for October

- EU HCOB Manufacturing, Services, and Composite Flash PMIs for October

- UK Flash Composite, Manufacturing, and Services PMIs for October

- US Initial Jobless Claims (Weekly)

- US S&P Global Manufacturing, Services, and Composite Flash PMIs for October

- US New Home Sales Units for September

These economic indicators will provide valuable insights into the overall health of major economies and their potential impact on agricultural markets.

Conclusion: A Dynamic Agricultural Landscape

The current surge in soybean prices, coupled with positive movements in wheat and corn markets, paints a picture of a dynamic and resilient agricultural sector. The interplay between election polls, international trade relations, weather patterns, and global economic factors continues to shape the landscape for farmers, traders, and consumers alike.

As the U.S. presidential election approaches, market participants will need to stay vigilant and adaptable. The potential for rapid changes in trade policies and international relations underscores the importance of timely information and strategic planning in the agricultural sector.

Stay ahead of market trends with Farmonaut’s cutting-edge agricultural technology solutions:

As global agricultural markets continue to evolve, staying informed and leveraging advanced technologies will be key to navigating the challenges and opportunities that lie ahead in this ever-changing landscape.