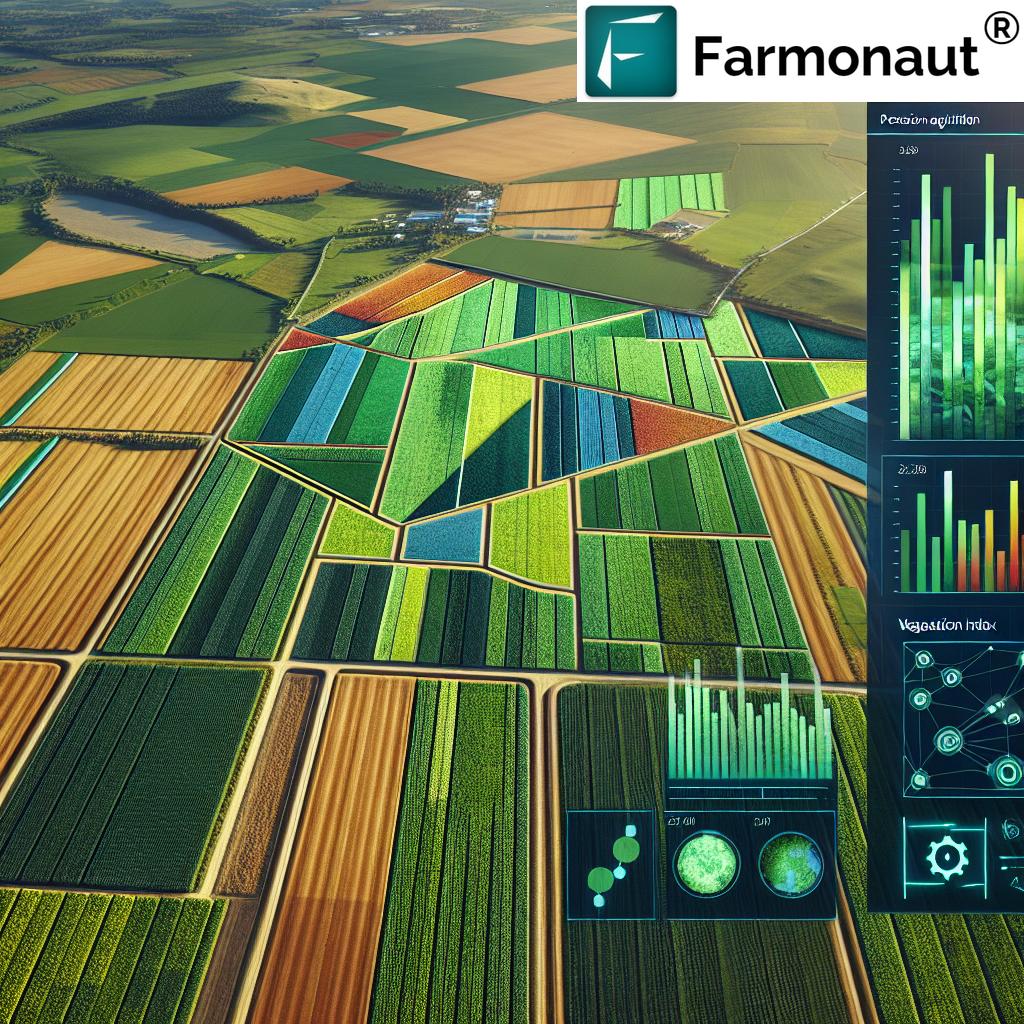

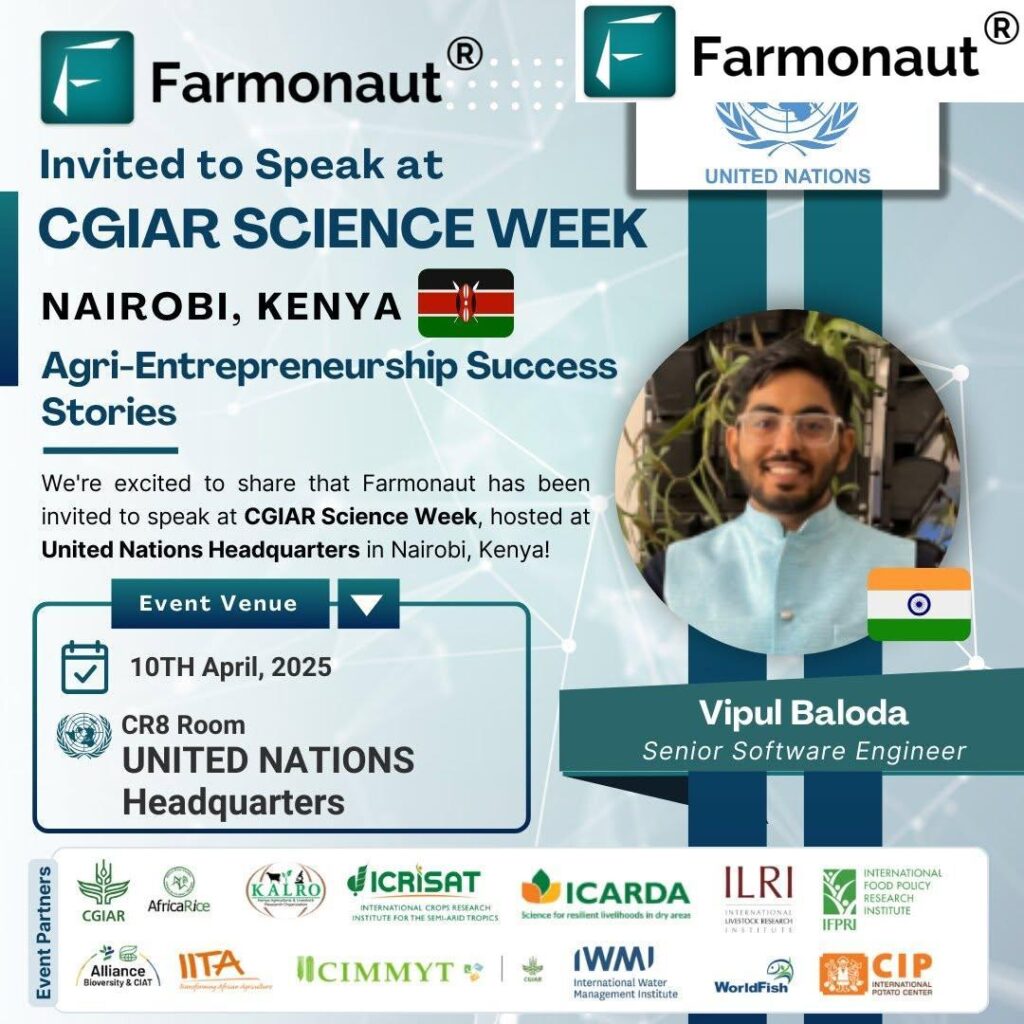

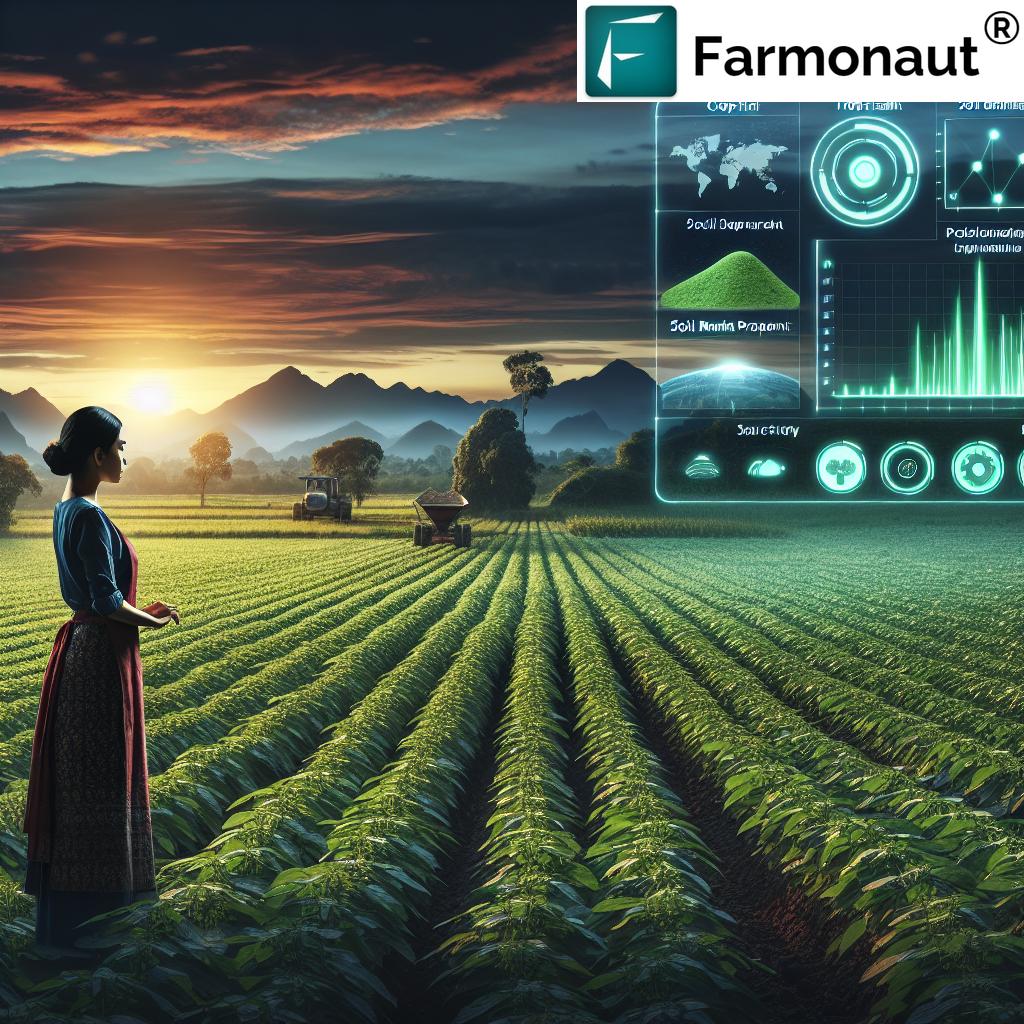

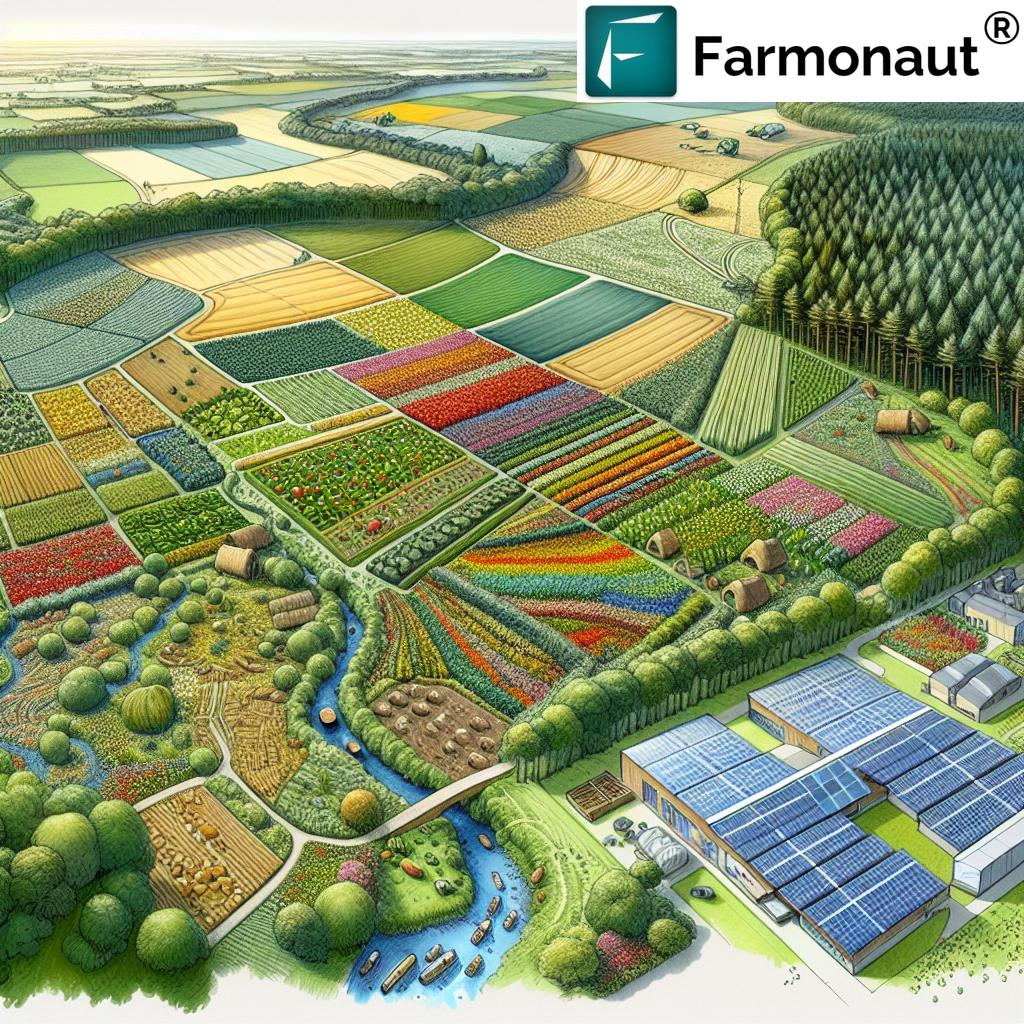

Discover how technology, yield prediction, and smart farming are revolutionizing agriculture in our latest blog. Learn how Farmonaut empowers farmers like Pampapati to make accurate decisions using precision farming insights and satellite yield prediction. With a 95% accuracy rate between forecasted and actual harvest in sugarcane farming, Farmonaut’s solutions show the power of agtech for farmers, improving planning, reducing post-harvest losses, and boosting sustainable agriculture practices. Explore real farmers real results, and see how weather, soil, and crop data turn uncertainty into confident farm management. Supported by FAO predictions, accurate crop forecasts and farm management technology help maximize investments, reduce risks, and secure a better livelihood for every farmer. Whether you’re seeking a sugarcane farming guide or want to make smarter, data-driven decisions for your farm, this article is your gateway to smart farming solutions and actionable advice. Ready to make every season successful? Dive into the full blog now.