Unleashing BRICS Power: Russia’s Bold Move to Dominate Global Grain Prices and Transform Food Security

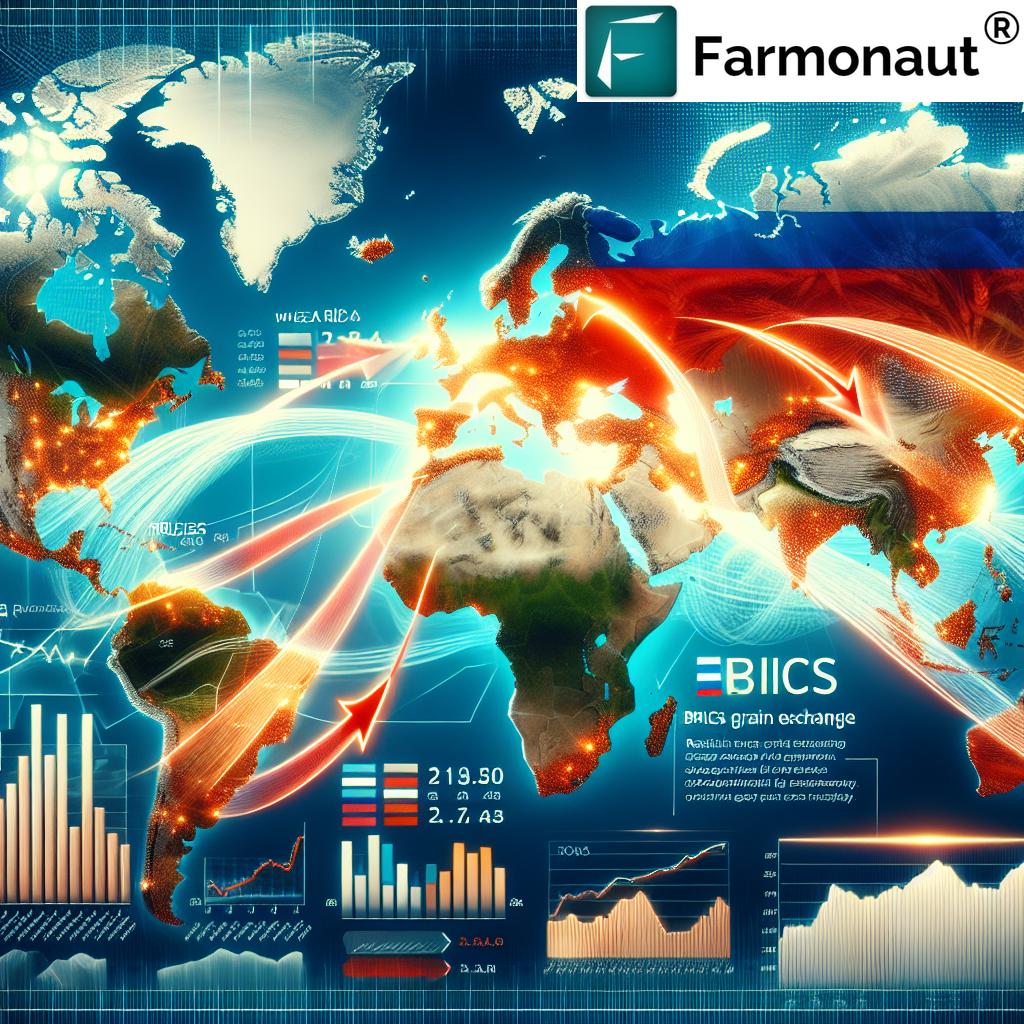

In a groundbreaking development that could reshape the international wheat market, Russia is spearheading an initiative to establish a BRICS grain exchange. This bold move aims to position the BRICS economic bloc as the dominant force in global grain prices, potentially transforming agricultural commodity pricing and food security worldwide.

The Birth of a New Agricultural Powerhouse

The recent three-day BRICS summit in Kazan, Russia, concluded with a declaration that went beyond the headlines about ending “illegal sanctions” against Russia and Iran. Buried within this document was a visionary plan to create a grain exchange within BRICS, a proposal put forth by Russian President Vladimir Putin himself.

This initiative is not just another economic strategy; it’s a calculated move to challenge the existing agricultural commodity pricing mechanisms dominated by Western nations. The proposed exchange aims to rival the Chicago Board of Trade, which has long been the international benchmark for grain futures.

Russia’s Global Wheat Dominance: A Game-Changing Factor

Russia’s position as the world’s leading wheat exporter in 2022 and 2023, with approximately 49 million tonnes exported, gives the BRICS bloc a significant advantage in the agricultural sector. This Russian wheat trade dominance, coupled with Brazil’s leadership in soybean and corn exports, positions BRICS as a formidable force in the global agricultural landscape.

- Russia: Top wheat exporter (49 million tonnes in 2022-2023)

- Brazil: Leading exporter of soybeans and corn

- BRICS countries: Among the world’s largest producers of grains, legumes, and oilseeds

For those interested in leveraging technology for agricultural insights, Farmonaut’s satellite-based crop monitoring app offers valuable tools for farmers and agribusinesses.

The OPEC-Style Wheat Pricing Mechanism: A New Era in Grain Price Formation

The concept of an OPEC for wheat is not just a catchy phrase; it’s a strategic move that could fundamentally alter grain price formation on a global scale. By taking cues from OPEC’s successful model in the oil industry, Russia and its BRICS partners aim to create a similar influence in the agricultural sector.

Hideki Hattori, chief grain analyst at Japanese milling company Nippn, explains, “The creation of a grain exchange, which is an extension of Russia’s most recent moves, is intended to boost price formation power. Strong resistance to the price leadership by Western nations is apparent.”

This Russian-led agricultural influence could lead to significant agricultural commodity pricing shifts, potentially affecting global food prices and accessibility.

BRICS Food Security Strategy: Balancing Power and Responsibility

The BRICS grain exchange is not just about market dominance; it’s also a strategic move towards enhancing global food security. Russia’s approach includes providing surplus wheat to poor countries free of charge, a gesture that could win allies and strengthen the bloc’s geopolitical position.

However, this strategy raises important questions:

- How will this impact food prices in developing nations?

- What are the implications for current global food aid programs?

- How will non-BRICS countries respond to this shift in agricultural power?

For those interested in tracking these global agricultural trends, Farmonaut’s satellite API provides valuable data and insights.

International Grain Market Transformation: Challenges and Opportunities

The establishment of a BRICS grain exchange could lead to a significant international grain market transformation. If Russia, for instance, decides to channel its wheat exports exclusively through this new exchange, it could potentially drive up international prices.

Tsutomu Kosuge, head of commodity research company Marketedge, notes, “At this stage, it is difficult to see the benefits for countries other than Russia, so many countries are taking a wait-and-see stance. However, if trade friction between the U.S. and China worsens under the next U.S. president, China could fall in line.”

This potential shift in the global agricultural landscape presents both challenges and opportunities:

- Potential increase in grain prices benefiting exporting countries

- Possible strain on importing nations, particularly in developing regions

- New opportunities for agricultural technology and innovation

- Shifts in global trade patterns and alliances

For developers looking to integrate agricultural data into their applications, Farmonaut’s API developer docs offer comprehensive guidance.

The BRICS Grain Exchange Impact: A Double-Edged Sword?

While the BRICS grain exchange impact could be substantial, it’s important to note the potential conflicts of interest within the bloc itself. Unlike OPEC, which consists solely of oil-producing nations, BRICS includes both major grain exporters and importers.

For instance:

- Egypt: Second-largest destination for Russian wheat exports

- Iran: Fifth-largest importer of Russian wheat

- China: World’s largest soybean importer, sourcing from both Brazil and the U.S.

These diverse interests within BRICS could lead to differing views on raising grain prices, potentially complicating the implementation and effectiveness of the proposed exchange.

Conclusion: A New Chapter in Global Agriculture

The proposed BRICS grain exchange represents a bold move by Russia and its partners to reshape the global agricultural landscape. By leveraging their collective agricultural might, BRICS countries aim to gain greater control over grain price formation and enhance their influence on global food security.

As this initiative unfolds, it will be crucial for stakeholders across the agricultural sector to stay informed and adapt to these potential changes. The impact of this move could extend far beyond the BRICS nations, affecting global food prices, trade relations, and agricultural policies worldwide.

For those looking to stay ahead in this evolving agricultural landscape, Farmonaut offers cutting-edge tools and data:

As the world watches this bold move by Russia and BRICS, one thing is clear: the global agricultural sector is on the brink of a significant transformation, with far-reaching implications for producers, consumers, and policymakers alike.