Unlock Agritech Potential: Farmonaut’s Guide to Precision Farming and Agricultural Risk Management

“Farmonaut’s precision farming technology analyzes over 10 million data points daily to optimize crop management and reduce risks.”

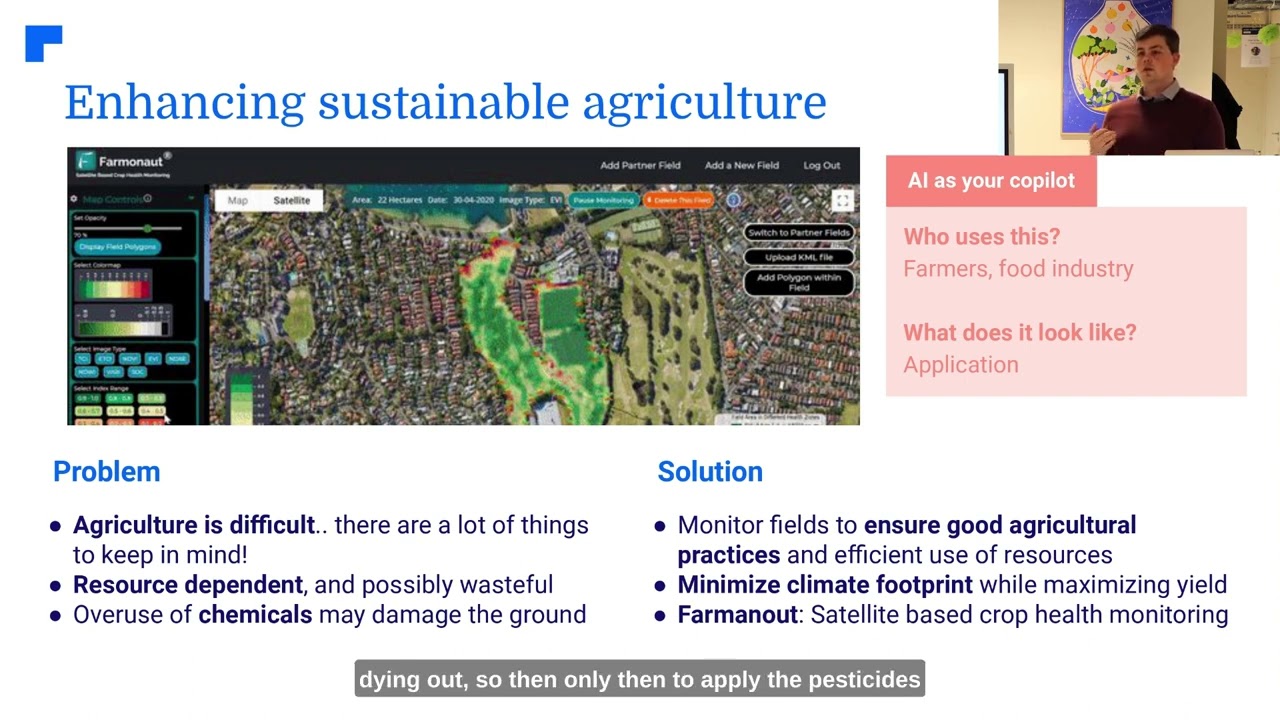

In today’s rapidly evolving agricultural landscape, the convergence of technology and traditional farming practices has given rise to a new era of precision agriculture and risk management. As we delve into the world of agricultural risk management and futures and options trading, we’ll explore how these innovative strategies are revolutionizing the agritech industry. Our focus will be on Farmonaut’s cutting-edge precision farming technology and its role in transforming sustainable agriculture solutions.

At Farmonaut, we’re committed to making precision agriculture accessible and affordable for farmers worldwide. Our platform integrates satellite-based farm management solutions with advanced technologies like artificial intelligence (AI) and blockchain to address various agricultural challenges. Let’s explore how these innovations are shaping the future of farming and risk management.

The Evolution of Agricultural Risk Management

Agricultural risk management has come a long way from traditional methods to modern, data-driven approaches. Today, farmers and agribusinesses have access to sophisticated tools and strategies to mitigate risks and optimize their operations. Let’s take a closer look at some key developments:

- Satellite-Based Crop Monitoring: Advanced satellite imagery allows for real-time crop health assessment, enabling early detection of potential issues.

- AI-Powered Advisory Systems: Artificial intelligence analyzes vast amounts of data to provide personalized recommendations for crop management.

- Blockchain Technology: Enhances traceability and transparency in agricultural supply chains, reducing fraud and improving trust.

- Futures and Options Trading: Provides financial instruments for hedging against price fluctuations in agricultural commodities.

These advancements have revolutionized how we approach agricultural risk management, allowing for more precise decision-making and improved farm efficiency.

Farmonaut’s Precision Farming Technology: A Game-Changer in Agritech

At the forefront of this agricultural revolution is Farmonaut’s precision farming technology. Our platform leverages satellite imagery, AI, and machine learning to provide farmers with invaluable insights into their crops and operations. Here’s how our technology is making a difference:

- Real-Time Crop Health Monitoring: We use multispectral satellite images to assess vegetation health (NDVI), soil moisture levels, and other critical metrics.

- Jeevn AI Advisory System: Our AI-driven tool delivers personalized farm advice, weather forecasts, and expert crop management strategies.

- Resource Optimization: By providing accurate data on crop needs, we help farmers optimize their use of water, fertilizers, and pesticides.

- Risk Mitigation: Early detection of potential issues allows for proactive measures, reducing the risk of crop failure.

To experience the power of Farmonaut’s precision farming technology, visit our web app or download our mobile apps:

The Role of Futures and Options Trading in Agricultural Risk Management

“Agricultural futures trading volume has increased by 300% in the last decade, revolutionizing risk management for farmers.”

Futures and options trading has become an integral part of agricultural risk management. These financial instruments allow farmers and agribusinesses to hedge against price fluctuations in commodities markets. Here’s how they work:

- Futures Contracts: Agreements to buy or sell a specific amount of a commodity at a predetermined price on a future date.

- Options Contracts: Give the holder the right, but not the obligation, to buy (call option) or sell (put option) a commodity at a specified price within a certain timeframe.

By utilizing these tools, farmers can protect themselves against adverse price movements and secure a more stable income. For instance, a wheat farmer can use futures contracts to lock in a price for their harvest months in advance, safeguarding against potential market downturns.

Crop Price Forecasting: A Key Component of Risk Management

Accurate crop price forecasting is essential for effective risk management in agriculture. At Farmonaut, we integrate various data sources to provide reliable price forecasts:

- Historical Price Data: Analyzing past price trends to identify patterns and cycles.

- Supply and Demand Factors: Considering global production levels, consumption patterns, and inventory reports.

- Weather Forecasts: Assessing potential impacts of weather conditions on crop yields and prices.

- Economic Indicators: Factoring in currency exchange rates, trade policies, and other macroeconomic factors.

By leveraging these insights, farmers and traders can make more informed decisions about when to sell their crops or enter into futures and options contracts.

Commodity Market Data Analysis: Empowering Informed Decisions

In the world of agricultural trading, data is king. Commodity market data analysis provides valuable insights that can inform trading strategies and risk management decisions. Key aspects of this analysis include:

- Price Trends: Identifying long-term and short-term price movements in agricultural commodities.

- Volume Analysis: Assessing trading activity to gauge market interest and potential price direction.

- Spread Analysis: Examining price differences between related commodities or contract months.

- Technical Indicators: Utilizing tools like moving averages and relative strength index (RSI) to identify potential entry and exit points.

At Farmonaut, we integrate commodity market data analysis into our platform, providing users with comprehensive insights to support their decision-making processes.

Sustainable Agriculture Solutions: The Farmonaut Approach

Sustainability is at the heart of Farmonaut’s mission. Our precision farming technology not only helps farmers optimize their yields but also promotes environmentally friendly practices. Here’s how we contribute to sustainable agriculture:

- Resource Efficiency: By providing accurate data on crop needs, we help reduce overuse of water, fertilizers, and pesticides.

- Carbon Footprint Tracking: Our platform offers real-time data on emissions, enabling businesses to take steps towards sustainability.

- Biodiversity Preservation: Precision farming techniques help minimize the impact on surrounding ecosystems.

- Soil Health Management: Our AI-powered recommendations promote practices that maintain and improve soil quality.

By embracing these sustainable solutions, farmers can not only reduce their environmental impact but also improve their long-term profitability.

Agricultural Derivatives: A Deep Dive

Agricultural derivatives play a crucial role in modern risk management strategies for farmers and agribusinesses. These financial instruments derive their value from underlying agricultural commodities. Let’s explore some common types of agricultural derivatives:

- Forward Contracts: Agreements between two parties to buy or sell a specific amount of a commodity at a predetermined price on a future date.

- Futures Contracts: Standardized, exchange-traded contracts that obligate the parties to buy or sell a specific amount of a commodity at a predetermined price on a future date.

- Options Contracts: Give the holder the right, but not the obligation, to buy (call option) or sell (put option) a commodity at a specified price within a certain timeframe.

- Swaps: Agreements to exchange cash flows based on the price of an underlying commodity over a specified period.

These derivatives provide farmers and traders with tools to manage price risk, secure future income, and even speculate on market movements. Understanding and effectively using these instruments can significantly enhance agricultural risk management strategies.

Market Analytics: The Backbone of Agritech Trading Strategies

In the fast-paced world of agricultural trading, market analytics serve as the foundation for developing effective strategies. At Farmonaut, we emphasize the importance of data-driven decision-making. Here’s how market analytics contribute to successful agritech trading:

- Historical Data Analysis: Examining past price trends, seasonal patterns, and market reactions to various events.

- Real-Time Market Monitoring: Tracking current price movements, trading volumes, and market sentiment.

- Predictive Modeling: Utilizing advanced algorithms to forecast potential market scenarios.

- Risk Assessment: Evaluating potential risks associated with different trading strategies.

By leveraging these analytical tools, traders can develop more robust strategies, identify potential opportunities, and better manage their risk exposure in the agricultural markets.

Managing Agricultural Portfolios: Best Practices

Effective management of agricultural portfolios requires a combination of strategic planning, risk assessment, and ongoing monitoring. Here are some best practices for managing agricultural portfolios:

- Diversification: Spread risk across different crops, regions, and financial instruments.

- Regular Portfolio Review: Continuously assess and rebalance your portfolio based on market conditions and risk tolerance.

- Use of Hedging Strategies: Implement appropriate hedging techniques to protect against adverse price movements.

- Stay Informed: Keep up-to-date with market news, weather forecasts, and global economic trends that may impact agricultural markets.

- Leverage Technology: Utilize platforms like Farmonaut to access real-time data and analytics for informed decision-making.

By following these practices, farmers and agribusinesses can build more resilient portfolios that can weather market volatility and maximize long-term profitability.

Wheat Futures Trading: A Case Study in Agricultural Risk Management

Wheat futures trading provides an excellent example of how agricultural risk management strategies work in practice. As one of the world’s most important food crops, wheat prices can be highly volatile due to factors such as weather conditions, global demand, and geopolitical events.

Here’s how a wheat farmer might use futures trading to manage risk:

- Market Analysis: The farmer monitors wheat futures prices and market trends.

- Risk Assessment: Based on production costs and desired profit margins, the farmer determines a minimum acceptable selling price.

- Hedging Strategy: If current futures prices are favorable, the farmer sells wheat futures contracts to lock in a price for their upcoming harvest.

- Contract Execution: At harvest time, the farmer sells their physical wheat crop on the spot market and simultaneously buys back the futures contracts.

- Outcome: If wheat prices have fallen, the loss on the physical crop is offset by gains on the futures contracts. If prices have risen, the gain on the physical crop is offset by losses on the futures contracts, but the farmer still achieves their target price.

This strategy allows the farmer to protect against downside risk while still maintaining a predictable income stream. At Farmonaut, we provide the data and insights needed to make informed decisions in wheat futures trading and other agricultural markets.

Global Market Trends: Navigating the Agricultural Landscape

Understanding global market trends is crucial for success in agricultural risk management and trading. Some key trends shaping the agricultural landscape include:

- Climate Change Impact: Shifting weather patterns are affecting crop yields and introducing new uncertainties into agricultural production.

- Technological Adoption: Increased use of precision farming techniques, AI, and blockchain in agriculture is changing how farms operate.

- Changing Consumer Preferences: Growing demand for organic and sustainably produced food is influencing crop choices and farming practices.

- Trade Policy Shifts: International trade agreements and tariffs continue to impact global agricultural markets.

- Emerging Markets Growth: Rising food demand in developing countries is creating new opportunities and challenges for global agriculture.

At Farmonaut, we help our users stay ahead of these trends by providing up-to-date market insights and analysis through our platform.

Leveraging Advanced Analytics for Smarter Farming Decisions

In the age of big data, leveraging advanced analytics is key to making smarter farming decisions. Farmonaut’s platform integrates various data sources and analytical tools to provide comprehensive insights:

- Predictive Analytics: Forecasting crop yields, pest outbreaks, and market trends based on historical data and current conditions.

- Prescriptive Analytics: Providing specific recommendations for crop management, resource allocation, and risk mitigation.

- Geospatial Analytics: Analyzing satellite imagery to assess crop health, soil conditions, and land use patterns.

- Machine Learning Algorithms: Continuously improving predictions and recommendations based on new data inputs.

By harnessing the power of these advanced analytics, farmers can make more informed decisions, optimize their operations, and better manage agricultural risks.

The Future of Agritech: Emerging Technologies and Opportunities

As we look to the future of agritech, several emerging technologies and trends are poised to further revolutionize the industry:

- Internet of Things (IoT): Connected sensors and devices providing real-time data on soil conditions, weather, and crop health.

- Drone Technology: Enabling more precise crop monitoring and targeted application of inputs.

- Gene Editing: Developing crop varieties with improved yield, disease resistance, and nutritional profiles.

- Vertical Farming: Expanding agricultural production in urban areas through innovative growing techniques.

- Artificial Intelligence: Enhancing decision-making processes and automating farm operations.

At Farmonaut, we’re committed to staying at the forefront of these technological advancements, continuously improving our platform to provide the most cutting-edge solutions for our users.

Comparative Analysis of Agricultural Risk Management Strategies

| Strategy | Risk Mitigation Level | Potential ROI | Complexity | Best Suited For | Key Benefits | Potential Drawbacks |

|---|---|---|---|---|---|---|

| Wheat Futures Trading | High | 10-20% | Advanced | Large Enterprises | Price protection, Liquidity | Requires market expertise, Margin calls |

| Crop Insurance | Medium | N/A (Loss Prevention) | Beginner | All Farm Sizes | Financial security, Peace of mind | Premium costs, Limited coverage |

| Diversification | Medium | Varies | Intermediate | Medium to Large Farms | Reduced overall risk, Stable income | Increased complexity, Resource demands |

| Forward Contracts | Medium | 5-15% | Intermediate | All Farm Sizes | Guaranteed price, Simplified planning | Limited upside potential, Counterparty risk |

| Weather Derivatives | Medium | Varies | Advanced | Large Enterprises | Protection against weather risks | Complex pricing, Basis risk |

This comparative analysis highlights the diverse range of risk management strategies available to farmers and agribusinesses. Each approach offers unique benefits and challenges, underscoring the importance of a tailored risk management plan that aligns with individual farm characteristics and risk tolerance levels.

Farmonaut’s Role in Revolutionizing Agricultural Risk Management

As we’ve explored throughout this guide, Farmonaut plays a pivotal role in revolutionizing agricultural risk management through our innovative precision farming technology. Our platform offers:

- Real-Time Data: Access to up-to-date information on crop health, weather conditions, and market trends.

- AI-Powered Insights: Personalized recommendations for crop management and risk mitigation.

- Sustainable Solutions: Tools to optimize resource use and reduce environmental impact.

- User-Friendly Interface: Easy-to-use mobile and web applications for farmers of all tech-savvy levels.

By leveraging Farmonaut’s technology, farmers and agribusinesses can make more informed decisions, reduce risks, and improve their overall profitability.

For developers interested in integrating our powerful satellite and weather data into their own applications, we offer a comprehensive API. Explore our API Developer Docs to learn more about the possibilities.

Conclusion: Embracing the Future of Agriculture

As we’ve explored in this comprehensive guide, the future of agriculture lies at the intersection of technology, data-driven decision-making, and sustainable practices. From precision farming techniques to sophisticated risk management strategies, the tools available to today’s farmers and agribusinesses are more powerful than ever before.

Farmonaut stands at the forefront of this agricultural revolution, offering cutting-edge solutions that make precision agriculture accessible and affordable for farmers worldwide. By leveraging our satellite-based farm management solutions, AI-powered insights, and commitment to sustainability, farmers can optimize their operations, mitigate risks, and contribute to a more resilient and sustainable global food system.

As we look to the future, the continued evolution of agritech promises even greater advancements in agricultural productivity, risk management, and environmental stewardship. By staying informed about market trends, embracing new technologies, and utilizing platforms like Farmonaut, farmers and agribusinesses can position themselves for success in an ever-changing agricultural landscape.

We invite you to join us on this journey towards a smarter, more sustainable future for agriculture. Explore Farmonaut’s solutions and discover how our technology can transform your farming operations today.

FAQ Section

- What is precision farming technology?

Precision farming technology uses data from various sources like satellites, sensors, and weather stations to provide detailed insights about farm conditions, enabling farmers to make more precise decisions about crop management. - How does Farmonaut’s platform help in agricultural risk management?

Farmonaut’s platform provides real-time crop health monitoring, AI-powered advisory services, and data analytics tools that help farmers identify potential risks early and make informed decisions to mitigate them. - What are agricultural derivatives?

Agricultural derivatives are financial instruments whose value is derived from underlying agricultural commodities. They include futures contracts, options, and swaps, which are used for risk management and price speculation in agricultural markets. - How can farmers benefit from futures and options trading?

Farmers can use futures and options trading to lock in prices for their crops in advance, protecting themselves against potential price drops and ensuring a more stable income. - What is the role of AI in modern agriculture?

AI in agriculture helps analyze vast amounts of data to provide personalized recommendations for crop management, predict potential issues, and optimize resource use, leading to improved farm efficiency and productivity.