Shocking Trump Surge Rattles Grain Markets: Trade War Fears Ignite CBOT Futures Plunge

In a stunning turn of events, the Trump election impact on agriculture has sent shockwaves through the US grain futures market, causing a significant plunge in Chicago Board of Trade (CBOT) futures. As early results from the U.S. presidential election show Donald Trump taking the lead, fears of renewed trade wars have gripped the agricultural commodity markets, leading to a sharp decline in wheat, corn, and soybean prices.

CBOT Futures Plunge: A Closer Look

The CBOT futures plunge trade war fears have become apparent as markets react to the possibility of a Trump presidency. As of 0459 GMT:

- Wheat futures fell 1.5% to $5.63-3/4 a bushel

- Soybean futures dropped 1.9% to $9.83 a bushel

- Corn futures declined 0.9% to $4.14-3/4 a bushel

This sudden downturn highlights the US agricultural commodity market volatility in the face of political uncertainty. The Trump surge effect on wheat, corn, and soybean prices is a clear indicator of the market’s apprehension about potential trade policies under a Trump administration.

Trade War Concerns and Their Impact

The prospect of new trade barriers under a Trump presidency has reignited trade war concerns among U.S. farmers and commodity traders. Ole Houe, director of advisory services at IKON Commodities in Sydney, stated, “A trade war with China is now more of a possibility.” This sentiment reflects the broader anxiety in the agricultural sector about the potential disruption to international trade relations.

The trade barriers impact on US farmers could be significant, potentially leading to reduced export opportunities and lower domestic prices. However, Houe also noted that even if Trump wins, prices would likely rebound quickly, saying, “The market will initially trade the trade but claw it all back within a week… There’s plenty of demand for wheat and feed grain in the world. Soybeans are fairly priced, but wheat and corn are too cheap.”

US Dollar Strength and Agricultural Exports

Another factor contributing to the market volatility is the strengthening of the U.S. dollar. The US dollar strength agricultural exports relationship is a critical concern for farmers and exporters. A stronger dollar typically makes U.S. farm exports more expensive for overseas buyers, potentially reducing demand and putting downward pressure on prices.

This currency dynamic adds another layer of complexity to the already turbulent agricultural commodity markets. Farmers and traders must now navigate not only potential trade policy changes but also currency fluctuations that could impact their competitiveness in the global market.

Global Grain Demand Amid Political Uncertainty

Despite the current market turmoil, the underlying fundamentals of global grain demand remain strong. The agricultural sector is looking forward to the upcoming U.S. Department of Agriculture (USDA) crop forecasts, which will provide crucial information about supply and demand dynamics.

Key factors influencing global grain demand amid political uncertainty include:

- Ongoing drought conditions in key wheat-producing regions like the Black Sea and Australia

- The conclusion of bumper US crop harvests for corn and soybeans

- Improving conditions in U.S. winter wheat areas

- Potential shifts in international trade patterns due to political changes

These factors underscore the complex interplay between political events, weather conditions, and market dynamics in shaping the global agricultural landscape.

Looking Ahead: Market Expectations and USDA Forecasts

As the agricultural sector grapples with the immediate impact of the election results, attention is already turning to upcoming events that could further influence market dynamics:

- U.S. interest rate decision on Thursday

- USDA crop forecasts on Friday

These events will provide critical data points for traders and analysts trying to navigate the uncertain waters of the current market environment. The USDA forecasts, in particular, will offer valuable insights into expected supply levels and could help stabilize markets in the wake of the election-induced volatility.

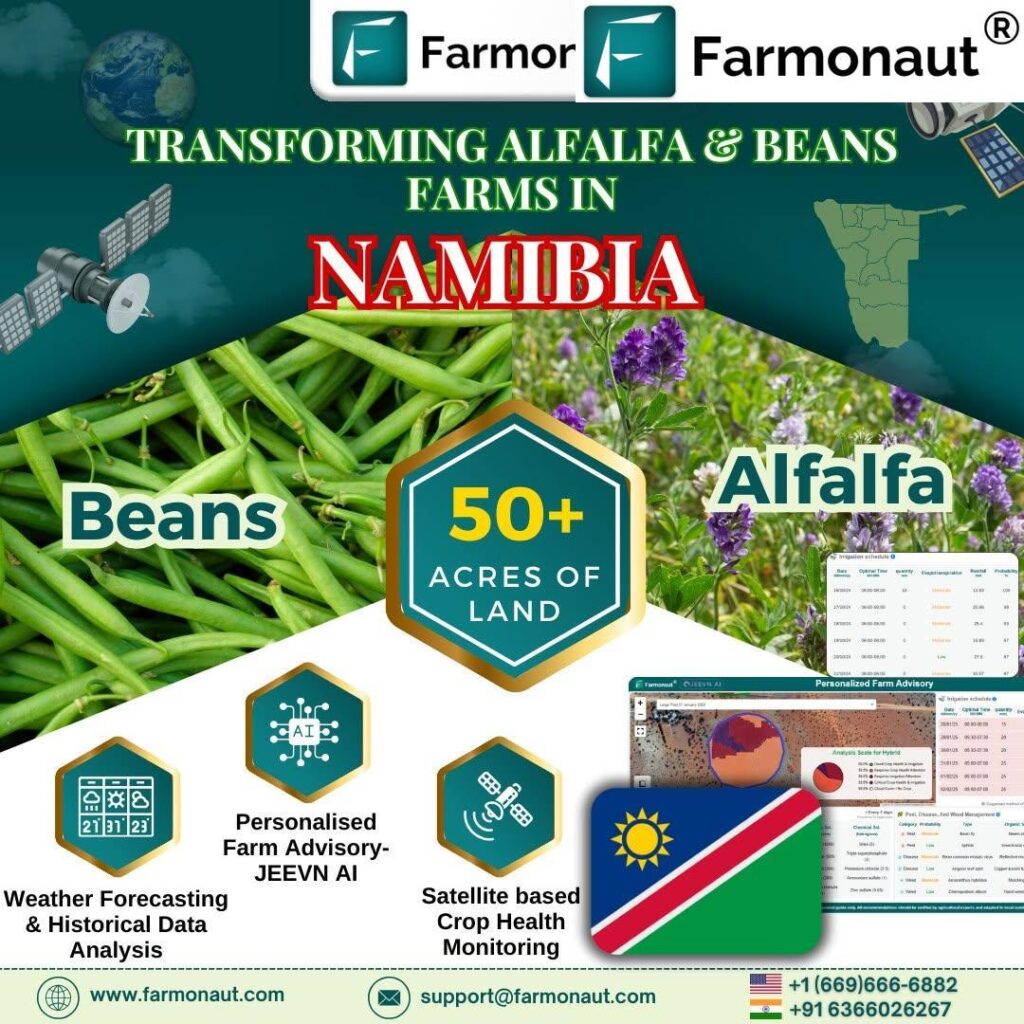

The Role of Technology in Agricultural Risk Management

In these uncertain times, farmers and agricultural businesses are increasingly turning to technology to help manage risk and optimize their operations. Farmonaut offers cutting-edge solutions for agricultural monitoring and decision-making:

- Satellite-based crop monitoring

- Weather forecasting and analysis

- Crop health assessment tools

These tools can help farmers make informed decisions even in the face of market volatility and changing trade dynamics. Explore Farmonaut’s API for comprehensive agricultural data and insights.

Conclusion: Navigating Uncertainty in Agricultural Markets

The Trump election impact on grain markets has created a turbulent environment for farmers, traders, and agricultural businesses. While the immediate reaction has been a sharp decline in futures prices, the long-term implications remain to be seen. The agricultural sector must remain vigilant and adaptable in the face of potential trade policy changes, currency fluctuations, and evolving global demand patterns.

As the situation continues to unfold, staying informed and leveraging technological tools will be crucial for success in this dynamic market environment. Whether through advanced crop monitoring solutions like Farmonaut or careful analysis of USDA forecasts, agricultural stakeholders have a range of resources at their disposal to navigate these challenging times.

For the latest updates and in-depth analysis of agricultural markets, explore Farmonaut’s developer documentation and stay tuned to trusted news sources for ongoing coverage of this developing story.