California Wildfire Crisis: How Insurers Navigate Risk and Protect Homeowners in High-Exposure Areas

“California FAIR Plan’s role as last-resort insurance provider has grown 180% since 2018 due to wildfire risks.“

As we delve into the complex world of California’s wildfire insurance crisis, it’s crucial to understand the unprecedented challenges faced by insurers and homeowners alike. The devastating fires currently ravaging the Los Angeles area have brought these issues into sharp focus, highlighting the delicate balance between maintaining market solvency and providing coverage in high-risk zones.

In this comprehensive analysis, we’ll explore the multifaceted aspects of this crisis, from the strategies employed by insurers to navigate risk, to the impact on homeowners in high-exposure areas. We’ll also examine the role of the California FAIR Plan, recent regulatory initiatives, and the potential future of the state’s insurance landscape amidst escalating natural disasters.

The Current State of California’s Wildfire Insurance Market

The California wildfire insurance market is in a state of flux, with insurers grappling with the escalating frequency and severity of wildfire events. Let’s break down the key components of this complex situation:

- Policy Nonrenewals and Limited Sales: Many insurers have strategically reduced their exposure in high-risk zones through policy nonrenewals and limiting new sales. This deliberate action aims to safeguard their financial stability amid unprecedented losses.

- California FAIR Plan’s Growing Importance: As traditional insurers pull back, the California FAIR Plan, established in 1968 as a last resort for high-risk properties, has become increasingly crucial.

- Market Erosion Concerns: The shift of policies from private insurers to the FAIR Plan has raised concerns about the potential erosion of California’s insurance market.

- Risk Management Strategies: Insurers are reassessing their risk management approaches, with some exploring advancements in catastrophe modeling and risk-based premiums.

To better understand the current landscape, let’s take a look at this snapshot of the California Wildfire Insurance Market:

| Insurance Provider Type | Estimated Market Share (%) | Policy Coverage in High-Risk Areas (%) | Average Premium in High-Risk Areas ($) | Risk Management Strategies | Estimated Loss Capacity ($) |

|---|---|---|---|---|---|

| Private Insurers | 75% | 30% | 2,500 | Nonrenewals, Limited Sales | 50 billion |

| California FAIR Plan | 25% | 70% | 3,800 | Last-resort coverage | 10 billion |

This table illustrates the significant shift in the market, with the FAIR Plan taking on a larger share of high-risk policies as private insurers retreat from these areas.

The Challenge of Insuring High-Risk Areas

Providing homeowners insurance in high-risk areas has become increasingly challenging for insurers. The reasons behind this are multifaceted:

- Unprecedented Scale of Disasters: The current wildfires in the Los Angeles area exemplify the growing scale and intensity of natural disasters in California.

- Financial Impact: Insurers face significant financial pressures due to the increasing frequency and severity of wildfire events.

- Risk Concentration: As more insurers pull out of high-risk areas, the remaining providers face a higher concentration of risk.

- Regulatory Constraints: Some experts argue that regulatory restrictions on premium pricing make it difficult for insurers to charge rates that reflect the true risk of wildfire-exposed homes.

To address these challenges, insurers are employing various strategies to mitigate risks and maintain solvency.

Insurers’ Risk Management Strategies

In the face of escalating wildfire risks, insurers are adopting a range of strategies to navigate this challenging landscape:

- Policy Nonrenewals: Many insurers have opted not to renew policies in high-risk areas to reduce their exposure.

- Limited New Policy Sales: Insurers are being more selective about writing new policies in fire-prone regions.

- Advanced Catastrophe Modeling: Companies are investing in more sophisticated catastrophe models to better assess and price risk.

- Risk-Based Premiums: There’s a push towards implementing more granular, risk-based pricing structures.

- Reinsurance: Insurers are leveraging reinsurance to spread risk and protect against large losses.

These strategies aim to help insurers remain solvent and continue to serve their existing policyholders while managing their exposure to wildfire risks.

The Role of the California FAIR Plan

As traditional insurers reduce their exposure in high-risk areas, the California FAIR Plan has become increasingly important. Here’s what you need to know about this last-resort option:

- Purpose: The FAIR Plan provides basic fire insurance coverage for high-risk properties when traditional insurance is unavailable.

- Growing Importance: With more insurers pulling out of fire-prone areas, the FAIR Plan’s role has expanded significantly.

- Concerns: There are worries about the FAIR Plan’s capacity to cover substantial losses if faced with a catastrophic event.

- Impact on Private Insurers: If the FAIR Plan were to fall short, the liability could potentially revert to private insurers, complicating their financial outlook.

The growing reliance on the FAIR Plan underscores the challenges facing California’s insurance market and the need for sustainable solutions.

Regulatory Initiatives and Their Effectiveness

In response to the ongoing crisis, California’s Department of Insurance has launched several initiatives aimed at fostering increased insurer participation in high-risk areas:

- Sustainable Insurance Strategy: This initiative aims to encourage insurers to write more policies in fire-prone areas.

- Mitigation Efforts: The state is promoting wildfire mitigation efforts to reduce risk and make properties more insurable.

- Premium Regulations: There’s ongoing debate about allowing more flexibility in premium pricing to reflect actual risk.

However, the effectiveness of these initiatives remains uncertain, especially in light of the ongoing wildfire crisis.

“Over 2.7 million California homes are in high or extreme wildfire risk areas, challenging insurers’ risk management strategies.“

The Future of California’s Insurance Landscape

As we look to the future, several trends and possibilities emerge for California’s insurance market:

- Advanced Risk Assessment: Improved catastrophe modeling and risk assessment tools may allow for more accurate pricing and risk management.

- Public-Private Partnerships: There may be increased collaboration between the state and private insurers to address coverage gaps.

- Climate Adaptation: Long-term strategies for climate adaptation and wildfire mitigation could play a crucial role in stabilizing the insurance market.

- Regulatory Evolution: We may see changes in insurance regulations to balance consumer protection with market stability.

The path forward will likely require a multifaceted approach, balancing the needs of homeowners, insurers, and the state.

Impact on Homeowners in High-Exposure Areas

For homeowners in high-risk wildfire zones, the current crisis presents significant challenges:

- Limited Options: Many homeowners are finding it increasingly difficult to secure traditional insurance coverage.

- Higher Premiums: Those who can obtain coverage often face substantially higher premiums.

- Reliance on FAIR Plan: More homeowners are turning to the California FAIR Plan as a last resort, which typically offers more limited coverage at higher rates.

- Mitigation Efforts: There’s an increased emphasis on individual wildfire mitigation efforts to improve insurability.

These challenges underscore the need for comprehensive solutions that address both market stability and homeowner protection.

The Role of Technology in Risk Management

Advancements in technology are playing an increasingly important role in wildfire risk management:

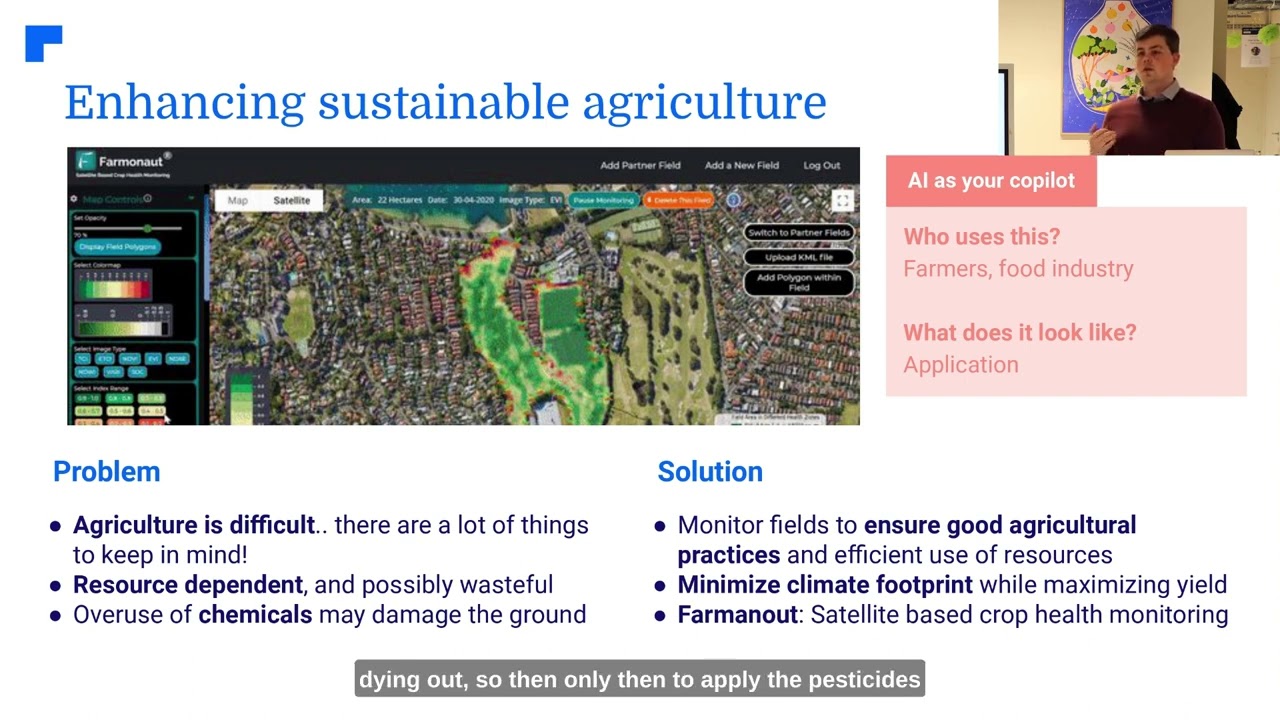

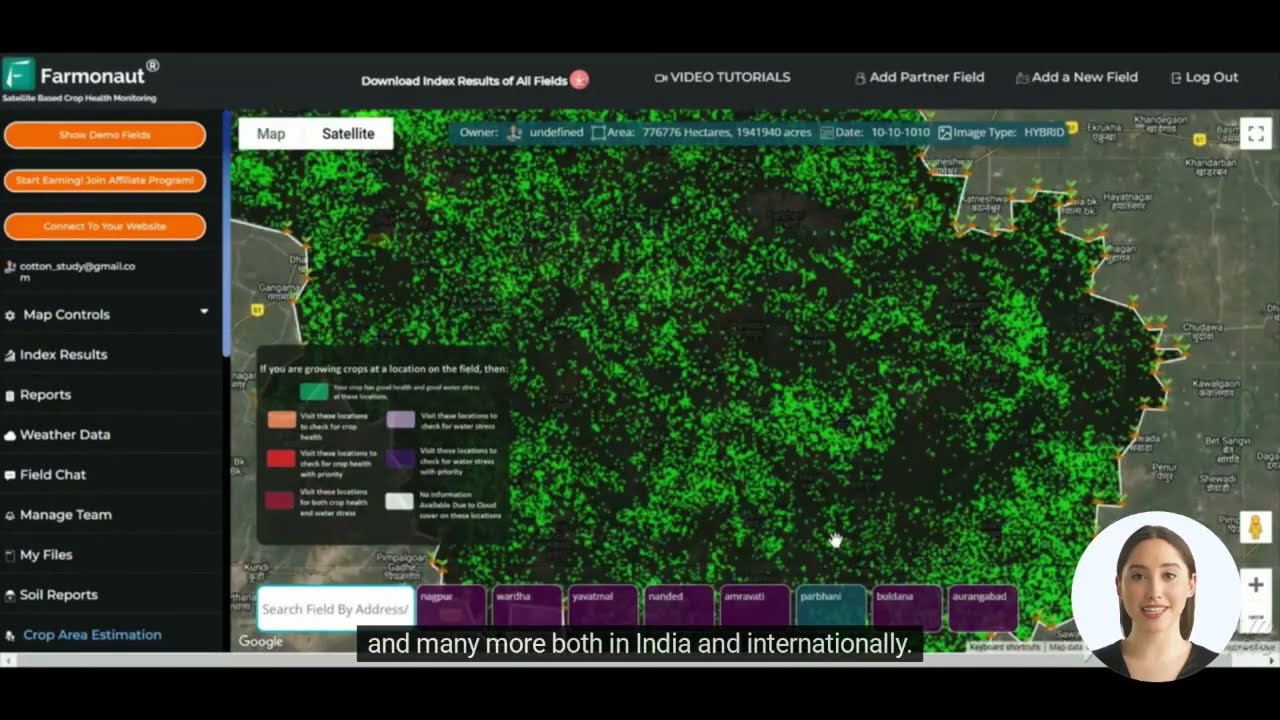

- Satellite Imagery: High-resolution satellite data is being used to assess wildfire risk more accurately.

- AI and Machine Learning: These technologies are improving the accuracy of risk models and predictive analytics.

- IoT Devices: Internet of Things (IoT) devices are being deployed to provide real-time data on environmental conditions and potential fire risks.

- Data Analytics: Advanced data analytics are helping insurers make more informed underwriting decisions.

These technological advancements could potentially help insurers better manage their risk exposure and possibly re-enter high-risk markets with more confidence.

Explore Farmonaut’s API for advanced satellite-based analytics

Check out Farmonaut’s API Developer Docs for integration details

The Economic Ripple Effects

The California wildfire insurance crisis has far-reaching economic implications:

- Property Values: Difficulty in obtaining insurance can negatively impact property values in high-risk areas.

- Local Economies: Reduced property values and increased insurance costs can affect local economies and tax bases.

- Construction Industry: The crisis may impact new construction in fire-prone areas, affecting the construction industry.

- State Financial Burden: Increased reliance on state-backed insurance options could potentially strain state finances.

These economic effects highlight the need for holistic solutions that consider not just the insurance market, but the broader economic landscape of California.

Lessons from Other Regions

California is not alone in facing wildfire insurance challenges. Looking at how other regions have addressed similar issues can provide valuable insights:

- Australia: Has implemented a national disaster insurance pool to help manage catastrophic risks.

- Florida: Developed a state-run insurer of last resort to address hurricane risks, which could offer lessons for California’s wildfire challenges.

- Colorado: Has focused on community-wide mitigation efforts to reduce wildfire risks and improve insurability.

While each region’s situation is unique, these examples could provide valuable lessons for California as it navigates its own wildfire insurance crisis.

The Role of Climate Change

The increasing frequency and severity of wildfires in California are closely linked to climate change. This connection has several implications for the insurance industry:

- Long-term Risk Assessment: Insurers need to factor in long-term climate projections when assessing risk.

- Adaptation Strategies: There’s a growing need for insurers to encourage and reward climate adaptation strategies.

- Sustainable Underwriting: Some insurers are exploring ways to incorporate sustainability into their underwriting practices.

- Climate-related Financial Disclosures: Increased pressure for transparency about climate-related risks in financial reporting.

Addressing the insurance crisis will likely require a concurrent effort to address the underlying climate issues driving increased wildfire risks.

Policy Recommendations

Based on our analysis, here are some potential policy recommendations to address California’s wildfire insurance crisis:

- Risk-Based Pricing: Allow more flexibility in premium pricing to accurately reflect risk, while ensuring consumer protections.

- Incentivize Mitigation: Develop programs that incentivize and support homeowners and communities in implementing wildfire mitigation measures.

- Public-Private Partnerships: Explore innovative partnerships between the state and private insurers to spread risk and ensure coverage availability.

- Improve Data Sharing: Enhance data sharing between insurers, regulators, and climate scientists to improve risk assessment and pricing models.

- Long-term Planning: Develop long-term strategies that consider both insurance market stability and climate change adaptation.

Implementing these recommendations would require collaboration between insurers, regulators, policymakers, and communities.

Conclusion

The California wildfire insurance crisis presents a complex challenge that requires a multifaceted approach. As insurers navigate the delicate balance between risk management and providing coverage, homeowners in high-exposure areas face increasing difficulties in securing affordable insurance.

The growing importance of the California FAIR Plan, while providing a crucial safety net, also raises concerns about market stability and long-term sustainability. Regulatory initiatives aim to foster increased insurer participation, but their effectiveness remains to be seen in the face of ongoing wildfire events.

Looking ahead, the future of California’s insurance landscape will likely be shaped by advancements in risk assessment technology, climate adaptation strategies, and potential regulatory changes. The path forward will require collaboration between all stakeholders – insurers, regulators, policymakers, and homeowners – to develop sustainable solutions that balance market stability with consumer protection.

As we continue to grapple with the impacts of climate change and increasing wildfire risks, the lessons learned from California’s experience will be valuable not just for the state, but for other regions facing similar challenges around the world.

FAQ Section

- Q: Why are insurers pulling out of high-risk wildfire areas in California?

A: Insurers are reducing their exposure in these areas due to the increasing frequency and severity of wildfires, which have led to unprecedented losses. They’re struggling to maintain financial stability while providing coverage in these high-risk zones. - Q: What is the California FAIR Plan?

A: The California FAIR Plan is a last-resort insurance option established in 1968 to provide basic fire insurance coverage for high-risk properties when traditional insurance is unavailable. - Q: How are homeowners in high-risk areas affected by this crisis?

A: Homeowners in high-risk areas are finding it increasingly difficult to secure traditional insurance coverage. Many are facing higher premiums or are forced to rely on the California FAIR Plan, which typically offers more limited coverage at higher rates. - Q: What strategies are insurers using to manage wildfire risks?

A: Insurers are employing strategies such as policy nonrenewals, limiting new policy sales in high-risk areas, investing in advanced catastrophe modeling, implementing risk-based premiums, and leveraging reinsurance to spread risk. - Q: How is technology being used to address wildfire insurance challenges?

A: Technology is playing a crucial role through the use of satellite imagery, AI and machine learning for improved risk modeling, IoT devices for real-time environmental monitoring, and advanced data analytics for more informed underwriting decisions.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!