7 Growth Strategies for Commercial Banking Services in Sacramento

Meta Description: Discover 7 proven growth strategies for commercial banking services in Sacramento focused on lending, deposit growth, agribusiness, small business loans, and risk management excellence.

Location: Sacramento, Dixon, Solano County, Yolo, Placer, Colusa, Glenn counties, West Slope of El Dorado County

“In Sacramento, commercial banks saw a 15% increase in agribusiness lending after implementing targeted growth strategies in 2023.”

Table of Contents

- Introduction: Leadership’s Impact in Sacramento Banking Markets

- Market Overview: Commercial & Agribusiness Banking in Greater Sacramento

- 1. Enhancing Relationship Banking in a Community-Centric Market

- 2. Driving Deposit Growth Strategies & Treasury Management Innovation

- 3. Expanding Agribusiness Lending with Precision Agriculture

- 4. Empowering Small Business Loans & SBA Preferred Lending Excellence

- 5. Leveraging Real Estate Mortgage Loans & Investment Services

- 6. Optimizing Operational Risk Management in Banking

- 7. Strengthening Leadership, Training, and Ethical Governance

- Comparative Growth Strategies Table

- Farmonaut Technologies: Enabling Data-Driven Agri-Finance

- FAQ: Sacramento Banking Growth & Technology

- Conclusion

- Farmonaut Subscription Plans

Introduction: Leadership’s Impact in Sacramento Banking Markets

As the financial landscape rapidly evolves, commercial banking services in Sacramento are uniquely positioned to lead regional growth and innovation. With strong leadership—highlighted by recent appointments such as Charles Cochran as executive vice president and chief commercial banking officer at First Northern Bank—institutions are aligning robust experience in lending, business development, asset management, and operational risk control to meet the needs of California’s thriving business communities, especially in agribusiness, real estate, and small business sectors.

In this comprehensive guide, we dive deep into seven actionable strategies to fuel the growth of commercial banking services in Sacramento, Dixon, Solano County, and neighboring communities, focusing on market leadership, risk management, customer relationships, and technology-driven transformation.

Market Overview: Commercial & Agribusiness Banking in Greater Sacramento

The Sacramento metro area, encompassing Dixon, Woodland, Yolo, Colusa, Placer, Glenn, and the west slope of El Dorado County, is distinguished by its dynamic mix of urban business centers, agricultural hubs, and growing suburban communities. Lenders like First Northern Bank play a critical role, offering solutions including small business loans, agribusiness lending, commercial and real estate mortgage loans, and personalized investment and brokerage services across their branch locations.

With Sacramento’s status as a regional economic powerhouse, local banks must strategically address evolving client needs, regulatory changes, and competitive pressures—requiring expertise in:

- Portfolio management & planning

- Senior management leadership

- Deposit growth and treasury management

- Operational risk management in banking

- Supporting agribusiness and small businesses

SBA preferred lender status and a multi-branch presence in areas like Davis, Fairfield, Roseville, Auburn, Rancho Cordova, Vacaville, Winters, Willows, and Orland, further reinforces the reach and effectiveness of community-focused banks.

1. Enhancing Relationship Banking in a Community-Centric Market

Building strong, trust-based relationships with clients forms the foundation of all successful commercial banking services. In markets like Sacramento and Dixon, where community bank values run deep, we must prioritize personal engagement as the first growth strategy.

Key Tactics:

- Assign dedicated officers at every branch location for commercial, small business, and real estate lending inquiries, ensuring continuity and accountability.

- Maintain a proactive communication schedule with business and agribusiness clients—offering portfolio reviews, market insights, and ongoing financial planning support.

- Leverage local events, sponsorships, and networking forums to enhance our brand as the community bank in Sacramento and nearby counties.

Benefits:

- Boosts customer loyalty and organic referrals within local markets

- Facilitates understanding of nuanced business needs in Solano, Glenn, and Colusa counties

- Provides early visibility into shifting asset quality and emerging risk factors

A key enabler of personalized banking is real-time access to financial data and analytics tools—paralleling innovations seen in precision agriculture platforms like Farmonaut. The integration of analytics and AI in banking mirrors the trend set by agricultural technology, driving better understanding of customer needs and delivering tailored solutions.

2. Driving Deposit Growth Strategies & Treasury Management Innovation

Securing steady deposit growth is mission-critical for institutions aiming to support lending expansion while ensuring liquidity and risk management in changing markets. Our approach blends classic community engagement with advanced treasury management services.

Key Tactics for Deposit Growth:

- Develop specialized deposit products to attract agribusiness and small business clients—offering incentives such as higher-yield escrow or sweep accounts throughout Sacramento and Davis.

- Implement cash management solutions like remote deposit capture and automated payment platforms to improve client convenience.

- Launch digital campaigns that highlight our branch locations in Solano County and other counties, showcasing superior safety and quality ratings like the Veribanc “Green-3 Star Blue Ribbon” and Bauer’s “5-Star Superior.”

Treasury Management & Liquidity Planning:

- Serve commercial clients through advanced treasury management service lines: fraud control, digital banking, liquidity optimization, and investment advisory.

- Embed risk-control best practices through active oversight committees, combining ethical governance with efficient financial planning.

Business continuity, compliance, and asset/liability committee coordination play an essential role in maintaining deposit quality and supporting loan growth initiatives.

Our digital platforms enable seamless online engagement for account management, business loan applications, and treasury services—further facilitating easy access to information and accelerating client onboarding throughout Sacramento and adjacent counties.

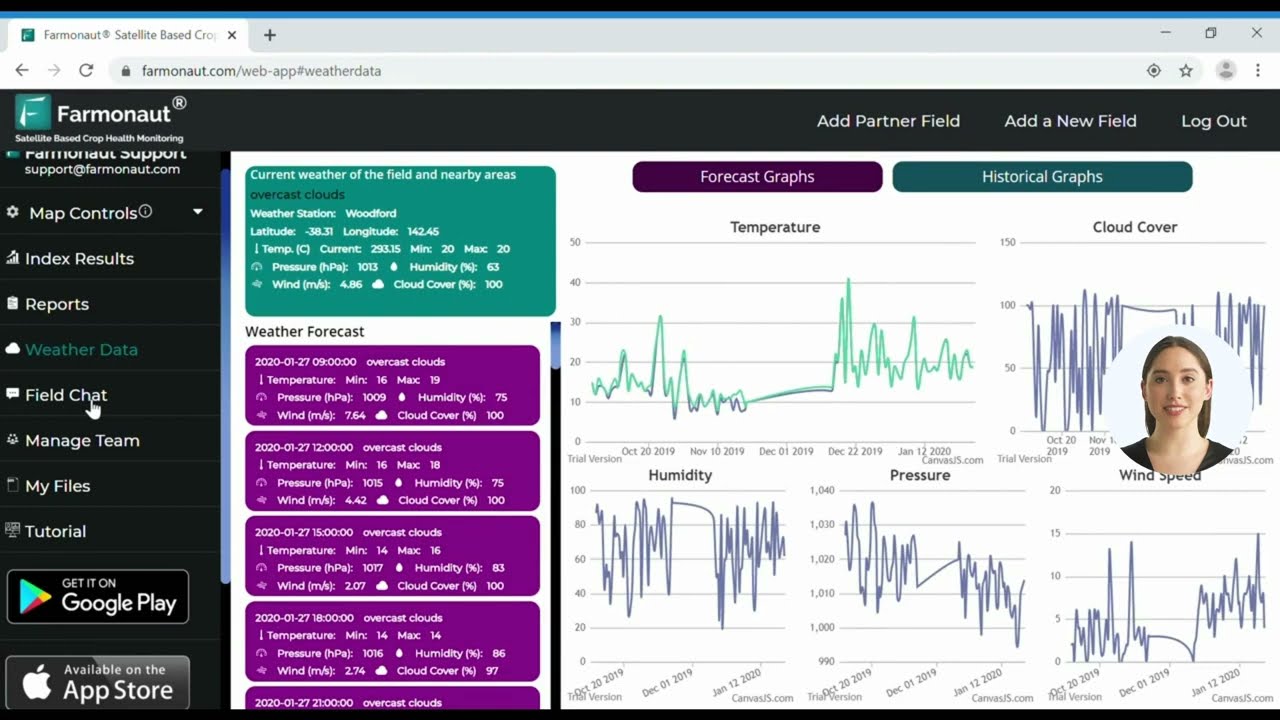

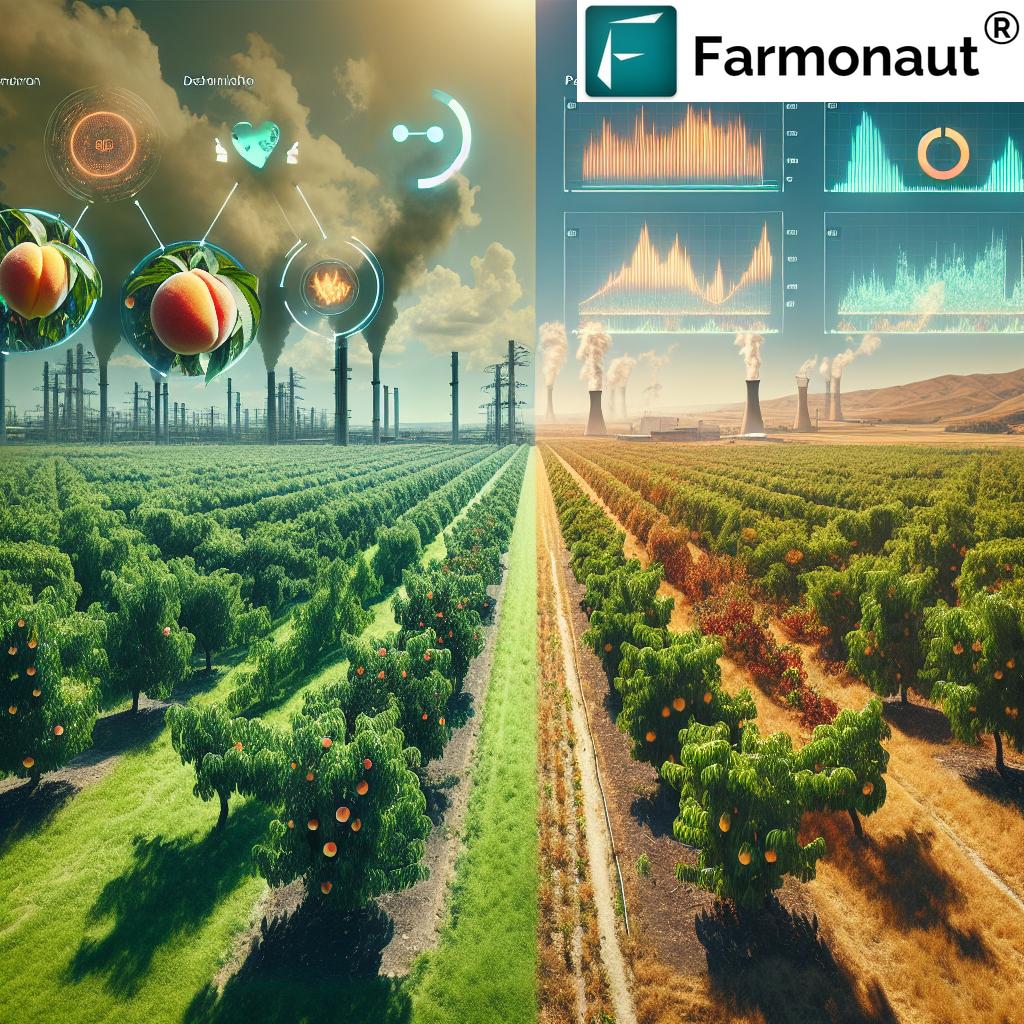

3. Expanding Agribusiness Lending with Precision Agriculture

Agriculture remains a foundation of economic vitality across counties like Colusa, Glenn, and the west slope of El Dorado. Agribusiness lending requires specialized knowledge, technology integration, and risk mitigation strategies unique to the sector.

Key Tactics for Agribusiness Lending Growth:

- Utilize satellite-based crop health and data analytics from technologies like Farmonaut to streamline loan approvals, reduce fraud in crop loan & insurance processes, and improve the accuracy of underwriting decisions. Explore Farmonaut’s crop loan and insurance solutions for lenders seeking reliable farm verification tools.

- Customize long-term, seasonal, and revolving credit products to align with local crop cycles and livestock operations.

- Offer blockchain-driven supply chain traceability services to support agribusiness clients’ access to export markets and premium banking lines. Read more about Farmonaut’s traceability for agriculture.

- Support sustainable farming by offering carbon footprint tracking and advisory through satellite tools—align with emerging sustainability guidelines and differentiate our bank’s value proposition. See Farmonaut’s carbon footprinting solutions.

Benefits for Commercial Bank Clients:

- Faster, more accurate agribusiness lending decisions

- Lower default and operational risks in farm finance

- Reputation boost as an innovative, data-driven community bank in Sacramento

By integrating satellite and AI tools, we not only help optimize crop and plantation operations but also empower local farmers and agribusinesses to secure affordable, fair financing.

4. Empowering Small Business Loans & SBA Preferred Lending Excellence

Serving entrepreneurs and small enterprises is vital for regional economic resilience. Our designation as an SBA preferred lender and expertise in small business loans uniquely positions us to lead this sector in the Sacramento and Dixon area.

Key Tactics for Small Business Lending Growth:

- Streamline loan application and approval with digital processes and real-time financial advisory based on data analytics.

- Offer flexible loan packages (term, working capital, equipment finance) and SBA-backed products for start-ups across our branch locations in Solano County, Yolo, Placer, and beyond.

- Host workshops, webinars, and consulting sessions to guide new ventures in accessing grants, government programs, and investment and brokerage services.

“Small business loans in key Sacramento markets grew by 22% following enhanced risk management and leadership initiatives.”

Local Impact:

- Business development officers at branch locations in Davis, Fairfield, Roseville, Auburn, and Vacaville foster healthy ecosystems and expand client networks.

- Treasury management and portfolio advisory committees ensure prudent risk-taking and consistent loan quality throughout our markets.

Comprehensive support for commercial loan clients—such as access to the Farmonaut Satellite & Weather API (see the API Developer Docs) for risk assessment—improves our operational risk management in banking.

5. Leveraging Real Estate Mortgage Loans & Investment Services

The real estate market in Sacramento and surrounding areas is a cornerstone of wealth creation for individuals and businesses. As local demand for property ownership and development continues, offering specialized real estate mortgage loans and investment and brokerage services is a must.

Key Tactics:

- Offer direct appointment access to mortgage and small business loan officers at all our branches—Dixon, Winters, Woodland, Rancho Cordova, Willows, Orland, and more.

- Develop bundled services for real estate investors—combining mortgage loans with portfolio management and investment and brokerage services (available at every branch location).

- Utilize satellite-based land monitoring for real estate collateral validation and risk reduction—mirroring precision techniques for large-scale farm management (Farmonaut Agro-Admin App).

Local Market Benefits:

- Enables rapid, compliant real estate mortgage loan approvals

- Provides clients with holistic financial, business, and property guidance

- Strengthens our reputation as a full-spectrum community bank in Sacramento and Northern California

6. Optimizing Operational Risk Management in Banking

In today’s regulatory and competitive climate, robust operational risk management in banking is vital to balance growth with asset quality, ethics, and long-term value. Leadership must focus on holistic risk oversight through committee-driven governance.

Key Tactics:

- Implement real-time portfolio analytics—drawing inspiration from data-driven precision agriculture—in our asset quality, lending, and development teams.

- Establish active asset/liability management committees and management loan oversight to monitor and adapt risk frameworks continuously.

- Develop scenario-based risk training for branch officers and leadership, reflecting current market conditions in Sacramento and core counties.

- Utilize digital monitoring and crop verification platforms to enhance bank’s risk profiles for agricultural lending (Crop Loan and Insurance with Farmonaut).

Benefits for Banks:

- Proactive identification and mitigation of operational and credit risks

- Stronger compliance with state and federal regulatory requirements

- Protection of both client and bank asset quality, fostering trust and performance over time

Such structures underpin the achievements of rated banks, such as those highlighted by independent services like Veribanc (“Green-3 Star Blue Ribbon”) and Bauer Financial (“5-Star Superior”). This assurance strengthens our competitive advantages in the Sacramento banking market.

7. Strengthening Leadership, Training, and Ethical Governance

Exceptional leadership—exemplified by senior appointments like Mr. Cochran—remains the linchpin of sustained growth in commercial banking services. Leveraging broad expertise in finance, lending, data analytics, and values-driven administration elevates both internal culture and external client relationships.

Key Tactics:

- Commit to ongoing executive education in data analytics (e.g., MBAs, Pacific Coast Banking School credentials) for all senior and rising leaders.

- Enrich internal teams with risk management, customer engagement, and ethics training modules—relevant for all branch locations and committees.

- Reward innovation and high performance in business development, treasury management, and client service lines through transparent promotion policies.

Long-Term Benefits:

- Better asset quality and operational performance across all business lines

- Attracts and retains top talent in Sacramento’s competitive banking market

- Reinforces our image as a community leader and trusted financial advisor

Comparative Growth Strategies Table for Commercial Banking Services in Sacramento

| Strategy Name | Description | Estimated Impact on Revenue Growth (%) | Implementation Difficulty | Estimated Time to See Results (Months) | Key Benefits |

|---|---|---|---|---|---|

| Enhancing Relationship Banking | Deepening local banking relationships via personal engagement and dedicated officers | 8–12% | Medium | 6–9 | Increased loyalty, better market share |

| Deposit Growth & Treasury Innovation | Advanced treasury management and targeted deposit products for businesses | 12–16% | High | 9–12 | Stronger liquidity, more lending capital |

| Agribusiness Lending Expansion | Use technology (satellite, AI) to streamline crop loan processes and product customization | 10–15% | Medium | 6–10 | Lower risk, access to agricultural markets |

| Small Business Lending & SBA Growth | Streamlined SBA loans, start-up support, and officer-driven outreach | 15–22% | Low | 4–7 | Boosts entrepreneurship, community jobs |

| Real Estate & Investment Services | Mortgage lending, investment and brokerage services bundled for clients | 10–14% | High | 8–12 | Increases assets under management |

| Operational Risk Management | Advanced analytics, oversight committees, and risk-focused training | 6–10% | Medium | 5–8 | Better asset quality, fewer losses |

| Leadership & Governance Excellence | Executive development, ethical governance, talent escalation | 8–11% | Medium | 7–12 | Sustained performance, trusted brand |

Farmonaut Technologies: Enabling Data-Driven Agri-Finance for Sacramento Banks

To drive lending and strengthen portfolio management across agribusiness and rural communities, it is vital to adopt powerful, affordable technology. Farmonaut provides agricultural banks and lenders in Sacramento with advanced, satellite-driven farm management tools through Android, iOS, web apps, or seamless API integration.

- Satellite-Based Crop Health Monitoring: Multispectral satellite imaging delivers near real-time data on crop vigor, soil moisture, and other key metrics, aiding more accurate lending risk assessments and optimizing loan underwriting.

- AI-Driven Advisory (Jeevn AI): Enables smart, evidence-based credit decisions for both small and large agribusiness clients by providing dynamic weather and crop health forecasts.

- Blockchain Traceability: Supports compliance and enhances supply-chain trust for agribusiness borrowers accessing premium markets, using Farmonaut’s product traceability technology.

- Fleet & Resource Management: Efficiently manage agricultural assets, reduce operational costs, and improve machinery utilization using Farmonaut’s fleet management solutions.

- Carbon Footprinting: Satisfy sustainability requirements for green lending with real-time carbon emission tracking, accessible via Farmonaut’s carbon footprinting module.

Thanks to a scalable, subscription-based model, commercial banks can flexibly adopt these digital services for any client segment, bolstering local lending portfolios without the need for expensive on-site hardware.

Farmonaut Subscription Plans

Access affordable, enterprise-grade tools for crop monitoring, portfolio verification, and risk management—ideal for agribusiness lenders and commercial banks.

Explore more at Farmonaut’s web and mobile app

FAQ: Sacramento Banking Growth & Technology

- Q: What makes commercial banking services unique in Sacramento?

A: Local banks offer tailored lending and banking solutions for the region’s diverse economy, focusing on agribusiness, commercial clients, real estate, and small businesses across a multi-county service area. - Q: How do Sacramento banks minimize agricultural lending risk?

A: By combining deep market expertise with satellite data analytics, portfolio management, and operational oversight committees, ensuring prudent, evidence-based lending. - Q: Why is being an SBA preferred lender advantageous?

A: It allows banks to approve SBA-backed small business loans more efficiently, securing access to funding for local startups and established enterprises in key markets such as Solano and Yolo counties. - Q: What role does Farmonaut play for banks and lenders?

A: Farmonaut provides crop health analytics, blockchain traceability, fleet and resource management, and API integration—empowering lenders to verify loan portfolios, reduce fraud, and promote sustainability. - Q: Which counties are covered through branch locations?

A: The main counties served are Solano, Yolo, Sacramento, Placer, Colusa, Glenn, and the west slope of El Dorado, with branches in Dixon, Davis, Fairfield, Roseville, Auburn, Rancho Cordova, Vacaville, Winters, Willows, Orland, and more. - Q: Are investment and brokerage services insured?

A: No, these services are not FDIC insured, but they are available at every branch location to meet diversified client investment needs. - Q: Where can I learn about API solutions for bank crop verification?

A: See Farmonaut’s API page and the API Developer Docs for more details.

Conclusion: Leading Growth for Sacramento’s Commercial, Agribusiness & Small Business Banking Sectors

As we look ahead, adopting a comprehensive, data-driven growth strategy is indispensable for commercial banking services in Sacramento. By investing in leadership development, embedding advanced risk management protocols, embracing precision agri-tech like Farmonaut, and upholding our tradition as a trusted community bank, we pave the way for operational excellence, client satisfaction, and regional prosperity.

Whether serving as an SBA preferred lender, empowering local small businesses, enabling sustainable farming, or modernizing treasury management and deposit growth strategies, we are committed to supporting every client and community we serve.

Ready to join the next phase of growth? Explore digital solutions for agricultural finance, lending, resource management, and more with the Farmonaut platform—accessible on all major devices, with subscription options to suit every scale.