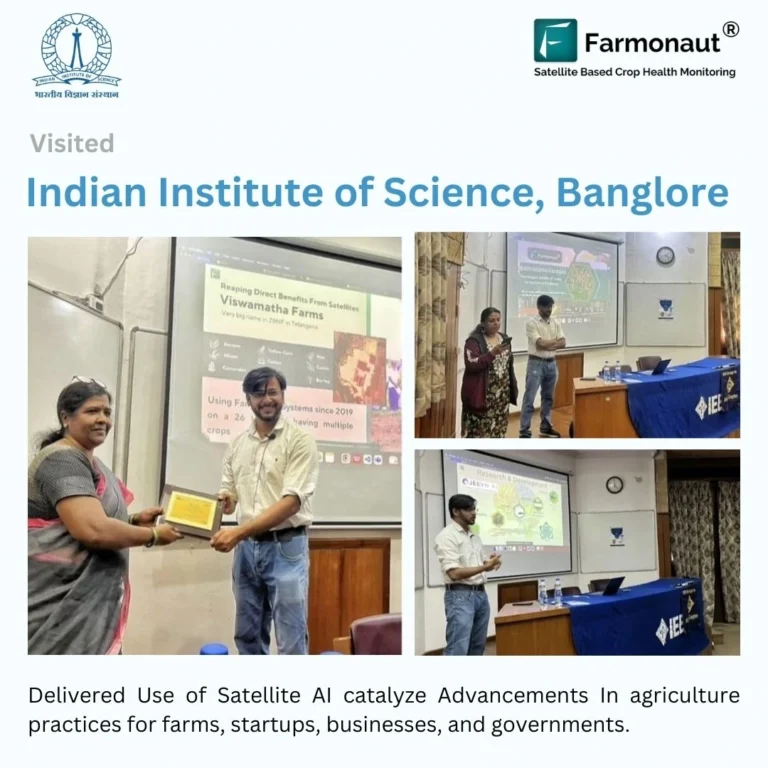

The Satellite Farm Advisor

Built to spot farm problems, Farmonaut is the best way to protect fields with satellites.

200,000+ Farmers Benefited

Worldwide access

10 Million+ Hectares Monitored

10,000,000+ API Hits

Efficient Irrigation

Personalized Advisory

Cost Efficiency

Improved Yields

Simplifies Management

Available On

Recent Blogs

Property Option Agreement Secures Strategic Mining Claims in Nevada

Labrador Mineralexploration: 20 km Oxidschicht-Zone entdeckt

Vanadium Eisen Projekt Labrador: 20 km Titan Magnetit Entdeckung

Agriculture Jobs Manitoba: Top 7 Powerful Hybrid Career Opportunities

Copper Exploration Breakthrough: 5 Key Drill Results in Northern Chile

2025 Ontario Vertical Farming Tech: Equity Investment Insights

5 innovaciones clave de drones agrícolas en Europa para mayor precisión

Oregon Gold Exploration Uncovers New High-Grade Zones in Major Expansion

Sustainable Palm Oil Production in Ghana: 5 Key Industry Trends

Réglementation stricte des pesticides à Boucherville : 7 faits clés

Our Satellite Services

Crop Health Monitoring

Identifying underperforming locations in the field

Crop Area & Yield Estimation

Estimate presence of crops and their yields at large scale

Evapotranspiration

Identify the areas with high water loss to the atmosphere.

Water Stress

Identify locations where plant water stress is low.

Radar Data

Crop health and soil moisture data under extreme cloud cover.

Soil Organic Carbon

Identify areas with decreased soil organic carbon levels.

Digital Elevation Model

Identify topographical slopes at micro level.

Colorblind Visualization

Get color neutral satellite data (specifically for colorblind users).

Soil Moisture

Identify locations where soil moisture is low.

Land Classification

Understand the land cover feature variations.

Weather Forecast

Access weather information from the closest station.

Plantation Management

Manage plantation farms at large scale at multiple locations.

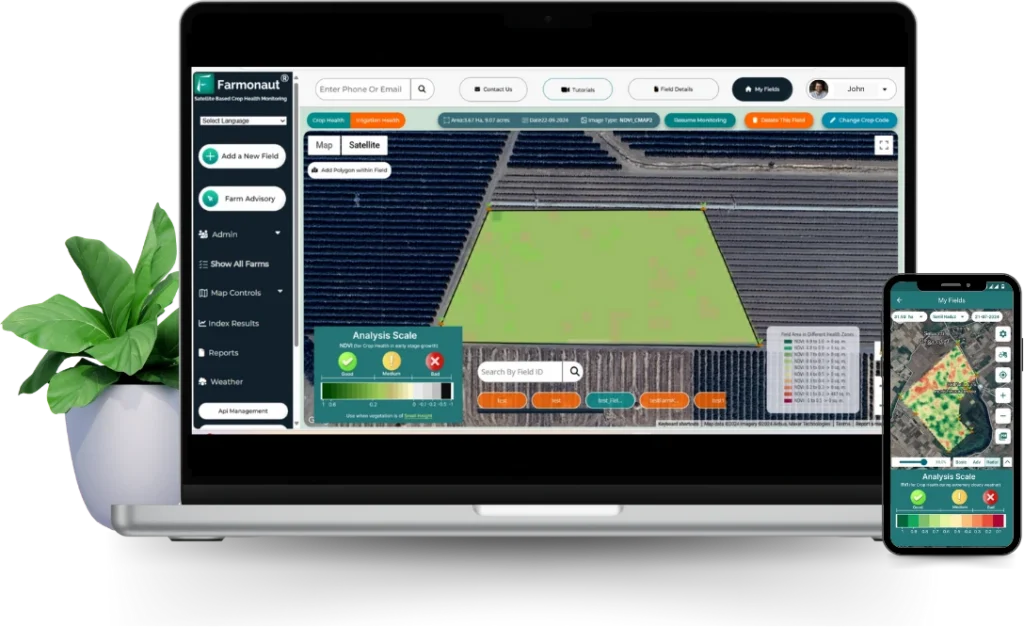

Our Technologies

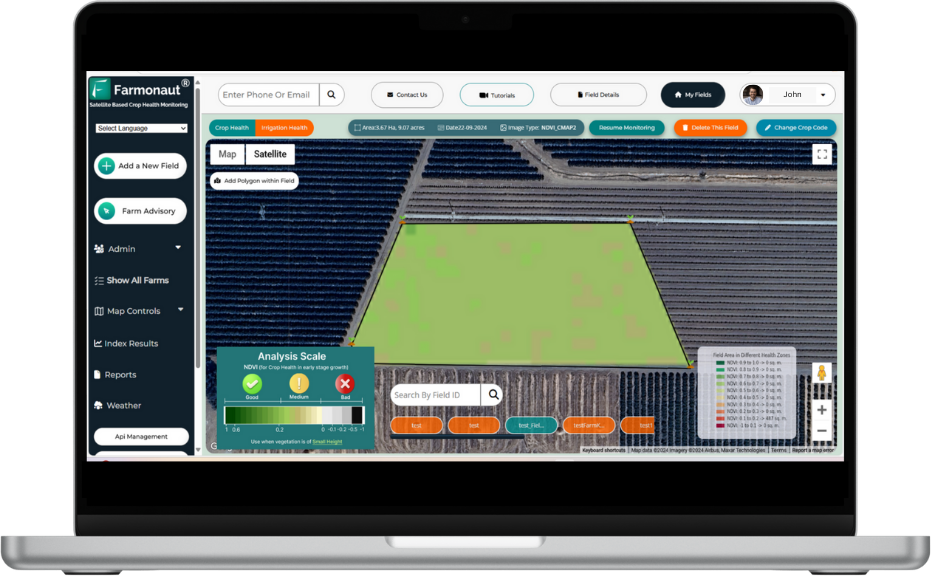

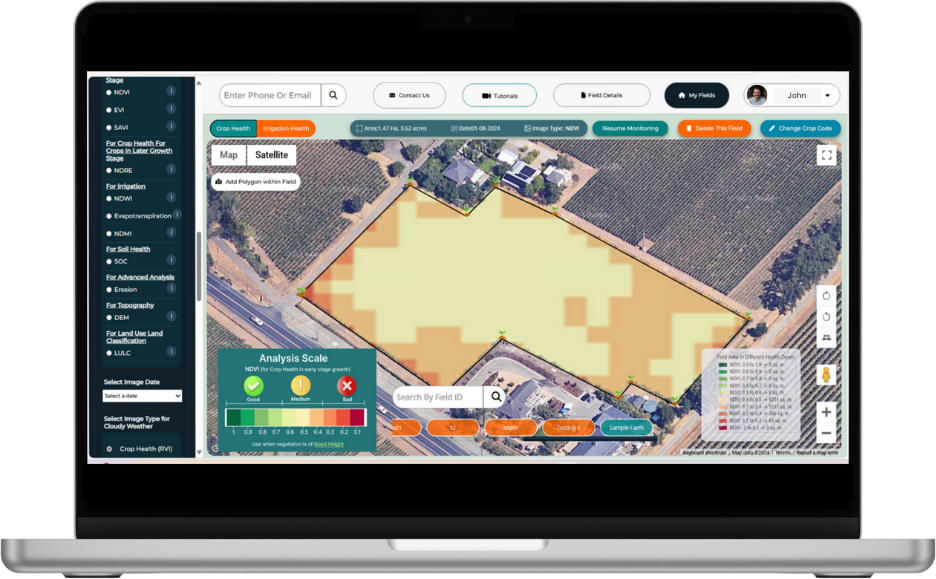

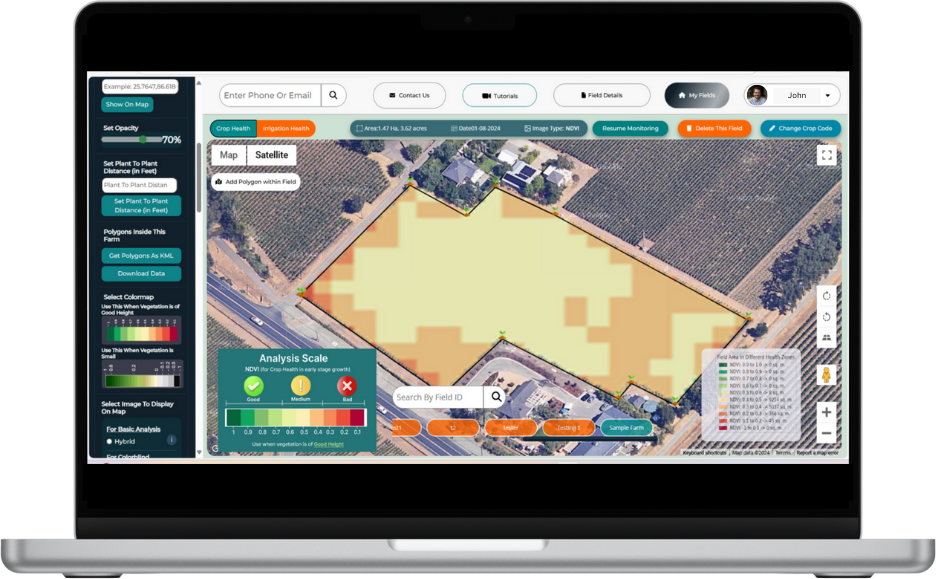

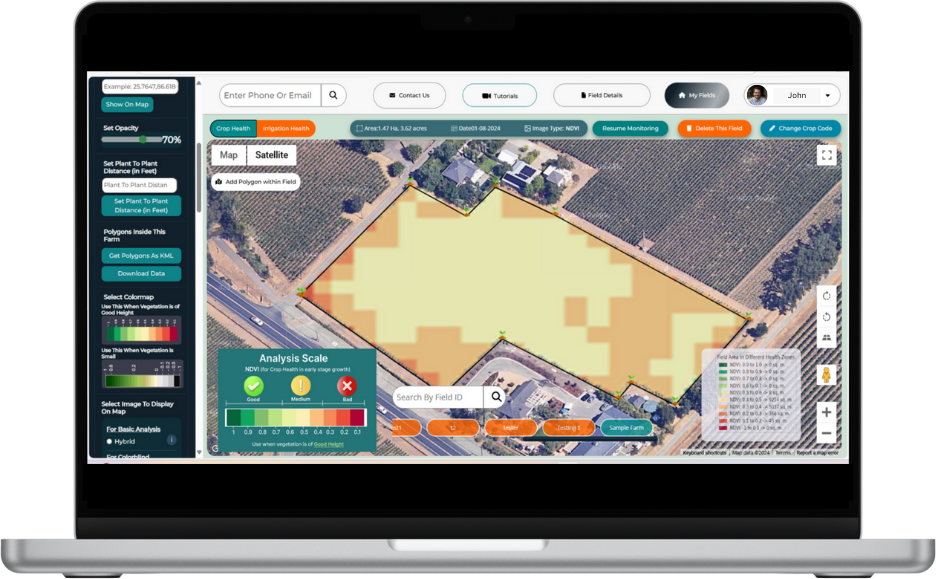

Satellite-based Crop Health Monitoring

We offer precision agriculture solutions. through satellite-based technology, farmers access real-time data on crop health, soil moisture levels, and weather patterns. This enables precise decision-making, optimizing resource allocation, and maximizing yields.

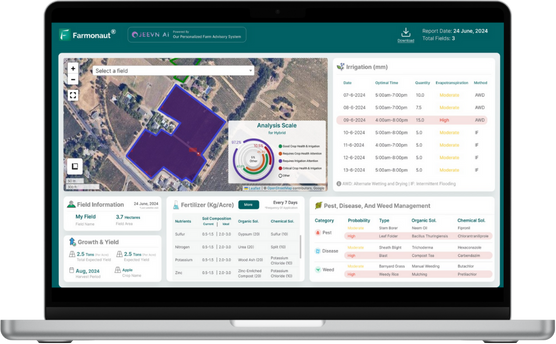

Jeevn AI Personalized Farm Advisory

Jeevn AI delivers tailored insights, real-time data analysis, expert crop management strategies, and accurate weather forecasts. Enhance your agricultural efficiency and productivity with our cutting-edge solutions designed to meet your specific farming needs.

Plantation Management

This enhances agricultural efficiency through satellite-based monitoring and AI-driven insights. It offers real-time crop health tracking, precision irrigation, and effective resource management. Integrating remote sensing and machine learning supports data-driven decision-making, improves productivity, and promotes sustainability.

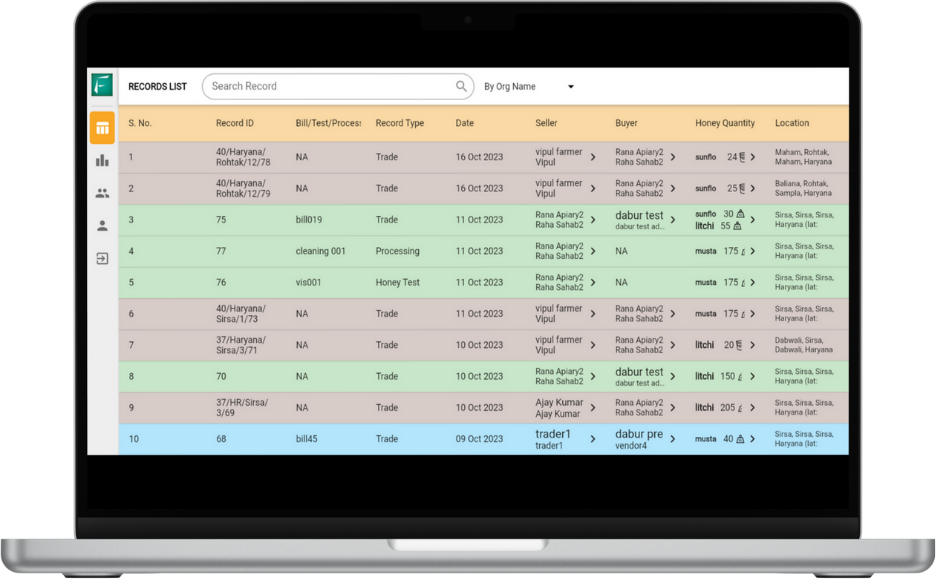

Blockchain Based Traceability

Our blockchain-based traceability product benefits corporate companies, particularly in the textile and fashion industries. We help companies build trust with consumers and enhance brand reputation.

Crop Loan and Insurance

We’re a key ally for farmers and financial institutions, providing advanced technologies that go beyond traditional agricultural support. We address common issues like fraudulent documents and misused funds in crop insurance.

Carbon Footprinting

A system that gives precise and helpful information about how much pollution is made. This technology helps businesses see how much harm they’re causing to the environment right now, and it helps them figure out ways to be more eco-friendly.

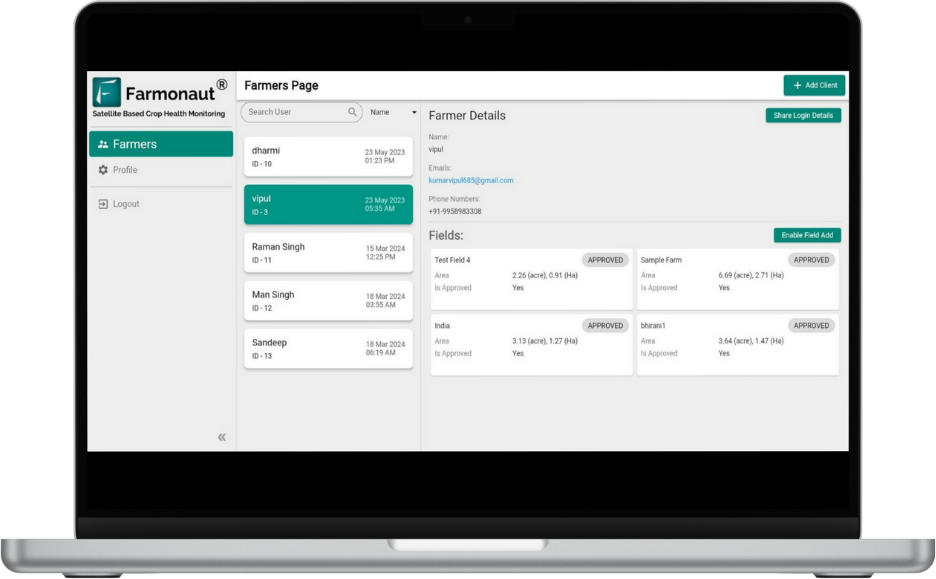

Farmonaut Agro Admin

An essential tool for companies looking to enhance the productivity of their field teams. It facilitates seamless task coordination and efficient progress tracking. With this system, communication is streamlined, resulting in a smoother workflow for ground teams.

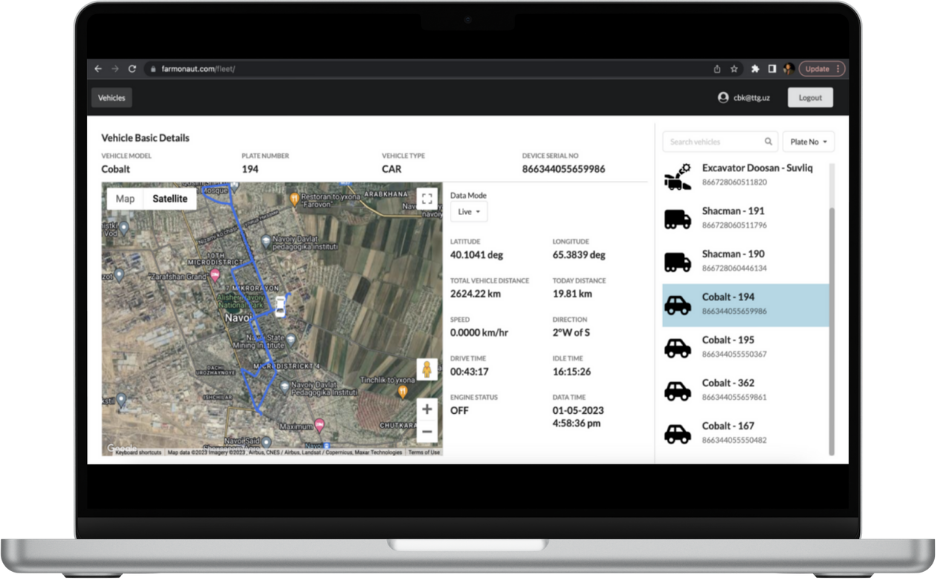

Fleet Management

A system for managing fleets, which helps businesses do it better. It’s really good at helping you use your vehicles the best way, saving money and keeping everyone safe. It all about making things easier and better for businesses that need to move around a lot.

Our Trusted Clientele

Case Studies

Our Success Work

Explore our case studies to see how we’ve delivered exceptional results for a diverse range of clients. Each story is a testament to our expertise and commitment to excellence.

Case Study

For over 2 years, we have been providing advanced plantation technology services to Godrej Agrovet…

Case Study

Connected with us from past 3 years, we have been providing Satellite-based crop monitoring Troforte Innovations, Australia…

Case Study

We monitored cotton crops for TTG, Uzbekistan, improving yield and reducing crop loss while saving ground assessment time…

Case Study

We gained 95% accuracy as per the official crop area released by the head of National Wheat Project of Egypt..

Case Study

For over 2 years, we have been providing satellite-based farm advisory services to Coromandel International…

Choose Us

Why Choose Us

We offer valuable insights and support to farmers and agribusinesses, making it easier for everyone to achieve better results.

Testimonials

Our Customer Feedback

We believe in the power of our products and services, but don’t just take our word for it. Here are some testimonials from farmers who’ve experienced the benefits in their farms.