Maximizing Crop Yields: Farmonaut’s Innovative Approach to Sustainable Agriculture and Passive Income

“Some Canadian dividend stocks have increased payouts for over 50 consecutive years, demonstrating remarkable consistency.”

In the ever-evolving landscape of finance and agriculture, we find ourselves at a fascinating intersection where sustainable farming practices meet innovative investment strategies. As we delve into the world of passive income and agricultural technology, we’ll explore how Farmonaut, a pioneering agritech company, is revolutionizing the way we approach farming while also examining lucrative opportunities in Canadian dividend stocks.

The Rise of Precision Agriculture and Passive Income

In recent years, we’ve witnessed a significant shift in both agricultural practices and investment strategies. On one hand, precision agriculture has emerged as a game-changer for farmers worldwide, offering data-driven insights to optimize crop yields and resource management. On the other hand, investors are increasingly turning to dividend stocks as a reliable source of passive income, particularly in uncertain economic times.

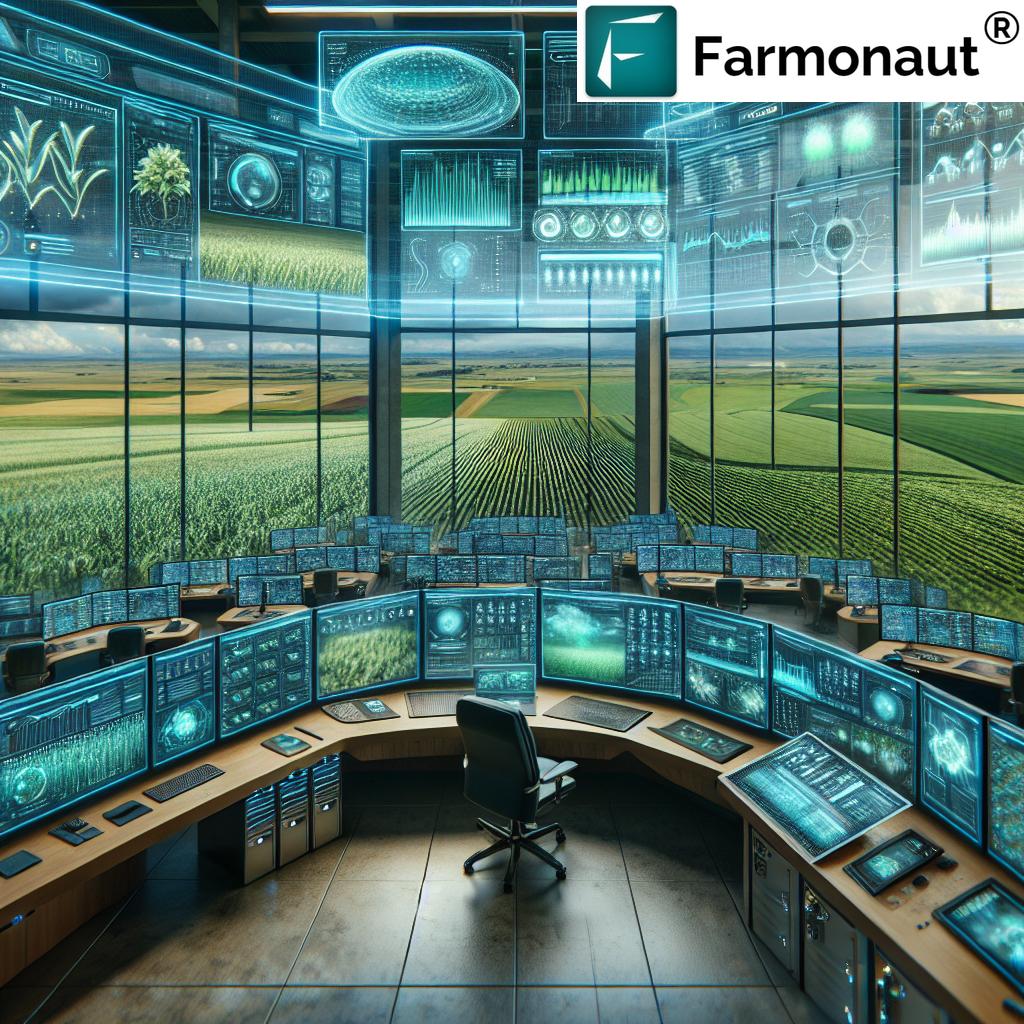

At the forefront of this agricultural revolution stands Farmonaut, a company that has seamlessly integrated cutting-edge technology with traditional farming methods. By leveraging satellite imagery, artificial intelligence, and blockchain technology, Farmonaut is making precision agriculture accessible and affordable for farmers of all scales.

Farmonaut: Transforming Agriculture Through Technology

Farmonaut’s platform offers a comprehensive suite of tools designed to address various agricultural challenges. Let’s explore some of the key technologies that set Farmonaut apart:

- Satellite-Based Crop Health Monitoring: Using multispectral satellite images, Farmonaut provides real-time insights into vegetation health, soil moisture levels, and other critical metrics. This data empowers farmers to make informed decisions about irrigation, fertilizer usage, and pest management.

- Jeevn AI Advisory System: This artificial intelligence-driven tool delivers personalized farm advisory services, including real-time insights, weather forecasts, and expert crop management strategies.

- Blockchain-Based Product Traceability: By integrating blockchain technology, Farmonaut ensures transparency and security throughout the agricultural supply chain, from farm to consumer.

- Fleet and Resource Management: Farmonaut’s tools help agribusinesses optimize their logistics, reducing operational costs and improving overall efficiency.

- Carbon Footprinting: To promote sustainability, Farmonaut offers real-time carbon footprint tracking, allowing businesses to monitor and reduce their environmental impact.

These innovative technologies not only maximize crop yields but also contribute to more sustainable and efficient farming practices. For those interested in exploring Farmonaut’s offerings, you can access their web app here:

The Power of Passive Income: Canadian Dividend Stocks

While Farmonaut is revolutionizing agriculture, investors are increasingly turning to Canadian dividend stocks as a reliable source of passive income. These stocks not only provide regular income through dividends but also contribute to long-term capital gains and portfolio stability.

Let’s examine five top Canadian dividend stocks that could enhance an investor’s portfolio:

| Company Name | Sector | Dividend Yield (%) | Consecutive Years of Dividend Growth | 5-Year Dividend Growth Rate (%) |

|---|---|---|---|---|

| Fortis | Electric Utility | 4.2 | 51 | 6.0 |

| Brookfield Renewable Partners | Renewable Energy | 7.0 | 12 | 5.5 |

| TC Energy | Energy Infrastructure | 5.8 | 23 | 7.0 |

| Canadian Utilities | Utilities | 5.2 | 52 | 4.5 |

| Bank of Montreal | Banking | 4.5 | 195 | 5.0 |

1. Fortis (TSX:FTS)

Fortis stands out as an essential electric utility company, providing consistent income regardless of market fluctuations. With a strong, defensive business model and regulated cash flows, Fortis has managed to raise dividends for an impressive 51 consecutive years. The company projects a compound annual growth rate (CAGR) of 4-6% for its dividends through 2029, supported by a substantial capital plan aimed at expanding its earning base.

2. Brookfield Renewable Partners (TSX:BEP.UN)

As a leader in renewable energy, Brookfield Renewable Partners is well-positioned to benefit from the global transition to green energy. With approximately 90% of its power generation contracted and around 70% of its revenues tied to inflation, Brookfield’s operational margins are expected to grow. The company has seen dividend growth at a CAGR of 6% since 2001 and aims for a future growth rate of 5-9%, currently offering a high yield of about 7%.

3. TC Energy (TSX:TRP)

TC Energy, an energy infrastructure giant, provides a reliable passive income stream through its regulated and contracted asset base. The company has elevated its dividends at a CAGR of 7% since 2000 and forecasts a 3-5% annual increase moving forward. Factors contributing to its anticipated growth include enhanced system utilization and a focus on substantial capital projects.

4. Canadian Utilities (TSX:CU)

With an astounding dividend increase streak of 52 consecutive years, Canadian Utilities is a standout in the field of dependable income stocks. Its resilient business model and solid cash flow position it for continued success. The company supports its dividend growth prospects through strategic investments aimed at expanding its regulated asset base.

5. Bank of Montreal (TSX:BMO)

As a venerable banking institution, Bank of Montreal boasts an impressive 195 consecutive years of dividend payments—the longest streak among Canadian companies. The bank has grown its dividends at a CAGR of 5% over the last fifteen years. Its diversified revenue streams, expanding loan and deposit portfolio, and efficient credit performance are strong advantages that foster steady earnings growth.

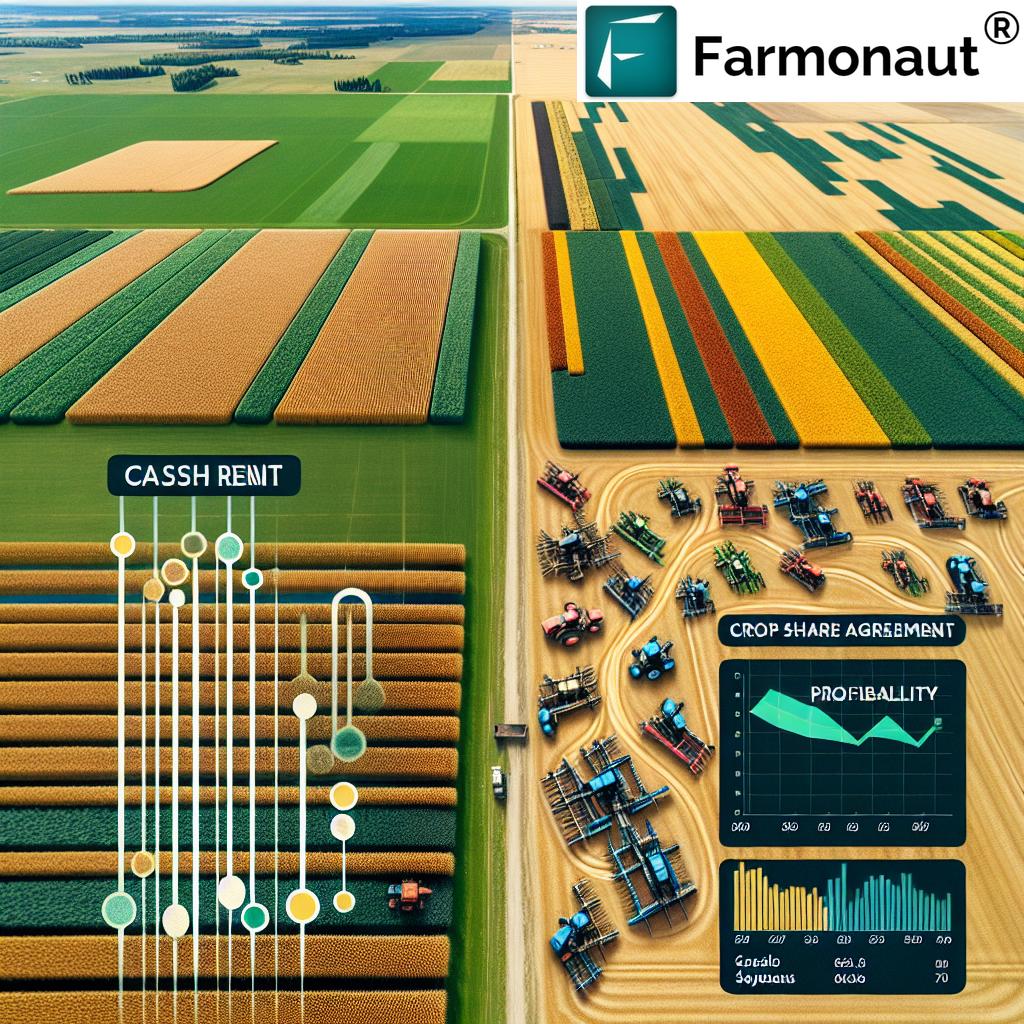

“Farmonaut’s innovative approach to sustainable agriculture aims to maximize crop yields while generating passive income opportunities.”

The Synergy Between Agriculture and Investment

While these Canadian dividend stocks offer attractive passive income opportunities, it’s fascinating to consider how they intersect with the agricultural sector. Many of these companies, particularly those in the utility and energy sectors, play crucial roles in supporting agricultural operations. For instance, reliable energy infrastructure is essential for modern farming practices, including those enabled by Farmonaut’s technology.

Moreover, as we see an increasing focus on sustainability and renewable energy, companies like Brookfield Renewable Partners are at the forefront of a transition that will significantly impact agriculture. This shift towards cleaner energy sources aligns well with Farmonaut’s mission to promote sustainable farming practices.

Farmonaut: Bridging Technology and Agriculture

Farmonaut’s innovative approach to agriculture extends beyond just crop monitoring. The company’s blockchain-based traceability solutions, for instance, have significant implications for the entire agricultural supply chain. This technology ensures transparency and trust, which is increasingly important for consumers and investors alike.

For those interested in leveraging Farmonaut’s technology, the company offers several access points:

- API Access: Developers and businesses can integrate Farmonaut’s satellite and weather data into their own systems. Explore Farmonaut’s API

- Mobile Apps: Farmonaut’s services are available on both Android and iOS platforms:

The Role of AI in Agriculture

Artificial Intelligence is playing an increasingly crucial role in modern agriculture, and Farmonaut is at the forefront of this revolution. The company’s Jeevn AI Advisory System is a prime example of how AI can be leveraged to provide personalized, data-driven insights to farmers.

Sustainable Agriculture and Passive Income: A Perfect Match

As we’ve explored, the worlds of sustainable agriculture and passive income investing are more interconnected than they might initially appear. Companies like Farmonaut are driving innovation in the agricultural sector, creating new opportunities for efficiency and sustainability. At the same time, dividend stocks, particularly those in sectors that support agriculture, offer investors a way to generate passive income while potentially supporting these advancements.

For those looking to combine their interest in agriculture with passive income generation, Farmonaut offers an intriguing opportunity through its affiliate program:

Earn With Farmonaut: Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions: Investing in Agricultural Innovation

For those interested in directly supporting and benefiting from Farmonaut’s innovative approach to agriculture, the company offers various subscription options:

Conclusion: A Sustainable Future for Agriculture and Investment

As we’ve explored throughout this article, the worlds of sustainable agriculture and passive income investing are increasingly intertwined. Farmonaut’s innovative approach to precision agriculture is paving the way for more efficient, sustainable farming practices. At the same time, Canadian dividend stocks offer investors a reliable source of passive income, with many of these companies playing crucial roles in supporting agricultural operations and the transition to cleaner energy sources.

By leveraging technologies like satellite imagery, AI, and blockchain, Farmonaut is democratizing access to precision agriculture, making it possible for farmers of all scales to optimize their operations and increase yields. This not only benefits individual farmers but also contributes to global food security and sustainability efforts.

For investors, the combination of stable dividend stocks and innovative agricultural technologies presents an exciting opportunity. By diversifying their portfolios with reliable income-generating stocks and potentially exploring opportunities in the agritech sector, investors can work towards building a sustainable financial future while supporting advancements in agriculture.

As we move forward, it’s clear that the synergy between sustainable agriculture and smart investing will play a crucial role in shaping our future. Whether you’re a farmer looking to optimize your operations, an investor seeking reliable passive income, or simply someone interested in the intersection of technology and agriculture, there are exciting opportunities on the horizon.

FAQs

- What is Farmonaut?

Farmonaut is an agricultural technology company that offers advanced, satellite-based farm management solutions. It provides services such as real-time crop health monitoring, AI-based advisory systems, and blockchain-based traceability. - How does Farmonaut’s technology benefit farmers?

Farmonaut’s technology helps farmers make informed decisions about irrigation, fertilizer usage, and pest management, ultimately optimizing crop yields and reducing resource wastage. - What are the best Canadian dividend stocks for passive income?

Some of the top Canadian dividend stocks for passive income include Fortis, Brookfield Renewable Partners, TC Energy, Canadian Utilities, and Bank of Montreal. - How can I access Farmonaut’s services?

Farmonaut’s services are available through web and mobile apps, as well as through API access for developers and businesses. - What is the Farmonaut affiliate program?

Farmonaut’s affiliate program allows individuals to earn a 20% recurring commission by sharing their promo code and helping farmers save 10% on Farmonaut’s services.

**

“Have you ever considered the ethical implications of investing in companies that profit from industries known to exacerbate climate change, such as fossil fuels? How do you balance potential financial gains with the moral responsibility to support sustainable and eco-friendly businesses?