Breaking News: Michigan Farmer Guilty in $1.2 Million Federal Crop Insurance Fraud Scheme

“A 76-year-old Michigan farmer pleaded guilty to a $1.2 million federal crop insurance fraud scheme.”

In a shocking turn of events that has sent ripples through the agricultural community, a federal farm fraud investigation has uncovered a significant case of crop insurance and USDA farm benefits fraud in Michigan. This high-profile case highlights the ongoing challenges in preventing government agriculture fraud and enforcing compliance with federal crop insurance programs. As we delve into the details of this complex scheme, we’ll explore the implications for the agricultural industry and federal oversight efforts.

The Case at a Glance

At the center of this agricultural fraud case is a 76-year-old farmer from Springport, Michigan, named Gaylord Lincoln. Lincoln, a former committee member of the USDA’s Farm Service Agency, has pleaded guilty to theft of public money in a federal investigation into alleged federal crop insurance and farm benefits fraud. The case, which has been unfolding in the U.S. District Court for the District of Eastern Michigan, involves allegations of a sophisticated scheme to obtain additional crop insurance benefits through sham farming operations.

The Scheme Unveiled

According to court documents, Lincoln was indicted by a grand jury in 2022 on 13 counts, including wire fraud and mail fraud. The allegations suggest that Lincoln set up so-called sham farming operations using the names of family members and farm employees to apply for and receive additional crop insurance benefits he wouldn’t have qualified for otherwise. This complex web of deceit allowed Lincoln to exploit federal farm programs and enrich himself at the expense of taxpayers.

The severity of the case is underscored by the government’s attorneys, who are recommending jail time for Lincoln despite his advanced age. In their sentencing memorandum, U.S. attorneys stated, “The totality of the defendant’s relevant conduct involved nearly a decade of fraud against the federal government resulting in $1.2 million in unjust enrichment.”

The Role of Insider Knowledge

What makes this case particularly egregious is Lincoln’s background as a former Farm Service Agency committee member. For 28 years, he served in this capacity, gaining intimate knowledge of the inner workings of the very programs he would later defraud. The government’s attorneys emphasized this point, stating, “Instead of working to ensure the program was run properly, the defendant took advantage of his unique knowledge to assist himself in furthering his fraud.”

This abuse of insider knowledge not only demonstrates a betrayal of trust but also highlights potential vulnerabilities in the system that may need to be addressed to prevent similar incidents in the future.

Legal Proceedings and Potential Consequences

As part of a plea agreement, Lincoln pleaded guilty to theft of public money under $1,000. While this charge carries a maximum one-year sentence, the pre-sentencing investigation report calculated Lincoln’s sentence at 27 to 33 months based on the broader scope of his fraudulent activities.

The government has recommended the maximum one-year sentence allowed under the plea agreement. This recommendation takes into account the significant loss to the government and the defendant’s position of knowledge and trust within the agricultural community.

Repayment and Ongoing Financial Obligations

In a positive development, Lincoln has repaid approximately $900,000 of the $1.2 million in unjust enrichment. However, the government recently learned that Lincoln has failed to pay the remaining $300,000 as per the terms of the settlement agreement. This outstanding balance may factor into the court’s final sentencing decision and highlights the ongoing financial implications of agricultural fraud cases.

Implications for the Agricultural Industry

This case serves as a stark reminder of the severe penalties for agricultural wire fraud and farm benefits theft. It also underscores the importance of integrity in the agricultural sector, particularly when it comes to federal assistance programs designed to support farmers and ensure food security.

The revelations from this investigation may lead to increased scrutiny of farm service agency operations and stricter oversight of crop insurance claims. It could also prompt a review of the selection process for committee members and the implementation of additional safeguards to prevent insider abuse.

The Role of Technology in Preventing Agricultural Fraud

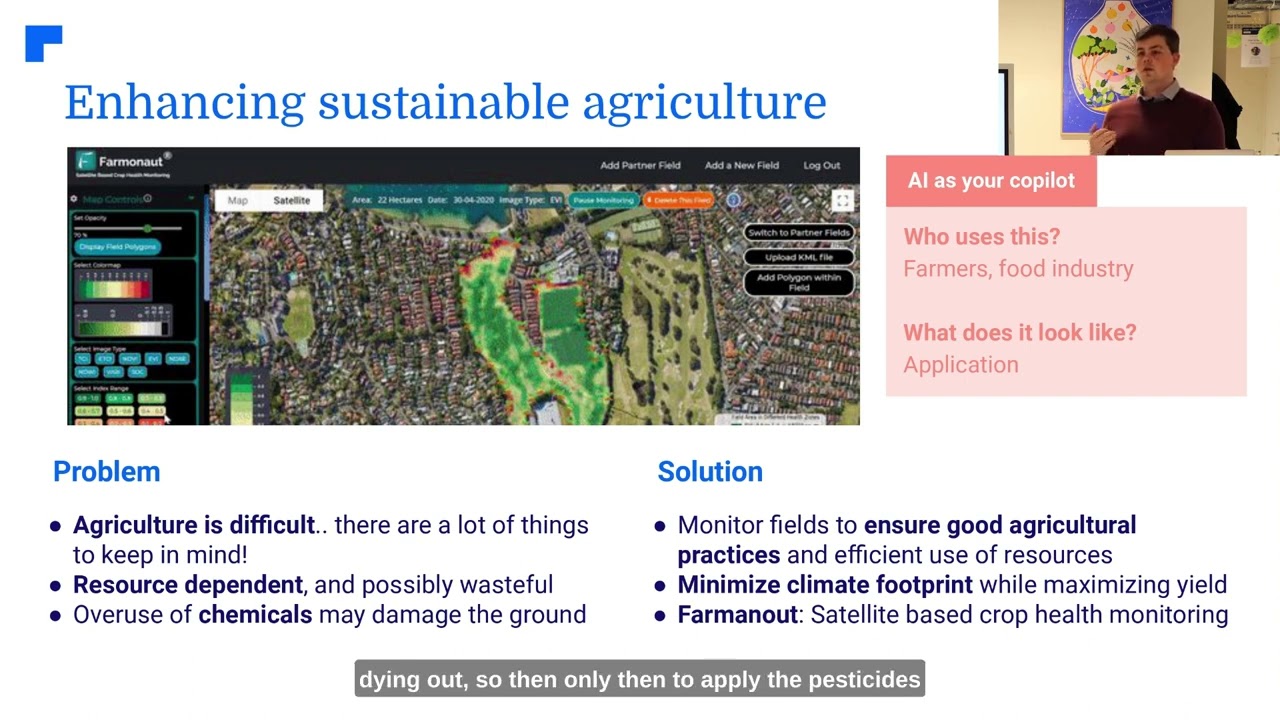

As we consider the implications of this case, it’s worth noting the potential role that advanced agricultural technologies could play in preventing similar incidents in the future. Companies like Farmonaut are at the forefront of developing innovative solutions that could help enhance transparency and accountability in the agricultural sector.

Farmonaut’s satellite-based farm management solutions, for instance, provide real-time crop health monitoring and AI-based advisory systems. While not directly related to fraud prevention, such technologies could potentially be adapted to assist in verifying crop conditions and yields, making it more difficult to falsify insurance claims.

The Importance of Compliance and Ethical Practices

The Lincoln case serves as a cautionary tale for all those involved in the agricultural industry. It emphasizes the critical need for strict adherence to regulations and ethical practices, especially when dealing with government programs and public funds.

Farmers, agricultural businesses, and industry professionals must prioritize compliance and transparency in all their dealings. This includes accurate reporting of crop yields, honest representation in insurance claims, and ethical use of government assistance programs.

Educational Initiatives and Industry Awareness

In light of this case, there may be a renewed focus on educational initiatives within the agricultural community. These could include:

- Workshops on federal crop insurance program compliance

- Training sessions on ethical business practices in agriculture

- Seminars on the legal consequences of agricultural fraud

- Information campaigns on the proper use of farm benefits and assistance programs

By increasing awareness and understanding of these issues, the industry can work towards preventing future instances of fraud and maintaining the integrity of agricultural support systems.

The Role of Technology in Modern Agriculture

While the Lincoln case highlights the darker side of agricultural practices, it’s important to note that technology is playing an increasingly positive role in modernizing and improving the industry. Platforms like Farmonaut are revolutionizing farm management through the use of satellite imagery, AI, and data analytics.

These technologies offer several benefits that could indirectly help combat fraud:

- Accurate crop health monitoring

- Precise yield predictions

- Transparent record-keeping

- Data-driven decision making

By leveraging these tools, farmers can not only improve their productivity but also maintain clear and verifiable records of their operations, which could be invaluable in case of audits or investigations.

Explore Farmonaut’s API for advanced agricultural data analysis

The Future of Agricultural Oversight

The Lincoln case may serve as a catalyst for changes in how agricultural programs are monitored and enforced. We might see developments such as:

- Enhanced data analysis tools to detect potential fraud patterns

- Increased collaboration between agricultural agencies and law enforcement

- More frequent and thorough audits of farm operations receiving federal benefits

- Stricter vetting processes for individuals in positions of trust within agricultural agencies

These measures could help strengthen the integrity of agricultural support programs and ensure that they continue to serve their intended purpose of supporting honest farmers and promoting food security.

The Impact on Rural Communities

Cases of agricultural fraud don’t just affect the individuals involved; they can have ripple effects throughout rural communities. When federal funds are misused or diverted through fraudulent schemes, it can lead to:

- Reduced resources for legitimate farmers in need

- Erosion of trust in agricultural institutions

- Potential increases in insurance premiums for all farmers

- Negative perceptions of the farming community as a whole

It’s crucial for rural communities to come together in the wake of such incidents, reaffirming their commitment to ethical practices and supporting measures that promote transparency and accountability in agriculture.

The Role of Financial Institutions

The Lincoln case also highlights the importance of vigilance on the part of financial institutions that work with the agricultural sector. Banks and insurance companies that provide crop loans and insurance play a critical role in the farm economy and can be key partners in preventing fraud.

Moving forward, we may see:

- More stringent verification processes for crop insurance claims

- Enhanced due diligence procedures for farm loans

- Increased use of technology to verify crop conditions and yields

- Closer collaboration between financial institutions and agricultural agencies

By implementing more robust checks and balances, financial institutions can help safeguard the integrity of agricultural financial products and services.

“The farmer, a former Farm Service Agency committee member, faces jail time despite repaying a substantial portion.”

The Legal Precedent

The outcome of the Lincoln case could set an important legal precedent for future agricultural fraud cases. The court’s decision, particularly regarding sentencing, may influence how similar cases are prosecuted and adjudicated in the future. This could lead to:

- More aggressive prosecution of agricultural fraud cases

- Harsher penalties for individuals in positions of trust who commit fraud

- Increased emphasis on restitution in addition to criminal penalties

- Greater scrutiny of plea agreements in agricultural fraud cases

Legal experts and industry observers will be watching closely to see how this case shapes the landscape of agricultural law enforcement.

The Role of Whistleblowers

While the details of how the Lincoln case came to light are not fully known, it’s worth noting the crucial role that whistleblowers often play in uncovering agricultural fraud. Encouraging and protecting individuals who come forward with information about fraudulent activities is essential for maintaining the integrity of the agricultural sector.

Future initiatives might include:

- Enhanced whistleblower protection programs specific to agriculture

- Education campaigns to inform agricultural workers about reporting fraud

- Anonymous tip lines for reporting suspected agricultural fraud

- Incentive programs for information leading to successful fraud prosecutions

By fostering an environment where individuals feel safe reporting suspected wrongdoing, the agricultural community can better police itself and maintain high standards of ethical conduct.

The Global Context

While the Lincoln case is specific to the United States, agricultural fraud is a global issue. As we consider the implications of this case, it’s worth looking at how other countries address similar challenges in their agricultural sectors. This could lead to:

- International cooperation in combating agricultural fraud

- Sharing of best practices for fraud prevention across borders

- Development of global standards for agricultural program integrity

- Cross-border investigations into large-scale agricultural fraud schemes

By taking a global perspective, we can learn from diverse approaches and work towards more robust, universally applicable solutions to agricultural fraud.

The Role of Consumer Awareness

While consumers may seem far removed from issues of agricultural fraud, they play a crucial role in shaping the industry. Increased consumer awareness about the importance of ethical farming practices can create market pressure for transparency and integrity. This could manifest as:

- Growing demand for products from verifiably ethical farms

- Increased interest in farm-to-table traceability

- Consumer education campaigns about agricultural support programs

- Public support for stricter oversight of agricultural subsidies and insurance

As consumers become more informed and engaged, they can become powerful allies in the fight against agricultural fraud.

Check out Farmonaut’s API Developer Docs for integration possibilities

The Path Forward

As the agricultural community grapples with the fallout from the Lincoln case, it’s clear that a multi-faceted approach will be necessary to prevent similar incidents in the future. This approach should combine:

- Stricter regulatory oversight

- Enhanced use of technology for verification and monitoring

- Improved education and training for agricultural professionals

- Greater transparency in agricultural support programs

- Stronger partnerships between government agencies, financial institutions, and the farming community

By working together and leveraging the best available tools and practices, the agricultural sector can emerge stronger and more resilient in the face of fraud challenges.

Conclusion

The Gaylord Lincoln case serves as a sobering reminder of the ongoing challenges facing the agricultural sector when it comes to fraud prevention and program integrity. As we’ve explored, the implications of this case extend far beyond a single farmer in Michigan, touching on issues of trust, oversight, technology, and the very future of agricultural support programs.

While the case highlights serious shortcomings in the current system, it also presents an opportunity for reflection and improvement. By learning from this incident and implementing stronger safeguards, the agricultural community can work towards a future where such large-scale frauds are less likely to occur.

As we move forward, it’s crucial that all stakeholders – from individual farmers to government agencies, from financial institutions to technology providers – play their part in maintaining the integrity of the agricultural sector. Only through collective effort and vigilance can we ensure that agricultural support programs continue to serve their intended purpose of supporting honest farmers and contributing to food security for all.

Key Elements of the Michigan Crop Insurance Fraud Case

| Case Element | Details | Potential Impact |

|---|---|---|

| Defendant Profile | 76-year-old Michigan farmer, former Farm Service Agency committee member | Erodes trust in agricultural institutions, highlights insider threats |

| Fraud Amount | $1.2 million in unjust enrichment | Significant loss to taxpayers, potential reduction in resources for legitimate farmers |

| Scheme Overview | Set up sham farming operations using names of family members and employees to obtain additional crop insurance benefits | Exposes vulnerabilities in the crop insurance system, may lead to stricter verification processes |

| Charges | Initially 13 counts including wire fraud and mail fraud; pleaded guilty to theft of public money under $1,000 | Could influence how future agricultural fraud cases are prosecuted and plea bargained |

| Potential Penalties | Maximum one-year sentence under plea agreement; initial calculation suggested 27-33 months | May set precedent for sentencing in similar cases, potentially deterring future fraud attempts |

| Repayment Status | Repaid $900,000; $300,000 still outstanding | Highlights challenges in full recovery of fraudulent gains, may influence future settlement agreements |

| Industry Implications | Increased scrutiny on farm service agency operations and crop insurance claims | Could lead to stricter oversight, more robust verification processes, and potential changes in agricultural policy |

FAQ Section

Q: What was the nature of the fraud committed in this case?

A: The fraud involved setting up sham farming operations using the names of family members and farm employees to apply for and receive additional crop insurance benefits that the defendant wouldn’t have qualified for otherwise.

Q: How much money was involved in the fraud?

A: The total amount of unjust enrichment was $1.2 million.

Q: Has the defendant repaid the fraudulently obtained money?

A: The defendant has repaid approximately $900,000, but $300,000 remains outstanding according to the latest information.

Q: What potential sentence does the defendant face?

A: Under the plea agreement, the defendant faces a maximum one-year sentence, although initial calculations suggested a potential 27-33 month sentence.

Q: How might this case impact future agricultural fraud investigations?

A: This case could lead to increased scrutiny of farm service agency operations, stricter oversight of crop insurance claims, and potentially harsher penalties for individuals in positions of trust who commit fraud.

Q: What role did the defendant’s position as a former Farm Service Agency committee member play in the case?

A: The defendant’s position gave him insider knowledge of the programs he defrauded, which was seen as an aggravating factor in the case. This highlights the potential for abuse by those in positions of trust within agricultural agencies.

Q: How can farmers and agricultural businesses protect themselves from being implicated in similar schemes?

A: Farmers and agricultural businesses should prioritize compliance and transparency in all their dealings, maintain accurate records, and seek legal counsel if they’re unsure about the legality of any farming practices or benefit claims.

Q: What steps might be taken to prevent similar frauds in the future?

A: Future prevention efforts might include enhanced data analysis tools to detect fraud patterns, increased collaboration between agricultural agencies and law enforcement, more frequent audits, and stricter vetting processes for individuals in positions of trust within agricultural agencies.

As we conclude our exploration of this significant agricultural fraud case, it’s clear that the implications reach far beyond a single farmer or even the state of Michigan. This case serves as a wake-up call for the entire agricultural industry, highlighting the need for increased vigilance, improved oversight, and the adoption of advanced technologies to ensure the integrity of farm support programs.

While the legal process will run its course, the broader conversation about preventing agricultural fraud must continue. It’s incumbent upon all stakeholders – from individual farmers to government agencies, from financial institutions to technology providers like Farmonaut – to work together in creating a more transparent, accountable, and ethical agricultural sector.

By learning from cases like this and implementing robust safeguards, we can help ensure that agricultural support programs continue to serve their intended purpose: supporting honest farmers and contributing to food security for all. As we move forward, let this case serve not just as a cautionary tale, but as a catalyst for positive change in the agricultural industry.