2025 Economic Outlook: Navigating Inflation, AI Adoption, and Recession Risks in Ogden’s Changing Marketplace

“AI could potentially replace up to 12 million jobs by 2025, reshaping the workforce landscape in Ogden’s marketplace.”

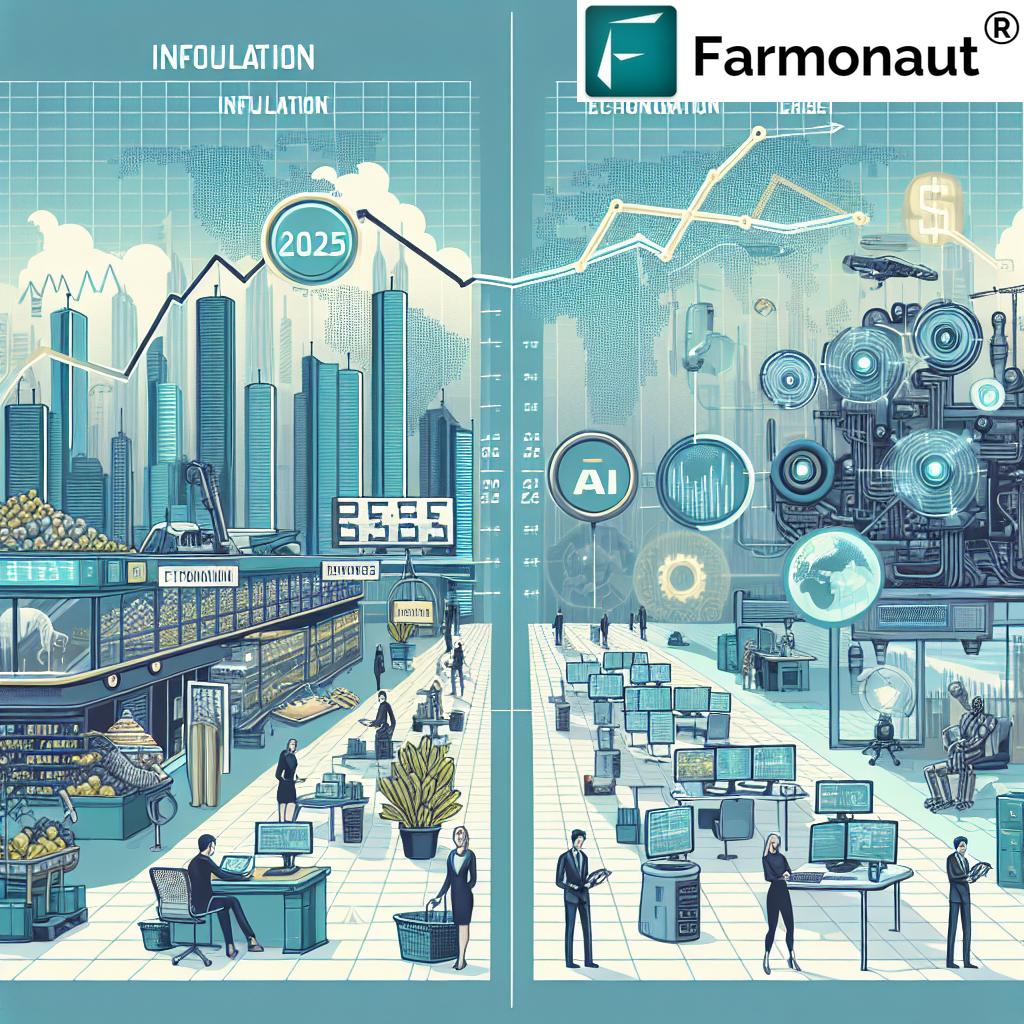

As we navigate the complex economic landscape of 2025, Ogden’s marketplace finds itself at the crossroads of technological innovation, inflationary pressures, and shifting consumer behaviors. In this comprehensive analysis, we will explore the multifaceted 2025 economic outlook, examining the intricate interplay between inflation, AI adoption, and recession risks that are shaping our financial future.

The Inflation Challenge: A Persistent Economic Hurdle

Inflation has emerged as a central theme in the 2025 economic narrative, with its impact reverberating through various sectors of Ogden’s economy. The annual inflation rate has reached 3%, marking the fourth consecutive month of increases. This persistent upward trend in prices is affecting consumers across the board, from grocery store purchases to gas pump fill-ups and rental payments.

Lindsey Piegza, chief economist at Stifel Financial, shared insights on the 2025 economic outlook at a recent event hosted by the Bank of Utah in Ogden. She emphasized that while there are some positive indicators, the overall picture for consumers remains challenging:

“I don’t want to paint too much of a rosy picture for consumers because it’s not all organic support for consumers,” Piegza stated. “Yes, we are seeing improvements in income; and with inflation coming down painfully slow, but coming down, real income growth turned positive as of 2023.”

However, the reality for many Ogden residents is a continued struggle with higher prices, elevated interest rates, and the resumption of student debt payments. These factors are collectively putting pressure on household budgets and influencing spending patterns.

Consumer Spending Trends: A Delicate Balance

The impact of inflation on consumer behavior is evident in the shifting spending trends observed in Ogden’s marketplace. Piegza noted:

“As a result, we are seeing this decline in spending, but it’s a second derivative decline. A slower pace of still positive expenditures. Consumers are still out on the marketplace buying goods and services; they’re just doing so at a noticeably reduced pace.”

This nuanced shift in consumer spending highlights the delicate balance many households are trying to maintain. While overall expenditures remain positive, the rate of spending has decreased as consumers become more cautious with their financial decisions. It’s important to note that these spending adjustments are not uniform across all income levels, with some households experiencing a disproportionate burden while others remain relatively unaffected.

The AI Revolution: Reshaping Ogden’s Workforce

One of the most significant trends influencing the 2025 economic outlook is the rapid adoption of artificial intelligence (AI) across various industries. As businesses in Ogden grapple with cost pressures, many are turning to AI as a solution to streamline operations and reduce expenses.

Piegza highlighted the profound impact of this technological shift:

“AI has really been a cost-savings lifeline, but we can’t underestimate the impact that this is continuing to have and will continue to have on the labor force, domestically and internationally.”

The scale of this transformation is staggering, with projections suggesting that up to 12 million jobs could be replaced by technology in 2025 alone. A survey conducted by Stifel Financial revealed that 50% of American businesses have already adjusted their existing workforce due to technology adoption over the past year, while 80% plan to make further adjustments in the next 12 to 18 months.

While AI adoption presents significant cost-saving opportunities for businesses, it also raises important questions about the future of employment in Ogden. As the workforce adapts to this technological shift, there will likely be a growing demand for reskilling and upskilling programs to help workers transition into new roles that complement AI technologies.

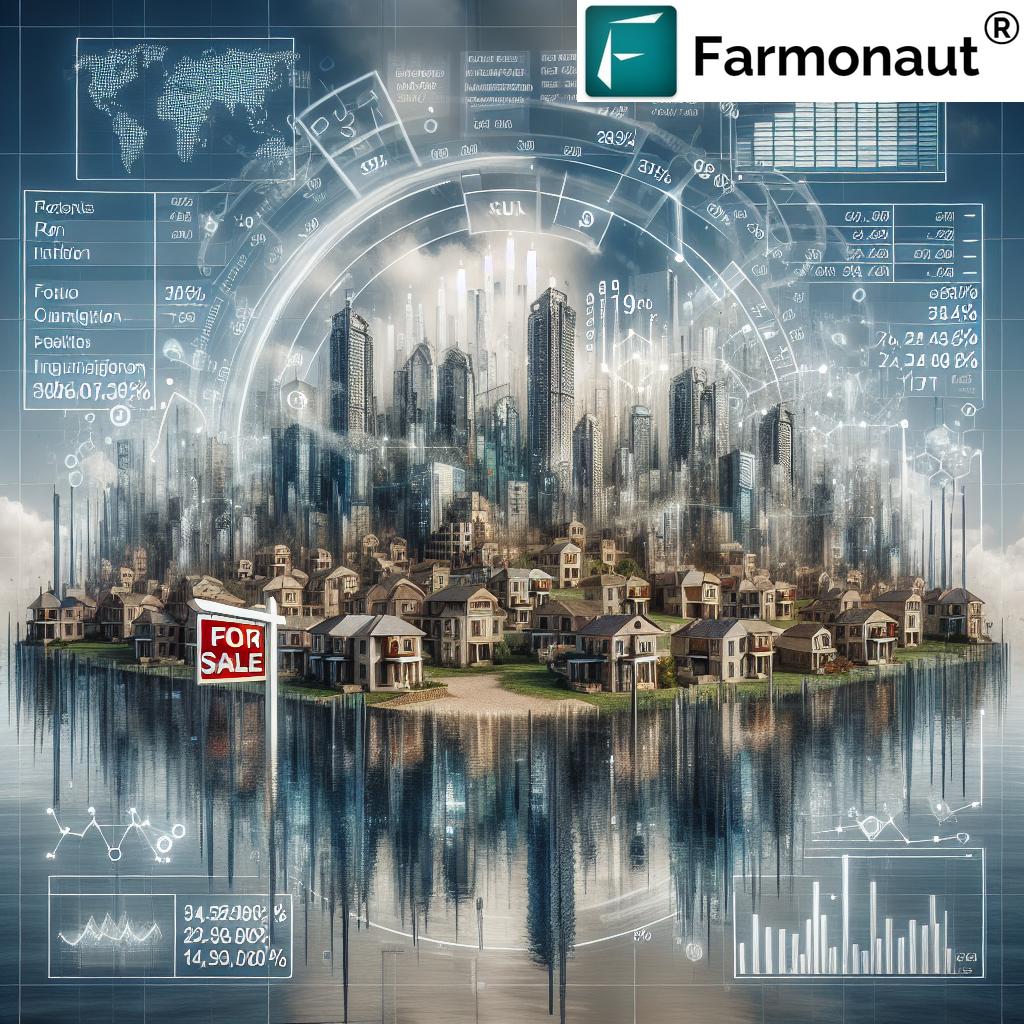

Housing Market Challenges: The Lockout Effect

“Housing affordability in Ogden reaches near record-low levels, creating a ‘lockout effect’ for potential buyers in 2025.”

The housing market in Ogden is facing its own set of challenges in 2025, with affordability issues creating significant barriers for both potential buyers and current homeowners. Piegza described this phenomenon as a “massive lockout effect,” with housing affordability reaching near record-low levels.

This situation has created a two-fold problem:

- Barrier to Entry: The high cost of housing has made it prohibitively expensive for many would-be homebuyers to enter the market.

- Reluctance to Sell: Current homeowners are hesitant to sell their properties, fearing the prospect of having to reset to higher interest rates on a new home purchase.

Piegza explained the complexity of this situation:

“This massive run-up in rates and the brevity with which rates climbed created not only a sizable lockout effect — it’s too expensive to move in — but a sizable lock-in effect. It’s too expensive to move out.”

This stagnation in the housing market could have far-reaching implications for Ogden’s economy, affecting everything from construction and real estate sectors to household wealth and mobility.

Recession Risk and Stagflation Concerns

As we look ahead to the remainder of 2025, the specter of a potential recession continues to loom over Ogden’s economy. While the risk has diminished compared to previous years, it remains a significant concern for businesses and policymakers alike.

Piegza provided a measured assessment of the recession risk:

“It’s reduced, certainly, from last year’s concerns, but I wouldn’t put it at zero. Our model puts it at about 15% over the next 12 to 18 months.”

However, Piegza’s primary concern for Ogden’s economy lies not in a traditional recession but in the potential for stagflation – a challenging economic scenario characterized by slow growth and persistent inflation. She elaborated on this risk:

“As this Fed is hyperfocused on avoiding negative growth or avoiding that recessionary period, the committee may allow or tolerate inflation to remain above the 2% target … for an extended period of time, eventually choking off upside potential and leading us to a non-accelerating economy. Sluggish growth, elevated prices — the very definition of stagflation — that’s my primary concern for the economy as I look at the Fed’s hyperfocus on achieving that delicate balance.”

This delicate balancing act by the Federal Reserve underscores the complexity of managing Ogden’s economic future, as policymakers attempt to navigate between the twin risks of recession and persistent inflation.

Policy Implications and Economic Strategies

As we consider the economic landscape of 2025, it’s crucial to examine the potential policy measures that could shape Ogden’s financial future. Several key areas of focus have emerged:

- Tariffs and Trade Policies: The implementation of higher tariffs could create more significant barriers for foreign goods entering the market.

- Tax Reductions: There are discussions about potentially extending or making permanent the landmark 2017 tax reductions, as well as the possibility of further reducing corporate tax rates.

- Immigration Laws: More stringent immigration policies could impact the labor market and certain sectors of the economy.

- Domestic Energy Production: An increased focus on boosting domestic energy production could have implications for both the energy sector and overall economic growth.

The potential inflationary impact of these policies, particularly tariffs, is a subject of debate among economists. Piegza offered her perspective on the matter:

“I would argue a one-time price increase, while certainly uncomfortable for consumers already bearing the brunt of higher prices for years, lacks the perpetual upward momentum needed to incite inflationary pressures. That being said, should this imposition of tariffs result in a back-and-forth, tit for tat, retaliatory response as we saw under President Trump’s first term, that can absolutely prove inflationary and under extreme scenarios, I think, add several tenths of a percentage point to inflation on an annual basis. So, the answer is, it depends.”

This nuanced view highlights the complexity of predicting the economic outcomes of various policy measures, emphasizing the need for careful consideration and analysis in policy-making decisions.

Technology Adoption and Its Impact on Ogden’s Economy

As we delve deeper into the technological aspects shaping Ogden’s economic landscape, it’s essential to consider the broader implications of AI and other advanced technologies across various sectors. While the adoption of these technologies presents challenges, it also opens up new opportunities for innovation and growth.

In the agricultural sector, for instance, companies like Farmonaut are leveraging satellite technology and AI to revolutionize farm management practices. These advancements are particularly relevant to Ogden’s surrounding agricultural areas, offering farmers new tools to optimize crop yields and manage resources more efficiently.

The integration of such technologies can lead to increased productivity and sustainability in agriculture, potentially offsetting some of the economic pressures faced by the sector. However, it’s crucial to consider the impact on traditional agricultural jobs and the need for workforce training to adapt to these new technologies.

Consumer Behavior and Market Adaptation

As Ogden’s consumers navigate the challenges of inflation and economic uncertainty, businesses are adapting their strategies to meet changing demand patterns. The shift towards more cautious spending habits is prompting retailers and service providers to reevaluate their offerings and pricing strategies.

Some key trends emerging in consumer behavior include:

- Increased focus on value for money

- Growing interest in sustainable and locally sourced products

- Rise in digital and contactless payment methods

- Preference for flexible shopping options (e.g., online, in-store, curbside pickup)

Businesses that can effectively adapt to these changing consumer preferences are likely to fare better in the evolving economic landscape of 2025.

The Role of Small Businesses in Ogden’s Economic Resilience

Small businesses play a crucial role in Ogden’s economy, often serving as the backbone of local communities. As they face the dual challenges of inflation and technological disruption, their ability to adapt and innovate will be critical to the city’s overall economic resilience.

Some strategies that small businesses in Ogden are adopting include:

- Embracing digital transformation to improve efficiency and reach new customers

- Focusing on niche markets and personalized services to differentiate from larger competitors

- Collaborating with other local businesses to create mutually beneficial partnerships

- Investing in employee training and development to adapt to new technologies and market demands

Supporting these small businesses through targeted policies and community initiatives could play a significant role in mitigating the economic challenges faced by Ogden in 2025.

The Importance of Workforce Development and Education

As AI and automation continue to reshape Ogden’s job market, the importance of workforce development and education cannot be overstated. Preparing the local workforce for the jobs of the future will be crucial in ensuring economic stability and growth.

Key areas of focus for workforce development in Ogden include:

- STEM education initiatives at all levels, from K-12 to higher education

- Vocational training programs aligned with emerging industries

- Partnerships between educational institutions and local businesses to create relevant curricula

- Reskilling and upskilling programs for workers in industries at risk of automation

By investing in these areas, Ogden can build a more resilient and adaptable workforce capable of thriving in the evolving economic landscape of 2025 and beyond.

Environmental Considerations and Sustainable Growth

As we consider Ogden’s economic future, it’s crucial to address the growing importance of environmental sustainability and its impact on economic policies and business practices. The push towards more sustainable economic models is likely to influence various sectors, from energy production to manufacturing and agriculture.

In the agricultural sector, for instance, technologies like those offered by Farmonaut are helping farmers implement more sustainable practices through precision agriculture and resource management. These advancements not only contribute to environmental conservation but also offer potential cost savings and efficiency improvements for farmers.

As Ogden navigates the economic challenges of 2025, integrating sustainable practices into its growth strategy could provide new opportunities for innovation and economic diversification.

2025 Economic Outlook Key Indicators

| Indicator | 2024 Value | 2025 Projected Value | Trend | Impact on Economy |

|---|---|---|---|---|

| Inflation Rate | 2.4% | 3.0% | ↑ | Increased pressure on consumer spending and business costs |

| Interest Rates | 5.5% | 5.75% | ↑ | Higher borrowing costs, potential slowdown in investment |

| AI Job Displacement (in millions) | 8 | 12 | ↑ | Significant workforce restructuring, need for reskilling |

| Housing Affordability Index | 120 | 110 | ↓ | Increased difficulty for first-time buyers, potential market stagnation |

| Consumer Spending Growth | 2.5% | 1.8% | ↓ | Slower economic growth, potential impact on retail and service sectors |

| Recession Risk (percentage) | 20% | 15% | ↓ | Decreased but still present risk of economic contraction |

| Unemployment Rate | 3.8% | 4.2% | ↑ | Slight increase in joblessness, potential strain on social services |

Conclusion: Navigating Ogden’s Economic Future

As we look ahead to the remainder of 2025 and beyond, Ogden’s economic landscape presents a complex picture of challenges and opportunities. The interplay of inflation, technological adoption, and shifting consumer behaviors will continue to shape the city’s financial future.

Key takeaways for Ogden’s residents and businesses include:

- Prepare for continued inflationary pressures and adjust budgets accordingly

- Embrace technological advancements while being mindful of their impact on the workforce

- Stay informed about potential policy changes and their economic implications

- Focus on developing adaptable skills to thrive in an evolving job market

- Consider sustainable practices as both an environmental and economic strategy

By staying informed, adaptable, and forward-thinking, Ogden’s community can work together to navigate the economic challenges of 2025 and build a resilient foundation for future growth and prosperity.

FAQ Section

- Q: How will inflation affect my daily life in Ogden in 2025?

A: Inflation will likely impact your purchasing power, making everyday items like groceries and gas more expensive. It’s important to budget carefully and consider ways to increase your income to keep pace with rising costs. - Q: What sectors in Ogden are most likely to be affected by AI adoption?

A: Industries such as manufacturing, customer service, and data analysis are likely to see significant AI integration. However, new job opportunities may arise in AI development, maintenance, and related fields. - Q: How can I prepare for potential job displacement due to AI?

A: Focus on developing skills that complement AI, such as critical thinking, creativity, and emotional intelligence. Consider upskilling or reskilling in areas less likely to be automated. - Q: What steps can small businesses in Ogden take to adapt to the changing economic landscape?

A: Small businesses should focus on digital transformation, niche markets, and personalized services. Building strong community connections and embracing innovation can also help in staying competitive. - Q: How might the housing market in Ogden change in 2025?

A: The housing market may continue to face affordability challenges. Potential buyers should be prepared for high costs, while current homeowners might consider renovating rather than moving due to high interest rates.

As we navigate the complex economic landscape of 2025, staying informed and adaptable will be key to thriving in Ogden’s changing marketplace. By understanding the interplay of factors such as inflation, AI adoption, and housing market dynamics, residents and businesses can make more informed decisions and better prepare for the challenges and opportunities that lie ahead.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

For those interested in leveraging cutting-edge agricultural technology, Farmonaut offers innovative solutions that can help farmers adapt to changing economic conditions. Explore their offerings:

For developers interested in integrating Farmonaut’s technology into their own applications, check out the API and API Developer Docs.