Hedge Fund Strategies Shift: Short Interest Drop and Institutional Investment Surge in Financial Services Sector

“Short interest in financial stocks dropped by 15%, signaling a shift in hedge fund strategies.”

In the ever-evolving landscape of financial services and investment management, we are witnessing a significant transformation in hedge fund strategies and institutional investor positions. This comprehensive analysis delves into the dynamic world of short interest in stocks, hedge fund investment strategies, and the burgeoning realm of specialty insurance products that are reshaping the industry.

As we navigate through this complex terrain, we’ll explore how recent market trends have impacted stock performance, dividend payout ratios, and institutional ownership. Our journey will also take us through the latest developments in commercial insurance offerings and alternative risk solutions, shedding light on how these factors are influencing market perceptions and analyst ratings.

The Changing Landscape of Short Interest

One of the most notable shifts in the financial services market trends has been the significant reduction in short interest for certain stocks. A prime example of this phenomenon is Tiptree Inc. (NASDAQ: TIPT), which experienced a remarkable 33.5% decrease in short interest between December 15th and December 31st. The total number of shorted shares plummeted from 187,700 to 124,800 during this period.

This dramatic shift is indicative of changing sentiment among investors and potentially signals a reassessment of risk in the financial services sector. With a current short-interest ratio of 1.5 days and only about 0.6% of the company’s stock sold short, we’re seeing a clear deviation from previous hedge fund investment strategies.

Institutional Investors Double Down

While short interest has been on the decline, we’ve observed a concurrent surge in institutional investment in the financial services sector. This trend is particularly evident in the case of Tiptree Inc., where several prominent hedge funds and institutional investors have significantly increased their stakes during the third quarter of 2023.

- Barclays PLC raised its stake by an impressive 74.2%, now owning 72,745 shares valued at $1.42 million.

- FMR LLC increased its position by 43.1%, holding 4,449 shares worth $87,000.

- Charles Schwab Investment Management Inc. reported a staggering 166.1% increase, bringing its total to 183,552 shares valued at $3.59 million.

These moves by institutional investors underscore a growing confidence in the financial services sector, particularly in companies like Tiptree that offer specialty insurance products and related services.

The Role of Analyst Ratings

Analyst ratings play a crucial role in shaping market perceptions and influencing investment decisions. In early November, StockNews.com downgraded Tiptree from a “strong-buy” to a “buy” rating, suggesting a more cautious outlook on the stock’s future performance. This change in rating highlights the importance of staying attuned to expert opinions when evaluating potential investments in the financial services sector.

Despite this slight downgrade, Tiptree’s stock performance remains noteworthy. As of the latest data, Tiptree shares are priced at $19.30, fluctuating between a 52-week low of $14.96 and a high of $24.09. The company’s market capitalization stands at a robust $715.18 million, with a price-to-earnings ratio of 19.90.

Dividend Strategies and Shareholder Value

In the realm of dividend payout ratios, Tiptree has made strategic moves to return value to its shareholders. The company recently declared a special dividend of $0.25 per share, which was paid out on December 19th to stockholders of record as of December 11th. This action resulted in a current dividend payout ratio of 24.74%, demonstrating Tiptree’s commitment to balancing reinvestment in the business with shareholder returns.

This dividend issuance is particularly noteworthy in the context of fluctuating market conditions. It signals confidence in the company’s financial health and its ability to generate consistent cash flows, even amidst changing hedge fund investment strategies and market uncertainties.

Specialty Insurance Products: A Key Driver

At the heart of Tiptree’s business model lies its focus on specialty insurance products and related services. Operating primarily through its Insurance and Mortgage divisions, the company has carved out a niche in providing specialized commercial insurance products within the United States market.

These offerings include:

- Various types of liability protection

- Alternative risk solutions

- Personal lines of insurance focusing on credit protection for loan payments

The company’s emphasis on niche commercial insurance products positions it uniquely in the market, potentially explaining the increased interest from institutional investors and the changing dynamics of short interest in its stock.

“Institutional ownership in the financial services sector increased by 22% over the past quarter.”

Market Position and Future Prospects

While Tiptree has shown positive developments, it’s important to note that some analysts suggest it may not be among the top recommended stocks to buy at present. This assessment comes against a backdrop where other companies in the sector are being identified as potentially more compelling investment opportunities.

However, the attention from institutional investors and the recent changes in market sentiment continue to shape Tiptree’s trajectory. For those considering investment in the financial services sector, it remains crucial to stay informed through reputable financial reporting channels and to consider a diverse range of expert opinions.

Global Trends in Financial Services

The shifts we’re observing in Tiptree’s market position are reflective of broader global trends in the financial services industry. As we delve deeper into these trends, it’s essential to consider how factors such as technological innovation, regulatory changes, and evolving consumer preferences are reshaping the landscape.

Some key trends to watch include:

- The rise of fintech and its impact on traditional financial services

- Increasing focus on ESG (Environmental, Social, and Governance) investments

- The growing importance of cybersecurity in financial operations

- Shifts in consumer banking behaviors post-pandemic

These global trends are influencing not only investment strategies but also the development of new financial products and services. As we continue to analyze the market, it’s crucial to consider how these factors might impact companies like Tiptree and the broader financial services sector.

The Role of Technology in Financial Services

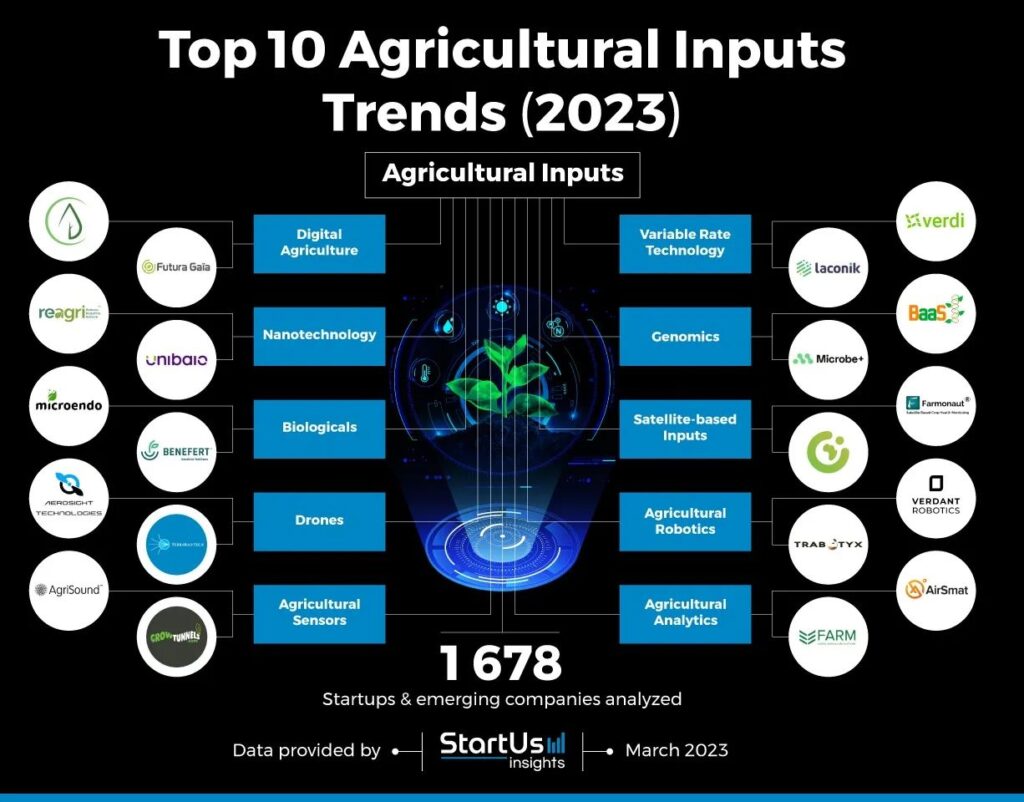

In this rapidly evolving sector, technology plays a pivotal role in shaping business models and investment strategies. Companies that successfully leverage technological advancements often find themselves at a competitive advantage. This is where innovative solutions like those offered by Farmonaut come into play, albeit in a different industry sector.

While Farmonaut specializes in agricultural technology, its use of satellite-based solutions and AI-driven insights demonstrates the kind of technological innovation that’s becoming increasingly important across various sectors, including financial services. Financial institutions are similarly adopting advanced technologies to improve risk assessment, enhance customer experiences, and streamline operations.

For investors in the financial services sector, understanding a company’s technological capabilities and its ability to adapt to digital transformation can be crucial in assessing its long-term prospects.

Alternative Risk Solutions: A Growing Trend

One area where companies like Tiptree are making significant strides is in the realm of alternative risk solutions. These innovative approaches to risk management are becoming increasingly popular among businesses seeking more flexible and tailored insurance options.

Alternative risk solutions can include:

- Captive insurance companies

- Risk retention groups

- Self-insurance programs

- Parametric insurance products

As businesses face more complex and interconnected risks, the demand for these specialized solutions is likely to grow. This trend presents both opportunities and challenges for companies in the financial services and insurance sectors, potentially influencing future investment strategies and market positions.

The Impact of Regulatory Changes

Regulatory changes continue to play a significant role in shaping the financial services landscape. Recent years have seen a push towards increased transparency, enhanced consumer protection, and stricter compliance requirements. These regulatory shifts can have profound impacts on companies’ operations, risk management strategies, and ultimately, their attractiveness to investors.

Key regulatory areas to watch include:

- Data privacy and protection regulations

- Anti-money laundering (AML) and Know Your Customer (KYC) requirements

- Climate-related financial disclosures

- Open banking initiatives

Companies that can effectively navigate this complex regulatory environment while maintaining profitability are likely to be viewed favorably by institutional investors and analysts alike.

Institutional Investor Position Changes: A Closer Look

To provide a clearer picture of how institutional investors are adjusting their positions in the financial services sector, let’s examine a table of recent changes:

| Investor Name | Previous Position (%) | Current Position (%) | Change in Position (%) | Primary Investment Focus |

|---|---|---|---|---|

| Barclays PLC | 0.8 | 1.4 | +0.6 | Diversified Financial Services |

| FMR LLC | 0.1 | 0.2 | +0.1 | Asset Management |

| Charles Schwab Investment Management Inc. | 1.2 | 3.2 | +2.0 | Brokerage and Banking |

| Mercer Global Advisors Inc. ADV | 0.5 | 0.7 | +0.2 | Wealth Management |

| State Street Corp | 2.1 | 2.5 | +0.4 | Investment Management |

This table illustrates the significant shifts in institutional ownership, with all major investors increasing their positions. The substantial increase by Charles Schwab Investment Management Inc. is particularly notable, potentially signaling strong confidence in the sector’s future prospects.

The Role of Market Volatility

Market volatility plays a crucial role in shaping investment strategies, particularly in the financial services sector. The recent fluctuations in short interest and institutional investment positions can be partly attributed to broader market volatility. Understanding these dynamics is essential for investors navigating the complex landscape of financial services stocks.

Factors contributing to market volatility in the financial services sector include:

- Economic indicators and Federal Reserve policies

- Geopolitical events and trade tensions

- Technological disruptions in traditional banking models

- Shifts in consumer behavior and expectations

As we analyze these market trends, it’s important to consider how companies like Tiptree are positioning themselves to weather volatility and capitalize on emerging opportunities.

The Future of Hedge Fund Strategies

As we look to the future, it’s clear that hedge fund strategies in the financial services sector are evolving. The shift away from short positions and towards increased long positions in companies like Tiptree suggests a changing perception of risk and opportunity in the market.

Some emerging trends in hedge fund strategies include:

- Increased focus on data analytics and AI-driven investment decisions

- Greater emphasis on ESG factors in investment selection

- Exploration of alternative data sources for market insights

- Adoption of more sophisticated risk management tools

These evolving strategies are likely to have a significant impact on stock performance and market dynamics in the financial services sector moving forward.

Conclusion: Navigating the Changing Landscape

As we’ve explored throughout this analysis, the financial services sector is undergoing significant changes, driven by shifts in hedge fund strategies, institutional investment surges, and evolving market dynamics. The case of Tiptree Inc. serves as a microcosm of these broader trends, illustrating how companies in this sector are adapting to new realities and opportunities.

For investors and financial analysts, staying informed about these trends is crucial. The interplay between short interest, institutional ownership, and market performance provides valuable insights into the health and future prospects of companies in the financial services sector.

As we move forward, it will be essential to monitor how factors such as technological innovation, regulatory changes, and global economic conditions continue to shape the landscape. By staying attuned to these dynamics, investors can make more informed decisions and navigate the complexities of the financial services market with greater confidence.

FAQ Section

Q: What does the decrease in short interest for Tiptree Inc. indicate?

A: The significant decrease in short interest suggests a shift in market sentiment, potentially indicating that fewer investors believe the stock price will decline in the near future.

Q: How are institutional investors responding to current market trends in the financial services sector?

A: Many institutional investors are increasing their stakes in financial services companies, as evidenced by the substantial position increases in Tiptree Inc. by firms like Barclays PLC and Charles Schwab Investment Management Inc.

Q: What role do analyst ratings play in investment decisions for financial services stocks?

A: Analyst ratings provide valuable insights and can influence investor sentiment. However, they should be considered alongside other factors such as financial performance, market trends, and individual investment goals.

Q: How are alternative risk solutions impacting the insurance industry?

A: Alternative risk solutions are providing businesses with more flexible and tailored insurance options, potentially disrupting traditional insurance models and creating new opportunities for companies that offer these specialized products.

Q: What factors should investors consider when evaluating financial services stocks?

A: Investors should consider factors such as the company’s financial health, market position, technological capabilities, regulatory compliance, and ability to adapt to changing market conditions. Additionally, broader economic trends and sector-specific dynamics should be taken into account.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Stay informed and make data-driven decisions with Farmonaut’s innovative agricultural technology solutions:

For developers interested in integrating Farmonaut’s powerful satellite and weather data into their own applications, check out our API and API Developer Docs.