Breaking News: U.S. Auto Tariffs Set to Reshape North American Automotive Industry

“The 25% U.S. tariff on foreign-made vehicles could impact over $200 billion worth of auto imports annually.”

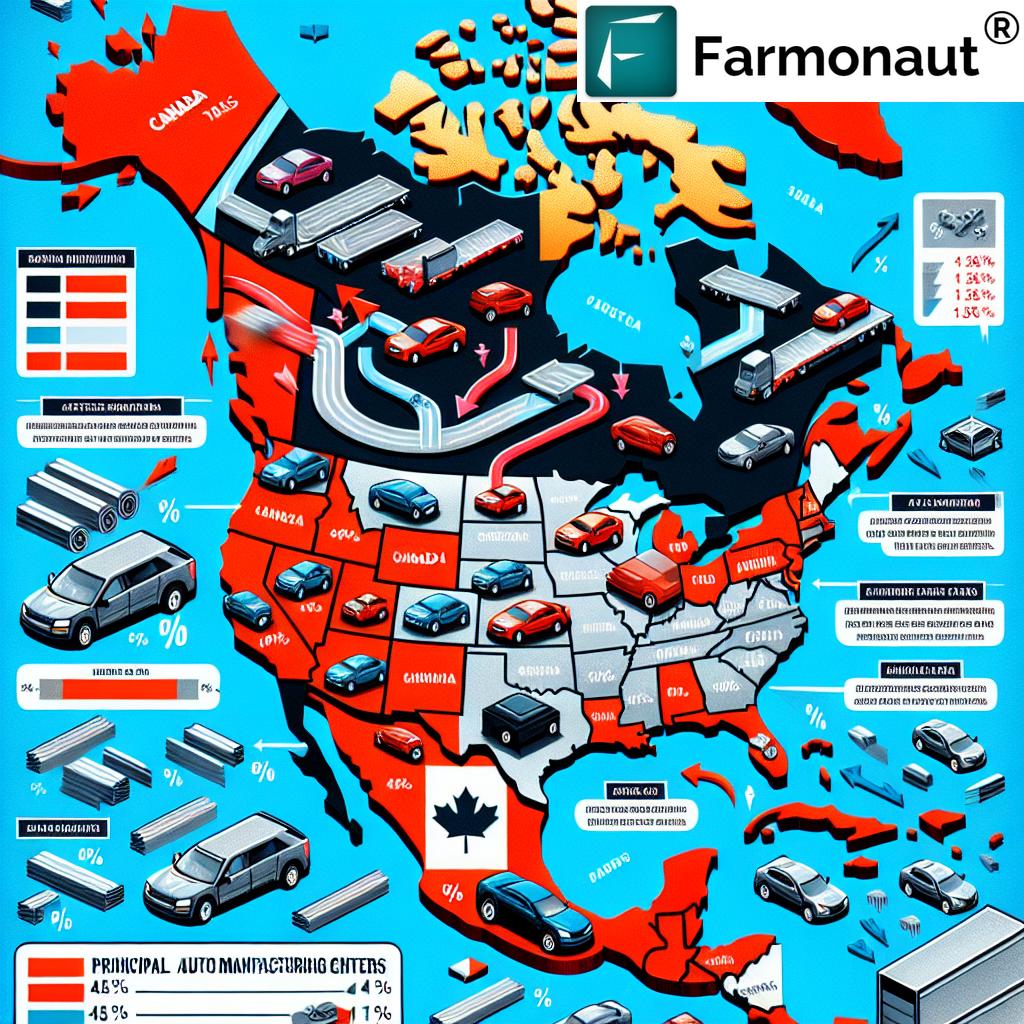

In a move that has sent shockwaves through the global automotive market, U.S. President Donald Trump has announced a 25% tariff on all autos not made in America. This decision, coupled with existing steel and aluminum tariffs, is poised to reshape the landscape of automotive manufacturing jobs and investment across North America. As we delve into the implications of these U.S. auto tariffs, we’ll explore how they’re likely to affect Canada-U.S. trade relations and the broader North American auto industry.

The Announcement: A Game-Changer for the Auto Industry

Speaking from the Oval Office, President Trump declared the implementation of a 25% tariff on foreign-made vehicles, separate from other global “reciprocal” tariffs set to be imposed on America’s allies. This move comes on top of the 25% steel and aluminum tariffs already in place, which have significantly impacted Canadian and Mexican shipments to the United States.

Trump’s assertion that these auto surcharges will drive carmakers and investors to produce vehicles on American soil has been met with skepticism from industry analysts, who argue that such a shift would take years to materialize fully. The president stated, “If they’re made in the United States, there is absolutely no tariff. We start off with a two and a half percent base, which is what we were at, and we go to 25 percent.”

Immediate Market Reactions and Industry Warnings

The announcement of impending auto tariffs has already caused ripples in the stock market, with indices like the S&P 500 dipping in anticipation. Automakers and analysts have warned of potentially severe consequences, with S&P Global Mobility predicting a possible drop in North American production by “up to 20,000 units per day within a week.”

This dramatic shift in trade policy is likely to have far-reaching effects on the automotive sector, impacting everything from manufacturing plans to cross-border auto parts supply chains. The CUSMA trade agreement, which has been a cornerstone of North American economic cooperation, now faces new challenges as these import duties threaten to disrupt established trade patterns.

The North American Automotive Landscape: Before and After Tariffs

| Industry Aspect | Pre-Tariff Scenario | Post-Tariff Projection |

|---|---|---|

| Vehicle Prices | Stable market-driven pricing | Potential 10-25% increase for imported vehicles |

| Manufacturing Jobs in U.S. | Approximately 1 million | Possible increase of 5-10% over 2-3 years |

| Manufacturing Jobs in Canada | Approximately 125,000 | Potential decrease of 10-15% within a year |

| Cross-border Parts Trade Volume | $100+ billion annually | Projected 20-30% decrease in first year |

| Market Share of U.S. vs. Foreign Automakers | 55% U.S. / 45% Foreign | Estimated shift to 60-65% U.S. / 35-40% Foreign |

This table illustrates the potential seismic shifts in the North American automotive industry as a result of the new tariffs. From job losses in Canada to price hikes for consumers, the ripple effects are expected to be significant and wide-ranging.

Implications for Canada-U.S. Trade Relations

The imposition of these tariffs is likely to strain the already complex Canada-U.S. trade relations. Canada has argued that Trump’s tariffs would violate the CUSMA, which allows for tariff-free trade of cars that contain 70% North American steel and aluminum, and are substantially produced by workers earning at least $16 (US) per hour.

In response to these developments, Canadian political leaders are already proposing strategies to mitigate the impact:

- Liberal Leader Mark Carney has proposed a $2 billion “strategic response” fund to help Trump-proof Canada’s auto industry.

- Plans to boost the Canadian steel, aluminum, and critical minerals sectors are being discussed.

- A potential “buy-Canadian” policy for government purchases of automotive vehicles is under consideration.

These measures underscore the gravity of the situation and the potential for significant disruption in the Canadian automotive sector, which directly supports 125,000 jobs and indirectly influences nearly 500,000 more.

Global Automotive Market: Bracing for Change

The ripple effects of these tariffs are expected to extend far beyond North America. Global automakers with significant U.S. market presence are likely to reassess their manufacturing and distribution strategies. Some potential outcomes include:

- Increased investment in U.S.-based manufacturing facilities by foreign automakers

- Shifts in global supply chains to accommodate new trade realities

- Potential retaliatory measures from other countries, leading to a more fragmented global auto market

“The North American automotive industry employs approximately 1.7 million workers across Canada, the U.S., and Mexico.”

The Future of North American Vehicle Production

As the automotive industry grapples with these new tariffs, we’re likely to see significant changes in North American vehicle production patterns. Some potential developments include:

- Increased localization of production in the U.S. to avoid tariffs

- Potential closure or downsizing of manufacturing plants in Canada and Mexico

- Greater focus on automation and efficiency to offset increased production costs

- Shifts in vehicle model offerings to align with new cost structures

These changes could reshape the competitive landscape of the North American auto industry, potentially favoring U.S.-based manufacturers in the short term but risking long-term competitiveness on the global stage.

Impact on Workers and Communities

The human impact of these tariffs cannot be overstated. Communities built around automotive manufacturing, particularly in Canada and Mexico, may face significant challenges:

- Potential job losses in Canadian and Mexican auto plants

- Shift in skilled labor demand towards U.S. manufacturing hubs

- Economic ripple effects on communities dependent on the auto industry

Workers in all three countries will need to adapt to changing industry dynamics, potentially requiring retraining or relocation to maintain employment in the sector.

Consumer Impact: Higher Prices and Limited Choices?

American consumers are likely to feel the impact of these tariffs in their wallets. Industry analysts predict:

- Increased prices for imported vehicles, potentially by thousands of dollars

- Reduced model variety as some foreign manufacturers may withdraw certain models from the U.S. market

- Longer wait times for popular imported models due to supply chain disruptions

These changes could significantly alter consumer behavior in the auto market, potentially shifting preferences towards domestically produced vehicles or encouraging longer ownership periods for existing vehicles.

Environmental Considerations

The shift in manufacturing patterns and potential changes in consumer behavior could have environmental implications:

- Increased localized production might reduce transportation-related emissions

- Higher vehicle prices could slow the adoption of newer, more fuel-efficient models

- Potential delays in the rollout of electric vehicles due to market uncertainties

These factors underscore the complex interplay between trade policies, industry dynamics, and environmental goals in the automotive sector.

The Role of Technology in Adapting to New Realities

As the automotive industry grapples with these new tariffs, technology will play a crucial role in helping companies adapt. Advanced manufacturing techniques, data analytics, and supply chain optimization will be key to maintaining competitiveness in this new landscape.

At Farmonaut, while our focus is on agricultural technology, we recognize the importance of data-driven decision-making across industries. Our satellite-based monitoring and AI-powered analytics platforms demonstrate how technology can help sectors adapt to changing regulations and market conditions. Learn more about our API solutions that could potentially be adapted for supply chain management in various industries.

Looking Ahead: Potential Scenarios and Industry Response

As the industry absorbs the impact of these tariffs, several scenarios could unfold:

- Short-term disruption followed by a new equilibrium in North American auto production

- Prolonged trade disputes leading to a more fragmented global auto market

- Accelerated innovation in U.S. auto manufacturing to offset higher production costs

- Increased focus on electric and autonomous vehicles as a way to differentiate in a changing market

Industry leaders will need to be agile and forward-thinking to navigate these uncertain waters. Explore our developer docs to see how data-driven insights can inform strategic decision-making in rapidly changing environments.

Conclusion: A Transformed North American Automotive Landscape

The imposition of U.S. auto tariffs marks a significant turning point for the North American automotive industry. As we’ve explored, the repercussions of this policy shift will be far-reaching, affecting everything from manufacturing jobs to consumer choices, and from global trade relations to environmental considerations.

While the full impact of these tariffs remains to be seen, it’s clear that the automotive industry is entering a period of profound change. Companies, workers, and consumers alike will need to adapt to this new reality, leveraging technology, innovation, and strategic planning to navigate the challenges ahead.

As we continue to monitor these developments, it’s crucial to stay informed and agile. At Farmonaut, we’re committed to providing cutting-edge technological solutions that help industries adapt to changing landscapes. While our focus is on agriculture, the principles of data-driven decision-making and technological innovation we employ are relevant across sectors.

Explore how Farmonaut’s solutions can help your business stay ahead in a rapidly changing world:

Earn With Farmonaut: Join our affiliate program and earn 20% recurring commission by helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

FAQ Section

- Q: How will the 25% tariff on foreign-made vehicles affect car prices in the U.S.?

A: Consumers can expect to see price increases on imported vehicles, potentially ranging from 10% to 25%, depending on how manufacturers and dealers absorb or pass on the tariff costs. - Q: Will these tariffs lead to more jobs in the U.S. automotive sector?

A: While the U.S. government anticipates job growth in domestic auto manufacturing, the overall impact on employment is complex. Some jobs may be created in U.S. plants, but there could be losses in related industries affected by higher costs and potential retaliatory measures. - Q: How might Canadian and Mexican auto industries be affected?

A: Both countries could see significant challenges, including potential plant closures or downsizing, job losses, and a decrease in cross-border parts trade. The integrated nature of the North American auto industry means these impacts could be substantial. - Q: What are the potential long-term consequences for the global automotive market?

A: The tariffs could lead to a more fragmented global auto market, shifts in manufacturing locations, changes in company strategies, and potentially accelerated innovation in areas like electric and autonomous vehicles as companies seek new competitive advantages. - Q: How might these tariffs affect the implementation of the CUSMA trade agreement?

A: The tariffs present a significant challenge to CUSMA, potentially undermining key provisions of the agreement related to automotive trade. This could lead to disputes and possibly renegotiations of certain aspects of the trade pact.

As we navigate these turbulent times in the automotive industry, staying informed and adaptable is key. While Farmonaut’s expertise lies in agricultural technology, our commitment to innovation and data-driven solutions resonates across industries facing significant change. We’ll continue to monitor these developments and provide insights on how technology can help businesses thrive in evolving landscapes.

including yours truly :). Keep doing what you are doing