Denmark Pioneers Livestock CO2 Tax: Sustainable Farming Strategies for 2030 and Beyond

“Denmark aims to reduce greenhouse gas emissions by 70% from 1990 levels through its livestock CO2 tax by 2030.”

As we delve into the groundbreaking agricultural policy shift in Denmark, we find ourselves at the forefront of a global movement towards sustainable farming practices. The Danish government’s innovative approach to tackling climate change through a livestock emissions tax marks a significant milestone in the fight against global warming. In this comprehensive exploration, we’ll examine the intricacies of this pioneering initiative and its potential to reshape the future of agriculture worldwide.

The Danish Livestock CO2 Tax: A Bold Step Towards Sustainability

Denmark’s decision to implement a CO2 tax on farm emissions by 2030 is a testament to the country’s commitment to environmental stewardship. This ambitious plan aims to reduce greenhouse gas output by an impressive 70% from 1990 levels, positioning Denmark as a global leader in sustainable farming practices. The policy, which is the result of extensive collaboration between farmers, environmental groups, and government experts, introduces a carbon pricing model that balances environmental goals with economic considerations.

The livestock emissions tax is set to start at 300 Danish crowns per ton in 2030, gradually increasing to 750 crowns by 2035. This incremental approach allows the agriculture industry to adapt and innovate over time, fostering a smooth transition towards more sustainable practices. To support farmers through this transition, the government has included a 60% income tax deduction, striking a balance between environmental imperatives and economic realities.

Understanding the Impact on Danish Agriculture

The introduction of this CO2 tax will undoubtedly have far-reaching implications for Danish agriculture. Let’s break down the key areas of impact:

- Livestock Management: Farmers will need to reassess their livestock management practices, focusing on reducing methane emissions from cattle and other ruminants.

- Crop Production: There may be a shift towards crops that support lower-emission livestock farming or alternative protein sources.

- Farm Machinery: Investment in more efficient, low-emission farm machinery will likely increase.

- Feed Strategies: Developing and implementing feed strategies that reduce enteric fermentation in livestock will become crucial.

While these changes present challenges, they also open up opportunities for innovation in the agricultural sector. Farmers who adapt quickly and effectively to the new regulations may find themselves at a competitive advantage in both domestic and global markets.

Global Implications of Denmark’s CO2 Tax

Denmark’s pioneering approach to emissions management in livestock farming could inspire similar policies worldwide. As a small country with a significant agricultural sector, Denmark’s success in implementing this tax could serve as a model for other nations grappling with the challenge of reducing agricultural emissions.

“The Danish livestock emissions tax will start at 300 crowns per ton in 2030, increasing to 750 crowns by 2035.”

The global implications of this policy are substantial:

- Market Shifts: As Danish farmers adapt to the new regulations, we may see changes in global agricultural markets, particularly in livestock and dairy products.

- Technology Transfer: Innovations in low-emission farming practices developed in Denmark could be exported to other countries.

- Policy Influence: Other nations, especially within the European Union, may look to Denmark’s example when crafting their own agricultural climate policies.

Sustainable Farming Strategies for 2030 and Beyond

As we look towards 2030 and beyond, it’s clear that sustainable farming practices will be crucial for the future of agriculture. Denmark’s CO2 tax is just one piece of a larger puzzle in creating a more environmentally friendly agricultural sector. Here are some key strategies that will likely play a significant role:

- Precision Agriculture: Utilizing technology to optimize resource use and minimize waste.

- Carbon Sequestration: Implementing farming practices that capture and store carbon in the soil.

- Alternative Protein Sources: Developing and scaling up production of plant-based and lab-grown protein alternatives.

- Renewable Energy Integration: Increasing the use of renewable energy sources in farm operations.

- Water Management: Improving irrigation efficiency and water conservation techniques.

These strategies, combined with innovative policies like Denmark’s livestock emissions tax, have the potential to transform agriculture into a more sustainable and environmentally friendly industry.

The Role of Technology in Sustainable Farming

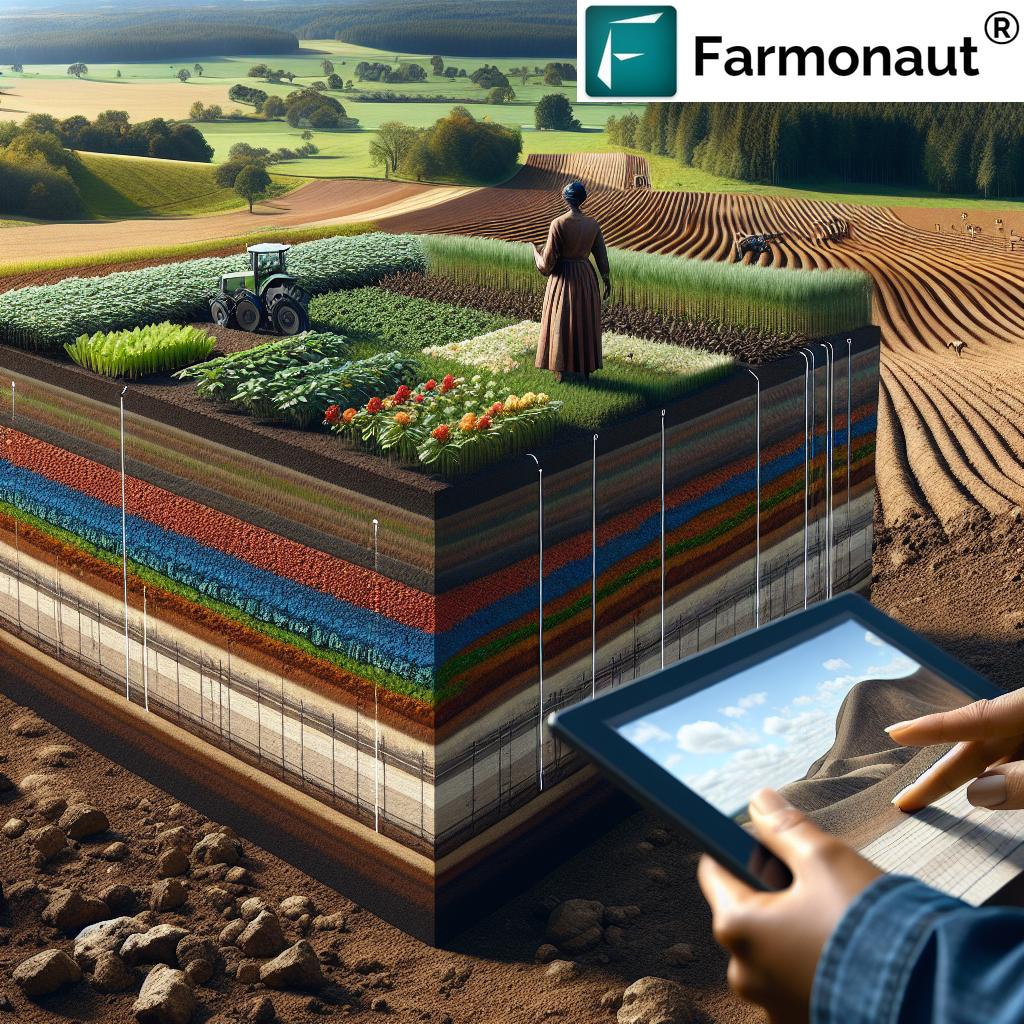

As we navigate the challenges posed by climate change and the need for more sustainable agricultural practices, technology will play a crucial role. Companies like Farmonaut are at the forefront of this agricultural revolution, offering innovative solutions that can help farmers adapt to new regulations and improve their environmental performance.

Farmonaut’s satellite-based farm management solutions provide farmers with valuable tools for precision agriculture, including:

- Real-time crop health monitoring

- AI-based advisory systems

- Blockchain-based traceability

- Resource management tools

These technologies can help farmers optimize their operations, reduce waste, and ultimately lower their carbon footprint – all crucial factors in meeting the goals set by policies like Denmark’s livestock emissions tax.

Explore Farmonaut’s solutions:

Denmark’s Livestock CO2 Tax: Timeline and Impacts

To better understand the progression and potential effects of Denmark’s livestock emissions tax, let’s examine a detailed timeline:

| Year | CO2 Tax Rate (Danish crowns per ton) | Estimated Emissions Reduction (% from 1990 levels) | Projected Impact on Livestock Production (%) | Farmer Income Tax Deduction (%) |

|---|---|---|---|---|

| 2023 | 0 | 30% | 0% | 60% |

| 2025 | 0 | 40% | 0% | 60% |

| 2030 | 300 | 60% | -5% | 60% |

| 2032 | 450 | 65% | -7% | 60% |

| 2035 | 750 | 70% | -10% | 60% |

This timeline illustrates the gradual implementation of the tax and its projected impacts on emissions and livestock production. The consistent 60% income tax deduction for farmers demonstrates the government’s commitment to supporting the agricultural sector through this transition.

Challenges and Opportunities for Danish Farmers

While the livestock emissions tax presents significant challenges for Danish farmers, it also opens up new opportunities for innovation and growth. Let’s explore some of the key challenges and potential opportunities:

Challenges:

- Initial costs of adapting to new regulations

- Potential reduction in livestock numbers

- Need for rapid adoption of new technologies and practices

- Competition from international markets with less stringent regulations

Opportunities:

- Development of new, low-emission farming techniques

- Potential for premium pricing on sustainably produced products

- Access to government support and incentives for sustainable practices

- Improved long-term sustainability and resilience of farming operations

By embracing these challenges and opportunities, Danish farmers can position themselves as leaders in sustainable agriculture, potentially gaining a competitive edge in both domestic and international markets.

The Role of Government Support and Policy

The success of Denmark’s livestock emissions tax will largely depend on the support and policies implemented alongside it. The government’s approach combines regulatory measures with financial incentives, creating a framework that encourages sustainable practices while supporting farmers through the transition.

Key elements of government support include:

- Research and Development Funding: Investment in new technologies and farming practices to reduce emissions

- Education and Training Programs: Helping farmers adapt to new sustainable farming methods

- Financial Incentives: The 60% income tax deduction and potential additional subsidies for sustainable practices

- Market Development: Support for developing markets for sustainably produced agricultural products

These supportive measures are crucial in ensuring that the livestock emissions tax achieves its environmental goals without unduly burdening the agricultural sector.

Global Climate Policy and Agriculture

Denmark’s initiative comes at a time when global attention is increasingly focused on the role of agriculture in climate change. The livestock sector, in particular, has been identified as a significant contributor to greenhouse gas emissions, primarily through methane production from cattle and other ruminants.

As countries around the world grapple with the challenge of reducing their carbon footprint, Denmark’s approach could serve as a valuable case study. The success or challenges faced in implementing this policy will likely inform similar initiatives in other nations, particularly those with significant agricultural sectors.

Some key considerations for global climate policy in agriculture include:

- Balancing emissions reduction with food security concerns

- Addressing the unique challenges faced by developing countries

- Ensuring fair competition in international agricultural markets

- Promoting technology transfer and knowledge sharing between nations

As we move towards 2030 and beyond, it’s clear that agriculture will play a crucial role in meeting global climate goals. Denmark’s livestock emissions tax represents an important step in this direction, potentially paving the way for more comprehensive and effective climate policies in the agricultural sector worldwide.

The Future of Sustainable Agriculture

As we look towards the future of sustainable agriculture, it’s clear that initiatives like Denmark’s livestock emissions tax are just the beginning. The agricultural sector will need to continue evolving and innovating to meet the challenges of climate change and increasing global food demand.

Some key trends and technologies that are likely to shape the future of sustainable agriculture include:

- Vertical Farming: Increasing food production in urban areas with minimal land use

- Gene Editing: Developing crops and livestock with improved yield and reduced environmental impact

- Artificial Intelligence in Agriculture: Using AI for precise crop management and resource allocation

- Regenerative Agriculture: Implementing practices that restore soil health and biodiversity

- Alternative Proteins: Expanding production of plant-based and cultured meat alternatives

These advancements, combined with policy measures like carbon pricing and emissions regulations, have the potential to transform agriculture into a more sustainable and environmentally friendly industry.

Conclusion: A New Era for Agriculture

Denmark’s pioneering livestock CO2 tax marks the beginning of a new era in agricultural policy and climate change mitigation. By taking this bold step, Denmark is not only addressing its own emissions challenges but also setting an example for the rest of the world to follow.

As we move towards 2030 and beyond, the success of this initiative will be closely watched by policymakers, farmers, and environmental experts worldwide. The lessons learned from Denmark’s experience will undoubtedly shape future policies and practices in sustainable agriculture globally.

While challenges remain, the potential benefits of this approach – both for the environment and for the long-term sustainability of the agricultural sector – are significant. By embracing innovation, leveraging technology, and fostering collaboration between farmers, governments, and environmental groups, we can work towards a future where agriculture not only feeds the world but also plays a crucial role in mitigating climate change.

As we continue to monitor the progress of Denmark’s livestock emissions tax and its impact on the agricultural sector, one thing is clear: the future of farming is sustainable, and the time for action is now.

FAQ Section

Q1: What is the main goal of Denmark’s livestock CO2 tax?

A1: The primary goal is to reduce greenhouse gas emissions from the agricultural sector by 70% from 1990 levels by 2030.

Q2: When will the tax be implemented?

A2: The tax is set to launch in 2030, starting at 300 Danish crowns per ton of CO2 equivalent.

Q3: How will farmers be supported during this transition?

A3: Farmers will benefit from a 60% income tax deduction to help offset the costs of adapting to the new regulations.

Q4: Will this tax affect food prices for consumers?

A4: While there may be some impact on production costs, the gradual implementation of the tax is designed to minimize sudden price increases for consumers.

Q5: How might this policy influence global agricultural practices?

A5: Denmark’s initiative could serve as a model for other countries looking to reduce agricultural emissions, potentially influencing global farming practices and climate policies.

Explore Farmonaut’s API solutions: