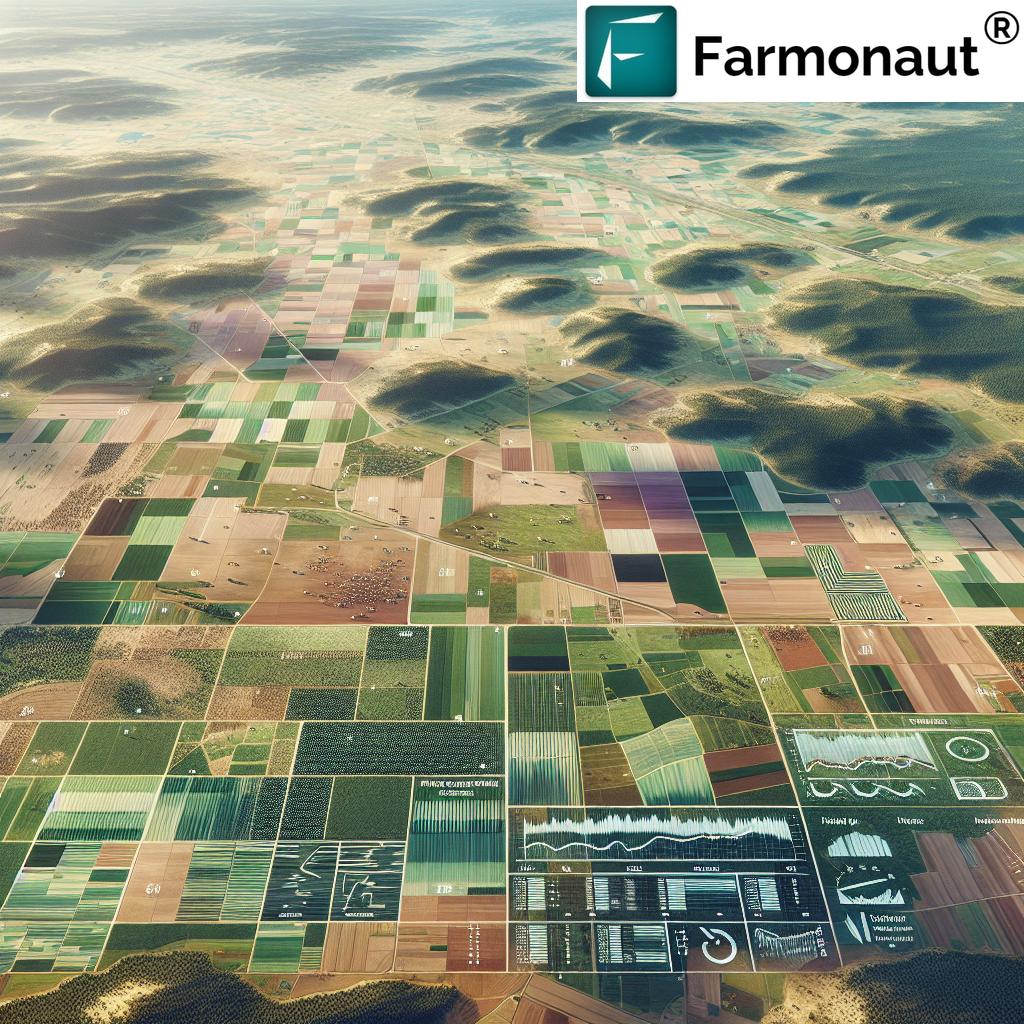

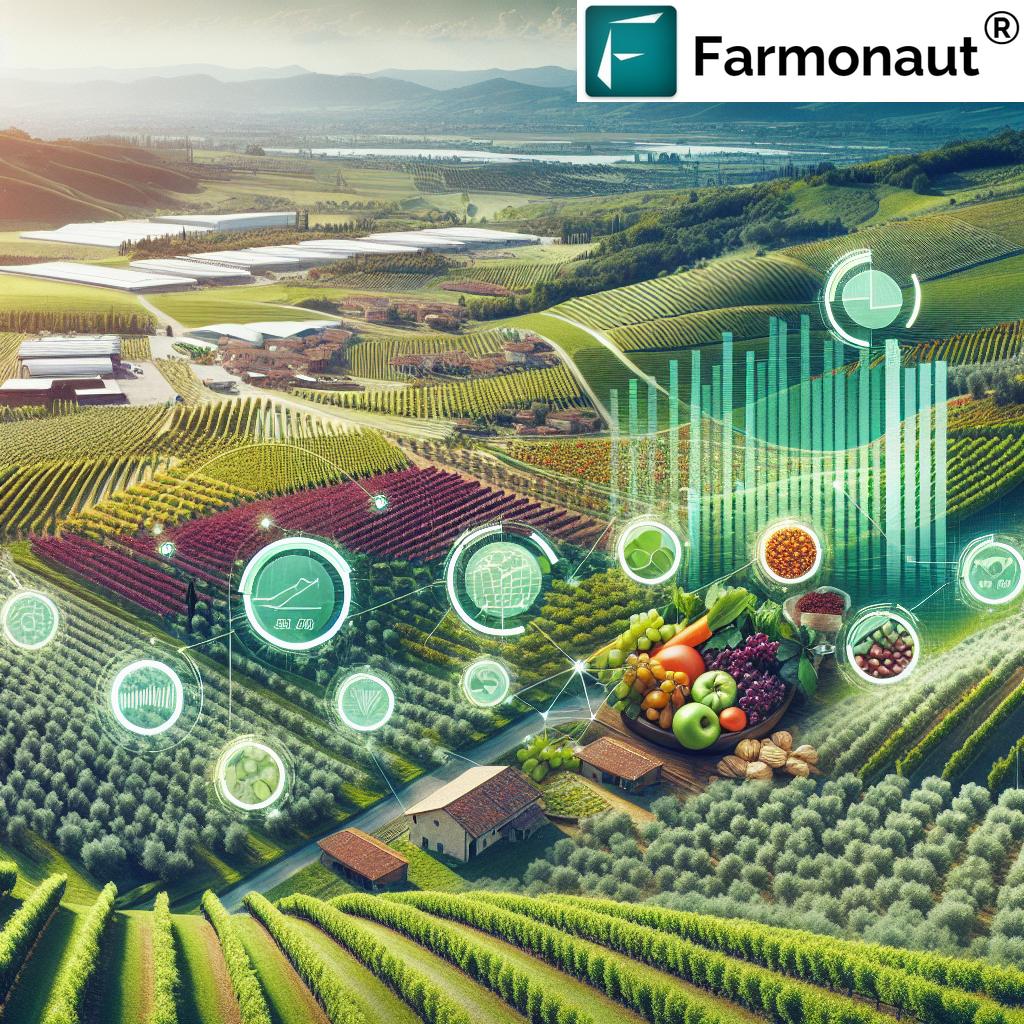

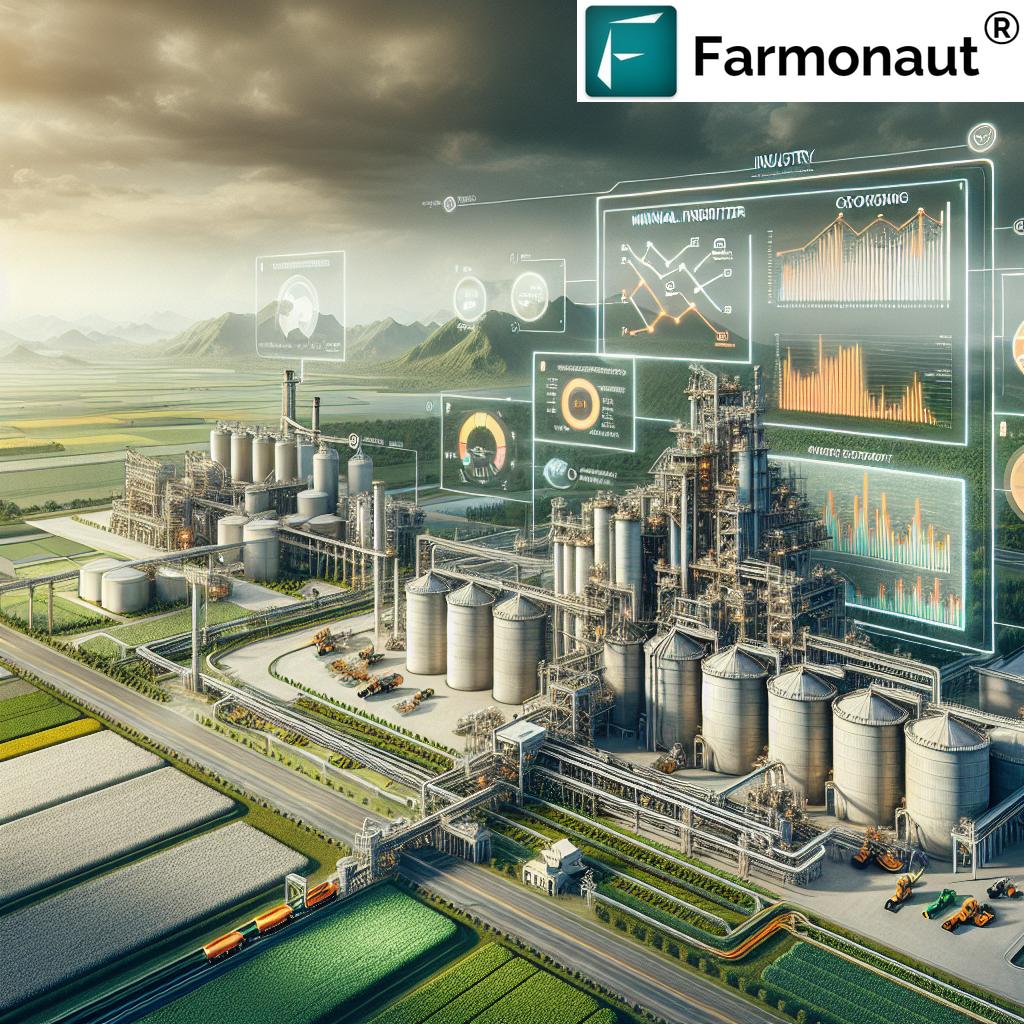

Italian agriculture faces a critical credit shortage, posing significant challenges for the future of the sector. The “Credito e Finanza 2025” forum in Rome highlighted alarming trends in agricultural lending, with overall funding decreasing from €43 billion in 2010 to €39.5 billion in 2023. Land credit has plummeted by 40%, hindering farm modernization and long-term investments. Rising land prices, bureaucratic hurdles, and inadequate guarantee systems contribute to this credit crunch. European counterparts like Germany and France offer innovative solutions, such as public banks providing zero-interest loans and crop-based securities for short-term credit. While Italy has implemented support programs through Ismea and Agea, concerns persist about their sufficiency in fostering long-term growth. This blog explores the complexities of Italian agricultural credit, its impact on farmers and producers, and potential strategies to overcome these obstacles, providing valuable insights into the evolving landscape of agricultural finance in Italy.