EU Carbon Border Adjustment Mechanism: Reshaping European Urea Markets and Fertilizer Pricing

“The EU Carbon Border Adjustment Mechanism, fully implementing in 2026, will impact pricing for 27 EU member states’ urea markets.”

In the ever-evolving landscape of European agriculture, we at Farmonaut are closely monitoring a significant development that is set to reshape the urea market and fertilizer pricing across the continent. The European Union’s Carbon Border Adjustment Mechanism (CBAM) is poised to usher in a new era for agricultural inputs, particularly urea, which plays a crucial role in crop nutrition and yield optimization.

As experts in agricultural technology and precision farming, we understand the importance of staying ahead of industry trends. The implementation of CBAM represents a pivotal shift in how Europe approaches carbon emissions and climate action within the fertilizer industry. In this comprehensive analysis, we’ll delve into the intricacies of CBAM, its potential impacts on the European urea market, and what this means for farmers, producers, and the broader agricultural sector.

Understanding the EU Carbon Border Adjustment Mechanism

The EU Carbon Border Adjustment Mechanism is a groundbreaking policy initiative designed to level the playing field between EU and non-EU producers by addressing the carbon footprint associated with imported goods. For the urea market, this mechanism is particularly significant as it directly affects one of the most widely used nitrogen fertilizers in agriculture.

- CBAM aims to equalize carbon costs for EU and non-EU producers

- It will require importers to purchase carbon certificates

- The policy is set to fully implement in 2026

- It’s part of the EU’s broader climate action strategy

The introduction of CBAM is a response to the long-standing issue of carbon leakage, where companies might shift production to countries with less stringent environmental regulations. By implementing this mechanism, the EU aims to encourage global climate action while protecting its domestic industries from unfair competition.

Timeline and Implementation of CBAM

The rollout of CBAM is a carefully planned process, with several key dates that stakeholders in the urea market need to be aware of:

- October 31, 2023: Beginning of the transition phase

- January 31, 2026: End of the transition phase

- February 2026: Full implementation begins

During the transition phase, which we are currently in, importers are required to submit quarterly reports detailing their imports and corresponding carbon emissions. This reporting period is crucial as it allows both the EU and importers to prepare for the full implementation of CBAM.

From February 2026, importers will need to secure CBAM certificates covering at least 80% of emissions each quarter. This requirement is expected to significantly impact the cost structure of imported urea, potentially altering market dynamics and pricing strategies.

Impact on European Urea Producers

For European urea producers, CBAM represents a potential turning point. Historically, these producers have faced reduced profit margins due to higher production costs influenced by the EU Emissions Trading System (EU ETS). The introduction of CBAM could significantly alter this dynamic:

- Potential increase in market share for EU producers

- Improved competitiveness against cheaper foreign imports

- Opportunity to focus on high-return projects under new regulations

Norwegian fertilizer giant Yara, for instance, has indicated its intent to prioritize projects that yield the highest returns in light of tightened regulations like CBAM. This strategic shift could be indicative of broader industry trends as EU producers adapt to the new regulatory environment.

Implications for Urea Importers and Traders

The implementation of CBAM poses significant challenges and considerations for urea importers and traders:

- Increased costs due to carbon certificate requirements

- Potential price increases of €10 to €100 per ton of urea

- Uncertainty in long-term pricing strategies

- Need for robust emissions reporting systems

The uncertainty surrounding CBAM pricing strategies has made many traders hesitant to commit to long-term deals. This caution is understandable given the potential for significant cost increases and the need to adjust business models to accommodate the new regulatory framework.

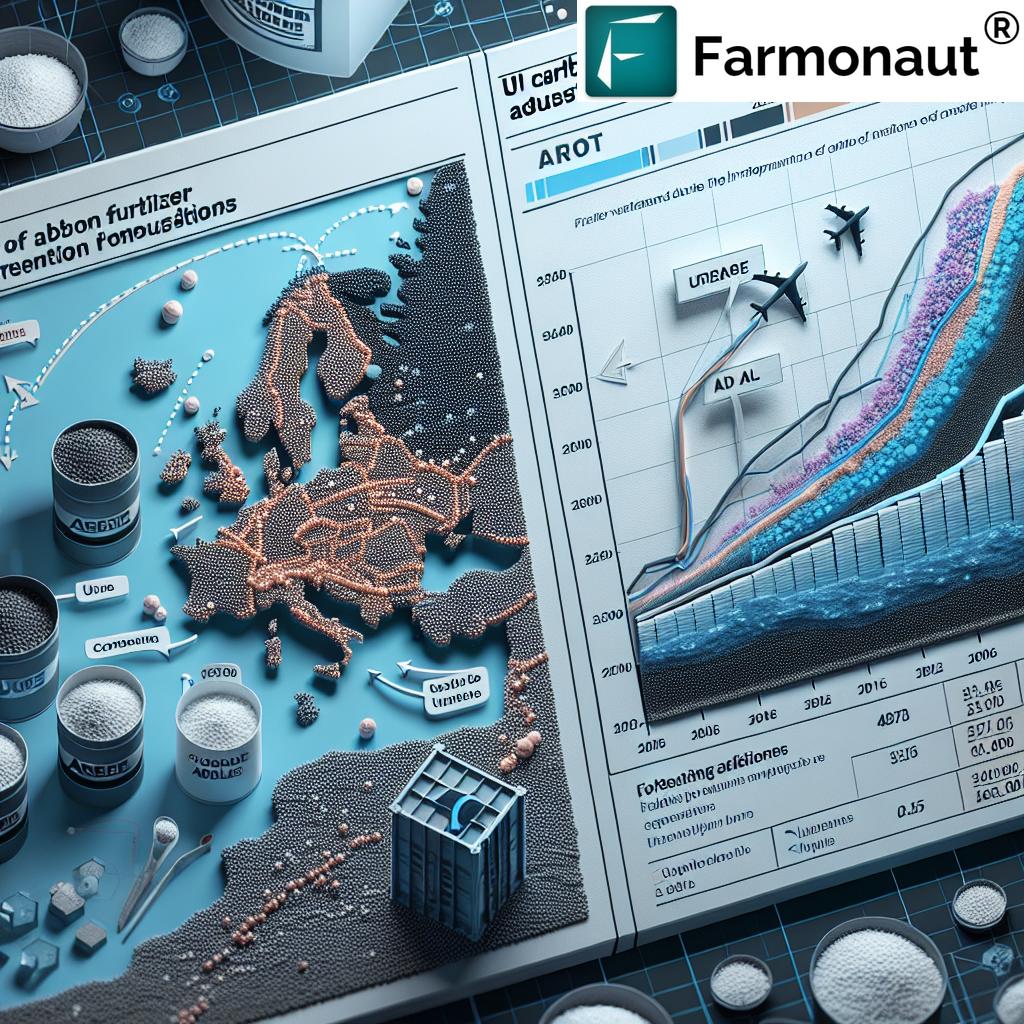

AdBlue Production and Pricing

“CBAM’s implementation could affect the production and pricing of AdBlue, a diesel exhaust fluid used in millions of vehicles.”

The impact of CBAM extends beyond agricultural urea to the automotive sector, particularly in the production of AdBlue. This diesel exhaust fluid, made from automotive-grade urea (AGU) and deionized water, plays a crucial role in reducing harmful emissions from diesel engines.

- Potential narrowing of price differentials between domestic and imported urea

- Challenges for secondary AdBlue producers reliant on imported urea

- Forecasted rise in AGU consumption and imports until 2029

As CBAM reshapes the urea market, it’s likely to have a ripple effect on AdBlue production and pricing. This could lead to significant changes in the automotive industry’s approach to emissions control and potentially impact consumer prices for diesel vehicles and AdBlue products.

European Agricultural Policy Changes

The introduction of CBAM is part of a broader shift in European agricultural policy, aimed at promoting sustainability and reducing the environmental impact of farming practices. These changes include:

- Emphasis on sustainable fertilizer production

- Encouragement of precision agriculture techniques

- Support for carbon-efficient farming practices

At Farmonaut, we’re at the forefront of these changes, offering advanced satellite-based farm management solutions that align with the EU’s goals for sustainable agriculture. Our platform provides valuable services such as real-time crop health monitoring and AI-based advisory systems, helping farmers adapt to these new policy landscapes.

Explore our advanced agricultural solutions:

Global Implications of CBAM

While CBAM is an EU initiative, its effects are likely to be felt globally, particularly in countries that are major urea exporters to Europe:

- Egypt, Algeria, and Russia may need to adapt their export strategies

- Potential for increased global focus on low-carbon fertilizer production

- Possibility of similar mechanisms being adopted by other countries or regions

The global fertilizer industry may see a shift towards more sustainable production methods as exporters seek to maintain their competitiveness in the European market. This could lead to a broader adoption of carbon-efficient technologies and practices in urea production worldwide.

Comparative Analysis: EU vs. Non-EU Urea Production Costs

To better understand the potential impact of CBAM, let’s examine a comparative analysis of urea production costs for EU and non-EU manufacturers:

| Cost Components | Pre-CBAM EU Costs (€/ton) | Pre-CBAM Non-EU Costs (€/ton) | Post-CBAM EU Costs (€/ton) | Post-CBAM Non-EU Costs (€/ton) | Percentage Change |

|---|---|---|---|---|---|

| Raw Materials | 150 | 130 | 150 | 130 | 0% |

| Energy | 100 | 80 | 100 | 80 | 0% |

| Labor | 50 | 30 | 50 | 30 | 0% |

| Carbon Pricing | 40 | 0 | 40 | 40 | +100% (Non-EU) |

| Total Production Costs | 340 | 240 | 340 | 280 | +16.67% (Non-EU) |

This table illustrates how CBAM could potentially equalize production costs between EU and non-EU manufacturers, primarily through the introduction of carbon pricing for non-EU producers. The most significant change is in the carbon pricing component, which could increase total production costs for non-EU manufacturers by approximately 16.67%.

Challenges and Opportunities in the Transition

The implementation of CBAM presents both challenges and opportunities for various stakeholders in the urea market:

Challenges:

- Adapting to new regulatory requirements

- Managing potential cost increases

- Developing accurate emissions reporting systems

- Navigating market uncertainties during the transition period

Opportunities:

- Investing in low-carbon production technologies

- Exploring new market strategies

- Developing more sustainable fertilizer products

- Leveraging precision agriculture for efficient fertilizer use

At Farmonaut, we’re committed to helping farmers and agribusinesses navigate these changes. Our advanced satellite-based solutions can assist in optimizing fertilizer use, reducing waste, and improving overall farm efficiency. Learn more about our API services for developers and businesses looking to integrate cutting-edge agricultural technology:

The Role of Technology in Adapting to CBAM

As the agricultural sector adapts to the changes brought about by CBAM, technology will play a crucial role in helping stakeholders navigate this new landscape:

- Precision agriculture tools for optimizing fertilizer use

- Satellite-based crop monitoring for efficient resource management

- AI and machine learning for predictive analytics in farming

- Blockchain technology for supply chain transparency and traceability

Farmonaut’s suite of technologies, including our satellite-based crop health monitoring and AI advisory system, are designed to help farmers and agribusinesses thrive in this changing environment. By leveraging these tools, stakeholders can improve their resource efficiency, reduce waste, and potentially mitigate some of the cost impacts associated with CBAM.

Future Outlook for the European Urea Market

As we look towards the future of the European urea market under CBAM, several key trends and predictions emerge:

- Potential shift towards more localized urea production within the EU

- Increased investment in carbon-efficient production technologies

- Growing emphasis on precision agriculture and efficient fertilizer use

- Possible emergence of new trade patterns and partnerships

While it’s challenging to predict the exact long-term impacts of CBAM, it’s clear that the policy will significantly reshape the European urea market. Stakeholders who adapt quickly and embrace sustainable practices are likely to find new opportunities in this evolving landscape.

Implications for Sustainable Fertilizer Production

CBAM is expected to accelerate the transition towards more sustainable fertilizer production methods:

- Increased research and development in low-carbon fertilizer technologies

- Greater adoption of circular economy principles in fertilizer manufacturing

- Exploration of alternative nitrogen sources and production methods

- Potential growth in the organic and bio-based fertilizer market

This shift towards sustainability aligns with Farmonaut’s mission to promote efficient and environmentally friendly farming practices. Our technology supports farmers in making data-driven decisions that can lead to more sustainable fertilizer use and improved crop yields.

The UK’s Approach to CBAM

It’s worth noting that the United Kingdom, while no longer part of the EU, has announced its own version of CBAM for fertilizers and other commodities, effective from January 1, 2027. This parallel initiative highlights the broader global trend towards addressing carbon emissions in international trade.

- UK CBAM to be implemented slightly later than EU version

- Potential for alignment or divergence in approach compared to EU CBAM

- Implications for trade between UK, EU, and non-EU countries

The UK’s adoption of a similar mechanism underscores the growing global consensus on the need to address carbon emissions in trade, particularly in carbon-intensive industries like fertilizer production.

Preparing for the Future: Strategies for Stakeholders

As the implementation of CBAM approaches, various stakeholders in the urea market should consider the following strategies:

For Urea Producers:

- Invest in carbon-efficient production technologies

- Explore opportunities for localized production within the EU

- Develop robust emissions tracking and reporting systems

For Importers and Traders:

- Diversify supply chains to mitigate risks

- Develop expertise in carbon accounting and CBAM compliance

- Consider long-term contracts with low-carbon producers

For Farmers:

- Adopt precision agriculture techniques for efficient fertilizer use

- Explore alternative fertilizer options, including organic and bio-based products

- Leverage technology for optimal crop management and resource allocation

At Farmonaut, we’re committed to supporting all stakeholders in navigating these changes. Our advanced agricultural solutions can help farmers optimize their fertilizer use, reduce waste, and improve overall farm efficiency in the face of changing market dynamics.

The Role of Artificial Intelligence in Agriculture

As the agricultural sector adapts to new regulations like CBAM, artificial intelligence (AI) is playing an increasingly important role in optimizing farm operations and resource use:

- AI-driven crop monitoring for precise fertilizer application

- Predictive analytics for yield optimization and resource allocation

- Automated decision-making tools for farm management

- Machine learning algorithms for pest and disease detection

Farmonaut’s Jeevn AI Advisory System is at the forefront of this technological revolution, providing farmers with real-time insights and expert crop management strategies. By leveraging AI, farmers can make more informed decisions about fertilizer use, potentially mitigating some of the cost impacts associated with CBAM.

Conclusion: Embracing Change in the European Urea Market

The implementation of the EU Carbon Border Adjustment Mechanism represents a significant turning point for the European urea market and the broader agricultural sector. While challenges lie ahead, particularly in terms of cost management and regulatory compliance, CBAM also presents opportunities for innovation, sustainability, and the development of more resilient supply chains.

As we navigate this transition, the role of technology and data-driven decision-making will be more critical than ever. At Farmonaut, we’re committed to supporting farmers, agribusinesses, and other stakeholders with cutting-edge solutions that promote efficiency, sustainability, and profitability in the face of changing market dynamics.

By embracing these changes and leveraging advanced technologies, the European agricultural sector can emerge stronger, more sustainable, and better equipped to meet the challenges of the 21st century. The future of farming is here, and it’s digital, data-driven, and more sustainable than ever before.

FAQ Section

Q1: What is the EU Carbon Border Adjustment Mechanism (CBAM)?

A1: CBAM is a policy designed to level the playing field between EU and non-EU producers by requiring importers to purchase carbon certificates for goods entering the EU market, including urea fertilizers.

Q2: When will CBAM be fully implemented?

A2: CBAM is set to be fully implemented in February 2026, following a transition phase that began on October 31, 2023.

Q3: How might CBAM affect urea prices in Europe?

A3: CBAM could potentially increase urea prices by €10 to €100 per ton, depending on the cost of carbon certificates and other market factors.

Q4: Will CBAM affect AdBlue production and pricing?

A4: Yes, CBAM is expected to impact AdBlue production and pricing, as it uses automotive-grade urea as a key component.

Q5: How can farmers adapt to potential price increases in fertilizers due to CBAM?

A5: Farmers can adapt by adopting precision agriculture techniques, exploring alternative fertilizer options, and leveraging technology for optimal crop management and resource allocation.