European Agriculture Policy Evolution: How Farmonaut’s GIS Technology Empowers EU Farmers and Cooperatives

“EU agricultural policy impacts over 22 million farmers and agricultural workers across 27 member states.”

In the ever-evolving landscape of European agriculture, policy development and technological innovation stand at the forefront of shaping a sustainable and productive future for farmers and cooperatives across the continent. As we delve into the intricate world of European agricultural policy and EU farming innovations, we at Farmonaut recognize the critical role that Geographic Information Systems (GIS) and precision agriculture technologies play in empowering farmers and driving the sector forward.

The European Union’s agricultural sector is a cornerstone of its economy and cultural heritage, with policies that impact millions of lives and livelihoods. In this comprehensive blog post, we’ll explore the evolution of European agricultural policy, the rise of precision agriculture, and how Farmonaut’s cutting-edge GIS technology is revolutionizing farming practices across the EU.

The Evolution of European Agricultural Policy

To understand the current state of European agriculture, we must first look at the historical context and policy developments that have shaped the sector.

| Year | Policy/Event | Impact on EU Farmers and Cooperatives |

|---|---|---|

| 1962 | Establishment of Common Agricultural Policy (CAP) | Ensured food security and fair income for farmers |

| 1992 | MacSharry reforms | Shift from market support to producer support, 15% reduction in cereal prices |

| 2003 | Mid-term review of CAP | Introduction of Single Payment Scheme, 20% increase in rural development funding |

| 2013 | CAP reform for 2014-2020 | Greater emphasis on environmental sustainability, 30% of direct payments linked to greening measures |

| 2018 | Introduction of Farm to Fork Strategy | Aim to reduce pesticide use by 50% and increase organic farming to 25% by 2030 |

| 2021 | New CAP reform for 2023-2027 | Focus on climate-smart practices, 40% of CAP budget dedicated to climate action |

The Common Agricultural Policy (CAP), introduced in 1962, has been the primary driver of agricultural development in Europe. Over the decades, it has undergone significant reforms to address changing needs and challenges:

- Food Security: Initially focused on ensuring food security and stable farmer incomes.

- Market Orientation: Shifted towards more market-oriented policies in the 1990s.

- Environmental Concerns: Increased emphasis on environmental sustainability and rural development since the 2000s.

- Climate Action: Recent reforms have prioritized climate-smart farming practices and renewable energy in agriculture.

The Rise of Precision Agriculture in Europe

As policy evolved, so did farming practices. The advent of precision agriculture technologies has been a game-changer for European farmers and cooperatives. These innovations allow for more efficient resource use, reduced environmental impact, and increased productivity.

“Precision agriculture technologies can reduce water usage by up to 30% in European farming operations.”

Key precision agriculture technologies transforming EU farming include:

- Satellite-based crop monitoring

- GPS-guided machinery

- Soil sensors and drones

- AI-powered decision support systems

At Farmonaut, we’re at the forefront of this technological revolution, providing advanced GIS solutions that empower farmers to make data-driven decisions and optimize their operations.

Farmonaut’s GIS Technology: Empowering EU Farmers and Cooperatives

Our state-of-the-art GIS technology is designed to address the unique challenges faced by European farmers and agricultural cooperatives. Here’s how Farmonaut is making a difference:

1. Real-time Crop Health Monitoring

Using multispectral satellite imagery, we provide farmers with up-to-date information on crop health, helping them identify issues early and take prompt action. This capability is crucial for implementing climate-smart farming practices and adapting to changing weather patterns.

2. AI-Powered Advisory System

Our Jeevn AI system offers personalized recommendations based on real-time data, weather forecasts, and historical trends. This empowers farmers to make informed decisions about irrigation, fertilization, and pest management, aligning with the EU’s sustainability goals.

3. Resource Optimization

By leveraging GIS data, we help farmers optimize their resource use, reducing waste and environmental impact. This aligns perfectly with the EU’s objectives for sustainable agriculture and efficient resource management.

4. Compliance with EU Policies

Our tools assist farmers in meeting the requirements of various EU agricultural policies, including environmental regulations and subsidy programs. This ensures that farmers can maximize their benefits while adhering to policy guidelines.

The Impact of GIS Technology on EU Agricultural Cooperatives

Agricultural cooperatives play a vital role in the European farming sector, and GIS technology is revolutionizing how these organizations operate:

- Improved Collective Decision-Making: Cooperatives can use shared data to make informed decisions about planting, harvesting, and marketing strategies.

- Enhanced Supply Chain Management: GIS helps cooperatives optimize logistics and reduce transportation costs.

- Better Risk Management: By analyzing historical and real-time data, cooperatives can better manage risks associated with climate change and market fluctuations.

Farmonaut’s solutions are tailored to meet the unique needs of EU agricultural cooperatives, fostering collaboration and efficiency across member farms.

Climate-Smart Farming Practices and Renewable Energy

The EU’s commitment to combating climate change is reflected in its agricultural policies, and GIS technology is instrumental in implementing climate-smart farming practices:

- Precision Irrigation: Our satellite-based moisture tracking helps farmers use water more efficiently, crucial in drought-prone regions.

- Carbon Sequestration: GIS data aids in identifying areas suitable for carbon sequestration practices, contributing to the EU’s climate goals.

- Renewable Energy Planning: Farmonaut’s technology can assist in optimal placement of renewable energy installations on farmland, supporting the EU’s push for clean energy in agriculture.

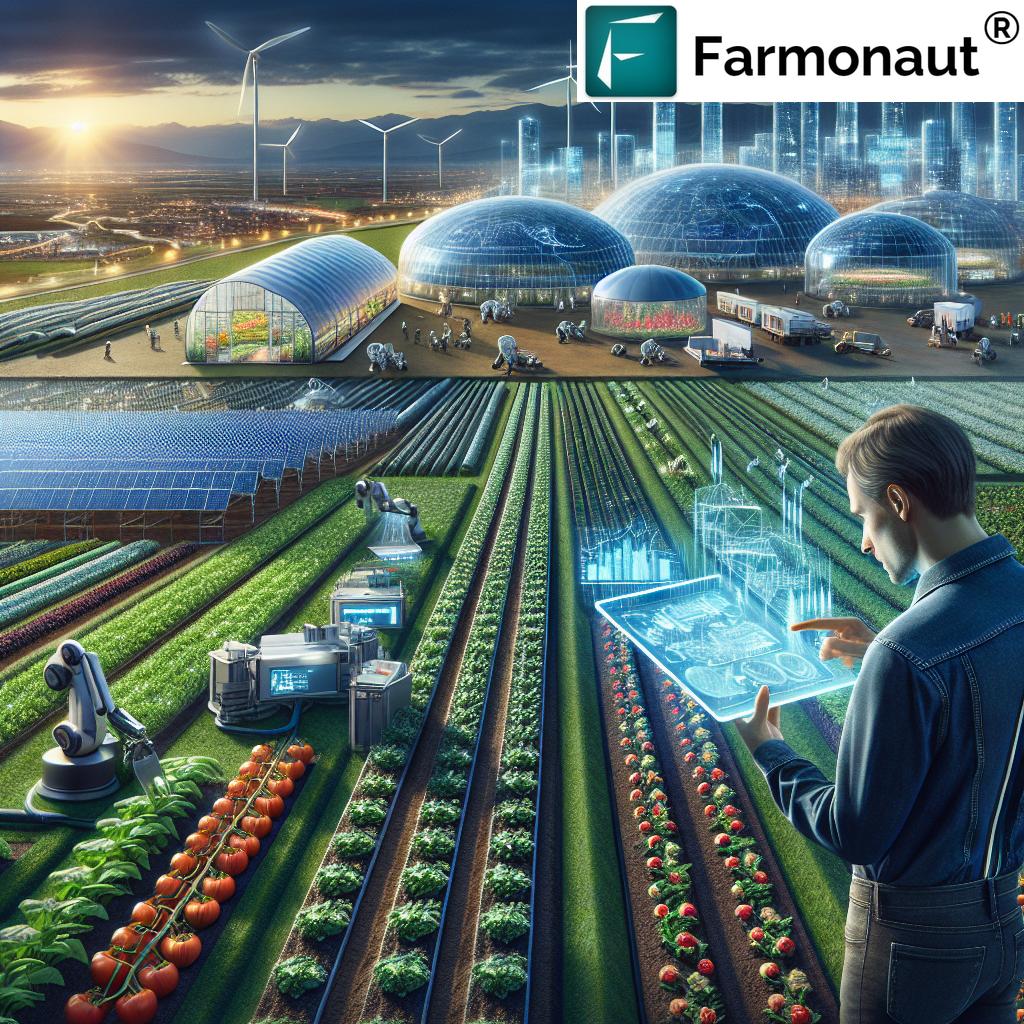

The Future of European Agriculture: Innovation and Sustainability

As we look to the future, the integration of GIS technology and precision agriculture will continue to play a crucial role in shaping European farming. Some key trends we anticipate include:

- Increased Adoption of AI and Machine Learning: These technologies will further enhance decision-making processes in agriculture.

- Blockchain for Traceability: Improving supply chain transparency and food safety.

- Integration of IoT Devices: Enhancing real-time data collection and farm management.

- Focus on Biodiversity: Using GIS to promote and monitor biodiversity in agricultural landscapes.

At Farmonaut, we’re committed to staying at the forefront of these innovations, continuously evolving our platform to meet the changing needs of European farmers and cooperatives.

Conclusion: Empowering European Agriculture through Technology

The evolution of European agricultural policy, coupled with advancements in GIS and precision agriculture technologies, is paving the way for a more sustainable, productive, and resilient farming sector. Farmonaut is proud to be at the forefront of this transformation, providing innovative solutions that empower EU farmers and cooperatives to thrive in an ever-changing landscape.

By leveraging our advanced GIS technology, farmers can not only comply with EU policies but also significantly improve their productivity, sustainability, and profitability. As we continue to innovate and adapt to the needs of European agriculture, we remain committed to our mission of making precision agriculture accessible and affordable for all.

The future of European farming is bright, and with the right tools and technologies, EU farmers and cooperatives are well-positioned to lead the global agricultural sector into a new era of sustainability and innovation.

FAQ Section

1. How does Farmonaut’s GIS technology comply with EU agricultural policies?

Farmonaut’s GIS technology is designed to align with EU agricultural policies by providing tools that support sustainable farming practices, resource optimization, and environmental protection. Our platform helps farmers meet regulatory requirements while improving their productivity and sustainability.

2. Can small-scale farmers benefit from Farmonaut’s precision agriculture solutions?

Absolutely! We’ve designed our platform to be accessible and affordable for farmers of all sizes. Small-scale farmers can benefit from our satellite-based crop monitoring and AI advisory system to make informed decisions and optimize their operations.

3. How does Farmonaut contribute to climate-smart farming practices in the EU?

Our GIS technology supports climate-smart farming by providing real-time data on crop health, soil moisture, and weather patterns. This enables farmers to implement precise irrigation, reduce chemical inputs, and adapt to changing climate conditions, all of which contribute to more sustainable farming practices.

4. What role does Farmonaut play in supporting EU agricultural cooperatives?

Farmonaut provides cooperatives with powerful tools for collective decision-making, supply chain optimization, and risk management. Our platform allows cooperatives to leverage shared data for improved planning and resource allocation across member farms.

5. How does Farmonaut’s technology integrate with existing farm management software?

Farmonaut offers API access, allowing seamless integration with other farm management software. This enables farmers and cooperatives to incorporate our GIS data and insights into their existing workflows and decision-making processes.

Ready to revolutionize your farming practices with Farmonaut’s GIS technology? Explore our solutions today:

For developers looking to integrate our powerful API:

Farmonaut API

API Developer Documentation