Global Grain Market Shakeup: Argentina’s Export Tax Cut Impacts Soybean Futures and US Winter Wheat Concerns

“Argentina’s export tax cut on soybeans led to a 7-day low in Chicago Board of Trade futures prices.”

In the ever-evolving landscape of global agricultural commodities, we at Farmonaut are closely monitoring the recent developments that have sent ripples through the grain markets. The intersection of policy changes, weather patterns, and international trade dynamics has created a complex scenario that demands our attention. Let’s delve into the intricacies of this market shakeup and explore its far-reaching implications.

Argentina’s Bold Move: Slashing Export Taxes

At the heart of this market upheaval is Argentina’s unexpected decision to reduce export taxes on key agricultural products: wheat, corn, and soybeans. This strategic move by one of the world’s leading grain exporters has set the stage for a significant shift in global grain market trends. As we analyze the situation, it’s crucial to understand the multifaceted impact of this policy change.

The reduction in export taxes is expected to catalyze a substantial increase in South American crop exports. Argentina, already a major player in the global agricultural arena, is poised to strengthen its position further. As the world’s leading exporter of processed soy oil and meal, the third-largest corn exporter, and a significant wheat producer, Argentina’s increased export capacity could reshape the competitive landscape of international grain exports.

Immediate Market Reactions: Soybean Futures and Price Fluctuations

The repercussions of Argentina’s policy shift were immediately felt in the global markets. On Monday, soybean futures prices on the Chicago Board of Trade (CBOT) experienced a notable decline, reaching their lowest point in nearly a week. This downturn marked the second consecutive session of losses, primarily attributed to the anticipation of increased grain supplies from Argentina.

Let’s break down the numbers:

- The most active soybean contracts fell by 1.4%, settling at $10.41-1/4 per bushel.

- At one point, prices dipped to $10.40 per bushel, the lowest since January 21.

- Wheat prices decreased to $5.38-3/4 per bushel.

- Corn experienced a 1.2% decline, landing at $4.80-3/4 per bushel.

These price movements reflect the market’s swift reaction to the news, underscoring the interconnectedness of global agricultural commodity trading. As we navigate these changes, it’s essential for farmers and traders to stay informed about these rapidly evolving market conditions.

Weather Woes: A Tale of Two Hemispheres

While policy changes are making headlines, weather patterns continue to play a crucial role in shaping crop production and market dynamics. In Argentina, farmers are grappling with hot and dry conditions that have adversely affected harvest predictions. The Buenos Aires Grains Exchange recently adjusted its forecasts, lowering expected yields for both soybean and corn crops.

“U.S. winter wheat crops face damage from frigid temperatures, potentially affecting up to 30% of planted acreage.”

Meanwhile, in the United States, a different climate challenge is unfolding. Frigid temperatures sweeping through the U.S. Plains and Midwest are reported to have potentially damaged a significant portion of the winter wheat crop. The lack of protective snow cover has exacerbated concerns, leaving much of the region vulnerable to worsening weather conditions.

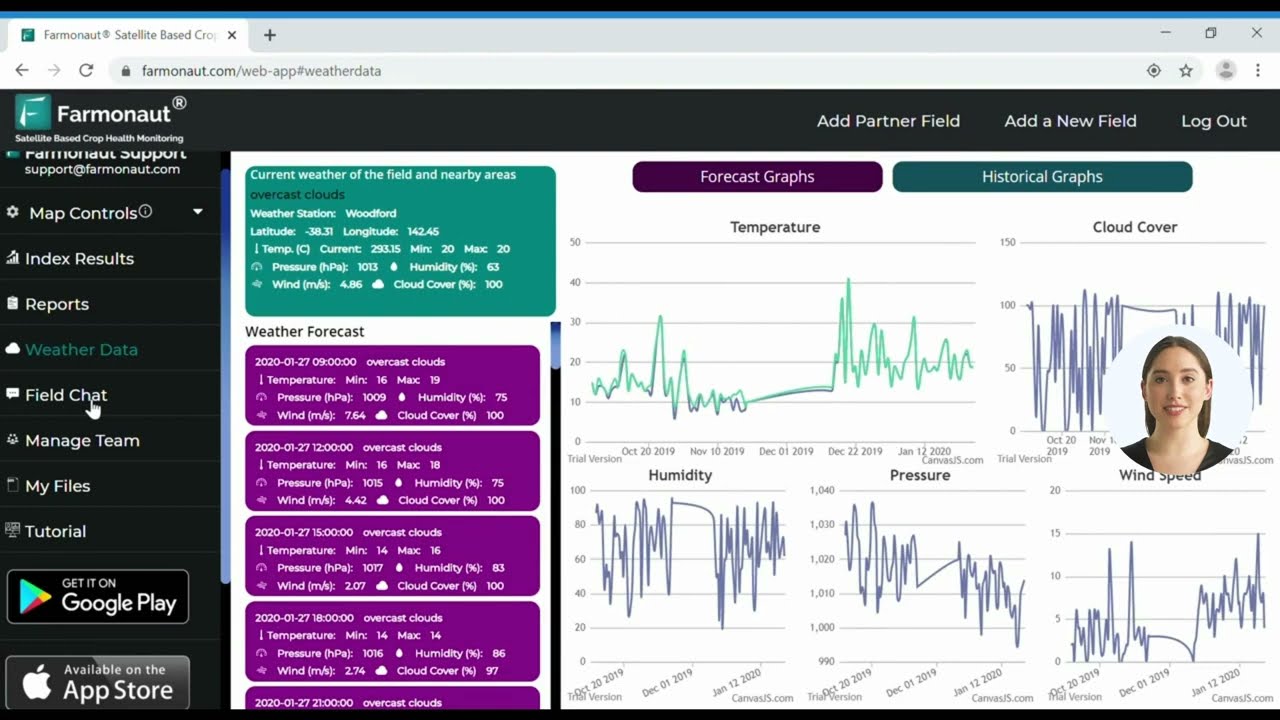

These contrasting weather scenarios highlight the importance of real-time crop health monitoring and advanced weather forecasting in modern agriculture. At Farmonaut, we understand the critical role that timely information plays in making informed decisions. Our satellite-based farm management solutions provide valuable insights into crop health, soil moisture levels, and weather patterns, helping farmers navigate these challenging conditions.

The Ripple Effect: Global Competition and Market Dynamics

Argentina’s increased export potential is set to intensify competition in the global agricultural market, particularly among rival exporters like the United States. This shift in the competitive landscape could have far-reaching implications for international grain exports and agricultural commodity trading.

Key considerations include:

- Potential long-term enhancement of Argentina’s production capabilities

- Increased competition for market share among major grain-exporting nations

- Possible adjustments in global supply chains and trade routes

- Impact on pricing strategies and profit margins for farmers and traders worldwide

As these dynamics unfold, it’s crucial for stakeholders across the agricultural sector to adapt their strategies and leverage advanced technologies to maintain a competitive edge.

China’s Role: Trade Challenges and Market Implications

Adding another layer of complexity to the global grain market situation is China’s recent decision to suspend imports from five Brazilian soybean exporters. This move, attributed to plant health violations, is expected to last for two months and affects companies representing over 30% of Brazil’s soybean exports to China in 2024.

This development underscores the intricate nature of international agricultural trade and the potential for sudden shifts in market dynamics. It also highlights the importance of maintaining high standards in crop production and export processes to ensure smooth international trade relations.

The Role of Technology in Navigating Market Volatility

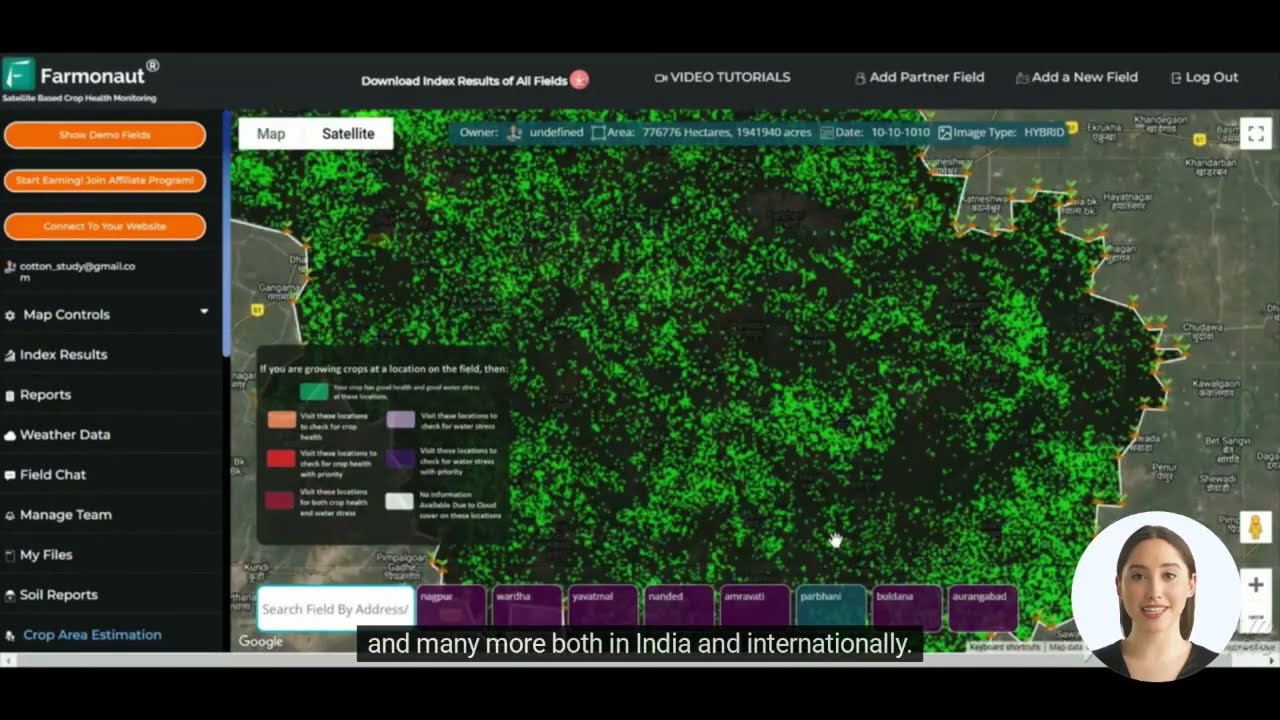

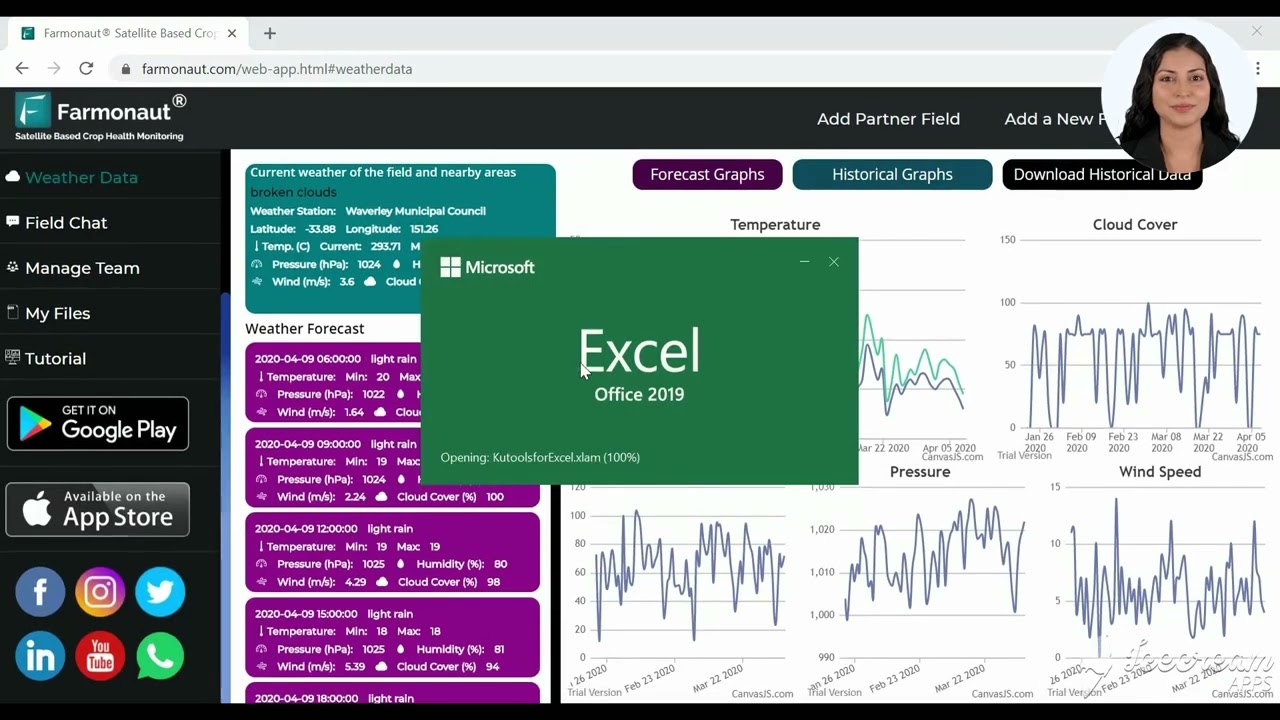

In these times of market uncertainty and rapid changes, the importance of advanced agricultural technology cannot be overstated. Farmonaut’s suite of tools, including our satellite-based crop monitoring API and AI-driven advisory systems, provide farmers and agribusinesses with the insights they need to make informed decisions.

Our technology offers:

- Real-time crop health monitoring

- Accurate weather forecasts and historical data analysis

- AI-powered recommendations for optimal resource management

- Blockchain-based traceability solutions for supply chain transparency

By leveraging these tools, agricultural stakeholders can better navigate the complexities of the global grain market and adapt to changing conditions more effectively.

Comparative Analysis of Global Grain Market Factors

| Country/Region | Crop Type | Market Impact | Price Trend |

|---|---|---|---|

| Argentina | Soybeans, Corn, Wheat | Export tax reduction; Increased exports expected | Declining (7-10% estimated) |

| United States | Winter Wheat | Crop damage due to frigid temperatures | Rising (5-8% estimated) |

| Brazil | Soybeans | Temporary export restrictions to China | Stable to Slightly Declining (2-3% estimated) |

| China | Soybeans (Import) | Import suspension from select Brazilian exporters | Potential Rise in Domestic Prices (3-5% estimated) |

This table provides a snapshot of the current global grain market dynamics, illustrating how policy decisions, environmental factors, and trade relationships are influencing prices and market trends across different regions and crop types.

Looking Ahead: Future Implications and Strategies

As we look to the future, it’s clear that the global grain market will continue to face both challenges and opportunities. The interplay between policy decisions, weather patterns, and international trade dynamics will shape the landscape of agricultural commodity trading in the coming months and years.

Key areas to watch include:

- The long-term impact of Argentina’s export tax reduction on global grain supplies and prices

- Recovery and adaptation strategies for U.S. winter wheat farmers affected by adverse weather

- Potential shifts in trade patterns as countries adjust to new market realities

- The role of technology in enhancing crop resilience and optimizing agricultural practices

At Farmonaut, we remain committed to providing cutting-edge solutions that help farmers and agribusinesses thrive in this dynamic environment. Our API developer documentation offers insights into how our technology can be integrated into existing systems for maximum benefit.

The Power of Precision Agriculture in Uncertain Times

In the face of market volatility and environmental challenges, precision agriculture emerges as a crucial tool for farmers and agribusinesses. Farmonaut’s advanced satellite-based farm management solutions offer a comprehensive approach to optimizing agricultural practices:

- Real-time crop health monitoring using multispectral satellite imagery

- AI-driven advisory systems for personalized farm management strategies

- Blockchain-based traceability solutions for enhanced supply chain transparency

- Fleet and resource management tools for efficient logistics

- Carbon footprint tracking to support sustainable farming practices

By leveraging these technologies, farmers can make data-driven decisions that improve crop yields, reduce input costs, and mitigate risks associated with market fluctuations and weather variability.

Empowering Farmers with Accessible Technology

At Farmonaut, we believe that advanced agricultural technology should be accessible to farmers of all scales. Our platform is designed to democratize access to precision agriculture tools, making it possible for small and medium-sized farms to benefit from the same level of insights traditionally available only to large agribusinesses.

Explore our solutions:

Join the Agricultural Revolution with Farmonaut

As we navigate the complexities of the global grain market, Farmonaut stands ready to support farmers, agribusinesses, and policymakers with cutting-edge technology and data-driven insights. Our commitment to making precision agriculture affordable and accessible aligns perfectly with the needs of an industry facing unprecedented challenges and opportunities.

Earn With Farmonaut: Join Our Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions: Tailored Solutions for Every Need

Frequently Asked Questions

Q: How does Argentina’s export tax reduction affect global grain prices?

A: Argentina’s decision to reduce export taxes on wheat, corn, and soybeans is expected to increase the country’s grain exports, potentially leading to lower global prices due to increased supply in the international market.

Q: What impact are weather conditions having on U.S. winter wheat crops?

A: Frigid temperatures in the U.S. Plains and Midwest are reported to have damaged a significant portion of the winter wheat crop, which could lead to reduced yields and potentially higher wheat prices.

Q: How can farmers use Farmonaut’s technology to navigate market volatility?

A: Farmonaut’s satellite-based crop monitoring and AI-driven advisory systems provide real-time insights into crop health, weather patterns, and market trends, enabling farmers to make informed decisions about planting, harvesting, and resource management.

Q: What are the long-term implications of these market changes for global agricultural trade?

A: The current market shakeup could lead to shifts in global trade patterns, increased competition among major grain-exporting nations, and potential changes in production strategies as farmers adapt to new market realities.

Q: How does Farmonaut’s blockchain technology contribute to agricultural supply chains?

A: Farmonaut’s blockchain-based traceability solutions enhance transparency in agricultural supply chains, allowing for better tracking of products from farm to consumer and potentially reducing fraud in the industry.

As we continue to monitor and analyze the evolving global grain market, Farmonaut remains committed to providing cutting-edge solutions that empower farmers and agribusinesses to thrive in an increasingly complex and interconnected world. By combining advanced technology with deep agricultural expertise, we’re helping to shape the future of farming – one data point at a time.