Global Soybean Market Trends: US-China Tariffs Impact on Agricultural Commodity Prices and Trade

“Chicago soybean and corn futures hit their lowest since early January, reflecting bearish sentiments due to ample South American supplies.”

In the ever-evolving landscape of global agriculture, we find ourselves at a critical juncture where geopolitical tensions and market dynamics are reshaping the soybean industry. As experts in agricultural technology and market analysis, we at Farmonaut are closely monitoring these developments to provide our users with the most up-to-date insights and tools for navigating these turbulent times.

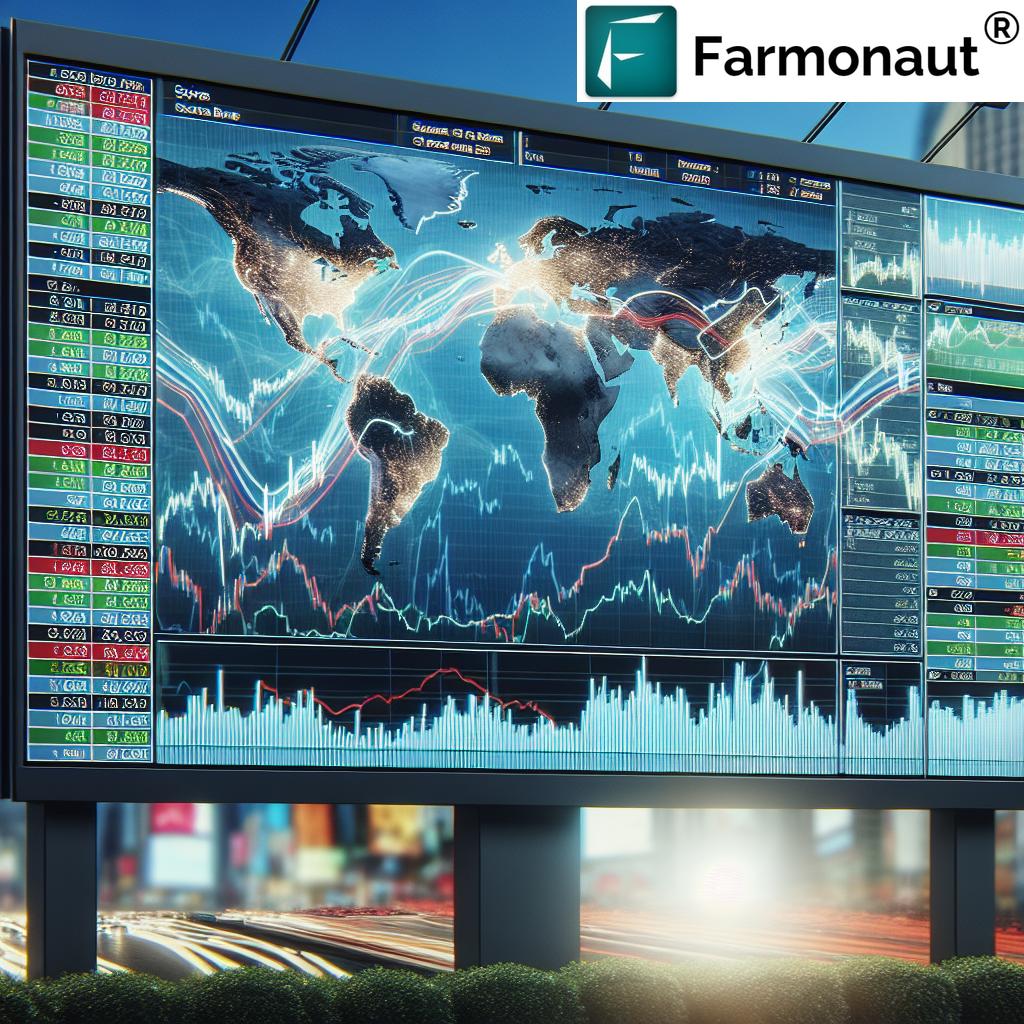

The Current State of the Global Soybean Market

The global soybean market is experiencing significant volatility, with prices and trade patterns shifting rapidly in response to various factors. Chicago Board of Trade (CBOT) soybean futures have recently touched their lowest levels since early January, a clear indication of the bearish sentiment pervading the market. This downturn is primarily attributed to the abundant supplies coming from South America, particularly Brazil, which has seen a robust harvest this season.

Concurrently, corn futures are also trading near multi-month lows, reflecting similar pressures from increased global supply. These market movements are occurring against the backdrop of impending U.S. tariffs on key trading partners, which are expected to have far-reaching implications for agricultural commodity flows worldwide.

US-China Trade Tensions: A Game-Changer for Soybean Markets

The looming specter of U.S. tariffs on imports from major trading partners, including China, is casting a long shadow over the agricultural sector. China, as the world’s largest soybean importer, plays a pivotal role in shaping global demand. The potential for retaliatory measures from China, particularly targeting American agricultural exports, has sent shockwaves through the industry.

As one Singapore-based oilseed trader aptly noted, “The market direction will also depend on how China reacts to U.S. tariffs.” This sentiment encapsulates the uncertainty gripping market participants as they attempt to navigate these uncharted waters.

Breaking Down the Numbers: CBOT Commodity Futures

Let’s delve into the specifics of recent market movements:

- Soybeans: The most active CBOT soybean contract fell 0.4% to $10.08 per bushel.

- Corn: Futures added a modest 0.1%, reaching $4.56-1/2 per bushel.

- Wheat: Prices edged up 0.1% to $5.48-1/2 per bushel, finding some support from dry weather concerns in India.

These figures underscore the delicate balance in agricultural commodity markets, where even small percentage changes can have significant implications for farmers and traders alike.

The South American Factor: Brazil’s Soybean Harvest Update

Brazil, a key player in the global soybean market, continues to exert considerable influence on prices and supply dynamics. Recent data from AgRural shows that Brazil’s cultivated soybean area for the 2024/25 season was 50% harvested by February 27, up from 39% a week earlier and 48% at the same time last year. This robust harvest progress is contributing to the bearish sentiment in global markets, as ample supplies from South America put downward pressure on prices.

Weather Woes: Dry Conditions in India Support Wheat Prices

While soybean and corn markets face bearish pressures, wheat prices have found some support from weather-related concerns. Forecasts of dry conditions in India, a major wheat producer, have helped to buoy prices slightly. However, news of a large Australian wheat crop has limited these gains, illustrating the complex interplay of global supply and demand factors in shaping agricultural commodity prices.

The Ripple Effects: Corn Futures Trading and Global Grain Supply

The impact of these market dynamics extends beyond soybeans to other key agricultural commodities. Corn futures, closely linked to soybean markets, are also feeling the effects of the current trade tensions and supply glut. The global grain supply outlook remains a key factor in determining price movements, with traders closely monitoring crop conditions and harvest forecasts in major producing regions.

“As the world’s largest soybean importer, China’s reaction to U.S. tariffs will significantly influence global agricultural market direction.”

China’s Role in Shaping Market Direction

China’s importance in the global soybean market cannot be overstated. As the world’s largest importer, China’s purchasing decisions have far-reaching consequences for producers and traders worldwide. The potential for reduced Chinese demand for U.S. soybeans in response to tariffs could lead to significant shifts in global trade patterns, with ripple effects felt across the entire agricultural sector.

The North American Angle: Mexico and Canada in Focus

While much attention is focused on the U.S.-China trade relationship, it’s crucial not to overlook the importance of other key trading partners. Mexico, for instance, is a major buyer of U.S. soybeans, corn, and wheat. The implementation of 25% tariffs on goods from Mexico and Canada, as announced by U.S. President Donald Trump, threatens to disrupt these established trade flows and create new challenges for North American agricultural markets.

Global Grain Supply and Demand: A Delicate Balance

Understanding the intricate dynamics of global grain supply and demand is essential for navigating the current market landscape. Factors such as weather conditions, planting decisions, and geopolitical events all play crucial roles in determining the balance between supply and demand. As we’ve seen with the dry weather in India supporting wheat prices and the large Australian crop tempering those gains, these factors can quickly shift market sentiment and price trajectories.

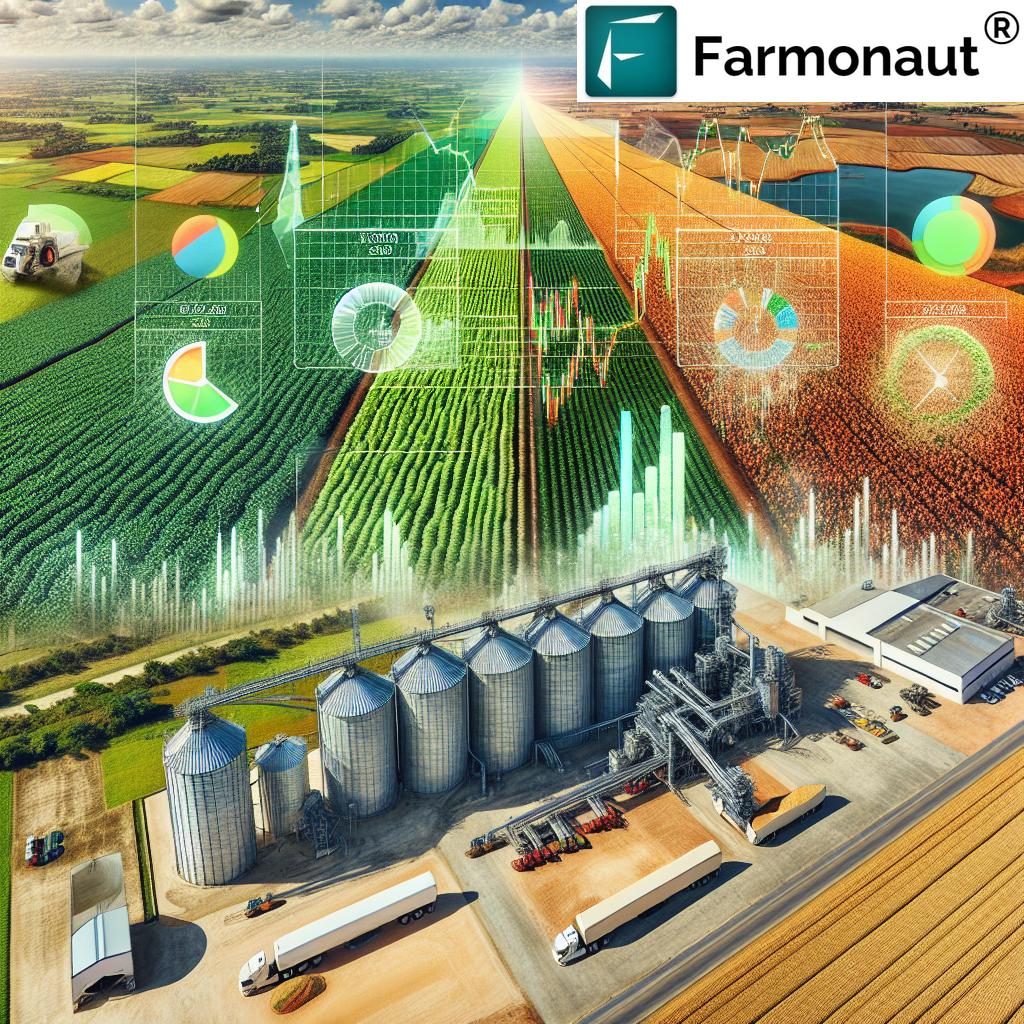

The Role of Technology in Agricultural Market Analysis

In these uncertain times, access to accurate and timely information is more critical than ever for farmers, traders, and policymakers. At Farmonaut, we leverage cutting-edge satellite technology and artificial intelligence to provide real-time insights into crop health, weather patterns, and market conditions. Our satellite-based farm management solutions empower users to make informed decisions in the face of market volatility.

Navigating Market Uncertainty with Precision Agriculture

As global soybean market trends continue to evolve, precision agriculture tools become increasingly valuable. Farmonaut’s platform offers:

- Real-time crop health monitoring

- AI-based advisory systems

- Blockchain-based traceability

- Resource management tools

These features allow farmers and agribusinesses to optimize their operations, reduce costs, and adapt to changing market conditions more effectively.

The Future of Agricultural Commodity Prices

Predicting the future direction of agricultural commodity prices in this complex environment is challenging. However, by closely monitoring key indicators such as:

- Global production forecasts

- Trade policy developments

- Weather patterns in major growing regions

- Shifts in consumer demand

We can gain valuable insights into potential market movements. Farmonaut’s advanced analytics and satellite monitoring capabilities provide users with a competitive edge in anticipating and responding to these market shifts.

Comparative Analysis: Global Soybean Market Trends

To better understand the current state of the global soybean market, let’s examine a comparative analysis of key indicators across major producing and consuming countries:

| Indicator | United States | China | Brazil | Argentina |

|---|---|---|---|---|

| Soybean Production (million metric tons) | 120.5 | 18.4 | 135.0 | 50.0 |

| Soybean Exports (million metric tons) | 57.8 | 0.1 | 86.5 | 5.5 |

| Soybean Imports (million metric tons) | 0.5 | 96.0 | 0.3 | 4.5 |

| Domestic Soybean Consumption (million metric tons) | 62.5 | 114.0 | 48.5 | 48.5 |

| Soybean Futures Price (USD/bushel) | 10.08 | N/A | N/A | N/A |

| Year-over-Year Price Change (%) | -15% | N/A | N/A | N/A |

| Tariff Impact on Trade | High | High | Medium | Low |

This table illustrates the interconnectedness of global soybean markets and highlights the potential impacts of US-China tariffs on agricultural commodity trade. It’s clear that any significant disruption in trade flows between major players like the U.S. and China could have far-reaching consequences for the entire market.

Leveraging Technology for Market Insights

In today’s rapidly changing agricultural landscape, staying ahead of market trends is crucial. Farmonaut’s advanced satellite monitoring and AI-powered analytics provide users with unparalleled insights into crop conditions, weather patterns, and market dynamics. Our platform enables:

- Real-time monitoring of crop health across vast areas

- Early detection of potential yield issues

- Optimization of resource allocation based on data-driven insights

- Enhanced decision-making for planting, harvesting, and market strategies

The Road Ahead: Adapting to a Changing Agricultural Landscape

As we navigate these uncertain times in the global soybean market, it’s clear that adaptability and access to timely information will be key to success. Farmers, traders, and policymakers must remain vigilant and responsive to rapidly changing market conditions. By leveraging advanced technologies like those offered by Farmonaut, stakeholders can position themselves to thrive amidst market volatility.

Conclusion: Embracing Innovation in Agricultural Markets

The global soybean market is at a crossroads, with geopolitical tensions, shifting trade patterns, and technological advancements reshaping the industry. As we’ve explored in this comprehensive analysis, factors such as US-China trade tariffs, South American harvest updates, and weather conditions in key growing regions all play crucial roles in determining market direction.

At Farmonaut, we remain committed to providing cutting-edge solutions that empower farmers, traders, and policymakers to navigate these complex market dynamics. By harnessing the power of satellite technology, artificial intelligence, and data-driven insights, we’re helping to shape the future of agriculture in an increasingly interconnected world.

As we look to the future, one thing is clear: those who embrace innovation and leverage advanced technologies will be best positioned to thrive in the ever-evolving landscape of global agricultural markets.

FAQ Section

Q: How are US-China trade tariffs likely to impact soybean prices?

A: US-China trade tariffs are expected to significantly disrupt soybean trade flows, potentially leading to lower demand for U.S. soybeans in China and putting downward pressure on prices. This could result in a shift in global trade patterns, with China potentially sourcing more soybeans from other major producers like Brazil.

Q: What role does Brazil play in the global soybean market?

A: Brazil is a major soybean producer and exporter, often competing with the U.S. for market share. The country’s harvest progress and export volumes can significantly influence global soybean prices. In recent years, Brazil has become the world’s largest soybean exporter, particularly to China.

Q: How do weather conditions affect soybean and other grain prices?

A: Weather conditions play a crucial role in determining crop yields and, consequently, prices. Dry weather in major producing regions can lead to concerns about reduced yields, potentially supporting prices. Conversely, favorable weather conditions can lead to expectations of abundant supplies, putting downward pressure on prices.

Q: What are the key factors to watch in the global grain market?

A: Key factors to monitor include:

- Weather conditions in major producing regions

- Trade policy developments, particularly between major exporters and importers

- Harvest progress and yield forecasts

- Changes in global demand, especially from large consumers like China

- Currency exchange rates, which can affect the competitiveness of exports

Q: How can farmers and traders use technology to navigate market volatility?

A: Advanced technologies like satellite-based crop monitoring, AI-powered analytics, and real-time market data platforms can help farmers and traders make more informed decisions. These tools provide insights into crop health, weather patterns, and market trends, enabling better risk management and strategic planning.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

For more information on our satellite-based farm management solutions and how they can help you navigate the complexities of the global agricultural market, visit our web app or explore our API for developers. You can also find detailed information in our API Developer Docs.