Shocking USDA Forecast Triggers Plunge in Corn and Soybean Futures: Market Shakeup Ahead?

In a surprising turn of events, the global commodity markets are experiencing significant turbulence following the latest USDA crop forecast. The unexpected report has sent shockwaves through the agricultural sector, causing a sharp decline in corn futures and soybean futures. This market upheaval has left investors and farmers alike scrambling to understand the implications and adjust their strategies accordingly.

USDA Corn Soybean Forecast Impact: A Market Game-Changer

The United States Department of Agriculture (USDA) released its latest crop forecast, indicating larger-than-expected yields for both corn and soybeans. This revelation has had an immediate and profound impact on the commodity futures market. According to the Chicago Board of Trade (CBOT), November soybeans hit a one-month low at $9.96 per bushel, while December corn settled at a concerning $4.08.

This dramatic drop in futures prices highlights the sensitivity of agricultural markets to government forecasts and underscores the importance of accurate yield predictions. Farmers and traders rely heavily on these projections to make informed decisions about planting, harvesting, and trading strategies.

Commodity Futures Market Trends: A Closer Look

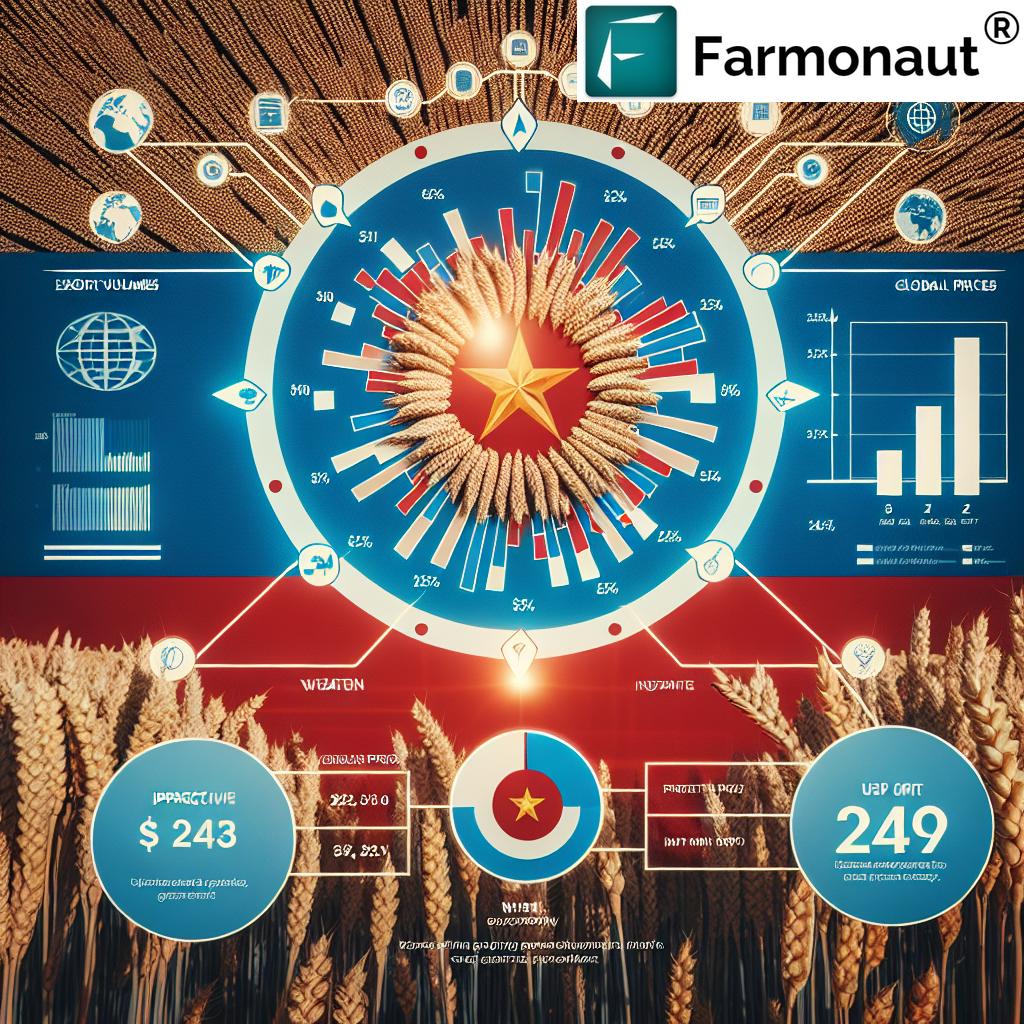

The ripple effects of the USDA forecast extend beyond corn and soybeans. Wheat futures also experienced a significant decline, settling at $5.85. This downturn can be attributed to a combination of factors, including:

- A stronger U.S. dollar, making American exports less competitive in the global market

- An improved global wheat supply outlook for 2023

- Increased Black Sea grain exports, particularly from Russia and Ukraine

These factors collectively contribute to the ongoing volatility in CBOT grain prices, creating both challenges and opportunities for market participants.

Brazil Soybean Planting Progress: Weather Woes and Recovery

While the U.S. market grapples with the USDA forecast, attention is also turning to Brazil’s soybean planting progress. Currently at 8.2%, the planting rate lags behind last year’s figures, primarily due to weather-related concerns. However, recent favorable rains have injected a dose of optimism into the Brazilian agricultural sector.

These improved agricultural weather patterns are expected to accelerate planting efforts in the coming weeks. The progress of Brazilian soybean planting is crucial, as it can significantly impact global supply and, consequently, futures prices.

For farmers looking to optimize their planting strategies and stay ahead of weather patterns, tools like Farmonaut’s satellite-based crop monitoring system can provide valuable insights.

U.S. Midwest Crop Yield Expectations: Resilience Amidst Challenges

Despite earlier weather challenges, expectations for the U.S. Midwest harvest remain high. Farmers across the region have demonstrated remarkable resilience in the face of unpredictable weather patterns and market fluctuations.

Key factors contributing to the optimistic outlook include:

- Advanced farming technologies enhancing crop management

- Improved drought-resistant crop varieties

- Strategic irrigation practices

- Timely implementation of pest control measures

Farmers can leverage cutting-edge technologies to monitor their crops effectively. The Farmonaut Android app and iOS app offer real-time insights into crop health and yield potential.

Global Wheat Supply Outlook 2023: A Shifting Landscape

The global wheat market is experiencing its own set of dynamics. The improved supply outlook for 2023 is influenced by several factors:

- Increased production in major wheat-exporting countries

- Favorable weather conditions in key growing regions

- Technological advancements in wheat cultivation

- Evolving trade policies and international agreements

This positive outlook has contributed to the downward pressure on wheat futures, aligning with the broader trend observed in corn and soybean markets.

CBOT Grain Price Fluctuations: Navigating Market Volatility

The Chicago Board of Trade (CBOT) remains the epicenter of grain price movements. Recent fluctuations in corn, soybean, and wheat futures underscore the complex interplay of factors influencing these markets. Traders and analysts are closely monitoring:

- Supply and demand dynamics

- Geopolitical events affecting trade

- Currency exchange rates

- Energy prices and their impact on biofuel production

Understanding these intricate relationships is crucial for anyone involved in the agricultural commodity markets.

Agricultural Market Weather Effects: A Double-Edged Sword

Weather remains a critical and often unpredictable factor in agricultural markets. Recent patterns have demonstrated both positive and negative impacts:

- Favorable rains boosting Brazil’s soybean planting prospects

- Earlier challenges in the U.S. Midwest affecting crop development

- Ongoing concerns about climate change and extreme weather events

For precise weather forecasts and their potential impact on crops, farmers can rely on Farmonaut’s Satellite Weather API. Detailed documentation is available in the API Developer Docs.

Looking Ahead: Market Implications and Strategies

As the agricultural sector digests the latest USDA forecast and navigates the resulting market turbulence, several key considerations emerge:

- Risk Management: Farmers and traders may need to reassess their risk management strategies in light of the increased market volatility.

- Global Trade Dynamics: The interplay between U.S. production, Brazilian planting progress, and Black Sea exports will continue to shape market trends.

- Technological Adaptation: Embracing advanced agricultural technologies and data-driven decision-making tools will be crucial for staying competitive.

- Policy Awareness: Keeping abreast of agricultural policies and trade agreements will be essential for anticipating market movements.

The upcoming USDA crop progress report is eagerly anticipated, as it promises to provide further insights into these complex market dynamics. Stakeholders across the agricultural value chain will be watching closely, ready to adapt their strategies to the ever-changing landscape of global commodity markets.

In conclusion, the recent plunge in corn and soybean futures, triggered by the shocking USDA forecast, serves as a stark reminder of the volatility inherent in agricultural markets. As weather patterns shift, global trade relationships evolve, and technology continues to advance, staying informed and adaptable will be key to success in this dynamic sector.

To stay ahead in this rapidly changing agricultural landscape, consider exploring the comprehensive crop monitoring and weather forecasting solutions offered by Farmonaut: