Unleashing the Harvest: Global Grain Supply Surge Drives Corn and Soybean Futures to New Lows

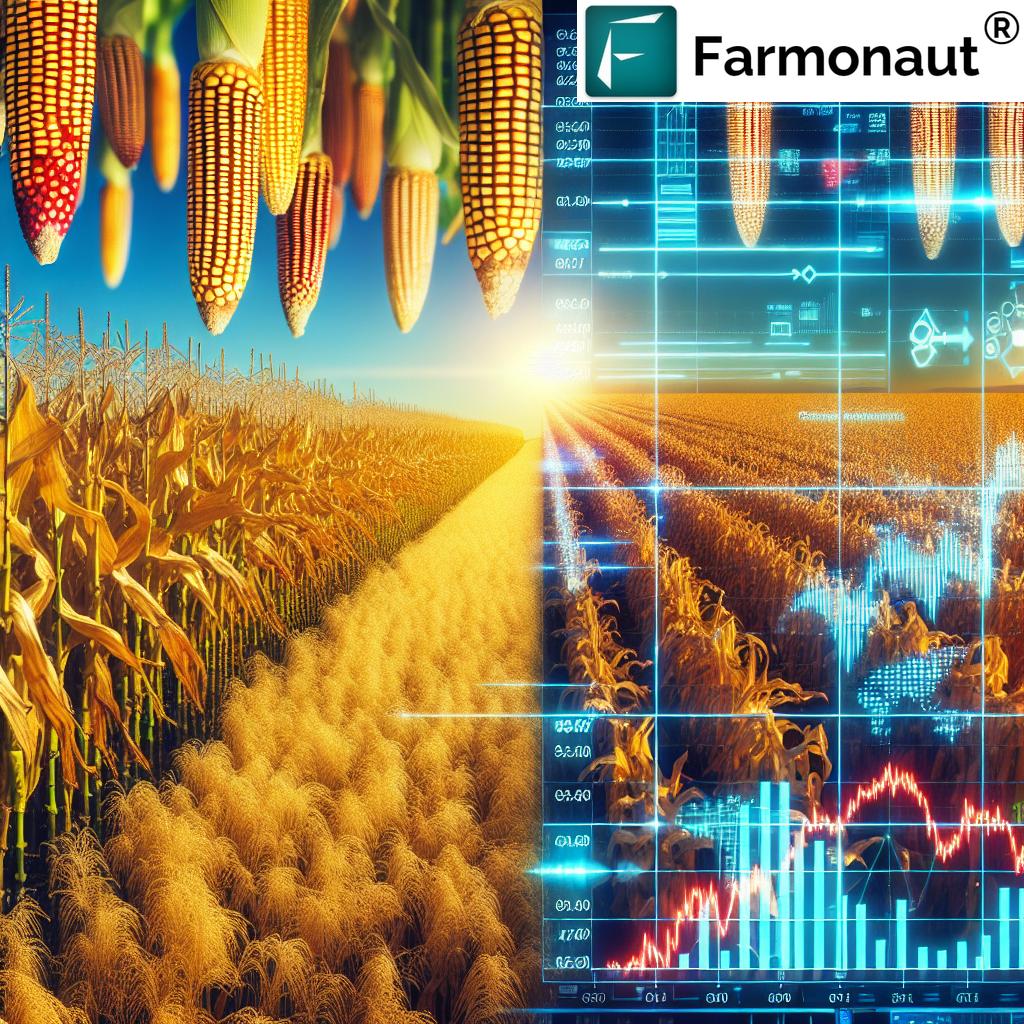

In a dramatic turn of events that has sent ripples through agricultural commodity markets, the global grain supply outlook has taken a bullish turn, leading to a significant corn soybean futures decline. This development has caught the attention of farmers, traders, and analysts alike, as the commodity price trends 2023 continue to evolve in response to a complex interplay of factors.

Chicago Board of Trade: A Barometer of Market Sentiment

The Chicago Board of Trade (CBOT), the nerve center of global grain trading, has recently witnessed corn futures and soybean futures plummet to levels not seen in recent memory. Corn futures have dipped to a startling $4.04 per bushel, while soybean futures have settled at $9.77 per bushel. These price points reflect a market grappling with the reality of abundant supplies and the strengthening U.S. dollar, which typically puts downward pressure on commodity prices.

For those looking to stay ahead of these market fluctuations, Farmonaut’s mobile app offers real-time updates and analysis on crop conditions and market trends.

U.S. Harvest Progress Impact: Exceeding Expectations

A key driver behind the current market dynamics is the accelerated crop harvest progress in the United States. According to the latest USDA crop reports, the harvest is outpacing the five-year average, a clear indication of robust production. This U.S. harvest progress impact has been significant, contributing to the bearish sentiment in the futures market.

- Corn harvest: 61% complete, surpassing the five-year average of 59%

- Soybean harvest: 76% complete, ahead of the 73% five-year average

These figures underscore the efficiency of American farmers and the favorable conditions that have prevailed during this crucial period. The rapid progress has amplified concerns about oversupply, further exerting downward pressure on futures prices.

Grain Export Dynamics: A Mixed Bag

The landscape of U.S. grain exports presents a nuanced picture. While a significant corn export to Mexico has been reported, it hasn’t been sufficient to buoy prices substantially. The grain export dynamics are further complicated by sluggish demand from China, a key player in the global agricultural commodity trade.

Farmers and traders can leverage Farmonaut’s Satellite Weather API to gain insights into weather patterns that may affect crop yields and export potential.

South American Crop Weather: A Game-Changer

The South American crop outlook has emerged as a pivotal factor in shaping the global grain supply outlook. Favorable South American crop weather conditions have bolstered expectations for robust harvests in countries like Brazil and Argentina. This optimistic outlook for South American production has added to the bearish pressure on futures prices, as traders anticipate an even more abundant global supply in the coming months.

To stay informed about international crop conditions, consider using the Farmonaut Android app or the iOS app for comprehensive global agricultural insights.

USDA Crop Report Analysis: Shaping Market Expectations

The USDA crop report analysis continues to be a cornerstone for understanding market dynamics. These reports provide crucial data on planting progress, crop conditions, and yield estimates. Recent analyses have reinforced the narrative of ample supplies, contributing to the downward trajectory of futures prices.

Key takeaways from recent USDA reports include:

- Upward revisions in yield estimates for both corn and soybeans

- Higher-than-expected ending stocks projections

- Modest adjustments in global demand forecasts

These factors collectively paint a picture of a well-supplied market, which has been reflected in the recent price action at the Chicago Board of Trade.

Commodity Price Trends 2023: A Year of Volatility

The commodity price trends 2023 have been characterized by significant volatility, with the corn and soybean markets exemplifying this pattern. Several factors have contributed to this year’s price fluctuations:

- Geopolitical tensions affecting global trade flows

- Extreme weather events in key growing regions

- Shifts in government policies and trade agreements

- Fluctuations in energy prices impacting production costs

As we move towards the end of the year, these trends continue to evolve, presenting both challenges and opportunities for market participants.

The Role of Technology in Modern Agriculture

In an era of rapidly changing market conditions, technology plays a crucial role in helping farmers and traders make informed decisions. Platforms like Farmonaut offer invaluable tools for monitoring crop health, predicting yields, and staying abreast of market trends.

For developers looking to integrate agricultural data into their applications, the Farmonaut API Developer Docs provide comprehensive guidance on leveraging satellite and weather data for agricultural insights.

Looking Ahead: Market Implications and Strategies

As the harvest season progresses and the global grain supply outlook continues to evolve, market participants are closely monitoring several key factors:

- Potential weather disruptions in South America

- Changes in Chinese import demand

- U.S. dollar movements and their impact on export competitiveness

- Developments in biofuel policies affecting corn demand

Farmers and traders are advised to stay vigilant and consider diversifying their risk management strategies in light of the current market conditions.

Conclusion: Navigating Uncertain Waters

The recent decline in corn and soybean futures prices underscores the dynamic nature of agricultural commodity markets. While current trends point towards ample supplies and bearish price action, the global agricultural landscape remains subject to rapid changes. Staying informed through reliable data sources and leveraging technology will be crucial for stakeholders looking to navigate these uncertain waters successfully.

As we move forward, the interplay between U.S. grain exports, global supply dynamics, and evolving demand patterns will continue to shape the market. Those who can adapt quickly to these changing conditions will be best positioned to thrive in this challenging environment.

To stay ahead of the curve in agricultural market insights, consider exploring the following resources:

By leveraging these tools and staying informed about market developments, stakeholders in the agricultural sector can make more informed decisions and better navigate the complexities of today’s commodity markets.