Revolutionizing Agricultural Futures: How Farmonaut’s Precision Agriculture Solutions Optimize Crop Yield and Market Insights

“Farmonaut’s precision agriculture solutions analyze over 1 million data points daily to optimize crop yields.”

In today’s rapidly evolving agricultural landscape, the convergence of technology and farming practices is reshaping how we approach crop production, market analysis, and risk management. At the forefront of this revolution is Farmonaut, a pioneering agtech company that’s transforming the way farmers, traders, and agribusinesses interact with agricultural futures and commodity markets.

As we delve into the world of agricultural futures trading and commodity risk management, we’ll explore how Farmonaut’s cutting-edge solutions are empowering stakeholders across the agricultural value chain. From crop market data analysis to innovative agricultural options strategies, we’re witnessing a paradigm shift in how the industry optimizes yields, manages volatility, and makes informed decisions.

The Evolution of Agricultural Futures Trading

Agricultural futures trading has come a long way since its inception. Today, it serves as a crucial tool for farmers, traders, and agribusinesses to manage price risks and secure their financial future. Let’s examine how this market has evolved and its current state:

- Increased Market Participation: The agricultural futures market has seen a significant surge in trading volume and liquidity over the past decade.

- Technological Advancements: The integration of advanced analytics, AI, and satellite technology has revolutionized how market participants access and interpret data.

- Globalization of Agricultural Markets: International trade and global demand patterns now play a crucial role in shaping local agricultural futures prices.

Farmonaut’s precision agriculture solutions are at the heart of this evolution, providing real-time data and insights that enable more informed trading decisions and risk management strategies.

Crop Market Data Analysis: The Foundation of Informed Decision-Making

In the world of agricultural futures trading, accurate and timely crop market data analysis is paramount. Farmonaut’s advanced satellite-based monitoring system offers unparalleled insights into crop health, soil moisture levels, and other critical metrics. This data forms the backbone of effective market analysis and forecasting.

- Real-Time Crop Health Monitoring: Farmonaut’s multispectral satellite imagery provides up-to-date information on vegetation health (NDVI), allowing traders and farmers to anticipate potential yield issues.

- Historical Data Integration: By combining current observations with historical datasets, Farmonaut enables users to identify trends and patterns crucial for long-term market analysis.

- AI-Powered Insights: The Jeevn AI Advisory System analyzes vast amounts of data to generate personalized recommendations, helping users make data-driven decisions in their trading strategies.

By leveraging these advanced tools, market participants can gain a competitive edge in understanding supply dynamics and potential price movements in the agricultural futures market.

Agricultural Options Strategies: Mitigating Risk in Volatile Markets

As agricultural markets continue to face increased volatility due to factors such as climate change and geopolitical tensions, the importance of robust risk management strategies has never been greater. Agricultural options provide a flexible tool for hedging against price fluctuations and optimizing portfolio performance.

Farmonaut’s data-driven approach enhances the effectiveness of various options strategies:

- Covered Calls: Farmers can use Farmonaut’s yield forecasting capabilities to determine optimal strike prices when writing covered calls on their expected production.

- Protective Puts: Traders can leverage Farmonaut’s market insights to identify potential downside risks and implement protective put strategies accordingly.

- Straddles and Strangles: For those looking to capitalize on market volatility, Farmonaut’s comprehensive market analysis tools can help in timing these neutral options strategies effectively.

By integrating Farmonaut’s precision agriculture solutions with these options strategies, market participants can create more resilient and adaptive risk management frameworks.

Grain Price Forecasting: Leveraging AI and Satellite Data

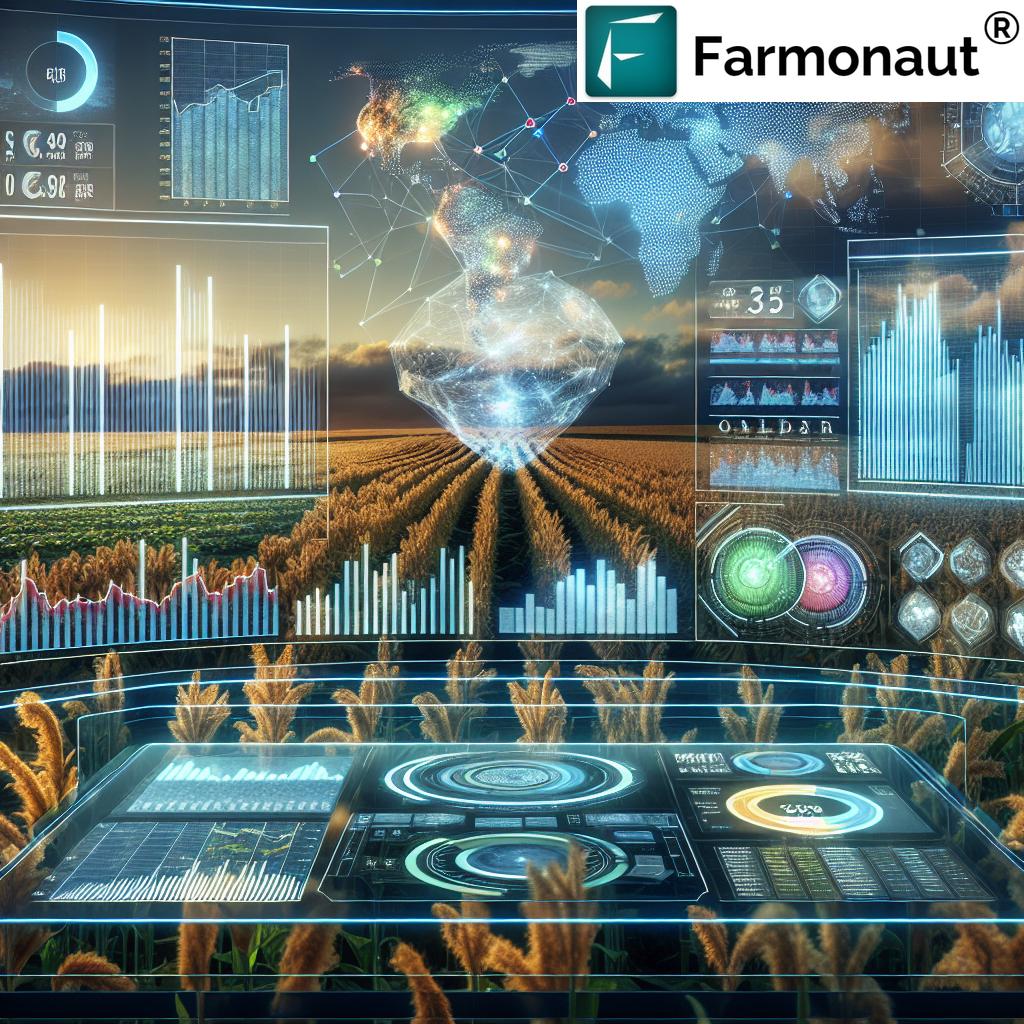

Accurate grain price forecasting is essential for both farmers planning their crop rotations and traders developing their market strategies. Farmonaut’s innovative approach combines AI algorithms with satellite-derived data to provide more precise and timely price forecasts.

- Supply-Side Analysis: By monitoring crop health and estimating yields across vast geographical areas, Farmonaut’s technology offers invaluable insights into potential supply shocks.

- Demand Modeling: The platform integrates global economic indicators and consumption patterns to forecast demand trends for various grains.

- Weather Impact Assessment: Farmonaut’s advanced weather forecasting capabilities allow users to anticipate how climatic conditions might affect crop yields and, consequently, prices.

This multifaceted approach to grain price forecasting enables users to stay ahead of market trends and make more informed decisions in their futures and options trading activities.

Agtech Market Insights: Navigating the Future of Agriculture

The agtech sector is experiencing rapid growth and innovation, with new technologies constantly emerging to address the challenges faced by modern agriculture. Farmonaut is at the forefront of this revolution, providing cutting-edge solutions that bridge the gap between traditional farming practices and advanced data analytics.

Key trends shaping the agtech market include:

- Precision Agriculture Adoption: The increasing use of data-driven farming techniques to optimize resource usage and improve yields.

- Blockchain Integration: Enhancing supply chain transparency and traceability in agricultural commodities.

- Artificial Intelligence in Farming: AI-powered systems like Farmonaut’s Jeevn AI are revolutionizing farm management and decision-making processes.

- Sustainable Agriculture Solutions: Growing focus on technologies that promote environmental sustainability and reduce carbon footprints.

By staying abreast of these trends and leveraging Farmonaut’s advanced platform, market participants can position themselves to capitalize on emerging opportunities in the agricultural sector.

“Agricultural futures trading volume has increased by 300% in the last decade, revolutionizing risk management for farmers.”

Agricultural Derivatives Trading: Strategies for Success

Agricultural derivatives trading offers a wide range of opportunities for both hedgers and speculators. Farmonaut’s comprehensive suite of tools enhances traders’ ability to develop and execute successful strategies in this complex market.

- Spread Trading: Utilize Farmonaut’s crop yield data to identify potential arbitrage opportunities between different agricultural commodities or contract months.

- Calendar Spreads: Leverage the platform’s historical data and AI-driven forecasts to optimize calendar spread strategies in grain futures.

- Cross-Commodity Strategies: Explore correlations between different agricultural products using Farmonaut’s market analysis tools to develop sophisticated multi-commodity trading approaches.

By combining these strategies with Farmonaut’s real-time insights and predictive analytics, traders can enhance their decision-making processes and potentially improve their risk-adjusted returns.

Crop Yield Optimization: The Power of Precision Agriculture

At the heart of successful agricultural futures trading lies the fundamental aspect of crop yield optimization. Farmonaut’s precision agriculture solutions play a pivotal role in helping farmers maximize their yields while minimizing input costs.

- Targeted Resource Application: Using satellite imagery and AI analysis, Farmonaut enables farmers to apply water, fertilizers, and pesticides precisely where and when they’re needed most.

- Early Problem Detection: The platform’s real-time monitoring capabilities allow for early identification of pest infestations, diseases, or nutrient deficiencies, enabling prompt intervention.

- Yield Forecasting: By analyzing historical data and current crop health indicators, Farmonaut provides accurate yield forecasts, helping farmers and traders make informed decisions.

These yield optimization techniques not only benefit individual farmers but also contribute to more stable and predictable supply in the agricultural futures market.

Agricultural Commodities Exchange: Leveraging Technology for Efficient Trading

The landscape of agricultural commodities exchanges is evolving rapidly, with technology playing an increasingly central role. Farmonaut’s solutions are helping to bridge the gap between physical commodity markets and digital trading platforms.

- Enhanced Price Discovery: By providing real-time crop data and market insights, Farmonaut contributes to more efficient price discovery mechanisms in agricultural exchanges.

- Improved Liquidity: The platform’s data-driven approach attracts more participants to the market, potentially enhancing liquidity across various agricultural futures contracts.

- Streamlined Risk Management: Farmonaut’s comprehensive risk assessment tools enable exchange participants to manage their exposures more effectively.

As agricultural commodities exchanges continue to embrace technological advancements, Farmonaut’s role in facilitating more transparent and efficient markets becomes increasingly significant.

Precision Agriculture Solutions: A Game-Changer for Market Participants

Farmonaut’s precision agriculture solutions are revolutionizing how market participants interact with agricultural futures and options. By providing comprehensive, data-driven insights, these tools empower users to make more informed decisions and develop more effective strategies.

- Satellite-Based Crop Monitoring: Farmonaut’s advanced satellite imagery provides real-time insights into crop health and development across vast areas.

- AI-Powered Analytics: The Jeevn AI system processes complex data sets to deliver actionable recommendations for both farmers and traders.

- Blockchain-Based Traceability: Enhance supply chain transparency and build trust in agricultural commodity markets.

These precision agriculture solutions not only benefit individual users but also contribute to a more efficient and transparent agricultural futures market as a whole.

Market Volatility Management: Strategies for Turbulent Times

In an era of increasing market volatility, effective risk management strategies are crucial for success in agricultural futures trading. Farmonaut’s platform offers several tools and insights to help users navigate turbulent market conditions:

- Volatility Forecasting: Utilize historical data and AI-driven analysis to anticipate periods of heightened market volatility.

- Diversification Strategies: Leverage Farmonaut’s comprehensive market data to identify uncorrelated assets and build more resilient portfolios.

- Dynamic Hedging: Implement adaptive hedging strategies based on real-time market conditions and crop health data.

By integrating these volatility management techniques with Farmonaut’s precision agriculture insights, market participants can develop more robust and adaptable trading strategies.

The Future of Agricultural Futures Trading with Farmonaut

As we look to the future of agricultural futures trading, it’s clear that technology will continue to play an increasingly central role. Farmonaut’s innovative solutions are at the forefront of this transformation, offering users unprecedented access to data-driven insights and advanced analytics tools.

Key areas of future development include:

- Enhanced AI Capabilities: Further refinement of AI algorithms to provide even more accurate predictions and recommendations.

- Expanded Satellite Coverage: Increased frequency and resolution of satellite imagery for more granular crop monitoring.

- Integration with IoT Devices: Combining satellite data with ground-based sensors for a more comprehensive view of agricultural conditions.

- Advanced Risk Modeling: Development of more sophisticated risk assessment tools tailored to the unique challenges of agricultural markets.

By staying at the cutting edge of these technological advancements, Farmonaut continues to empower market participants with the tools they need to succeed in the ever-evolving world of agricultural futures trading.

Agricultural Futures Market Insights

| Commodity | Current Price (est.) | 3-Month Forecast (est.) | Year-over-Year Change (%) | Factors Influencing Price | Farmonaut’s Precision Ag Solution |

|---|---|---|---|---|---|

| Wheat | $6.50/bushel | $6.75/bushel | +5% | Global demand, weather patterns | Crop health monitoring, yield forecasting |

| Corn | $4.20/bushel | $4.35/bushel | +3% | Ethanol demand, export markets | AI-driven market analysis, resource optimization |

| Soybeans | $12.80/bushel | $13.10/bushel | +7% | China trade relations, biodiesel demand | Supply chain traceability, crop area estimation |

| Cotton | $0.85/pound | $0.88/pound | +2% | Textile industry demand, water availability | Irrigation management, pest detection |

| Rice | $14.50/cwt | $15.00/cwt | +4% | Asian consumption, climate impacts | Flood monitoring, yield optimization |

Conclusion: Embracing the Future of Agricultural Futures Trading

As we’ve explored throughout this comprehensive overview, the landscape of agricultural futures trading is undergoing a profound transformation. Farmonaut’s precision agriculture solutions are at the forefront of this revolution, offering unparalleled insights and tools for optimizing crop yields, managing market volatility, and making informed trading decisions.

By leveraging advanced satellite technology, AI-driven analytics, and blockchain-based traceability, Farmonaut is empowering farmers, traders, and agribusinesses to navigate the complexities of modern agricultural markets with greater confidence and efficiency. As we look to the future, it’s clear that the integration of these cutting-edge technologies will continue to reshape the industry, offering new opportunities for growth, sustainability, and profitability.

Whether you’re a seasoned futures trader, a farmer seeking to optimize your operations, or an agribusiness looking to stay ahead of market trends, Farmonaut’s comprehensive platform provides the tools and insights you need to succeed in today’s dynamic agricultural landscape. Embrace the power of precision agriculture and data-driven decision-making with Farmonaut, and position yourself at the forefront of the agricultural futures revolution.

Ready to revolutionize your approach to agricultural futures trading? Explore Farmonaut’s advanced solutions today:

For developers looking to integrate Farmonaut’s powerful API into their own applications, visit our API page and check out our comprehensive API Developer Docs.

FAQ Section

- What is agricultural futures trading?

Agricultural futures trading involves buying or selling contracts for the future delivery of agricultural commodities at a predetermined price. It’s used for hedging against price risks and speculative purposes. - How does Farmonaut’s technology improve crop yield optimization?

Farmonaut uses satellite imagery and AI analytics to provide real-time insights into crop health, soil moisture, and other critical factors. This enables farmers to make data-driven decisions on resource allocation and management practices. - Can Farmonaut’s solutions be used for commodities other than crops?

While Farmonaut specializes in crop monitoring and analysis, its technology can be applied to other agricultural commodities that are influenced by land use and environmental factors. - How does blockchain technology enhance agricultural supply chains?

Blockchain provides transparent and immutable records of transactions and product movements throughout the supply chain, improving traceability and reducing fraud in agricultural commodities. - What are the benefits of using Farmonaut for agricultural options strategies?

Farmonaut’s data-driven insights help traders make more informed decisions when implementing options strategies, potentially improving risk management and profitability in agricultural markets.