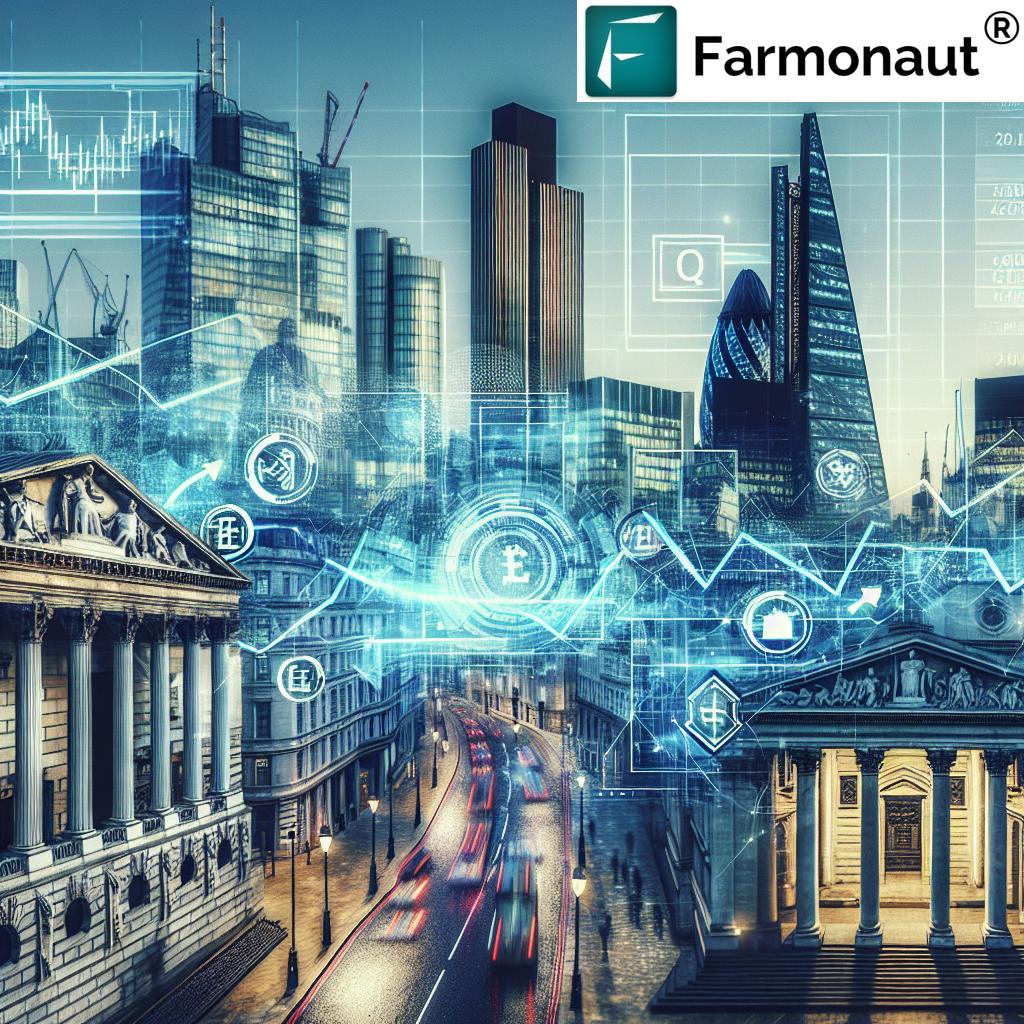

Strategic Shifts in UK Banking: Analyzing Market Challenges and Operational Reviews in Britain’s Financial Sector

“A major Spanish bank is reviewing its UK operations, potentially impacting Britain’s £8.6 trillion financial services sector.”

In the ever-evolving landscape of global finance, we are witnessing significant strategic shifts in the UK banking sector. As industry experts, we at Farmonaut recognize the importance of staying informed about these changes, particularly as they relate to the broader economic ecosystem that affects our agricultural clients. Today, we’ll delve into the recent developments surrounding a major Spanish bank’s review of its UK operations and the implications for Britain’s financial sector.

The Changing Face of UK Banking

The UK banking sector is currently facing a period of intense scrutiny and potential transformation. A prominent Spanish bank, Banco Santander, is exploring options for its presence in the British market, signaling a possible strategic shift in financial market operations. This review comes two decades after Santander’s acquisition of Abbey National, which cemented its position as a key player in UK banking.

Let’s break down the key aspects of this situation:

- Santander is conducting a regular assessment of its business units, including its UK operations.

- The review could lead to scaling back or even exiting the UK market.

- Britain remains a core market for Santander, alongside Mexico, Brazil, and Spain.

- The bank competes with major UK institutions like Lloyds Banking Group and Barclays.

This strategic review is not occurring in isolation. It’s part of a broader trend in the banking industry, where international financial institutions are reassessing their global footprints in light of changing market dynamics and regulatory landscapes.

Market Challenges and Operational Pressures

The UK banking sector review is taking place against a backdrop of significant challenges:

- High Operational Costs: Banks in the UK are grappling with elevated business costs compared to their international competitors.

- Regulatory Pressures: Increased scrutiny from regulatory bodies is adding complexity to banking operations.

- Capital Allocation Issues: Banks are finding it challenging to allocate capital effectively within their broader group structures.

- Market Competitiveness: The UK market remains highly competitive, putting pressure on profit margins.

These factors have led to frustration among banking executives, particularly regarding capital allocation and tax structures in Britain. Mike Regnier, Santander Britain’s chief executive, recently expressed these concerns during a parliamentary session, highlighting the difficulties faced by international banks operating in the UK.

Strategic Options and Potential Outcomes

As we analyze the situation, several strategic options emerge for Santander and potentially other international banks operating in the UK:

- Scaling Back Operations: This could involve reducing the bank’s footprint in certain areas of the UK market.

- Market Exit: While drastic, completely exiting the UK market is a possibility being considered.

- Focus on Growth Regions: There’s potential for shifting resources to faster-growing markets like the United States.

- Operational Restructuring: Banks may look to streamline their UK operations to improve efficiency and reduce costs.

It’s important to note that these decisions are still in the preliminary stages, and no imminent announcements are expected. The uncertainty surrounding potential buyers for Santander’s UK operations adds another layer of complexity to the situation.

Recent Developments Impacting the Sector

“Recent job cuts and court rulings on car loans have affected up to 5% of UK banking sector employees.”

Several recent events have further complicated the operational environment for banks in the UK:

- Court Ruling on Car Loans: A British court ruling concerning motor finance commissions has led Santander to allocate £295 million for potential costs related to the inquiry.

- Job Cuts: Santander has already reduced its workforce in Britain by approximately 1,400 jobs in October, reflecting the need for operational efficiency.

- Evolving Business Landscape: Banks are adapting to changes in consumer behavior, technological advancements, and regulatory requirements.

These developments underscore the challenges faced by the banking sector and the need for strategic adaptation to ensure long-term sustainability in the UK market.

Comparative Analysis: UK Banking Sector Challenges and Strategic Responses

| Challenge | Impact | Strategic Response |

|---|---|---|

| High Operational Costs | Reduced profitability and competitiveness | Operational restructuring, cost-cutting measures |

| Regulatory Pressures | Increased compliance costs and operational complexity | Investment in compliance technology, potential market exit |

| Capital Allocation Issues | Inefficient use of resources, reduced returns | Reassessment of market presence, focus on high-growth areas |

| Market Competitiveness | Pressure on profit margins, market share challenges | Product innovation, strategic partnerships, niche market focus |

This table provides a clear overview of the major challenges facing UK banks and potential strategic responses. As we can see, banks are considering a range of options to address these issues, from operational restructuring to potential market exits.

The Broader Impact on the UK Financial Sector

The strategic shifts we’re observing in the UK banking sector have far-reaching implications for Britain’s financial services industry as a whole. As a £8.6 trillion sector, any significant changes in banking operations could have ripple effects across the economy.

- Job Market: Potential job losses in the banking sector could impact employment figures and the availability of financial expertise.

- Consumer Services: Changes in bank presence on high streets could affect access to financial services for individuals and businesses.

- Economic Contribution: The financial sector’s contribution to the UK economy may be affected if major banks scale back their operations.

- International Competitiveness: The UK’s position as a global financial hub could be challenged if international banks reduce their presence.

At Farmonaut, we understand the importance of a robust financial sector for our agricultural clients. Access to finance, banking services, and financial advice is crucial for farmers and agribusinesses. While we focus on providing cutting-edge satellite-based farm management solutions, we recognize that the health of the banking sector indirectly impacts the agricultural industry.

The Role of Technology in Banking Transformation

As the banking sector faces these challenges, technology is playing an increasingly important role in shaping strategic responses. At Farmonaut, we’ve seen firsthand how technological innovation can transform industries, and banking is no exception.

- Digital Banking: The shift towards online and mobile banking is reducing the need for physical branches, potentially alleviating some operational costs.

- AI and Machine Learning: These technologies are being employed to improve risk assessment, fraud detection, and customer service.

- Blockchain: While we use blockchain for agricultural traceability, banks are exploring its potential for secure transactions and smart contracts.

- Data Analytics: Advanced analytics are helping banks make more informed decisions about market strategy and resource allocation.

For those interested in how technology is transforming industries, you can explore our satellite-based farm management solutions on our web app or check out our API for developers.

Looking Ahead: The Future of UK Banking

As we look to the future, several key trends are likely to shape the UK banking landscape:

- Consolidation: We may see increased mergers and acquisitions as banks seek to achieve economies of scale.

- Specialization: Some banks may focus on niche markets or specific financial products to differentiate themselves.

- Technological Integration: Continued investment in fintech solutions will be crucial for staying competitive.

- Regulatory Evolution: Changes in financial regulations could significantly impact banking strategies.

- Global Market Dynamics: International economic trends will continue to influence UK banking operations.

At Farmonaut, we’re committed to staying abreast of these changes and their potential impact on the agricultural sector. Our innovative solutions, such as our Android app and iOS app, are designed to help farmers navigate changing financial landscapes by optimizing their operations and improving profitability.

Conclusion: Navigating Change in the Financial Sector

The strategic shifts we’re observing in UK banking represent a critical juncture for Britain’s financial sector. As international banks like Santander review their operations and consider scaling back or exiting the market, we’re likely to see significant changes in the banking landscape over the coming years.

These changes will have far-reaching implications, not just for the banking sector, but for the broader economy, including industries like agriculture that rely on robust financial services. At Farmonaut, we believe that staying informed and adaptable is key to navigating these changes successfully.

While we focus on providing cutting-edge agricultural technology solutions, we recognize the interconnectedness of various economic sectors. Our commitment to innovation and adaptability mirrors the approach that banks and other financial institutions must take in this evolving landscape.

As we continue to monitor these developments, we encourage our readers to stay informed and consider how these changes might impact their own industries and financial strategies. Whether you’re a farmer using our satellite-based crop monitoring tools or a financial professional navigating market changes, adaptability and innovation will be key to future success.

FAQ Section

Q1: What is driving the strategic review of UK banking operations by international banks?

A1: The review is driven by several factors, including high operational costs, regulatory pressures, capital allocation challenges, and intense market competition in the UK banking sector.

Q2: How might these strategic shifts impact consumers and businesses in the UK?

A2: Consumers and businesses may see changes in bank presence on high streets, potentially affecting access to financial services. There could also be impacts on job markets and the availability of certain banking products.

Q3: Are other international banks likely to follow suit in reviewing their UK operations?

A3: While each bank’s situation is unique, the challenges facing the UK banking sector are industry-wide. It’s possible that other international banks may conduct similar reviews of their UK operations.

Q4: How is technology influencing these strategic decisions in banking?

A4: Technology is playing a crucial role, with banks investing in digital banking, AI, blockchain, and data analytics to improve efficiency, reduce costs, and enhance customer experiences.

Q5: What potential outcomes could result from these strategic reviews?

A5: Potential outcomes include scaling back operations, market exits, focusing on growth regions, operational restructuring, or maintaining current operations with strategic adjustments.

Earn With Farmonaut

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions

As we conclude our analysis of the strategic shifts in UK banking, we at Farmonaut remain committed to providing innovative solutions for the agricultural sector. While the financial landscape may be changing, our focus on empowering farmers with cutting-edge technology remains constant. We invite you to explore our range of services and join us in shaping the future of agriculture.

Stay informed, stay adaptive, and let’s navigate these changing times together.