2024 U.S. Cattle Inventory Report: Key Trends and Market Implications for Producers

“The 2024 US cattle inventory dropped 2% to 87.2 million head, signaling significant market shifts for producers.”

Welcome to Farmonaut’s comprehensive analysis of the January 2024 U.S. Cattle Inventory Report. As leaders in agricultural technology and satellite-based farm management solutions, we’re excited to bring you this in-depth look at the latest trends and market implications for the cattle industry. Our goal is to provide producers, market analysts, and agricultural professionals with valuable insights to make informed decisions in this dynamic sector.

Overview of the 2024 U.S. Cattle Inventory

The United States Department of Agriculture (USDA) has released its annual cattle inventory report, revealing significant changes in the national herd size and composition. As of January 1, 2024, the total number of cattle and calves in the U.S. stood at 87.2 million head, marking a 2% decrease from the previous year. This decline signals important shifts in the livestock market that producers and industry stakeholders must carefully consider.

Let’s dive deeper into the key components of this report and explore what these numbers mean for the future of the U.S. cattle market.

Detailed Breakdown of Cattle Inventory Categories

“Detailed breakdowns of cow, heifer, and calf inventories provide crucial data for agricultural professionals’ decision-making.”

To fully understand the implications of the 2024 cattle inventory report, it’s essential to examine the various categories within the overall population. Here’s a comprehensive look at the numbers:

| Inventory Category | 2023 / 2024 (million head) |

|---|---|

| Total Cattle and Calves | 89.0 / 87.2 |

| Beef Cows | 28.9 / 28.2 |

| Milk Cows | 9.4 / 9.3 |

| Heifers (500 pounds and over) | 19.2 / 18.8 |

| Steers (500 pounds and over) | 16.1 / 15.8 |

| Calves (under 500 pounds) | 13.6 / 13.3 |

| Cattle on Feed | 14.2 / 14.0 |

These figures provide a clear picture of the changes occurring across different segments of the cattle industry. Let’s analyze each category to understand its impact on the market.

Beef Cow Inventory

The beef cow inventory, a critical indicator of future beef production, has decreased by 2.4% to 28.2 million head. This reduction suggests that ranchers are continuing to liquidate their herds, likely due to a combination of factors including drought conditions, high input costs, and market uncertainty. The implications of this decrease could lead to tighter beef supplies in the coming years, potentially resulting in higher prices for consumers and improved profit margins for producers who maintain their herd sizes.

Milk Cow Inventory

The dairy sector has seen a slight decrease in milk cow numbers, down 1.1% to 9.3 million head. This modest reduction reflects ongoing efficiency gains in milk production per cow, allowing dairy farmers to maintain or increase milk output with fewer animals. However, it also indicates potential consolidation within the industry as smaller operations may be exiting the market.

Heifers and Steers

The inventory of heifers and steers weighing 500 pounds and over has decreased by 2.1% and 1.9%, respectively. This reduction in replacement heifers and market-ready cattle could lead to tighter supplies in the short term, potentially supporting cattle prices. However, it also raises questions about the long-term expansion potential of the national herd.

Calves Under 500 Pounds

The 2.2% decrease in calves under 500 pounds is a direct result of the reduced cow herd and could signal continued tightness in feeder cattle supplies for the coming year. This trend may lead to increased competition among feedlots for available calves, potentially driving up prices for cow-calf producers.

Cattle on Feed

The number of cattle on feed as of January 1, 2024, was down 1.4% from the previous year. This reduction aligns with the overall decrease in cattle inventory and could lead to reduced beef production in the short term. Feedlot operators will need to carefully manage their placements and marketings to optimize profitability in this changing landscape.

Regional Variations in Cattle Inventory

Understanding regional differences in cattle inventory is crucial for producers and market analysts. The 2024 report highlights significant variations across different states and regions:

- Texas: Remains the top cattle-producing state but experienced a 3% decrease in total inventory.

- Nebraska: Saw a 2% reduction in cattle numbers, impacting its position as a major cattle-feeding state.

- California: Reported a 1% increase in dairy cow numbers, bucking the national trend.

- Midwest: Generally experienced smaller declines compared to Western states, potentially due to better forage conditions.

These regional variations reflect differences in local weather patterns, feed availability, and market conditions. Producers should consider these factors when making decisions about herd expansion or contraction.

Calf Crop Estimates and Future Production Outlook

The 2023 calf crop was estimated at 34.3 million head, down 2% from 2022. This decrease in calf numbers has important implications for future beef production and feeder cattle availability. Let’s break down the calf crop estimates:

- First-half born calves: Estimated at 25.1 million head, down 1.8% from 2022

- Second-half born calves: Projected at 9.2 million head, a 2.5% decrease from the previous year

These figures suggest that the contraction in the cattle herd is likely to continue into 2024 and possibly beyond. Producers should anticipate tighter supplies of feeder cattle, which could lead to increased competition and potentially higher prices in the coming years.

Market Implications for Producers

The 2024 U.S. cattle inventory report has several important implications for producers across the industry:

- Tighter supplies: The overall reduction in cattle numbers is likely to lead to tighter beef supplies, potentially supporting higher prices for finished cattle and beef products.

- Increased competition for feeder cattle: With fewer calves available, feedlots may face increased competition and higher prices for feeder cattle.

- Opportunity for herd expansion: For producers with available resources, the current market conditions may present an opportunity for strategic herd expansion.

- Focus on efficiency: With reduced cattle numbers, there will be an increased emphasis on improving production efficiency to maintain profitability.

- Potential for price volatility: The tight supply situation could lead to increased price volatility in both the live cattle and feeder cattle markets.

At Farmonaut, we understand the importance of data-driven decision-making in agriculture. Our satellite-based farm management solutions can help cattle producers optimize their operations in these changing market conditions.

Weather and Environmental Factors

Weather conditions play a crucial role in cattle production, influencing feed availability, herd management decisions, and overall industry dynamics. The 2024 inventory report reflects the impact of recent weather patterns:

- Drought conditions: Persistent drought in key cattle-producing regions has led to reduced forage availability and increased feed costs, contributing to herd liquidation.

- Regional variations: Some areas have experienced improved moisture conditions, potentially setting the stage for localized herd rebuilding efforts.

- Long-term climate trends: Producers are increasingly factoring in long-term climate projections when making decisions about herd sizes and management practices.

Farmonaut’s advanced satellite imagery and AI-powered analytics can provide valuable insights into pasture conditions, helping producers make informed decisions about grazing management and feed procurement.

Feedlot Capacity and Utilization Trends

The 2024 cattle inventory report also provides insights into feedlot capacity and utilization trends:

- Total feedlot capacity: Remained relatively stable at 17.3 million head

- Utilization rate: Decreased slightly to 81% due to reduced cattle numbers

- Regional shifts: Some areas saw increased feedlot capacity, while others experienced consolidation

These trends highlight the ongoing evolution of the cattle feeding sector, with implications for both feedlot operators and cow-calf producers. Efficient resource management and strategic planning will be crucial for success in this changing landscape.

International Trade Implications

The U.S. cattle inventory has significant implications for international trade in beef and live cattle:

- Export potential: Tighter supplies may lead to reduced export volumes but potentially higher values for U.S. beef in international markets.

- Import considerations: There may be increased demand for imported beef to supplement domestic supplies, particularly for processing-grade beef.

- Live cattle trade: The reduction in U.S. cattle numbers could impact live cattle trade with Canada and Mexico.

Producers and industry stakeholders should closely monitor international market developments and trade policies that could affect the beef sector.

Explore Farmonaut’s API for advanced agricultural data analysis

Technological Advancements in Cattle Management

As the cattle industry faces challenges and opportunities presented by the changing inventory landscape, technological advancements are playing an increasingly important role in farm management:

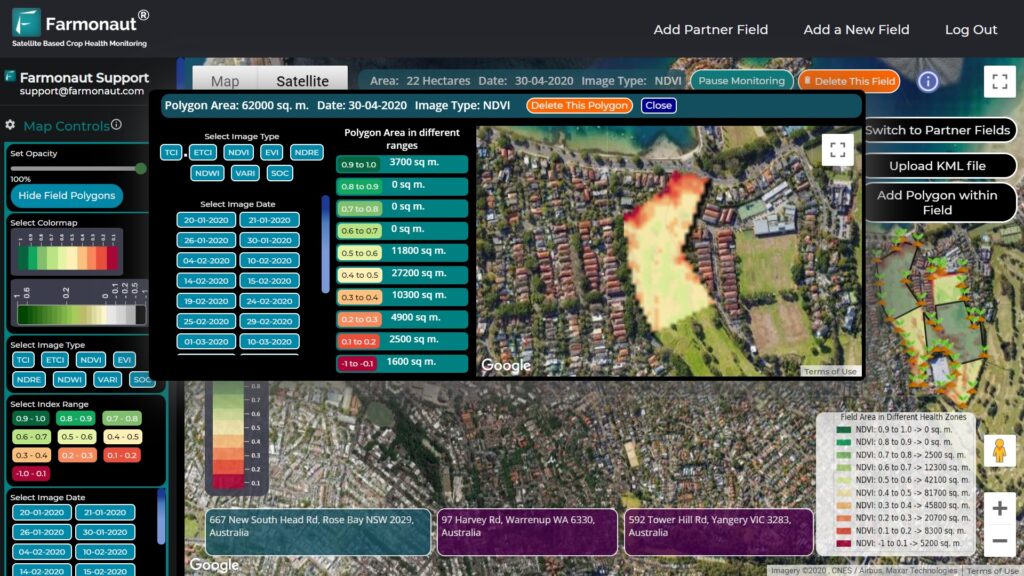

- Precision agriculture: Satellite-based monitoring systems, like those offered by Farmonaut, help producers optimize pasture management and resource allocation.

- AI-powered analytics: Advanced algorithms can predict market trends, helping producers make informed decisions about buying, selling, and herd management.

- Blockchain technology: Improving traceability and transparency in the beef supply chain, enhancing food safety and consumer trust.

- Remote sensing: Satellite imagery and drones provide valuable data on forage quality and quantity, supporting grazing management decisions.

These technologies are transforming the way cattle producers operate, enabling more efficient and sustainable practices across the industry.

Economic Outlook for the Cattle Industry

Based on the 2024 inventory report and current market conditions, we can make several projections about the economic outlook for the U.S. cattle industry:

- Cattle prices: Expectations of higher prices for both feeder and fed cattle due to tighter supplies

- Production costs: Continued focus on managing input costs, particularly feed and energy expenses

- Profitability: Potential for improved margins for efficient producers, but with increased volatility

- Investment: Opportunities for strategic investments in herd expansion and technology adoption

- Market cycles: The industry may be entering a phase of the cattle cycle characterized by herd rebuilding and price strength

Producers should consider these economic factors when developing their business strategies for the coming years.

Access Farmonaut’s API Developer Docs for integration with your farm management systems

Sustainability and Environmental Considerations

The cattle industry is increasingly focused on sustainability and environmental stewardship. The 2024 inventory report highlights several trends related to these issues:

- Efficiency gains: Producing more beef with fewer cattle, reducing the environmental footprint per unit of production

- Carbon sequestration: Growing interest in practices that enhance soil health and carbon storage on grazing lands

- Water management: Increased adoption of water-efficient technologies and management practices

- Methane reduction: Research and implementation of strategies to reduce enteric methane emissions from cattle

These sustainability efforts are crucial for the long-term viability of the cattle industry and its ability to meet consumer expectations.

Consumer Trends and Beef Demand

Understanding consumer preferences and demand trends is essential for producers navigating the changing cattle market:

- Premium beef demand: Continued strong demand for high-quality, marbled beef

- Alternative proteins: Growing competition from plant-based and lab-grown meat alternatives

- Transparency: Increased consumer interest in traceability and production practices

- Health considerations: Ongoing debate about the role of beef in healthy diets

Producers should stay informed about these consumer trends and consider how they might impact marketing strategies and production decisions.

Policy and Regulatory Environment

The cattle industry operates within a complex policy and regulatory framework. Key areas to watch include:

- Trade policies: Ongoing negotiations and agreements that affect beef exports and imports

- Environmental regulations: Potential new rules related to greenhouse gas emissions and water quality

- Animal welfare standards: Evolving regulations and consumer expectations regarding animal care practices

- Land use policies: Changes that could impact grazing rights on public lands

Staying informed about policy developments is crucial for producers making long-term business decisions.

Farmonaut’s Role in Supporting Cattle Producers

At Farmonaut, we’re committed to providing cutting-edge technologies that help cattle producers thrive in this dynamic market environment. Our satellite-based farm management solutions offer:

- Real-time pasture monitoring: Track vegetation health and growth patterns to optimize grazing strategies

- Weather forecasting: Access accurate, localized weather predictions to inform management decisions

- Resource management tools: Efficiently track and allocate resources across your operation

- Data-driven insights: Leverage AI and machine learning to gain valuable insights for your business

By integrating Farmonaut’s technologies into your cattle operation, you can make more informed decisions, improve efficiency, and stay ahead in a competitive market.

Conclusion

The 2024 U.S. Cattle Inventory Report reveals significant changes in the national herd, with implications that will reverberate throughout the industry in the coming years. As producers navigate this evolving landscape, staying informed and leveraging advanced technologies will be key to success.

At Farmonaut, we’re dedicated to supporting the cattle industry with innovative solutions that drive efficiency, sustainability, and profitability. By combining the insights from this report with our advanced satellite-based farm management tools, producers can make data-driven decisions that position them for success in the years ahead.

We encourage all stakeholders in the cattle industry to carefully consider the trends and implications outlined in this report. By staying informed and adaptable, we can work together to build a strong, sustainable future for U.S. cattle production.

Frequently Asked Questions (FAQ)

- Q: What is the main takeaway from the 2024 U.S. Cattle Inventory Report?

A: The report shows a 2% decrease in total cattle and calves to 87.2 million head, indicating a contraction in the national herd and potential market shifts. - Q: How might the reduced cattle inventory affect beef prices?

A: The tighter supply could lead to higher beef prices for consumers and potentially improved profit margins for producers. - Q: What factors are contributing to the decline in cattle numbers?

A: Drought conditions, high input costs, and market uncertainty are key factors influencing producers’ decisions to reduce herd sizes. - Q: How can producers use technology to adapt to these market changes?

A: Technologies like Farmonaut’s satellite-based monitoring systems can help producers optimize resource management, improve efficiency, and make data-driven decisions. - Q: What are the implications for international trade in beef?

A: Tighter supplies may lead to reduced export volumes but potentially higher values for U.S. beef in international markets.